Markets and Economy Update – May 2022

Generally speaking, there are two topics of conversation which nearly guarantee that I am going to mentally disengage from a discussion. First, is any type of dialogue in which someone describes in detail a dream they had the night before. When that happens, I usually go through a mental Rolodex of items in my fridge and wonder if I have enough ingredients to make Thai food that evening. The second topic is any type of diatribe about a bad travel experience at an airport or on a flight.

So, how am I going to begin this month’s market and economy update? I am going to begin with a bad travel experience at an airport and on a flight. Please, bear with me. There is a point, I think. Over a week ago, I had some business-related travel that had me flying home the Friday before Memorial Day weekend. As you may have heard, the airline industry canceled over 2,500 flights as it dealt with, among many other things, a high volume of travelers.

While I will spare you the gory details, my personal experience was a series of unfortunate events that spanned across the travel and leisure industry, including airports, airlines, ride-shares, restaurants and hotels. For about 48 hours, Murphy’s Law ruled the day and it got to the point where I cringed and whimpered, “Please. No more!” whenever my phone buzzed and indicated a flight notification from my airline.

Sentiment – Perception is Reality

Clearly, I was not alone in my despondency. Everywhere I looked either at the airport, in a car, at a restaurant or in a hotel, morale was low. Everyone was, in a word, a bit moody. When negative momentum begins to snowball, it can have a cascading effect on sentiment across the board. This type of pessimistic sentiment is exactly what we’ve seen in financial markets over the past several months, as investors have been bombarded with unique challenges from all directions, including:

- Inflation: There are levels of price increases not seen in over 40 years.

-

Fed Uncertainty: The Federal Reserve is singularly focused on combating inflation through asset purchase tapering and aggressively raising interest rates.

-

Geopolitical Conflict: Russia’s invasion of Ukraine and the subsequent fallout beyond the tragic loss of life (global tensions, higher energy prices, etc.).

-

Supply Chain Issues: There are ongoing supply chain challenges due to, among many other things, labor shortages.

-

Residual Pandemic Effects: China has implemented strict lockdowns in key cities to combat COVID-19, thus exacerbating existing supply chain issues.

-

Waning Fiscal Stimulus and Tightening Monetary Policy: As we covered in our previous letter, investors are in the early stages of stimulus withdrawal.

-

A Cooling Housing Market (?): Clearly, there may be markets that remain perpetually red hot, but with an average 30-year fixed mortgage rate at 5.30%, will aggregate demand dip in the housing market as certain home buyers are priced out?

Much like my recent travel experience, 2022 has seemingly delivered one daunting challenge after another that investors must digest, understand and navigate. Beyond that, I tend to believe that baseline human stress and anxiety levels have increased since the onset of the pandemic. Many of us are just living in a world of elevated risk that, consciously or subconsciously, may impact our mindsets in all aspects of life. Heck, it would not surprise me to visit my family doctor a year from now and see a chart that shows a blood pressure reading of 140/90 as “average”.

Just how bad has sentiment grown? To detail this, we will look at two charts.

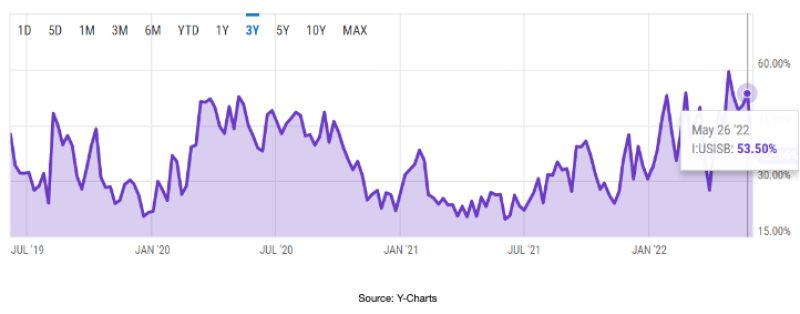

The chart below illustrates results from a weekly survey by The American Association of Individual Investors in which they ask investors if they are Bullish, Bearish or Neutral on the stock market over the next six months. Below is the Percent Bearish chart that illustrates the percentage of respondents that have a negative (bearish) near-term outlook on the stock market.

