Coronavirus Update: Report Cards Are Arriving

When I was a teenager in high school, there was no time of the school year (prom date considerations aside) more panic-inducing than when report cards were mailed home each semester. I remember always doing a mental inventory of my performance in each class. I’d think: Physics – I started strong, then hit that mid-semester lull and blew a few quizzes, then aced the final. I’d say I’ll be in the A minus range. Biology – Jenny McKinnon was assigned as my lab partner and I couldn’t concentrate for a single second. B minus, if I’m lucky.

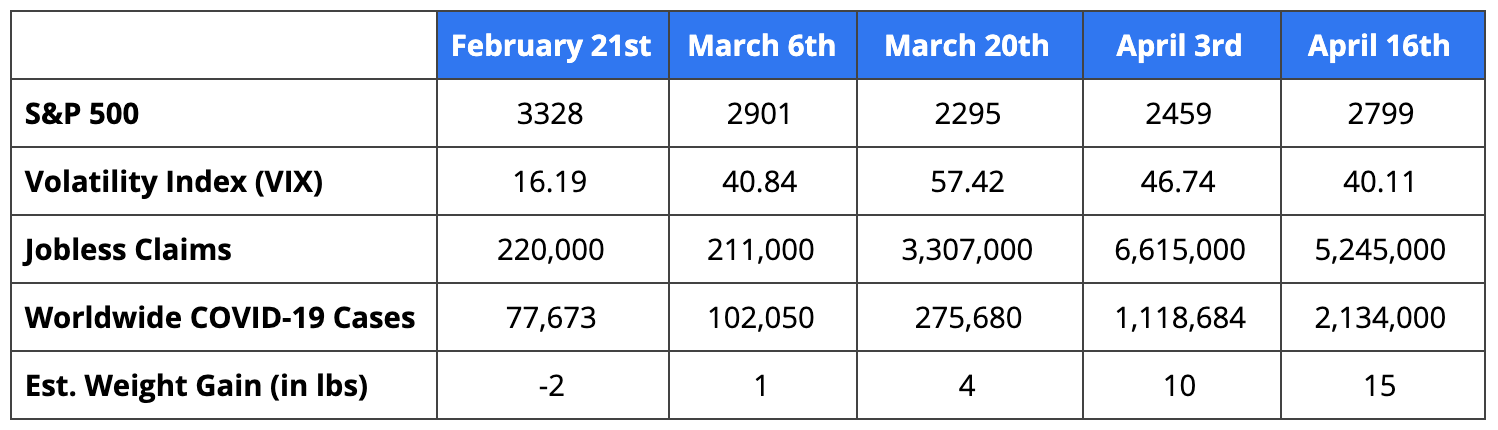

Recent days have been fascinating – strictly economically speaking – as we are finally starting to see earnings reports and other economic indicators that begin to reflect the realities of the COVID-19 pandemic. In short – report cards are finally starting to arrive, and investors are beginning to get a strong dose of reality. Therefore, we’ll start our weekly commentary with a very basic report card of some of the data that has emerged in recent days.

I have to admit, I nearly flinched with every keystroke when recording many of these numbers. While this data is staggeringly bad, it’s not entirely unexpected given how rapidly COVID-19 brought the global economy to a screeching halt.

As detailed in the chart above, Q1 GDP was reported at -4.8% on April 29th. While -4.8% is bad, we expect Q2 GDP numbers to be much, much worse. As you can see in the chart below from IHS Markit, the decline in Q1 GDP was relegated only to the last few weeks in March. Prior to that, GDP was on pace for annualized growth in the +/- 2% range. Therefore, Q2 (April, May & June) will be the quarter in which the full effect of the pandemic will be felt domestically, and we wouldn’t be surprised to see GDP meet or exceed the negative 25% range.

Brief Earnings Summary – When it comes to financial markets, we are seeing a mixed bag to start the earnings season. 24% of the companies in the S&P 500 reported earnings as of April 24th, with both the financials & energy sectors missing earnings targets, in aggregate, by -30.1% and -8.1% respectively. In financials, many of these estimated vs. actual EPS misses are quite substantial, including Capital One (-$3.02 vs. $1.88), Wells Fargo ($0.01 vs. $0.37) and Discover (-$0.25 vs. $0.72).

Conversely, we’ve seen Healthcare and Information Technology provide the largest EPS surprises, including old stalwarts like Johnson & Johnson ($2.30 vs $2.02) and Intel ($1.45 vs. $1.28). Still, we are very early in earnings season with 172 S&P 500 companies reporting during the week of April 27th through May 1st, so there is still much to learn. Regardless, analysts expect a year-over-year earnings decline of -15.8% for Q1 which, if this materializes, will represent the largest year-over-year decline in earnings since Q2 of 2009 (-26.9%).

