Markets and Economy Update – August 2023

For many, the month of August represents the beginning of the end of each summer. Many individuals, couples, or families hit the open road or head to the airport to try and squeeze-in one last vacation. My family was no different and, in our case, we were in a race against the clock before the chaos of the school year began for our two boys.

For the second year in a row, my wife, two boys and I loaded up the family truckster to bid adieu to summer with a week at the beach. After nearly twenty years of living in the land-locked state of Colorado, we’ve been relishing the opportunity to get our feet in the sand and take a dip in the ocean without having to board an airplane with a toddler.

As is typical for me during time away from the office, I find it difficult to completely unplug and take my mind off of what’s going on in the economy, financial markets and investment portfolios. Throughout the week, my mind would continue to draw parallels between my immediate environment and something work-related. This is either incredibly pathetic or a positive sign that I love what I do every day. Perhaps a little of both?

For example, as I sat in weekend traffic staring at the bumper of the SUV in front of me, I couldn’t help but think about the elemental nature of Fed policy. Policy tools for impacting economic conditions are incredibly limited. Open market operations aside, the Fed can really only pump the brakes on the economy by raising interest rates or, conversely, press the economic accelerator by lowering interest rates. There’s no ability to switch lanes or pull up a Waze app to help the Fed navigate economic conditions in real-time.

Honestly, the market parallels started even before our vacation really ever began. You see, for the second year in a row, my wife and I rushed as we overstuffed the car in 95 degree heat (and about 130% humidity). So, naturally, we buckled up the kids, got about 10 minutes from home then realized that an important bag got left behind. In a situation like this, blame is irrelevant (because I was in charge of the packing checklist) so we reached the nearest exit, turned around and, before we knew it, we were right back where we started.

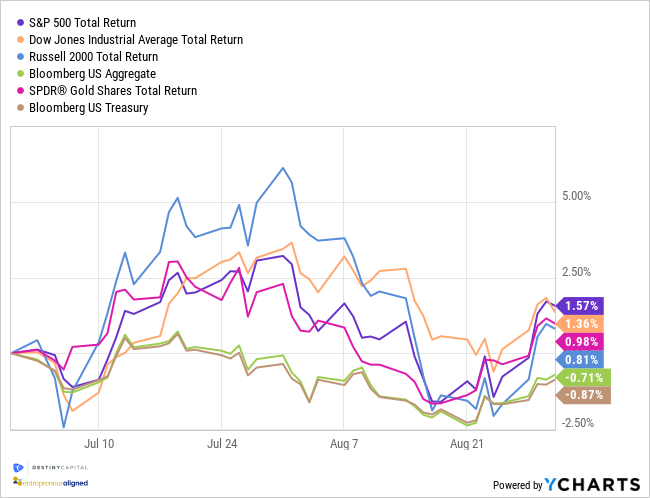

At that point in August, that little detour reminded me a lot of what we had seen in the financial markets throughout the month. While markets ascended in the month of July, August saw the stock market retreat back to lower levels. As a result, and as you can see in the chart below, investors just about ended up back where they began on July 1st.

Major Index Total Return – 07/01/2023 – 08/31/2023

All things considered, August was somewhat of a quiet month with no Federal Open Market Committee meeting or subsequent policy changes to impact the direction of financial markets. However, we did see the conclusion of Q2 2023 earnings season, more inflation data was gathered, and we’re seeing some interesting developments in the labor market, so we’ll briefly highlight each of these areas in this month’s letter.

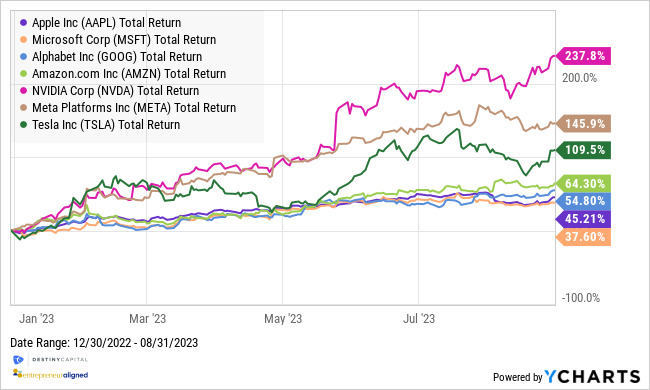

The Magnificent Seven & Earnings Season

Generally speaking, Q2 earnings season yielded solid results with 79% of S&P 500 companies beating earnings estimates, which is above the 5 and 10 year averages. Still, as I alluded to in a previous letter, all eyes were on the ‘Magnificent Seven’ companies – Apple, Microsoft, Alphabet, NVIDIA, Meta, Tesla and Amazon – as these seven stocks make up nearly 30% of the S&P 500 index. These stocks have also helped to drive the year-to-date surge in the index, as you can see in some of the colossal return numbers below.

