Markets and Economy Update – January 2023

The year was 2006. I was young(er), single and, by that time, had spent about four years building an adventuresome new life as a transplant in Denver, Colorado. This was also just about the age when friends – both old and new – started to couple up, and I found myself attending a wedding every other weekend each summer.

That year, one particular wedding brought me back to my home state of New Jersey, where the night after the nuptials, an impromptu high school reunion spontaneously began at Mulligan’s Irish Pub in Hoboken. Old friends seemed to descend upon Mulligan’s from all over the tri-state area (New Jersey, New York and Connecticut). The night was still somewhat young, and I vividly remember standing on the curb and chatting with a few old buddies, when I saw a smiling girl approach with brown, curly, long hair and wearing a colorful University of Virginia (UVA) shirt. She knew a friend I was speaking with and stopped at our group. We were introduced, and we chatted.

We eventually made our way inside, and our conversation went on for quite a while. As is common with most Irish pubs, Mulligan’s had the ideal combination of dim lighting and efficient, generous bartending that somehow tipped the scales ever so slightly in favor of a semi-witty Irish lad such as myself. Conversely, this is probably why you do not see too many pale, freckled faces at posh, cologne-scented nightclubs with fluorescent colored drinks and pulsing lounge music, but I digress.

The night eventually grew late and the party began to break up. On her way out, the girl asked for my number (nobody ever believes that part of the story, but it is true), and we said we would stay in touch. Now here I sit, writing this letter roughly seventeen years later, and that curly haired UVA girl and I have been married for over a decade and have two beautiful young boys.

Okay, so what is the point of that story, and why am I writing about it in a market update letter? Well, last week, a few important economic events caused me to reflect upon the theme of “turning points”. Clearly, standing on the curb outside of that Irish pub and watching that curly-haired UVA girl come into view was a pivotal turning point in my life.

Back on March 15th of 2020, the Federal Open Market Committee (FOMC) sharply cut the federal funds rate to zero and launched unprecedented quantitative easing measures to prop up the United States economy during the most uncertain days of the COVID-19 pandemic. That day proved to be a crucial turning point for investors as the S&P 500 began to ascend and never really looked back until over a year and a half later.

On February 1st of 2023, the FOMC concluded their latest meeting, and Fed Chairman Jerome Powell’s subsequent press conference got me thinking, “Is this another turning point for the American economy?”

Clearly, we do not expect a dramatic shift in sentiment like we saw back in March of 2020, but the tone and tenor coming from the Fed was clearly different this time. In this month’s letter, I’ll begin by talking about the latest Fed meeting before getting into a topic that is likely on the minds of most investors these days – will the U.S. dip into a recession in 2023?

The latest Fed meeting – striking a new tone

Around 2:00pm Eastern Standard Time on February 1st, the Fed released a written statement announcing a 25 basis point (0.25%) rate hike that would bring the federal funds target rate up to 4.50%-4.75%. This was expected.

As is my recent tradition during the post-meeting press conferences, I burn off some nervous energy by hopping on my exercise bike. I pedal away while watching Jerome Powell speak live via the Fed’s YouTube channel on my office’s smart TV while monitoring minute-by-minute market reactions on my phone. It is a clumsy setup, but efficient, and the bike riding is something I started while watching other nerve-wracking events like the Phillies and Eagles playoff games. Suddenly, one line had me stand up in the saddle, press the pause button on my remote and quickly rewind the presser. Did I hear Powell correctly?

I pressed play, and once again, heard Jerome Powell say, “I still think – I continue to think – that there’s a path to getting inflation back down to 2% without a really significant economic decline or significant increase in unemployment.”

I try not to be overly hyperbolic but, as someone who has for years parsed every word uttered or written by the Fed, I thought that this was an extraordinarily bold statement. This wasn’t the only headline-making statement of the day. Powell also said what the markets have been longing to hear for over a year by stating, “We can now say for the first time that the disinflationary process has started.”