What does this mean for investors? – given the grim economic numbers and the expected decline in Q1 earnings, financial markets should be continuing to test the lows reached in late March, right? Well, as ESPN College Football Analyst, Lee Corso, would say, “Not so fast, my friends!” Over the past week, we’ve seen domestic equities – including mid and small caps – rebound.

Here in Colorado, we affectionately use the phrase “getting out over your skis” to describe someone who’s getting a little ahead of themselves. Given what we know and what we’ve learned in recent days, the stock market may be getting a little out over its skis given the level of uncertainty surrounding global markets. The question is – why are the markets optimistic? We attribute this to 4 key topics.

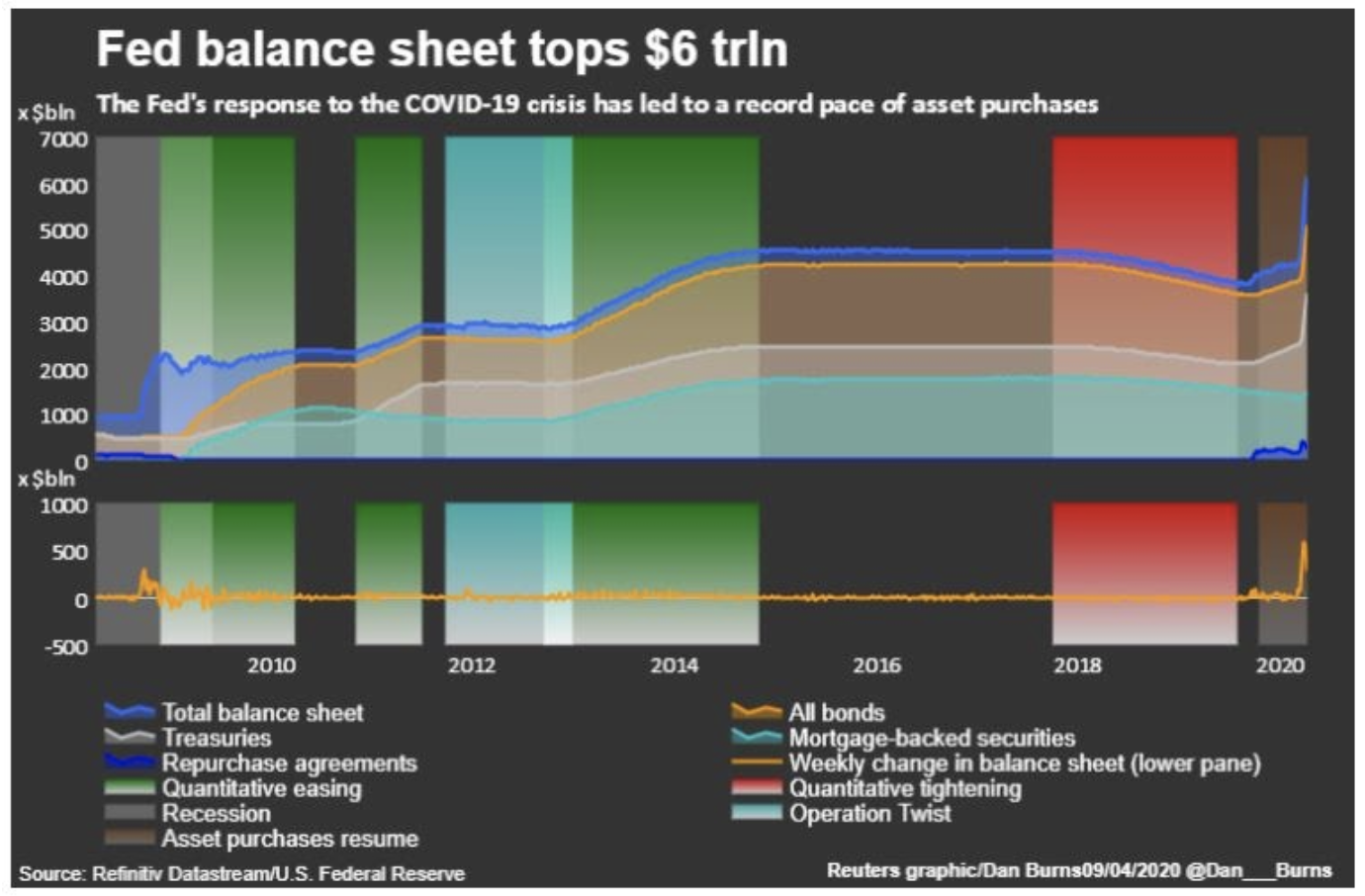

