Markets and Economy Update – September 2023

On Saturday, October 7th, I went about my day with a familiar sense of unease, uncertainty, and underlying despondency despite the fact that I was attending what should’ve been a festive family gathering. That morning, I was caught off-guard when I began reading emerging reports of a violent Hamas incursion into southern Israel. As the day passed and I learned more about the situation on the ground, I realized that my familiar emotions of distress seemed to mimic those I felt on February 24th of 2022 – the day of the Russian invasion of Ukraine.

As a husband and father, it’s difficult not to feel a sense of guilt when my focus inevitably – and often quickly – turns to investor implications of events like this when there are men, women and children enduring far, far worse than potential market volatility. Yet, during our monthly market update webinar, Destiny Capital CEO, Jarrod Musick, and I typically conclude our remarks by referencing five topics that could potentially impact the trajectory of financial markets, for good or ill. One of those five key topics includes the escalation or de-escalation of geopolitical conflict so, unfortunately, it’s a theme that we’ve become accustomed to reviewing in recent years.

While conflict and violent clashes between Israel and Hamas and/or Hezzbolah have occurred throughout the recent past, this feels a bit different. In fact, to my knowledge, this is the first time that Israel has made an official declaration of war since the Yom Kippur war of 1973.

This tragic situation is exceedingly complex and we are learning more by the minute. In this letter, we’ll initially attempt to focus on two key investor themes that may emerge in the days, weeks and, potentially, months ahead, and these themes are related to energy and, as usual, the Federal Reserve and monetary policy.

The Evolving Economics of Energy

Economically speaking, there are some common themes between the Russia/Ukraine conflict and the tragic situation in Israel. In both scenarios, there are concerns about contagion. Would Russia’s invasion or the Hamas attacks draw-in other nations, leading to a much broader global conflict?

Similar to what we saw with Russia, there are also fears that regional contagion in the Middle East could affect energy markets by causing disruptions in oil supplies, particularly if members of OPEC (Organization of the Petroleum Exporting Countries) like Iran get drawn into the current conflict.

In the not-so-distant past, any type of violence or tensions in the Middle East might’ve sent shockwaves throughout global energy markets by causing oil prices to spike due to supply concerns. Given that oil has been the lubricant that has rotated the gears of global economic growth for decades, it’s not surprising that volatility in energy might inevitably bleed into the global stock market. Historically, higher energy prices meant more pain for consumers and corporations alike. While that still holds true, dynamics have changed a bit over the past few decades, particularly when looking at energy through a domestic lens.

For example, back in 1973, U.S. President Gerald Ford signed the Energy Policy and Conservation Act of 1975 which, among other things, created the Strategic Petroleum Reserve (SPR) in the United States. This act, and the subsequent petroleum reserve, was in response to an oil embargo imposed on the U.S. by the OAPEC (Organization of Arab Petroleum Exporting Countries), which caused a painful recession in the United States. Wisely, the U.S. sought to pursue energy independence that would leave the country’s oil & gas supplies less susceptible to external political forces, weather events, logistical failures and more.

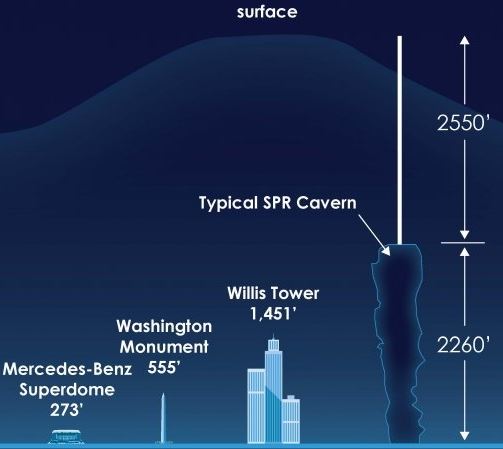

What exactly is the Strategic Petroleum Reserve and what does it look like, you ask? Many of you may hear about the SPR via various news sources in the coming days and weeks, so I thought it might be worth elaborating in a little bit more detail.

In aggregate, the Strategic Petroleum Reserve comprises about sixty cylindrical salt caverns that can be found deep below the surface, each with an estimated diameter of 200 feet and height of 2,260 feet, as you can see in the graphic below.

Source: U.S. Department of Energy

The vast majority of the SPR caverns can be found on the gulf coastlines of Texas and Louisiana. Why is the SPR concentrated in these locations? Well, these sites allow the oil from the SPR to be distributed to nearly half of all U.S. refineries via existing pipelines and/or barges.