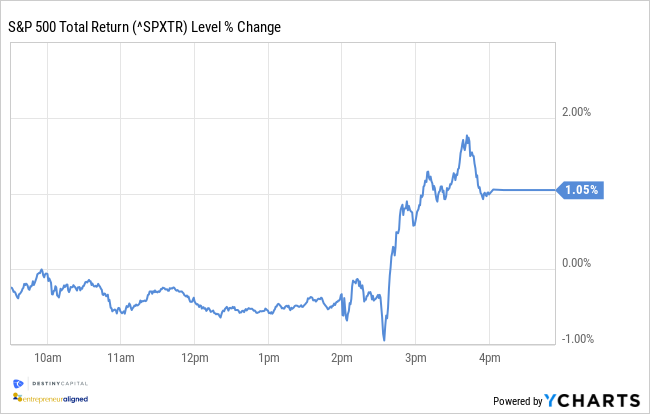

As you can see in the intraday S&P 500 chart below, markets were clearly buoyed by what they heard from the Fed Chairman. I assure you, that has not often been the case over the past year, where I have grown accustomed to cringing and waiting for an immediate market selloff due to an offhand comment by Powell.

February 1, 2023 – S&P 500 Intraday Chart:

All eyes are on Core Services ex-Housing

Jerome Powell celebrated the fact that we are clearly seeing disinflation in the goods sector, and progress continues to be made in the housing sector. While this may not be great news for home sellers, buyers or builders, it is good news as it relates to the inflation story. However, one area that Powell spoke of with caution was Core Services ex-Housing (excluding housing), and he referenced this many times throughout his 45 minute press conference. Core Services ex-Housing accounts for roughly 50% of core Personal Consumption Expenditures (PCE – the Fed’s preferred inflation measure), and includes inputs from about seven sectors. These sectors include education, healthcare, insurance, repairs, personal services and more. It is quite a diverse group of inputs that have yet to show signs of disinflation.

Powell stated that the Fed believes that disinflation will begin to emerge in Core Services ex-Housing, but they have not seen firm evidence of it yet. Until that happens, they must stay the course and keep interest rates at sufficiently restrictive levels until cracks begin to appear, and disinflation materializes.

The labor market

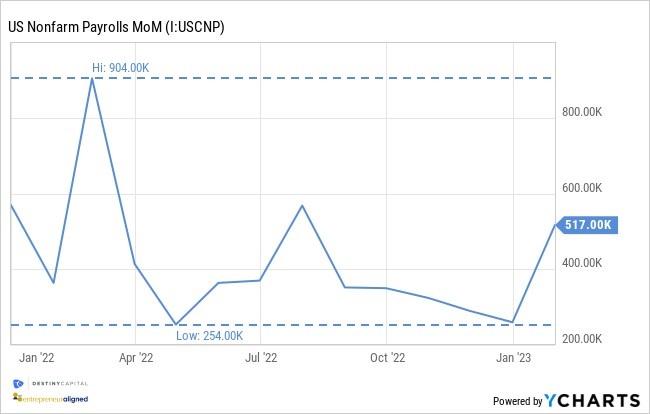

Many economists believe that there may need to be further softening in the labor market before we will see disinflation in Core Services ex-Housing. Specifically, wages appear to be an important variable in keeping inflation elevated in these sectors. This helps to explain the general bewilderment and caution experienced by investors, when the January jobs numbers were released indicating that there were 517,000 nonfarm payroll jobs added during the month as seen in the monthly payrolls chart below. Keep in mind that consensus estimates were for about 188,000 jobs added in January.

Monthly Jobs Numbers: 517,000 Added in January of 2023:

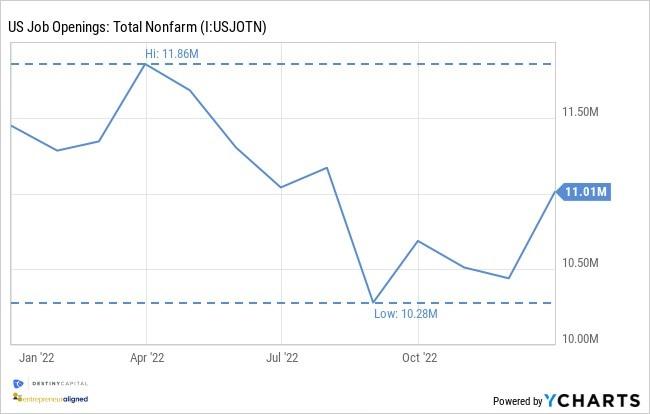

Furthermore, the Job Openings and Labor Turnover Survey (JOLTS) report was released on February 1st, showing that job openings rose to 11.01 million, as seen in the chart below. This means that there are roughly 1.82 job openings available for every unemployed job seeker.