1) Fed Intervention: Clearly, the Federal Reserve’s actions have reassured investors, providing rate cuts and liquidity. In a release on April 29th, the Federal Open Market Committee stated that the Fed would continue to take any and all actions required to support the economy and meet the Fed’s mandate as it relates to employment, interest rates, and inflation. Summarized in Chart A below, the Fed’s actions to-date are unprecedented and have had a calming and reassuring effect on financial markets.

Chart A

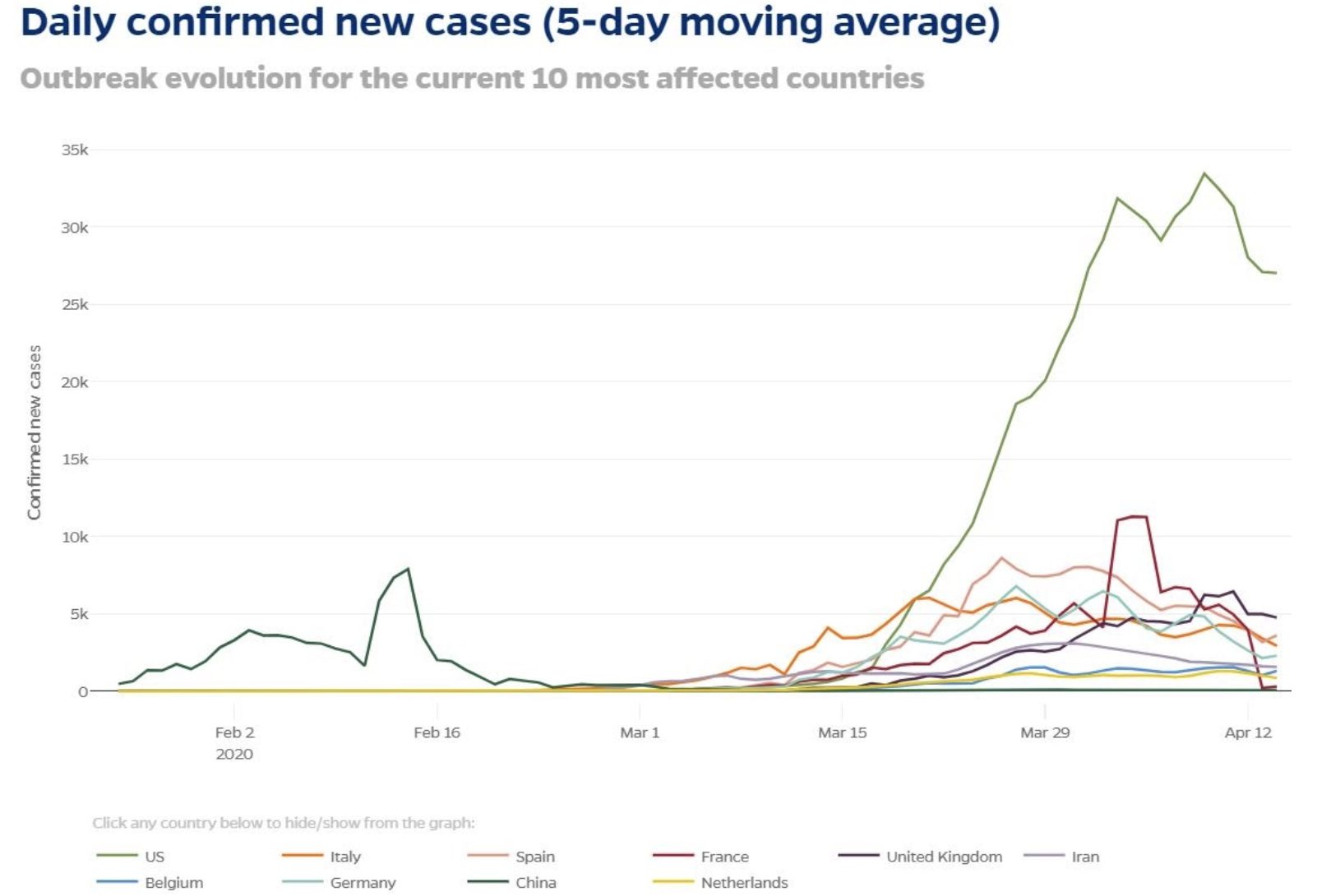

2) Flattening of the Curve: We are seeing the curve begin to flatten in the 10 most affected countries, as seen in Chart B, indicating that social distancing measures have been effective in stalling the spread of COVID-19. Markets also responded favorably to the news shared by Dr. Anthony Fauci on April 29th, when he said “the data shows that remdesivir has a clear-cut, significant, positive effect in diminishing the time to recovery.” This indicates that progress is being made towards more effective treatments, and this is very welcome news.

