SECURE Act 2.0: How expanded legislation provides new opportunities to plan and maintain a strong retirement

By Adam Burch, CFP®, Client Wealth Specialist

The SECURE Act, signed into law in late 2019, brought a number of changes to retirement plan rules. Some of these changes were fairly minor but others, like the delaying of Required Minimum Distributions to age 72 and the elimination of the provision that allowed non-spousal beneficiaries to “stretch” distributions over their life expectancy, were much more far-reaching. The aim of the bill was twofold: To encourage retirement savings and generate additional tax revenue. For instance, the bill enabled employers to enroll long-term, part-time employees in retirement plans, which provided many workers new access to tax-advantaged savings. On the other hand, forcing some beneficiaries to distribute inherited retirement account balances over a shorter period generated (or pulled forward) taxes.

On December 23, 2022, the SECURE Act 2.0 was signed into law, building upon some of the original SECURE Act framework and introducing more changes aimed at helping Americans prepare for and maintain a strong retirement. Some of the more significant updates include the further delay of Required Minimum Distributions (RMDs), new opportunities for Roth accounts, additional options for spousal beneficiaries, and the ability to transfer 529 balances into a Roth IRA.

Due to the sheer volume of provisions, and without getting too far into the weeds, we won’t outline every detail. We have identified the key SECURE Act 2.0 highlights that will likely impact several our clients and have outlined them for you below.

Major Provisions Impacting Retirement Contributions

Inflation-Adjusted IRA Catch-up Contributions: For twenty years now, those 50 and older have been able to make “catch-up” contributions to their IRA. Initially $500 per year, the catch-up limit was increased to $1,000 in 2006 and has remained the same ever since. Beginning in 2024, the catch-up amount will be indexed to inflation and will increase in increments of $100. This is good news for those that maximize IRA or Roth IRA contributions every year.

Increased Retirement Plan Catch-up Contributions: The over-50 catch-up contribution limit for 401(k), 403(b), and governmental 457(b) plans has steadily increased over time. The limit is increasing from $6,500 to $7,500 for 2023. But starting in 2024, the SECURE Act 2.0 allows those turning 60, 61, 62, or 63 during the year to make catch-up contributions equal to the higher of $10,000 or 150% of the regular over-50 catch-up limit.

Roth Catch-Up Contributions: To add even more complexity, beginning in 2024, all catch-up contributions to 401(k), 403(b), and governmental 457(b) plans for those with wages over $145,000 must be made on a Roth basis. If this change directly impacts you, we suggest talking with your employer soon to make sure it’s on their radar.

Other Roth Opportunities:

- Roth Employer Contributions: Effective in 2023, employers are allowed (but not required) to make matching or nonelective contributions to retirement plans on a Roth basis, as long as employer contributions are vested immediately. Because the employer is contributing “after-tax” money, the contribution amount will be included in the employee’s taxable wages for the year.

- Roth SIMPLE and SEP IRA: If you contribute to a SIMPLE or SEP IRA, you’ll have the opportunity to make Roth contributions starting in 2023.

Required Automatic Enrollment and Contribution Increases: Starting in 2025, employers adopting new 401(k) and 403(b) plans must automatically enroll eligible employees. Contributions must be at least 3% of salary and must automatically increase by 1% per year until they reach at least 10%. Employees can opt out and some employers (governmental, churches, and newer businesses among others) are exempt.

Major Provisions Impacting Retirement Distributions

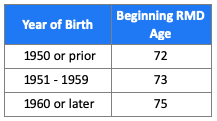

Further Delay of Required Minimum Distributions: This is one of the most impactful provisions of this bill and one that will touch many of our clients. When RMDs were first established in the 1980’s the required starting age for retirement distributions was 70½, and it remained that way until the original SECURE Act pushed it back to age 72 just a few years ago. Now, for those reaching age 73 in 2023 or later, RMDs will be delayed even further as outlined below.

This means that those who turn 72 in 2023 will have one more year before RMDs kick in! Of course, there may be cash flow or tax optimization reasons to take a distribution anyway, but you will not be required to distribute until age 73.

