Markets and Economy Update – April 2022

By: Tim Doyle, CFP® – Chief Investment Officer

Let us pretend that over the past few years you began every single morning with three chocolate donuts and washed them down with a 32 ounce, super-caffeinated iced coffee. Eventually, at your long-delayed physical, your doctor peeled the sphygmomanometer off of your arm, glanced up and gravely stated, “We need to talk.” Reluctantly, you admitted to your doctor your habit of morning coffee and donuts, and the wide-eyed doctor declared the need for immediate change. “You can’t keep starting each day like this,” the doctor said, “I’m recommending that we change this behavior over time, starting now.” Your doctor then suggested an aggressive weaning period with the goal of a caffeine and sugar free diet by year’s end.

In this scenario, you would imagine that those first few months living with significantly less caffeine and sugar might be a bit of an adjustment, would you not? You might become a little edgy, and a little moody, right? Every obstacle and every inconvenience might be amplified as your body slowly adjusts to its new, stimulant-free normal.

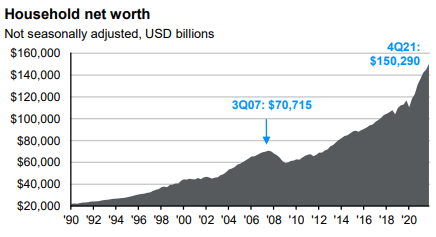

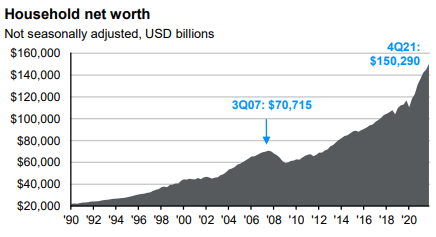

Similarly, financial markets and investors are in the early stages of a painful weaning process after an extended period with an “all you can eat and drink” mentality, thanks to accommodative monetary policy and aggressive fiscal stimulus. To give you a sense of just how much liquidity has been pumped into markets over the past two years, we look at Chart A, below, which illustrates the Federal Reserve’s balance sheet.

Chart A – Fed Balance Sheet

Source: Federal Reserve, JP Morgan Asset Management

Keep in mind that this chart does not include the trillions of dollars in fiscal stimulus that was approved by the federal government in the form of PPP loans, stimulus checks, enhanced unemployment benefits and other aggressive spending measures.

What stands out in the chart above is the contrast in how monetary policy was implemented after the 2008 financial crisis when it came to size, scope and pace. Then, Fed intervention was a gradual, cautionary process, which some may argue prolonged the pain of the financial crisis and stunted faster growth.

Contrast the response in 2008 and beyond with what we saw in March of 2020 when the Fed acted aggressively and decisively to combat a worldwide economic freeze. In ten years, students will be arguing in economic classes across the country as to whether or not the Fed made the right call. Personally, I will approach any eventual judgment with empathy and humility, recognizing just how much was at stake during both the great financial crisis in 2008 and the onset of the COVID-19 pandemic in 2020.

For now, as you might expect, investors are a little edgy, knowing that they will have to give up their big “caffeine and sugar fix”, so to speak, and financial markets have been extremely moody as a result.

In fact, as of the end of April, there are only two major asset classes that are producing positive year-to-date returns: commodities (+30.2%) and cash (+0.1%). Even the bulk of the +30.2% return in commodities came in the days immediately after Russia’s invasion of Ukraine on February 24th, when significant uncertainty entered the supply and demand equation, and oil prices spiked.

All other major asset classes, including bonds, are down significantly, as seen in the YTD column in the Chart B below.

Chart B – Annual Asset Class Returns – 2007 through YTD (May 1, 2022)

Source: JP Morgan Asset Management – Guide to the Markets

Not only are markets already moody due to fiscal and monetary stimulus withdrawal, but they have been confronted with near-term obstacles that are causing emotions to run high. These obstacles include elevated and persistent inflation, geopolitical conflict between Russia, Ukraine and the West, energy supply concerns in Europe, pandemic lockdowns in China, supply chain shortages, a tight labor market, rising wages, record high job openings and uncertainty surrounding an aggressively hawkish Fed. As you might expect, many of these issues are interrelated.

These obstacles are a lot like our hypothetical sugar and caffeine junkie on their first day of abstinence, sleeping through their alarm, scarfing down some grapefruit on their way out the door, finding that their car has a dead battery, forgetting their key fob to get into their building at work, eating more grapefruit for lunch and then getting a flat tire on the way home . . . in the rain. I do not mean to offend all of the grapefruit fans out there, including my beautiful wife. Personally, I only consume the astringent fruit in the occasional “Greyhound” form.

Regardless, in short, it has not been a pleasant way to begin a new cleansing cycle for financial markets. Investors are emotional and uncertain, and emotion and uncertainty inevitably lead to volatility.