Apple/Microsoft/Alphabet/Amazon/NVIDIA/Meta/Tesla Total Return – 12/31/22 to 08/31/23

On the whole, investors breathed a sigh of relief as the majority of these companies delivered strong Q2 numbers, as I’ll summarize below, starting with the biggest hitter of the quarter, NVIDIA:

NVIDIA – the stock entered earnings season with a tremendous amount of hype, and it’s pretty safe to say that the company delivered, posting $13.5 billion in revenue – a staggering 101% year-over-year increase. When looking at earnings, earnings per share (EPS) came in at $2.70, well above the consensus analyst estimate of $2.14. These earnings figures represented an eye-popping 429% year-over-year increase. Driving this monumental performance was the company’s H100 AI and A100 chips, which help to power AI breakthroughs like ChatGPT. This business segment represented roughly $10.3 billion of the company’s $13.5 billion in revenue.

Apple – the company beat analysts’ expectations for both earnings and revenues, albeit slightly. Back in August of 2018, the company did something once thought to be impossible – I passed the $1 Trillion threshold in market cap (market cap = share price x shares outstanding). At the end of August of 2023, the company’s market cap has ballooned to over $2.8 Trillion. Still, the company has seen revenues level-off (and even decline) in two of its primary business segments – the iPhone and iPad sales. However, Services revenue (iTunes, software, Apple Pay, Apple Card, etc.) has climbed from roughly $12.5 billion in Q4 of 2019 all the way up to $21.2 billion last quarter. So, clearly, the business is evolving, and investors wonder if the iPhone 15 can generate buzz and boost sales.

Tesla – the company beat analysts’ expectations in both earnings and revenues, with revenues coming in at $20.4 billion – an increase of 49.3% on a year-over-year basis. Revenues were clearly boosted by the company’s delivery of 466,140 vehicles in the quarter, which is an 83% increase from the same quarter last year.

Alphabet – the company beat Q2 earnings estimates with EPS of $1.44 per share vs. consensus estimates of $1.33. Revenues climbed 7% on a year-over-year basis. While Google ad revenue only grew by 3.3%, the company’s cloud division saw revenues spike 28% year-over-year which, like Apple, shows the company evolving a bit to foster continued growth.

Meta (Facebook) – while progress toward a fully functioning metaverse has seemingly stalled a bit, Meta continues to post very strong financial prowess, posting considerable revenue growth and earnings of $2.98 per share, which beat analyst estimates of $2.88. Revenues were boosted by 12% year-over-year growth in Meta’s bread & butter – advertising revenue. Financial performance, coupled with a 14.5% decline in headcount, flowed through to the bottom line with net income rising to $7.79 billion – well above the $6.69 billion a year ago.

Amazon – in keeping with the trend above, Amazon beat analyst EPS estimates by 34 cents. After single-digit growth in 5 out of 6 quarters, the company finally broke out and posted double-digit revenue growth, driven largely by Amazon Web Services (AWS).

Microsoft – the company beat both analysts’ earnings and revenue expectations and, like many information technology companies, appear to be positioning themselves as major players in the AI space. As Microsoft CEO, Satya Nadella said, “The next major wave of computing is being born, as the Microsoft Cloud turns the world’s most advanced AI models into a new computing platform. We are committed to helping our customers use our platforms and tools to do more with less today and innovate for the future in the new era of AI.”

Earnings Summary – While we typically don’t invest directly in individual stocks like the seven detailed above, it’s clear that they have been an important driver of market momentum throughout 2023. These companies also happen to be fascinating drivers of innovation, so it’s been interesting to see how these organizations have evolved in order to foster growth, including as we enter the very early stages of what could be the next major driver of growth – Artificial Intelligence (AI).

Inflation & The Labor Market

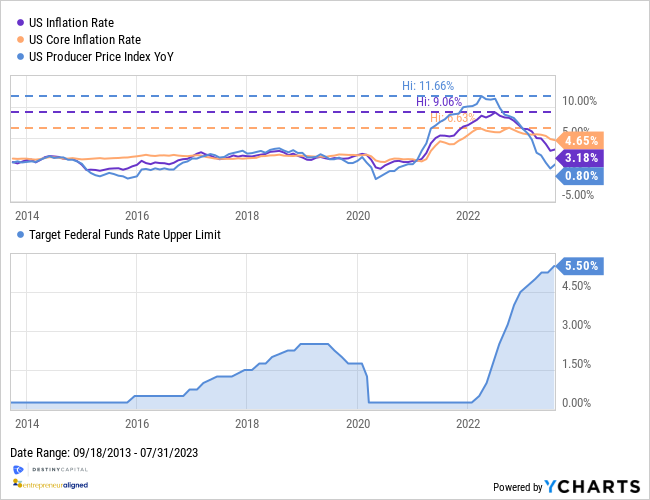

Since the Federal Reserve began raising interest rates in March of 2023, the U.S. has made some considerable progress in taming inflation. The chart below helps to illustrate this journey, with the upper section detailing headline CPI, core CPI and the Producer Price Index (PPI). Meanwhile, the lower half represents interest rates by illustrating the upper-limit of the fed funds target rate.

Inflation vs. Interest Rates

As you can see, inflation finally began to roll over as interest rates continued to rise. One element of this data that seems to get overlooked is the PPI (Producer Price Index) figure of 0.80% year-over-year. PPI represents the selling prices received by domestic producers for their output. This is inflation at the wholesale level and represents prices from manufacturers and/or service providers.