US Investor Sentiment – % Bearish – 3 Year

As you see in the chart above, in late April of 2022, bearish sentiment was nearly 60%. You also might note that throughout the most desperate depths of the COVID-19 pandemic in the spring and summer of 2020, bearish sentiment barely reached 55%, let alone a reading close to 60%. In fact, the April 25th bearish sentiment reading of 59.36% was the highest on record since March of 2009.

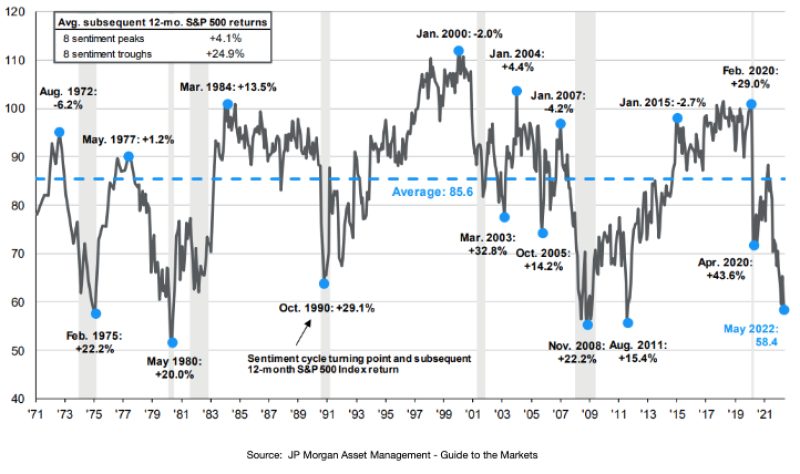

Investor sentiment is one thing, but the American consumer is what drives much of the economy, as nearly 70% of United States Gross Domestic Product consists of consumption. Therefore, we now turn to the University of Michigan’s Consumer Sentiment Index to gauge the mindset of this important element of our economy. The results are, well, not very inspiring.

Consumer Sentiment Index and Subsequent 12-month S&P 500 Returns

While I expected to see Consumer Sentiment fall in recent months, I was fascinated to see that consumer sentiment had fallen so precipitously. Just look at the two Consumer Sentiment index readings below, and consider the context of both time periods.

November of 2008: 55.3

May of 2022: 58.4

50-Year Average: 84.1

Are investors and consumers facing unique headwinds in 2022? Yes. Am I surprised to see investor bearishness and consumer sentiment at such pessimistic levels relative to some of the most damaging and dramatic events in the history of the global economy? Yes, I suppose I am. Could this help to explain (at least, in part) why nearly all asset classes have sold off so precipitously throughout 2022? Perhaps.

Silver Lining

In my overall experience in this industry, pessimism tends to lead to fear. Fear leads to emotion. Emotion leads to bad financial decisions. As Warren Buffet says, “Be fearful when others are greedy. Be greedy when others are fearful.” In fact, if there is a silver lining in these pessimistic investor/consumer numbers, it would be in looking at the average performance of the S&P 500 in the 12-months after consumer sentiment bottoms out. As seen in the chart above, over the past 50-years, the average 12-month return of the S&P 500 index after consumer sentiment reaches its bottom is +24.9%.

2022 has been a challenging year for investors. There is no question about that. However, as JP Morgan’s Chief Global Strategist, David Kelly, says, “Volatility is the price we pay for better long-term returns on equities.” If history is any guide, now is not the time to abandon long-held strategies centered around data, diligence, and discipline.

Tesla, Elon Musk and Environmental, Social and Governance (ESG)

I will close this month’s letter on a bit of a unique topic that has garnered some headlines in recent weeks. To the surprise of many, around mid May it was announced that Standard & Poors had removed EV giant Tesla from its ESG index. Upon hearing this news, Tesla’s CEO Elon Musk openly criticized ESG as, among other things, a scam.

