Coronavirus Update: The New Abnormal

As the pandemic crisis continues to persist, I’ve sensed an evolving spectrum of emotions from friends, family and co-workers in recent days and weeks. In fact, I’m finding that some of these emotions often overlap with the commonly known ‘five stages of grief’ that many people experience when dealing with loss or hardship. Before continuing, I should note that when attempting to communicate any difficult, sensitive, or complex subject – as a rule – I try to focus my writing on something relatable. In nearly all cases, I’m discovering that this relatable topic tends to be either food or cooking, and this week’s letter is no different. You see, over the years, I’ve found that my slow evolution to becoming a competent cook often invoked the aforementioned 5 stages of grief:

Denial: asking “It’s not too salty, right?” as everyone at your table simultaneously reaches for their water glass, darting sidelong glances at each other.

Anger: slinging expletive-laced rants at a pot of rice that is inexplicably charred on the bottom while maintaining a porridge-like consistency on top.

Bargaining: making lofty promises to a higher power in the futile hope that your Thanksgiving turkey isn’t bone dry when you slice into it in front of your guests.

Depression: knowing that TV food personalities like Guy Fieri have a television career and you don’t.

Acceptance: “To hell with it, let’s just order Chinese.”

While I’ve personally experienced many of these stages throughout the COVID-19 crisis, I’m finding that this pandemic brings its own unique dynamic. This shouldn’t come as a surprise because we are living in ‘the new abnormal’, aren’t we? After 2+ months of social distancing and countless remote conversations, I think the word that best defines what I’m sensing from others most often these days is – Longing. Longing for connection. Longing for normality. Longing to sit in the stands at a Rockies game with an ice cold beer, or any of the other small freedoms we’re suddenly realizing we’ve taken for granted all these years.

While some of these freedoms are starting to re-emerge with social distancing restrictions loosening, I still feel like my toddler son with his plastic toy hammer as he lightly bangs on a piece of furniture. He’ll often start softly and quietly, then gradually begin to bang harder and louder, glancing furtively at me to see if Dada’s noticed yet, worrying that if he bangs too hard or too loud, he’ll damage the furniture and get his toy taken away. We are all trying to find a similar equilibrium as states across the country begin to loosen social distancing restrictions, and it’s a delicate balance that we’re all attempting to manage in our own unique way.

To pull back the curtain a bit here at Destiny Capital – we begin every semi-weekly team meeting focusing on one of our firm’s seven core values. During each meeting, we spend time reviewing how that particular core value was represented each day, along with successes and failures. I found it coincidental that the core value for the month of May was/is one of our most important values – Empathy. I couldn’t think of a better value to guide us through this challenging time, knowing that the pandemic may be affecting each of us, and the clients we serve, in very different ways.