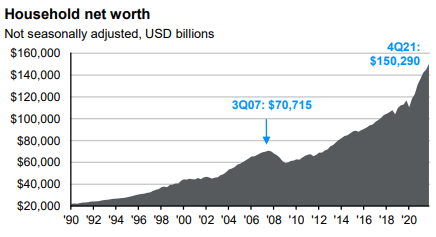

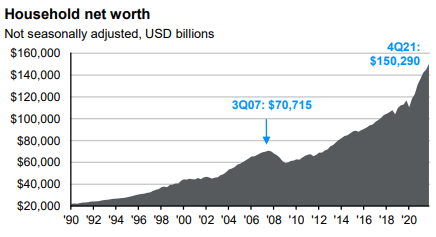

This is when we, as disciplined long-term investors, must remind ourselves that volatility is normal. Below are two of my favorite “big picture” charts. Chart C illustrates the trajectory of the S&P 500 index since 1996 while highlighting returns between key inflection points.

Chart C – S&P 500 Index Performance

Source: JP Morgan Guide to the Markets

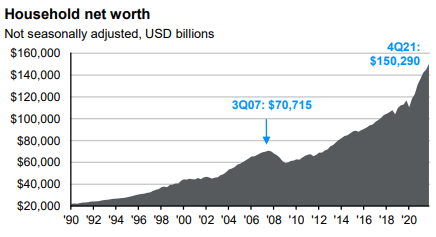

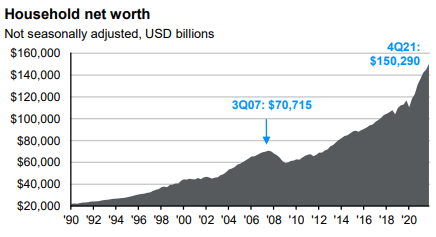

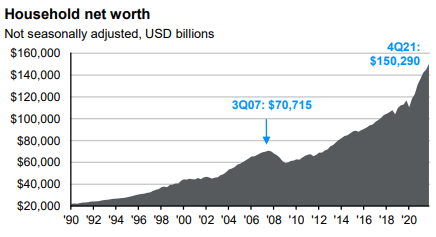

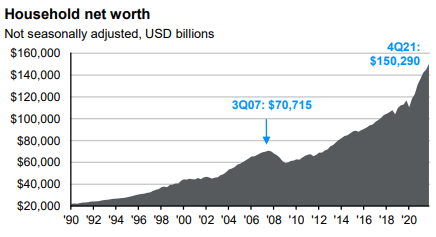

Chart D shows calendar year returns (gray bars) along with intra-year declines in the S&P 500 (red dots).

Chart D – S&P 500 Index Volatility

Source: JP Morgan Guide to the Markets

As you can see, on average, the S&P 500 experiences intra-year declines of -14% while calendar year returns finished positive in 32 of the past 42 years.

As long-term investors, this is not our first rodeo, and we know that investment returns in financial markets are far from linear. While the trajectory has been moving in a positive direction over the long run, we all know that it can be quite a bumpy ride along the way, and the positive market performance experienced in 2021, as enjoyable as it was, was the exception, not the rule.

Bond Market Update

As we touched on last month, one thing that investors are not quite accustomed to experiencing is volatility in fixed income (bond) markets. As a key part of a diversified portfolio, bonds have historically been viewed as a ballast against stock market volatility. To demonstrate this, we look at the correlations of United States Treasuries to the S&P 500.

In short, what we are looking for here is a very low (near zero) or, ideally, negative correlation to the S&P 500, meaning that if the stock market zigs, these bonds may zag. You will see this illustrated below (column bordered in red) where the two year United States Treasury historically has a -0.35 correlation, meaning that if the S&P 500 declines, we would expect to see two year United States Treasury notes ascend to some extent.

Chart E – U.S. Treasury – Correlations

Source: JP Morgan Asset Management – Guide to the Markets

However, what is highly unusual about bond market activity in 2022 is that we are seeing negative year-to-date (YTD) returns in bond markets at magnitudes that are similar to those experienced in some sectors of equity markets.

What happened? Well, historically, you would expect bond prices to fall incrementally as interest rates rise over time, not at once. Earlier in 2022, some bond investors were apparently convinced that the Federal Reserve was/is going to stick with its agenda to raise rates throughout the remainder of the year, and markets priced-in over a year’s worth of incremental rate hikes in a few short months. In that sense, and given the price decline in the Aggregate Bond Index, bond prices are already potentially trading at 2023 interest rate levels. The interest rate hikes are already baked into the pie, as we say.

We also must remind ourselves that if there is any deviation from Fed policy in the coming quarters, bond prices could spike. For anyone trying to time the market, we experienced this exact scenario in 2018-2019 as the Fed shocked investors when it reversed course and lowered the Fed Funds Target Rate after a series of rate hikes. Many investors got whipsawed as fixed income investments rapidly ascended and even outperformed stocks for an extended period of time.

As long-term, diversified investors, it is also important to note that we view bond investing from a “total return” perspective. When buying and selling bonds, total return consists of the price return (appreciation/depreciation of the underlying bond price in the open market), and the coupon payment. So, as coupon payments are received periodically and accumulate over the course of the year, we expect this to offset some of the immediate price effects of the bond market sell-off.