Chart B

3) Industries & Sectors Immediately Affected by COVID-19: We’ve noted in previous communications that industries like retail, restaurants & bars, airlines & cruises, and hotels & tourism make up a small percentage (7%) of S&P 500 operating earnings, as seen in Chart C. This could help to explain why S&P 500 performance has rebounded from the deep lows experienced in late March despite the severe damage experienced by each of these industries since the beginning of the pandemic.

Chart C

4) Optimism due to the easing of Stay At Home Orders: We are starting to see cities and states begin to lift stay at home orders, offering hope that the domestic economy will begin to emerge from hibernation with some workers returning to jobs and consumers beginning to spend.

Let’s be clear – the United States is in a recession with some data and metrics that rival what was experienced in the great recession. You might be asking – how is this different? Well, in the case of the COVID-19, we know that there will be an end game. Experts are confident that a vaccine will emerge. However, in a best case scenario, doctors and scientists still contend that we are 12-18 months away from a widely available vaccine. In the meantime, we are still dealing with a tremendous amount of uncertainty.

We’re often asked by clients – what will recovery look like? Will it be V-shaped, L-shaped, etc.? Will the economy be humming again by the end of summer? Will lifting the stay at home orders result in a rebound?

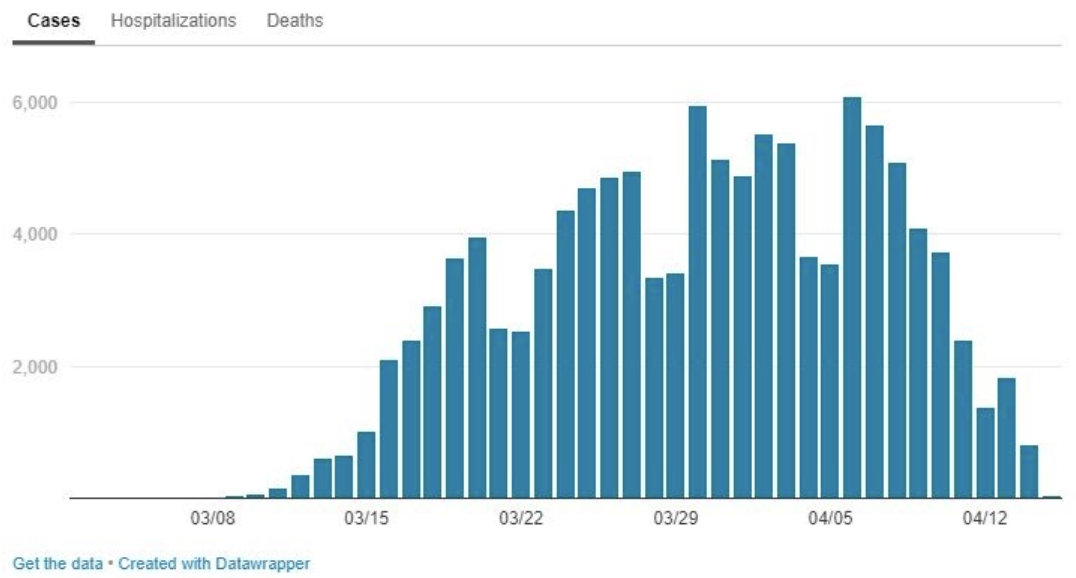

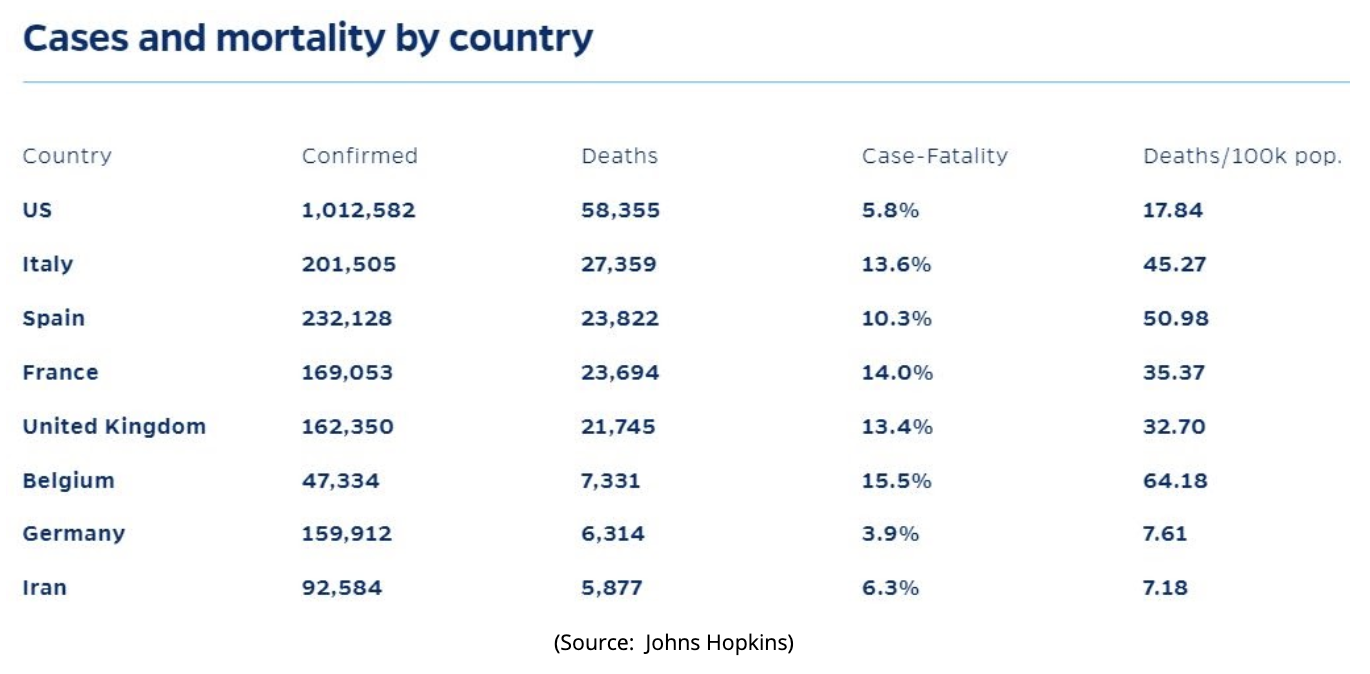

When it comes to life returning to ‘normal’, it’s not a matter of what people can do, it’s a matter of what people will do. You can lift every restriction across the country, but that doesn’t necessarily mean that citizens will be comfortable going to restaurants & bars, sitting in a movie theater, flying on airplanes, attending sporting events, etc. You only need to look at the mortality data of COVID-19 as seen in Chart D, provided by Johns Hopkins, to see why