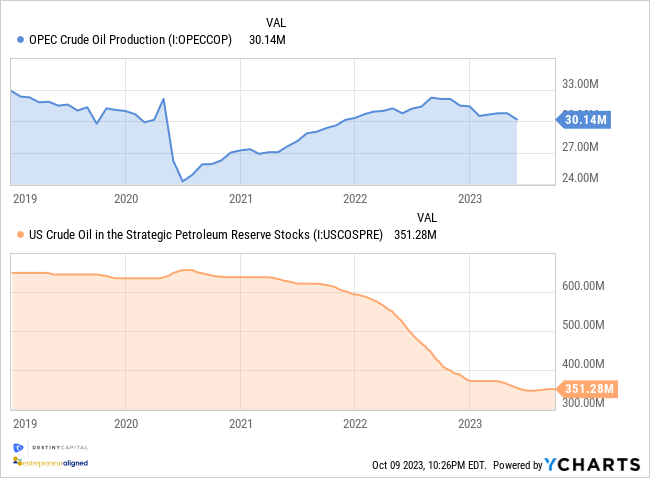

Now, the SPR is currently capable of storing up to 713.5 million barrels of oil. However, influenced by inflation and OPEC production controls, the SPR has dwindled from over 600 million barrels in late 2021 to roughly 351 million barrels today. This is illustrated in the charts below, with the top blue chart showing OPEC crude oil production tapering off in 2022, while the bottom orange chart shows current levels of the Strategic Petroleum Reserve.

OPEC Production (top blue) and Strategic Petroleum Reserve Levels (bottom orange)

As inflation rose and OPEC cut production, petroleum reserves were released to help balance the supply/demand equation to, ideally, lower prices. Reserves are drawn upon under the authority of the President of the United States, who is given this authority as stated in the Energy Policy and Conservation Act.

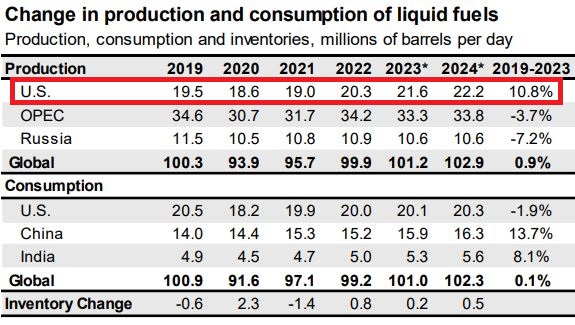

While historically low petroleum reserves are not an ideal scenario in the event that a global catastrophe occurs, it’s important to note that the energy production capabilities of the United States are far cry from where they were even just fifteen years ago. As seen highlighted in red below, U.S. production of liquid fuels (crude oil, natural gas, biodiesel, & fuel ethanol) has been on the rise, and is expected to continue on that trajectory into 2024.