As someone who spent the better part of three years researching this strategy, I can understand why Musk has taken such a stance. At the onset of Entrepreneur Aligned’s due diligence into a variety ESG investment strategies, I came to a similar opinion based on my superficial knowledge at the time, particularly when reviewing indexed strategies like Standard and Poor’s. At the time, I asked, how in the heck can Exxon and Phillip Morris be included in an ESG index strategy?

It is impossible to deny the impact that Tesla and Mr. Musk have had on the global perspective around electric vehicles and the shift towards more sustainable energy resources. It is also apparent that Elon Musk’s interpretation and understanding of ESG investing is a far cry from ESG in practice at Entrepreneur Aligned. I don’t blame him at all. Many, either industry insiders or outsiders, often have a misguided interpretation of what ESG is or should be.

ESG investment decisions are many times simply based on arbitrary “ESG scores” that are assigned to a company’s perceived record on environmental, social and governance issues. This is ESG in name only, at its most basic and provides little, if any, value to long-term investors. Are there asset managers who employ these strategies? Yes. This practice is called “greenwashing”. It goes without saying that these are managers and strategies we seek to avoid.

ESG investing at its core is about identifying risks and opportunities that have long been ignored by traditional fundamental stock research and analysis. Entrenched in the tenets of true ESG research is the concept of “materiality”. Materiality refers to the material ESG risks faced by certain industries, sectors and sub-sectors. These financially material risks often provide a basis of comparison among peer organizations.

Clearly, not all corporations are created equally. For example, due to their inherent infrastructure, a utility company may have far greater ‘E’ (environmental) risks than a company in the communications services sector, where the ‘S’ (social) risks around data privacy and security may be more prevalent.

As such, effective ESG researchers are going to spend far more time researching, understanding and modeling the environmental vulnerabilities of a utility company, whereas with a communications services company like Facebook, there will be an acute focus on the data privacy and security risks that may impact shareholder value. This is a very basic example of the very nuanced concept of “materiality”.

Our partner in ESG investing, Calvert Research & Management, has truly set the standard for what ESG investing should be. In understanding Calvert’s process I, ironically, think that Tesla truly is a case study for the efficacy of ESG investing.

To be clear, Entrepreneur Aligned’s ESG investors currently own Tesla stock. While the company has achieved tremendous success on many levels, that does not mean that there are not risks that should not be analyzed beyond quarterly guidance, a balance sheet, a profit and loss or a statement of cash flows.

For example, areas of acute focus for Tesla (and other EV companies) include supply chain risk, which is typically in the Governance realm of the ESG spectrum. All EV makers need lithium, nickel, aluminum, cobalt, manganese, oxygen, iron and phosphorus in their drivetrain batteries. Several of these materials (particularly cobalt and lithium) are mined in countries that do not follow internationally recognized labor and environmental standards.

To combat any financially material issues, according to our partners Calvert Research and Management, Tesla developed a program based on OECD Due Diligence Guidance for Responsible Mineral Supply Chains. Under the program, Tesla uses direct sourcing of materials and direct local engagement to reduce risks. The company also relies on audits on refiners and mine sites carried out by third parties such as the Responsible Minerals Assurance Process (RMAP) standards set forth by the Responsible Minerals Initiative (RMI).

There are many other financially material issues that are of concern to Tesla investors. Still, instead of immediately enacting punitive measures against the company, we seek to engage the company to request the data required to make informed decisions on behalf of our investors. If the company is not forthcoming with pertinent data, then votes can be made, or shareholder resolutions may emerge. As shareholders and owners, this is no less than what we deserve – the information required to make informed decisions related to risk and return.

In short, ESG investing isn’t a replacement of traditional, fundamental investment research and analysis. At Entrepreneur Aligned, we consider it an enhancement to these practices. We take our fiduciary standard seriously. If we deem that a strategy or product may result in stronger risk adjusted returns for our clients, then we would be abdicating our fiduciary standard by ignoring it. Through ESG investing, we are adhering not only to our fiduciary standard, but to our core investing principles centered around themes like data, discipline, and innovation.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.