people may have reservations in returning to business as usual. Given current mortality rates in the United States, if you packed an airplane with 200 people for a flight and each person ended up contracting COVID-19, 10 to 12 of those 200 people would end up dead. Clearly this case/mortality data isn’t perfect and doesn’t specify age or health, but it’s sobering nonetheless.

Chart D

Nothing would make me happier than experiencing a strong V-shaped recovery that results in 10 more years of economic expansion. However, current data simply doesn’t support that prediction in the near term.

To close, I’ll return to the skiing metaphor to illustrate Destiny Capital’s thoughts on recovery. In the month of March, the economy careened over the edge of a double-black diamond with one ski missing and its hair on fire. The economy has since reached the bottom of the hill, hopped on a treacherous kiddie lift and has arrived at mid mountain. For the next 2-3 quarters, we expect the economy to traverse an extended catwalk (a horizontal trail that connects different sections of the mountains) with a few declines and climbs mixed in. After a grueling catwalk traverse, we expect to finally reach the brand new high speed quad lift and – we hope – begin our ascent to higher altitudes.

Regardless of near term predictions, we are long-term investors, and we ultimately believe that asset prices will be higher in future years regardless of any volatility experienced in the interim. All it may take to accelerate the economic recovery is a treatment that vastly improves outcomes and reduces the COVID-19 mortality rate. As we’ve experienced in recent weeks, when markets rebound, they tend to rebound very quickly. This is why we stay invested in diverse assets and remain disciplined even throughout the worst of times.

As always, we will continue to provide weekly updates with a continued focus on corporate earnings over the coming weeks. If you have any questions about outlook or strategy, please don’t hesitate to contact your Destiny Capital Team.