Total Job Openings – United States:

A turning point?

Why could this last Fed meeting be a turning point for investors? I have written multiple times over the past few months that it seems like “bad” is the new “good”. What I mean by that is that over the past six months, investors have jeered good jobs reports and cheered any news that might indicate a softening domestic economy, such as sub-50 manufacturing and services Purchasing Managers Indexes (PMIs) or stalling wage growth. Investors have long-assumed that strong economic indicators would give the Fed the impetus to squeeze the economy harder and harder through more aggressive (hawkish) monetary policy.

Yet, with Powell’s comment on February 1st about the prospect of taming inflation without a significant economic decline or spiking unemployment, it turns out that investors might get to have their cake and eat it too. There is a path ahead, according to Powell, that could result in the coveted “soft landing”. While a 2023 recession seemed like a strong probability in late 2022, we are seeing more and more economists talking about slow/stagnant growth and less about that dreaded “R word”.

The Fed does not “do” optimism. If anything, they prefer to prepare the country for the worst, and hope for the best. This is why I found Powell’s optimistic comments so remarkable. Yes, the Core Services ex-Housing numbers will warrant scrutiny moving forward, but as Powell said, this is a diverse group of inputs, and the FOMC expects to see disinflation in this sector. It just has not definitively emerged there yet.

Will there be a recession?

When I think about the prospect of a recession in 2023, like Juliet, I ask, “What’s in a name?” Let us say that we have two quarters of negative Gross Domestic Product (GDP) growth in Q2 and Q3 of 2023. Will the National Bureau of Economic Research (NBER) truly declare a recession if unemployment remains at or under 4%? It is difficult to imagine that they would, and we saw a very similar scenario in 2022 with Q1 GDP at -1.60% and Q2 GDP at -0.60%, yet there was no recession declared.

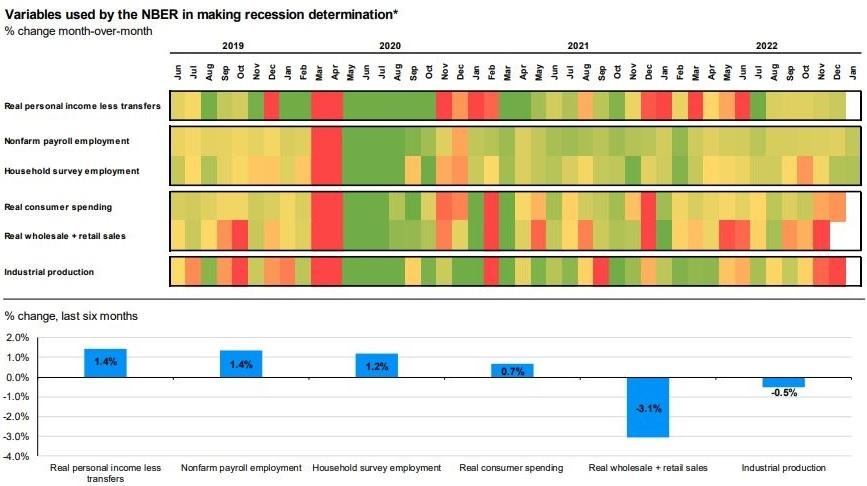

To gauge the current outlook, we look at some of the key recession determinants tracked by NBER, as seen in the quilt chart below. Clearly some of the data is lagging, but you see a mixed story. There are some key areas where the data is encouraging, such as the employment picture and real personal income, less transfers.

NBER Recession Determinants:

Source: JP Morgan Asset Management

On the other hand, we see some cracks emerging in industrial production and in areas that are influenced by the ever so important United States consumer, such as consumer spending and retail sales. Furthermore, personal savings rates have fallen in the United States, and the household debt service ratio has risen as inflation and general spending patterns have eroded any remnants of fiscal stimulus received due to the pandemic.

