Markets and Economy Update – June 2021

All Eyes on the Fed

As the parent of a three-year-old boy, I have come to grudgingly accept the fact that I am fully susceptible to manipulation. You see, my son loves two foods above all else: olives and ice cream, though not necessarily at the same time. Still, ice cream is his true favorite, and he knows exactly how to employ the right Jedi mind tricks that will result in two scoops of chocolate ice cream being handed to him as he sits at his little table and chair. After all, I have come to learn that this reward is often mutually beneficial. My son gets his ice cream, while I get an adoring smile and nine minutes of blessed quiet as he sits and exhibits model behavior. Those nine minutes do not sound like much, yet they are everything.

However, there are many times when I have to deny his unceasing requests for a treat, even though it can be so easy to give in and avoid the fallout of a refusal. “Ice cream is a treat,” I’ll say. “You can’t expect dessert every night,” I’ll declare, as his eyes begin to well with the most sympathetic tears you will ever see. That is usually when his Jedi mind tricks take hold, and, in a fog, I somehow end up with an ice cream scoop in-hand.

As investors, thanks to loose monetary policy and a series of fiscal stimulus packages, we have grown accustomed to the investing equivalent of ice cream every night. Both equity and bond markets have come to rely on that daily sugar rush, and all eyes have turned to the Federal Reserve to see if and when they will pry the ice cream spoon from our fingers.

Federal Open Market Committee

As we have written in previous letters, the Federal Open Market Committee (FOMC) understands that any reversal of course may cause a tantrum in financial markets. Therefore, the Fed must carefully weigh priorities as it relates to its key mandates of stable prices, full employment and moderate long term interest rates.

In their carefully-worded release on June 16, 2021, the FOMC stated, “The Committee will aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time and longer‑term inflation expectations remain well anchored at 2%. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.”

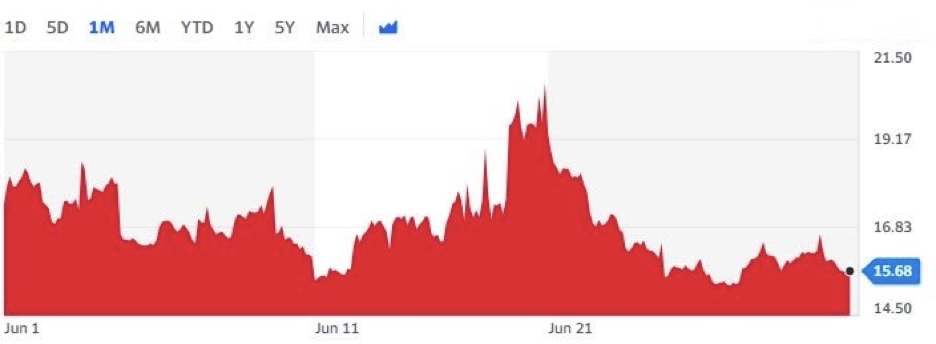

To me, the Fed is implying that they are willing to absorb prolonged periods of elevated inflation as the risks related to COVID-19 abate and until the unemployment rate reaches target levels. Apparently, I am not the only one who interpreted their remarks in this way, because equity markets immediately responded favorably to this announcement. Since then, we have seen the S&P 500 temporarily climb to new highs while volatility has fallen as seen in the Chicago Board Options Exchange (CBOE) Volatility Index chart, below.

CBOE Volatility Index Chart – 1 Month

On June 25, 2021, the Bureau of Economic Analysis (BEA) released a report showing that the Personal Consumption Expenditures index (the Fed’s favorite inflation measure) came in at 3.9% y/y in May. That seems to fall within the range of inflation moderately above 2%, so markets seem to believe that the Fed is going to let the ice cream party last quite a bit longer as the unemployment rate gradually declines (currently at 5.8%).

Personal Consumption Expenditures (PCE)

Infrastructure Plan Momentum

Meanwhile, the Biden Administration continues to hammer away at an infrastructure package that would introduce additional stimulus into the economy. A bipartisan effort at an infrastructure bill was introduced about a week ago, and the White House announced their support of it. The total cost of the new deal would be $1.2 trillion over eight years with $579 billion in new spending, as outlined in the chart, below.

Clearly, this plan is short on specifics and many hurdles remain when it comes to an agreement on any stimulus package, but we do expect additional stimulus implemented this year through either a new infrastructure plan or through budget reconciliation efforts. This stimulus (inflation notwithstanding) could provide some tailwinds for financial markets and the U.S. economy in general.