Source: JP Morgan Asset Management, EIA.gov

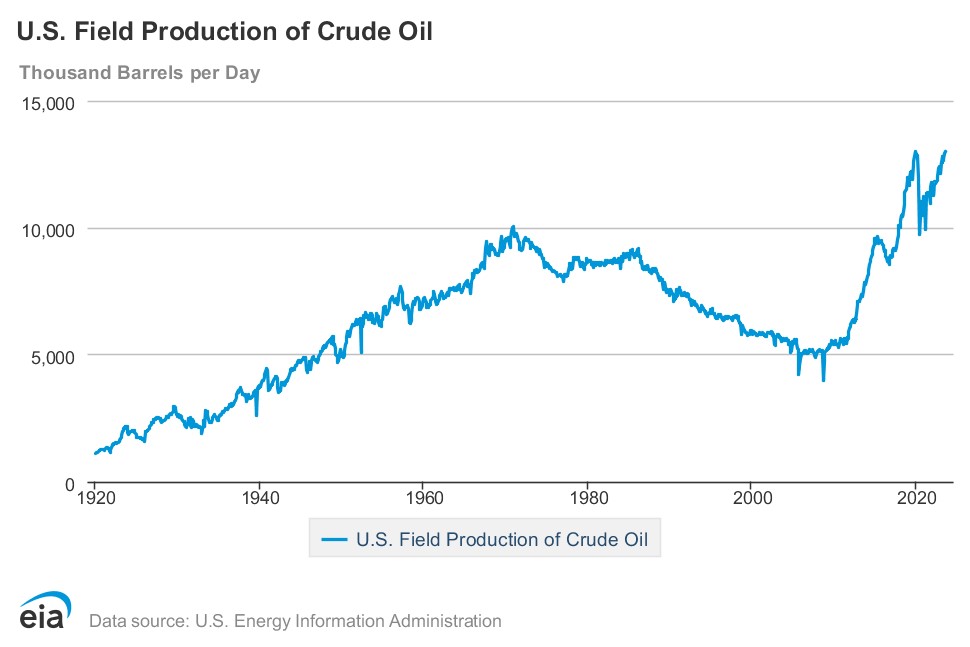

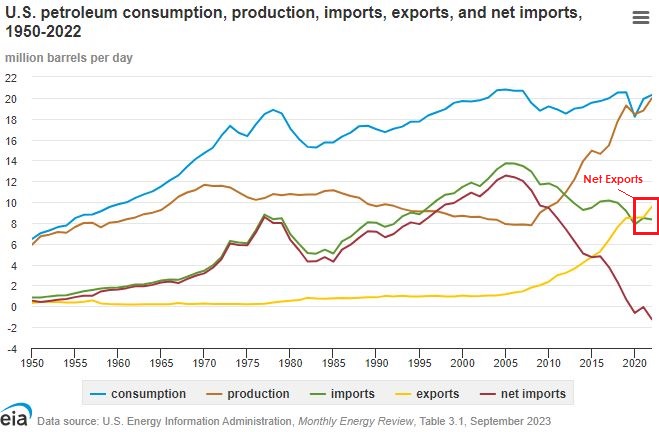

When considering crude oil alone, production levels have again reached all time highs, as seen in the chart below produced by the U.S. Energy Information Administration.

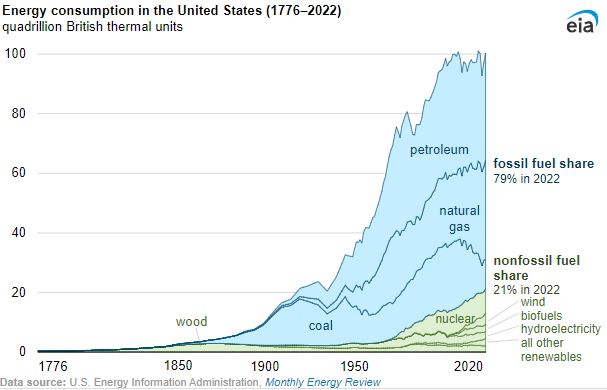

The U.S. has also endeavored to further enhance energy independence through the expansion of renewable energy sources. While progress has been made in diversifying our nation’s energy sources, only 21% of U.S. energy consumption comes from non-fossil fuel sources such as nuclear, wind, hydroelectricity and biofuels, as illustrated below.

Thus far, in the early stages of the war between Israel and Hamas in Gaza, oil prices have remained somewhat stable at roughly $85 per barrel. That can clearly change at any time.

There could also be an additional factor that may come into play given the shock to the region – Saudi Arabia. In recent months, reports have emerged that the U.S. has been fostering potential diplomatic ties between Israel and Saudi Arabia, which controls about one-third of OPEC oil production. Like all elements of the Middle East region, this situation is exceedingly complex, and little is truly known about whether or not diplomatic ties would be achieved and what they would entail. Was progress being made? Will this conflict derail any such efforts? Little is currently known, but this is an element of this situation we’ll be paying attention to in the weeks ahead.

The point here is not to claim that the United States is immune to energy supply shocks, but the situation is clearly much different in 2023 than it was in 1973. As you can see in the chart below, the U.S. became a net exporter of petroleum for the first time ever in 2020, meaning we export more petroleum to other countries than we import, which is an interesting and potentially impactful milestone.

Clearly, energy is only one element of the current conflict that could impact investors, so we’ll close by focusing on ways in which this war may impact the Federal Reserve and monetary policy.

Geopolitical Conflict, The Fed & Monetary Policy

As an individual that comes entirely from Irish descent, I’ve come to learn that folks who share my genetic makeup tend to possess several interesting traits that tend to include lightly pigmented (aka pale) skin, freckles, wit, a penchant for a Guinness or two around the holidays and, oddly enough, an innate sense of guilt. So, you’ll imagine the remorsefulness I felt when I thought to myself, “you know, I bet the stock and bond markets could initially react favorably to this,” as more and more news of the Israeli conflict emerged.

Why might the stock market ascend – initially, at least – after such a horrific and potentially volatile crisis emerges? It’s simple – Fed policy.

The CME Group is a worldwide derivatives marketplace that created the CME FedWatch Tool. This tool is designed to produce interest rate probabilities based on fed funds rate futures pricing data. In short, the tool is intended to show what investors are pricing-in when it comes to the fed funds rate after future Federal Open Market Committee (FOMC) meetings. As a curiosity, this is a resource that I tend to track with regularity.