Theoretically, lower prices paid by producers should eventually flow through to consumers, and that appears to be happening at some level. In March of 2022, PPI peaked at 11.66%, indicating that the fight against inflation was far from over. Yet, here we are roughly 18 months later, and PPI has fallen precipitously to 0.80% year-over-year which, generally speaking, is a positive sign.

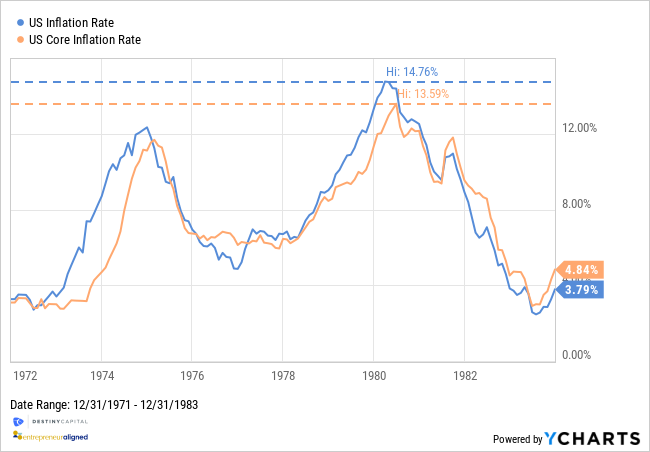

While progress has been significant, policymakers are extremely apprehensive of repeating mistakes from the past. What Fed Chairman, Jerome Powell, is trying to avoid is double-dip inflation as we saw in the mid-70’s through the early 80’s, as illustrated in the chart below.

US Consumer Price Index – Core & Headline – 12/31/1971 through 12/31/1983

As a result, the Fed has continued their hawkish messaging about continuing to raise interest rates in the future while keeping rates higher for longer. So far, the Fed has walked this tightrope without plunging the U.S. into a deep recession. However, some slight cracks are beginning to form in the labor market.

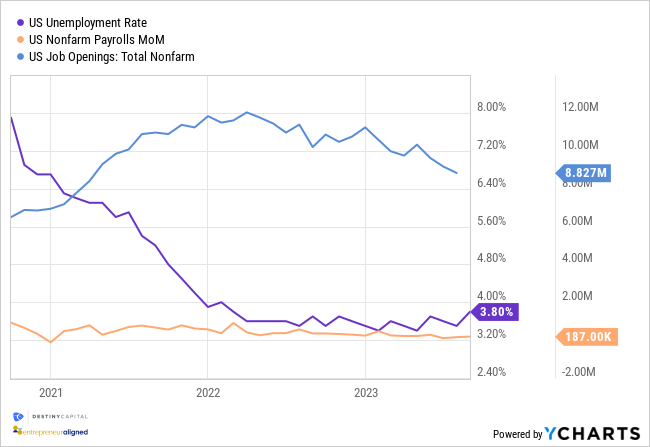

The chart below summarizes the ‘employment situation’ in the United States with three key data points – the unemployment rate (purple), non-farm payrolls added (orange), and total job openings (blue line). Over the past two years, total job openings in the U.S. hovered between a staggering 10 and 11 million. This represented nearly two open positions for every American job seeker. Based on the last Job Openings and Labor Turnover Survey (JOLTS) report, job openings have fallen to 8.8 million. While that figure is still elevated, it represents a meaningful decline.

The U.S. Employment Situation – Unemployment Rate / Nonfarm Payrolls/ Job Openings

Furthermore, we are seeing fewer jobs added each month. Over the past six months, total non-farm payrolls have averaged just under 200,000 jobs per month. Over the past three months, we’ve seen an even starker decline with 105k jobs added in June, 157k added in July, and 187k added in August. Meanwhile, the unemployment rate has ticked-up ever-so-slightly to 3.8%.

While none of these figures could be classified as ‘bad’, they do represent some softening in the labor market which is exactly what the federal reserve wants to see. While policymakers certainly don’t want to see the unemployment rate spike to 8%, they do believe that a weaker labor market will be key to taming inflation over the long run and avoiding a repeat of what happened in the late 70’s and early 80’s.

After a 2023 filled with inflation, Fed policy changes, a banking crisis, and a highly publicized downgrade of the credit rating of the United States, August was a bit of a welcome respite from drama for investors. That is likely to change a bit in September as we get our next Consumer Price Index (CPI) report on September 13th, then the next Federal Reserve meeting concludes a week later on September 20th. Stay tuned.

The latter portion of the year is also an important time for many investors. This is when required minimum distributions (RMDs) must be satisfied for some IRA owners, or when the tax picture becomes a little more clear for many households and we look for strategic opportunities to add value through loss harvesting or Roth conversions, to name just a few strategies. As such, this can be a good time to clean the beach sand off of your feet and touch base with your team of advisors to make sure your goals are on track and there is no stone left unturned. This is what we do, and our team is here and eager to help, so please don’t hesitate to reach out.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Advisory services provided by Destiny Capital Corporation, a Registered Investment Adviser.