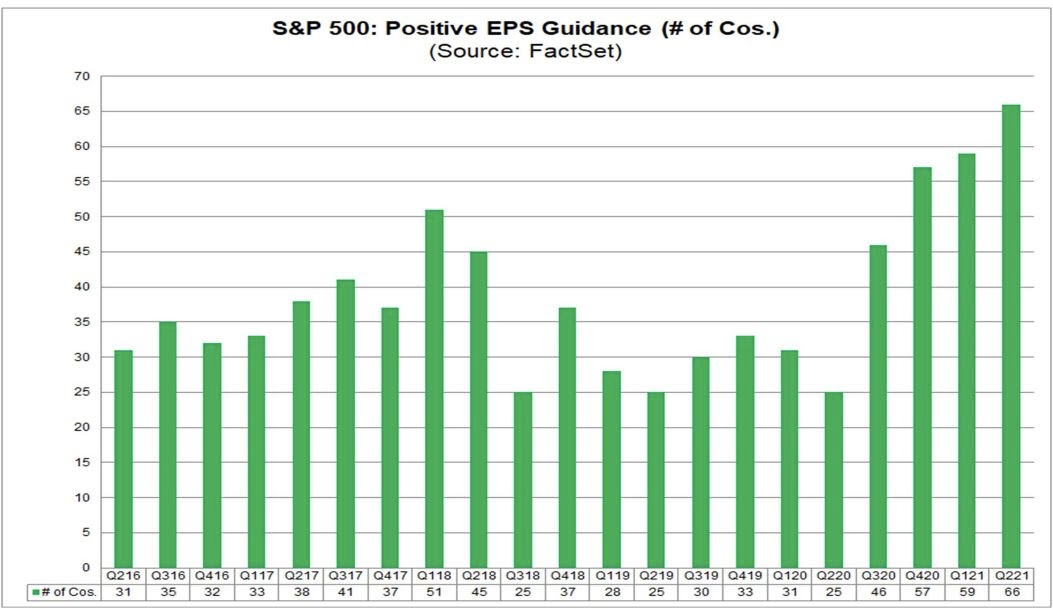

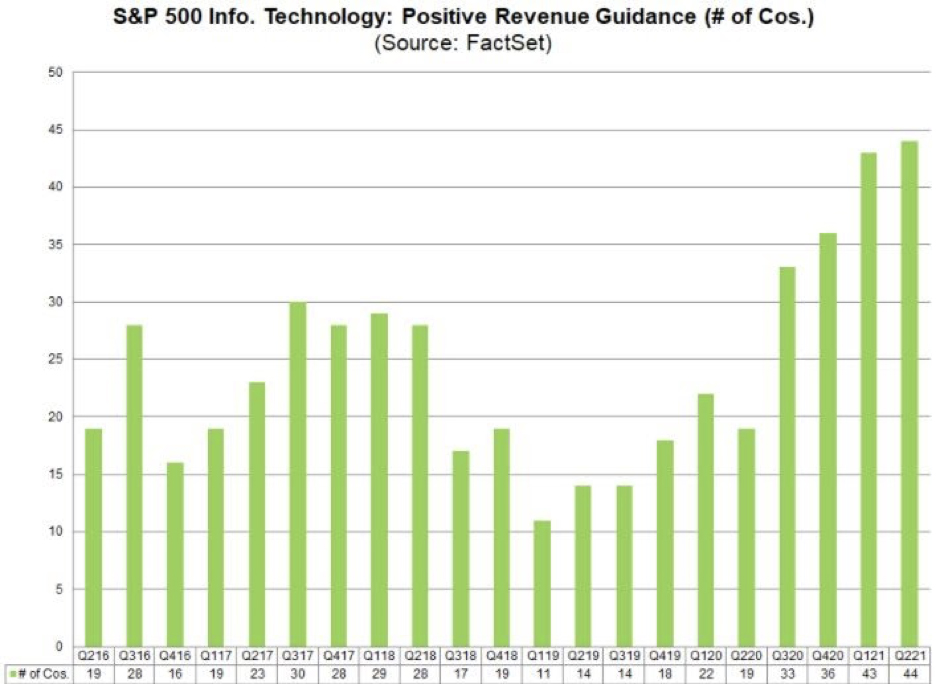

Positive EPS and Revenue Guidance

As the second quarter ends, 103 S&P 500 companies have issued earnings per share (EPS) guidance for the quarter. Typically, roughly 100 companies issue EPS guidance of any kind. Of these 103 companies, 66 have issued positive EPS guidance, while 37 have issued negative guidance.

If 66 is the final number of companies issuing positive EPS guidance, this will represent the highest number since FactSet began tracking this metric in 2006. This is partially driven by the number of companies issuing positive revenue guidance as well.

Among S&P 500 sectors, information technology (IT) companies lead the way with 28 companies in the IT sector issuing positive EPS guidance versus a five-year average of 18. Furthermore, 44 information technology companies have issued positive revenue guidance for the quarter (as seen below) which is well above the five-year average of 23.

The bottom line is that many S&P 500 companies may be further along in their recovery than initially forecasted. In fact, on March 31, 2021, the estimated earnings growth rate for Q2 2021 was 52.1%. That has since been revised, given some of this positive guidance, and the estimated earnings growth rate for the S&P 500 for Q2 2021 stands at 62.8%. It remains to be seen whether or not actual earnings will fall in line with revised analyst expectations and if we will continue to see the level of positive earnings surprises that companies experienced in Q1.