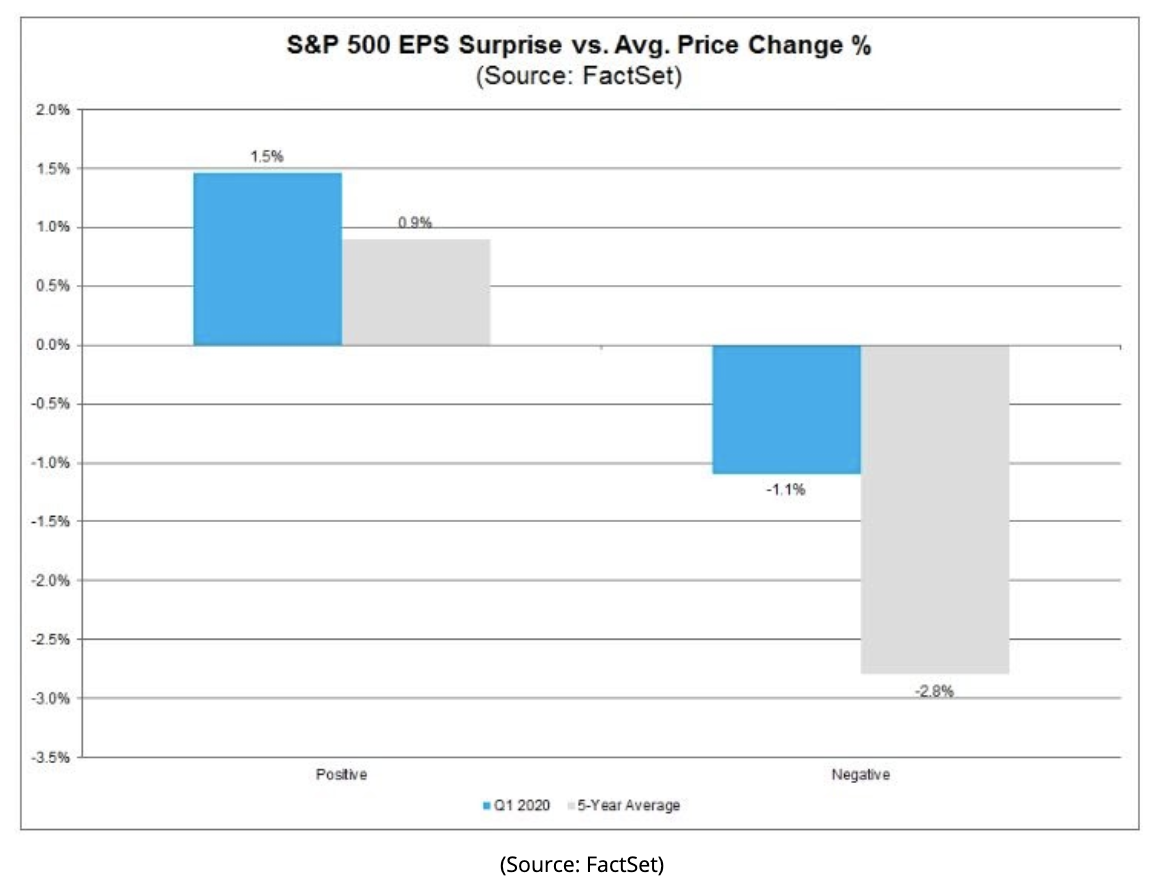

I joke with others on our team that we are also witnessing empathy – of sorts – in financial markets. This earnings season, I was interested to see that – relative to historical averages – companies aren’t being punished as severely for negative earnings surprises. As seen in the chart below, the 5-year average price change after a negative earnings surprise has been -2.8%. However, during this quarter, the average price change has been -1.1%. Clearly, this type of data can be taken with a grain of salt given that many stocks were punished prior to the release of any earnings data, but I was pleased that additional negative data didn’t severely exacerbate the stock price damage for many companies, on average.

Now that this quarter’s earning season is winding down, there is much more to cover, so we’ll continue this letter with our typical COVID-19 update, then focus on corporate earnings as we come to the end of ‘earnings season’ and approach Memorial Day weekend.

COVID-19 Update – as of this writing, there are just over 5 million confirmed COVID-19 cases worldwide with 329,000 fatalities and 1.9 million recoveries. In the United States, there are just over 1.5 million confirmed cases with 93,000 fatalities and 294,000 recoveries. Where Destiny Capital is headquartered in Colorado, there are 22,797 confirmed cases with just over 1,000 fatalities. Recovery data is not readily available in the state.

On a positive note – we continue to see a decline in the number of confirmed cases over time, as illustrated in the chart below. What we don’t quite know is whether or not – or to what extent – this new case data reflects the loosening of social distancing restrictions across the country. Therefore, we’ll keep a keen eye on this confirmed case data in the weeks ahead, hoping for a continued decline, but being wary of short-term spikes domestically.

Earnings Update – as of Friday, May 15th, 90% of all S&P 500 companies had reported earnings, with a blended earnings decline (actual reported earnings combined with estimated earnings of companies who have yet to report) of -13.8%. If this decline holds after the remaining 10% of S&P 500 companies report, this would represent the largest year-over-year earnings decline since the 3rd quarter of 2009 (-15.7%).

Leading the way with negative earnings surprises was the Financials sector, which reported the largest aggregate difference in actual vs. estimated earnings of -20.1%. The Consumer Discretionary sector was next with aggregate negative actual vs. estimated earnings of -11.1%, with large names like Marriott International ($0.26 vs. $0.87), Hanesbrands ($0.05 vs. $0.11), Bookings Holdings ($3.77 vs. $5.61) and even Amazon.com ($5.01 vs $6.16) missing the earnings mark.