Consumer behavior can change quickly, however, so this bears significant scrutiny in the coming weeks and months. For example, we are seeing a rebound in consumer confidence, which has risen to 64.9 from a seventy-year low of 50 back in 2022.

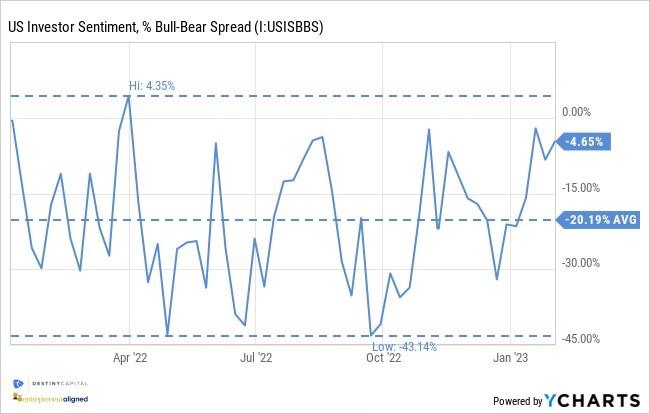

Investors have also grown a bit less pessimistic since late December of 2022 as evidenced in the Bull/Bear Spread chart below. This is a weekly chart that helps to summarize general investor sentiment with a reading above zero indicating that more investors are bullish (optimistic) than not, whereas any reading below zero indicates that there are more bears (negative outlooks) than bulls.

After an extremely bearish average spread of -20% since January of 2022, it is encouraging to see investor sentiment rebounding in recent weeks as new, positive developments emerge.

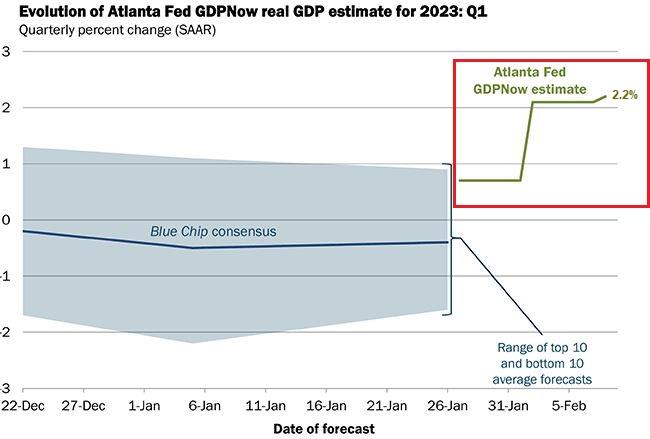

Finally, I will close this month’s chart-a-palooza with the most updated forecast for Q1 2023 Gross Domestic Product (GDP). Every few days, I receive iPhone updates from the Atlanta Fed’s GDPNow tool which, in recent quarters, has been a bit more accurate in predicting final GDP numbers than other consensus estimates. The initial GDPNow estimate was released in late January of 2023 and estimated that final Q1 GDP would be around 0.7%. However, the tool is constantly refining calculations as new data emerges, and it has since elevated that Q1 GDP estimate from 0.7% to 2.2%, as seen in the area highlighted in red below.

GDP Now Q1 2023 Estimate – 2.2%:

Source: Federal Reserve of Atlanta – GDPNow

With just under two months to go until quarter-end, there is still plenty of time for that estimate to be downwardly revised. Furthermore, it is important to stress that 2.2% GDP growth is hardly scintillating. However, the GDP forecast, and much of the data referred to in this letter, seem to encapsulate one word that I use to describe the United States economy in nearly every Markets and Economy update, and that word is “resilient”.

Through luck or skill (or both), the economy has navigated 450 basis points (4.50%) of unprecedented rate hikes without careening into a ditch. Do we expect the United States economy to experience stalling – or even negative – growth in 2023? Perhaps. Does that mean it may dip into a recession? To that, again, I ask, “What’s in a name?”

In the meantime, we will continue to closely monitor consumer behavior to gauge whether or not some of these minor cracks turn into something foundational. Overall, markets have reacted positively to recent developments in early 2023 with the S&P 500 up 6.28% during the month of January. We would all like for that trend to continue as, we hope, investors operate with far less uncertainty in the coming year than we dealt with throughout 2022.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.