Additional Options for Spousal Beneficiaries: Currently, when a spouse inherits a retirement account, they have several options for handling RMDs. These include treating the account as their own or distributing based on the deceased spouse’s age using the “Single Life Expectancy” table (which typically requires higher distributions). However, beginning in 2024, spousal beneficiaries can elect to be treated as the decedent for RMD purposes. This could be particularly beneficial if the deceased spouse was younger than the surviving spouse and could delay and/or reduce RMDs.

Elimination of Required Minimum Distributions for Roth Balances in Employer Plans: Although RMDs have never been required for Roth IRAs, if you previously had Roth money in an employer plan, were no longer working for that employer, and reached RMD age, you were required to distribute. With SECURE Act 2.0, RMDs for any Roth balances are eliminated starting in 2024. However, if you have an old retirement plan and are no longer contributing it may make sense to consolidate accounts, so we encourage you to contact your Destiny Capital team.

Increased Qualified Charitable Distribution Limit: Many of our clients utilize Qualified Charitable Distributions (QCDs) so we’re always interested when changes are introduced. If you’re unfamiliar, a Qualified Charitable Distribution is an otherwise taxable distribution made directly from an IRA, whose owner is at least 70½, to a qualified charitable organization. The great thing about QCDs is that they count toward a client’s annual RMD amount, but the distributions are considered entirely tax-free. For this reason, it’s often more beneficial to donate to charity via QCD than to give directly.

While the age at which you can begin QCDs isn’t changing, the maximum annual QCD limit (historically $100,000) will be adjusted for inflation starting in 2024. We know that most people do not reach the annual maximum, but we believe it’s still worth noting. If you’re interested in Qualified Charitable Distributions and how they may benefit you, please reach out to us.

Other Notable Provisions

Ability to Transfer 529 Balances to a Roth IRA: This has been one of the more highly anticipated provisions and one that we suspect some of our clients will be interested in. The provision is intended to provide options to families concerned about unused 529 Plan balances and penalties associated with non-qualified distributions. Effective in 2024, SECURE Act 2.0 allows money to be transferred directly from a 529 Plan to a Roth IRA. However, this new opportunity does not come without restrictions. To qualify:

- The 529 must exist for 15 years or longer.

- Any 529 contributions made within the last 5 years (plus earnings) are not eligible for transfer.

- Money must be transferred to the 529 Plan beneficiary’s Roth IRA. (However, at least for now, it does seem that if the 529 beneficiary is changed, money can be rolled to additional Roth IRAs.)

- Transfers are limited to the annual IRA contribution limit, with a lifetime transfer limit of $35,000.

Incentives for Smaller Employers: Most recently, employers with fewer than 100 employees that adopted a new retirement plan were eligible for a tax credit equal to 50% of the plan startup cost (not to exceed $5,000). SECURE Act 2.0 increases the credit to 100% (up to current overall limits) for employers with 50 or fewer employees and provides an additional credit for employer contributions.

Student loan payment matching contributions: Effective in 2024, employers will be allowed to make matching retirement plan contributions based on employee student loan payments. The idea is that this provision will enable employers to contribute to retirement plans even if employees are making student loan payments rather than contributing themselves.

What does this mean for you?

Of course, the big question with these updates is how they may impact you personally. SECURE Act 2.0 introduces a new level of complexity but also a slew of retirement and tax planning opportunities, which we find exciting. Our team of strategists, planners, and coordinators are working diligently to identify which components allow us to help optimize or simplify your financial life. We will incorporate into the planning and conversations ahead or will reach out directly on anything identified with an immediate need. As always, we invite you to contact us with any questions or updates as well. Our entire mission is to help you be successful in the pursuit of a truly remarkable life, and that will be our focus as we navigate these changes and the year ahead.

Source: Senate Finance Committee Summary Document

DISCLOSURE: Adam Burch is a Certified Financial Planner with Destiny Capital and Entrepreneur Aligned, a DBA of Destiny Capital. This article is for informational purposes only and should not be relied upon as a basis for your investment or personal financial decisions. We recommend consulting with your Wealth advisor, CPA/tax advisor, and/or attorney, as applicable to your situation, prior to implementing any new tax, legal, or investment strategy.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.