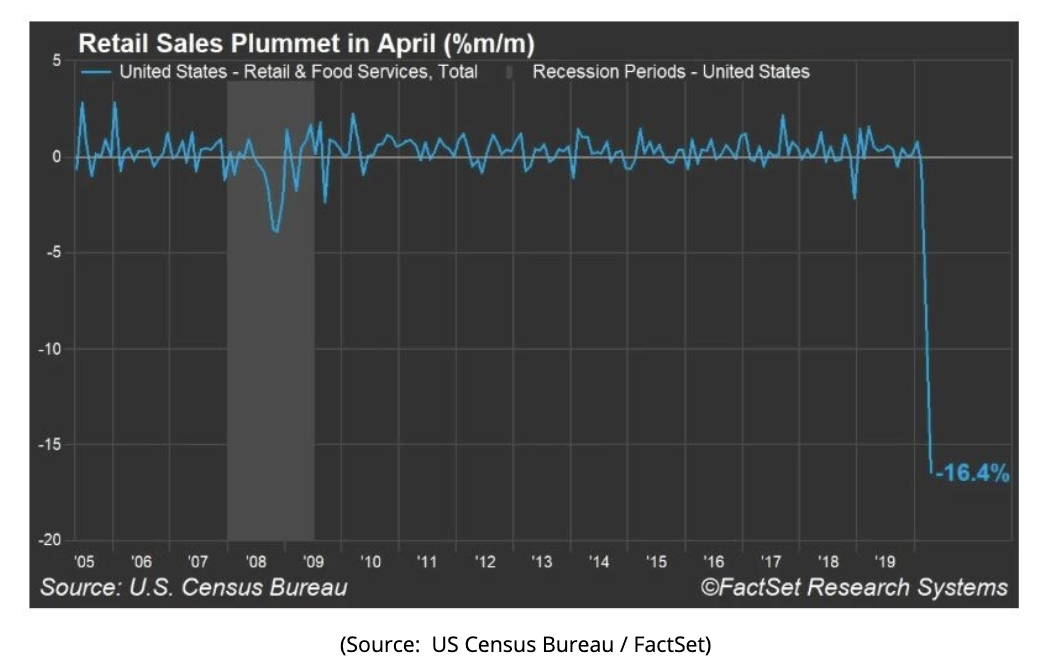

It’s not much of a surprise that the Consumer Discretionary sector is struggling given the significant drop off in statistics such as Retail Sales. As seen in the chart below, month-over-month retail sales fell -16.4% in April, which dwarfs any numbers in recent memory, including during the Great Recession.

Regardless, this quarter’s earnings decline may look like a wonderful dream compared to estimates for future quarters in 2020. According to FactSet, analysts estimate that there will be a year-over-year decline in earnings in Q2 of -41.9%, -23.8% for Q3, and -11.6% in Q4. Of course, these are simply estimates and, if the last few months have taught us anything, it’s that circumstances can change both dramatically and rapidly.

Despite all of this – including an additional 2.4 million of initial jobless claims reported on May 21st – financial markets remain resilient. As we’ve written many times before, investors are forward-looking and make purchase (or sale) decisions now based on the potential for future earnings and profit. We see markets get excited about positive news related to COVID-19 treatments and vaccines because that perhaps accelerates our time spent on the road to recovery.

At Destiny Capital – after earning a few additional grey hairs – we tend to find ourselves in the Acceptance phase of this crisis. We remain optimistic about the global economy in the long term, but are fully cognizant that many unknowns still remain and that there could be both opportunities and setbacks in the coming weeks and months. During this time, we will be here, and will continue to remain empathetic and attentive to your needs regardless of what the future may bring. You have a strong, focused, and motivated group here to serve you, and I would encourage you to lean on our team if there is anything you need. After all, knowledge and planning can help to overcome uncertainty and fear, and this fact has never been more relevant and evident than it is today.

Please stay safe and stay well.

Share this

Build a Resilient Retirement

Don’t wait—download our essential retirement guide and start planning for a secure future.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.