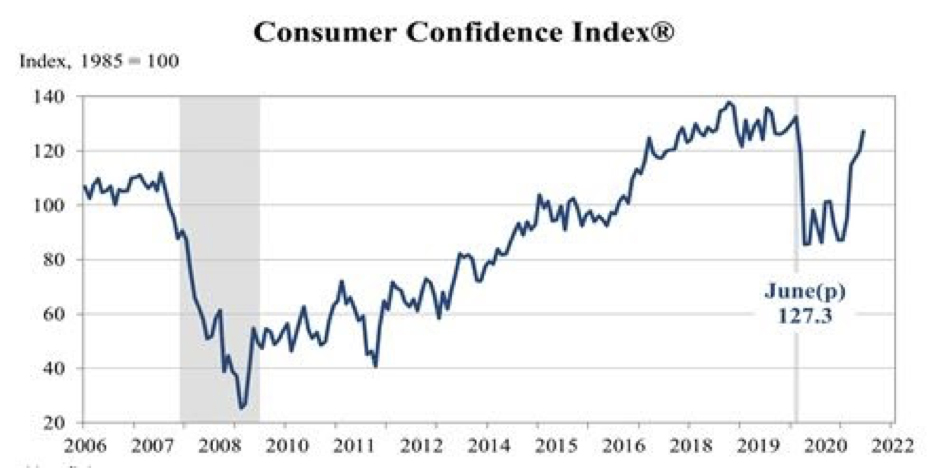

Consumer Confidence and Pent-Up Demand

Finally, we get to the most prominent driver of the American economy – the consumer. On June 29, 2021, the Consumer Confidence Index neared pre-pandemic levels by coming in at 127.3, up from 120.0 in May.

Consumer Confidence Index – June 2021

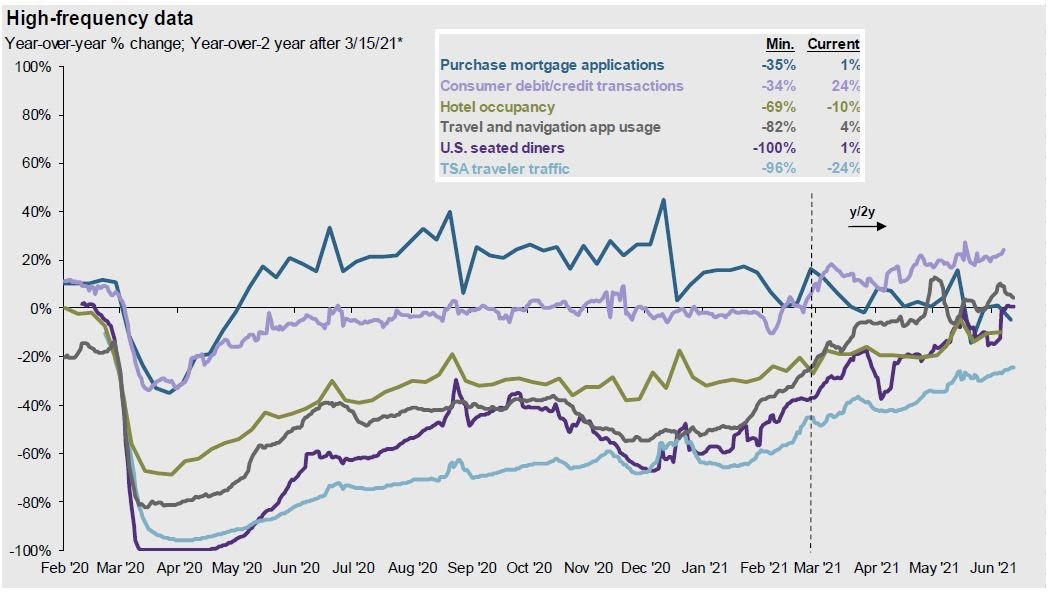

As vaccination efforts continue and COVID-19 restrictions ease, we anticipate that a confident American consumer stands ready and willing to unleash the pent-up demand that has been building over the past 15 months. We can already see this represented in a surge of high-frequency data that shows that activity like traveler traffic, travel app usage, seated diners, hotel occupancy and consumer transactions have reached (and in some cases, exceeded) pre-pandemic levels.

Summer Months

While inflation fears persist and warrant persistent monitoring, there is a lot for investors to be excited about as we enter the summer months.

Anecdotally, it is heartwarming to see my Destiny Capital team members finally able to visit out-of-state family members, take long-awaited vacations or celebrate wedding receptions that were put on hold due to the pandemic. We see more and more clients withdrawing funds to treat themselves, to travel abroad or to take their extended families on a trip. My wife and I will be able to have a fourth birthday party for our son in a few weeks, and friends and family will be present to see his mind-blown reaction when he realizes that ice cream comes in cake form, too.

Destiny Capital’s office fully opens once again after the Fourth of July holiday. We’re excited to talk (in person, in many cases) with clients about what their future looks like and how we can help them utilize their wealth to be present for what matters most to them.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.