Finally, for the first time in quite a long time, we are also seeing bond yields increase to meaningfully higher levels. This means that we can expect fixed income instruments across the spectrum to begin producing more and more reliable income for investors. We can see this in the chart below where 10 year United States Treasury yield now exceeds the dividend yield of the Russell 1000 (broad stock market) Index, and Investment Grade Corporate Bonds are now approaching and exceeding the 4% mark.

Chart F – Increasing Bond Yields

Source: Orion Advisor Solutions

Equity Market Update

We will now turn our attention to equity markets and an earnings season that has just passed the halfway mark.

Over the past five years, one topic that has often been overlooked by investors is the growing concentration of the top 10 S&P 500 companies as measured by market cap. The S&P 500 Index is a cap-weighted index, meaning that the larger a company is as measured by market cap (market cap = share price x shares outstanding), the larger it is represented as a percentage of the overall index.

I will give a clearer example, I hope, using the chart below. Recognizing that this list is fluid, the Top 10 companies in the S&P 500 as measured by market cap are Apple, Microsoft, Amazon, Tesla, Alphabet Class A, Alphabet Class C, Berkshire Hathaway, NVIDIA Corp, Meta Platforms and United Health Group Inc. In aggregate, the stock of these 10 corporations make up nearly 30% of the S&P 500 Index. This means that if you buy a traditional, market cap weighted S&P 500 Index ETF with $100,000, roughly $30,000 will be invested and split among these 10 stocks.

Chart G – S&P 500 Weighting of Top 10 Stocks

Source: JP Morgan Asset Management – Guide to the Markets

This means, during times of market volatility, investors can be extremely sensitive to the quarterly performance of a select few companies. If these companies stagger at any level, whether it be on revenues, earnings or forward guidance, markets may overreact, particularly when it comes to negative surprises. As a result, these investor reactions (or overreactions) may not just affect that company’s stock price, but broader markets in general. The same can be potentially said on the upside as markets gain more and more upward momentum.

As an example, both Amazon and Apple released earnings on 4/28/2022. Investors let out a sigh of relief when Apple beat analyst estimates and recorded one of their strongest three month stretches in history. However, the party was short-lived, as Apple reported forward guidance that warned of supply chain headwinds. Then, Amazon reported quarterly earnings and declared a significant earnings-per-share (EPS) shortfall, coming in at -$7.56 for Q1 2022 versus an average analyst estimate of +$8.35, citing (among other things) supply chain issues and rising costs.

Despite Apple’s positive revenue and EPS surprise, the negative news won the day and the Nasdaq promptly sold off over -5.5% over the course of roughly two trading days before markets stabilized.

When looking at broader markets, we now have 55% of S&P 500 companies reporting Q1 2022 results. As of the end of April, 80% of these companies have reported EPS above estimates, while 72% of these companies have beaten revenue estimates. Both figures are above their respective 5-year averages.

Another interesting figure that has emerged is related to S&P 500 earnings growth and the effect of Amazon’s poor performance on the broader index. According to FactSet, the year-over-year earnings growth rate for the S&P 500 in Q1 thus far is +7.1%, which is below the five-year average growth rate of +15.0% and below the 10-year average growth rate of +8.8%. However, if you remove Amazon stock from the S&P 500’s earnings growth equation, the growth rate of the S&P 500 jumps from +7.1% to +10.1%, as seen in the chart below, which is well above the 10-year average.

Chart H – S&P 500 Earnings Growth Ex Amazon

Source: FactSet Earnings Insights

In short, the performance of broader markets will continue to take its cues from a handful of large, mega cap corporations. Thankfully, long-term investors have largely been rewarded as these companies tend to be innovative industry leaders and well-run organizations. It is important to monitor this underlying relationship and ensure that investors are not missing important opportunities elsewhere in markets over time. This is why we not only diversify within stocks, but among a variety of asset classes.

What is next? Well, we are clearly keeping an eye on corporate earnings with a focus on the long term trajectory of our portfolios as we decipher long term trends amongst the daily noise. We expect Jerome Powell to announce that the Federal Open Market Committee (FOMC) will implement a 50 basis point (0.50%) hike in the target fed funds rate during his May 4th press conference. While this rate hike may ultimately have a significant effect on borrowers, we don’t expect this to have a significant, immediate impact on bond markets. As I suggested earlier in this letter, while there can always be surprises, rate increases have largely been priced-in, and we expect the Fed to continue its aggressive policies in fighting inflation. We hope that the Fed and a resilient, innovative United States economy can work together in navigating a soft landing.

In the meantime, we expect the stock market to remain reactionary, particularly when absorbing earnings data from higher profile stocks that disproportionately impact the trajectory of the broader index.

As always, we will continue to communicate as data emerges and markets evolve, and I would encourage you to reach out to your Entrepreneur Aligned team with any questions.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Share this

Build a Resilient Retirement

Don’t wait—download our essential retirement guide and start planning for a secure future.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.