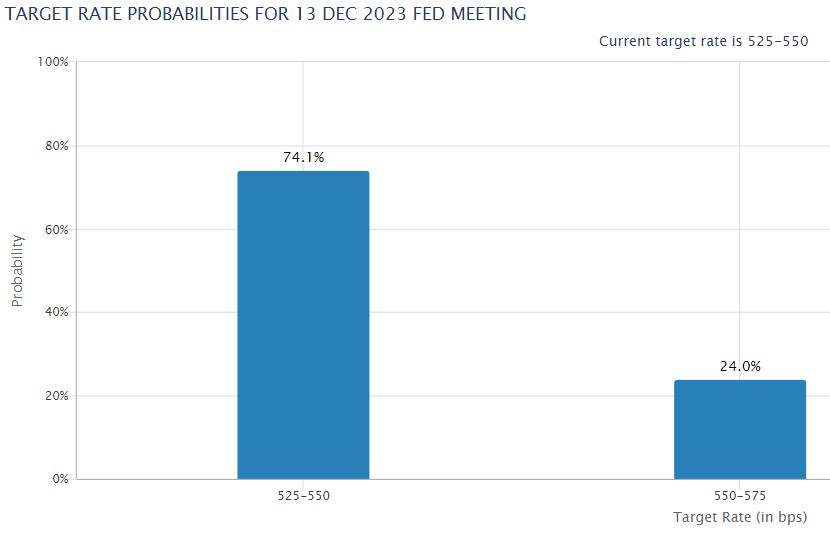

On Friday, October 6th, markets were pricing-in a 50% chance of a 0.25% rate hike as a result of the Fed meeting on December 13, 2023, and a 50% chance of no rate hike. It was essentially a coin toss scenario as to whether or not we’d get another 25 bps rate hike this year.

On Monday, October 9th, I was anxious to check the CME FedWatch Tool once again. Based on my initial speculation over the weekend, I wasn’t too surprised to find that the probabilities of another rate hike in 2023 had shifted drastically – at least according to futures traders. As you can see in the graph below, probabilities have now shifted to predict a 74.1% chance of no rate hike in 2023 and a 24% chance of a single 25bps rate hike in mid December. That’s quite a difference in just one business day.

CME Group FedWatch Tool

For nearly a year, investors have been waiting for the Fed to pause future rate hikes and, eventually, resume a path toward rate normalization at lower interest rate levels. Based on this CME FedWatch data, investors are anticipating that the war between Israel and Hamas may produce enough economic uncertainty to keep the Fed from hiking interest rates further until there is much more clarity around the path ahead.

I want to stress that this conflict is very new and we are consuming more and more information by the hour. While markets have yet to sell-off (as of this writing), it remains very early and it can be dangerous to make firm predictions about market behavior or assumptions about future Fed decisions. After all, many analysts thought that rate hikes were over after the banking crisis emerged in March of 2023. Yes, the Fed then paused rate hikes in May and June, but it didn’t take long before Fed Chairman Jerome Powell was back at the podium stating that rates would need to go higher and stay there longer than previously anticipated by Fed decision makers.

Furthermore, we get Producer Price Index (PPI) data on October 11th and the Consumer Price Index (CPI) inflation report on October 12th, so this is bound to be an eventful week for investors. If inflation comes-in hotter than expected, are inflationary pressures worrisome enough for the Fed to overlook the potential global economic impact of what could be a prolonged war between Israel and Hamas in Gaza?

When considering questions like this, one word always comes to mind for me. That word is uncertainty. When uncertainty rises, market volatility tends to follow – at least for a time.

Furthermore, when emotions run high, it’s important to take a step back and view investing from a long-term lens. Personally, when volatility spikes due to macro events, I like to recall the emotions I felt when I learned of the collapse of Lehman Brothers in 2008, or the ‘flash crash’ of 2010, or even during the dire depths of the COVID-19 pandemic. The chart below helps to illustrate that there always seems to be a reason to sell out of the stock market. Yet, over the long-term, the trajectory for investors has been positive.

Source: YCharts

As the situation in Israel evolves and as new economic data emerges, we’ll be sure to continue to communicate our perspectives. In fact, in the coming days, Jarrod Musick and I will be releasing a new webinar with a focus on some of the topics I’ve covered in this letter. Of course, in the meantime, if you have any specific questions about your personal financial picture, please don’t hesitate to reach out to our team with questions.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.