Markets and Economy Update – May 2021

A Focus on Inflation

I tend to be both a visual and auditory learner who somehow seems to find a television, film or pop culture parallel for just about everything. Given this fact, when thinking about today’s unique investing landscape, I cannot help but recall a scene from the 1997 comedy classic: Austin Powers – International Man of Mystery.

In this particular scene, Austin Powers and his sidekick Vanessa surreptitiously infiltrate Virtucon, the corporate lair of Dr. Evil, Austin’s nemesis. Austin and Vanessa battle it out with security guards and henchmen in a sprawling warehouse and then hop on a giant steamroller in order to “hasten” their escape.

That’s the gag. With Austin behind the controls, the steamroller casually rolls forward with one of the henchmen in its path, far ahead. The henchman screams in abject terror, never moving, as the steamroller slowly rolls and rolls and rolls, until the henchman is inevitably pulverized.

This scene reflects how I tend to view the topic that is top-of-mind for so many economists, analysts and investors these days – inflation. The speed at which inflation has and will affect financial markets is, in many respects, the inverse of what we just experienced in 2020 with the COVID-19 pandemic. Inflation, while certainly painful, is not necessarily an immediate peril that will cause a steep, panicked sell-off in financial markets.

However, we are keeping a keen eye on inflation, as its effects could alter the investing landscape now and in the quarters ahead, particularly as it relates to certain asset classes. Therefore, we feel that it is important to take some time to outline our general thesis around inflation, its effects and how it might impact investment strategy throughout the remainder of 2021 and into 2022.

First, we’ll start with some basics.

Inflation – What is It?

The Federal Reserve’s mandate includes three key themes: maximum employment, stable prices and moderate long term interest rates. When focusing on price stability, the Fed is talking about controlling inflation, which is measured using a variety of tools.

Get ready for some acronyms.

The most commonly referenced measurement of inflation is the Consumer Price Index (CPI), which is produced by the Bureau of Labor Statistics (BLS). However, the Fed likes to be different, so they do not use CPI when tracking inflation. They use the Personal Consumption Expenditure (PCE) deflator, which is produced by the Bureau of Economic Analysis (BEA).

Both tools (CPI and PCE) measure the change in prices that a consumer pays for a basket of goods and services. While there are many similarities between CPI and PCE, there are also some key differences. For example, CPI sources data directly from consumers while PCE sources data from businesses. When it comes to analyzing the data itself, the formulas used in calculating CPI and PCE differ in the weightings applied to various goods and services. This means that, for example, CPI may deem that the price of chicken is worth a higher weighting than PCE’s formula does when calculating aggregate price movements.

Perhaps the most substantial difference between CPI and PCE relates to the scope of goods and services covered. Generally speaking, CPI is a bit more limited in scope, as it only includes out-of-pocket consumer expenditures. Meanwhile, the PCE formula incorporates expenditures that are not directly paid for by the consumer. These expenditures include health and medical costs covered by employer-provided insurance, Medicare and/or Medicaid. As we all know, those healthcare-related costs are not insignificant.

Both CPI and PCE offer a Headline reading, which includes the entire basket of goods and services covered. They also offer a Core reading, which excludes the more volatile inputs such as Energy and Food. This tends to result in a more consistent inflation reading from month to month.

Both CPI and PCE are effective measurements of inflation, but their outputs may differ slightly. Regardless, in its mandate, the Federal Reserve specifies an inflation target of 2%, as measured by PCE. This is the level in which the Fed believes that consumers and businesses will not have to worry about rising or falling prices when making plans or when borrowing or lending for longer periods.

Inflation – What Causes It?

At its core, inflation is a product of basic supply and demand. Generally speaking, most economists reference two common categories of inflation when identifying potential causes: Demand Pull Inflation and Cost Push Inflation.

Demand Pull Inflation tends to occur during times when consumers are ready, willing and able to spend, which results in a lot of consumer dollars chasing a finite supply of goods and services. When do consumers have money to spend? Well, that tends to occur during times of high wages, low taxes, strong government spending (fiscal stimulus), loose monetary policy (low interest rates), etc. Does this type of environment sound familiar?

While Demand Pull Inflation tends to focus on consumer activity, Cost Push Inflation tends to focus more on producers. Many years ago, I once worked at a wealth management firm where our CEO, during a quarterly firm-wide meeting, said, “Our greatest cost is you – our employees.” At that very moment, I made an internal declaration that, if I were in a position of business leadership, I would never speak to or reference my employees in terms of cost, expense or liability.

At Destiny Capital, we truly feel that our employees are our greatest asset, so I hate focusing on cost when talking about colleagues who add so much value to our firm, our clients and our partners. Even so, when looking at the financials of any business, it is easy to see that their most significant expense tends to be employee payroll. So, when wages rise, that can clearly affect profitability. Businesses then have a few options. They can, for example, be less profitable, OR they can pass some or all of that increased cost onto consumers, in the form of price increases. As such, wage growth is a key element of both Demand Pull and Cost Push Inflation.

Prices can also rise when producers experience supply chain issues or when the cost of certain raw materials increase. We have seen some supply bottlenecks in recent months, due to issues like the COVID-19 pandemic, the utility freeze in Texas, the Suez Canal obstruction and even the Colonial pipeline hack.

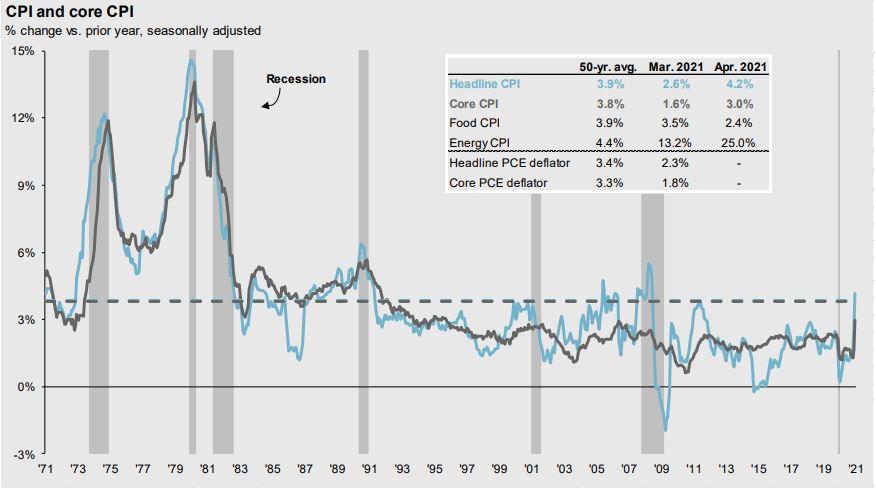

Given the information detailed above, we are clearly in an environment in which we would expect to see upward pressure on prices. This is also why April’s 4.2% Headline CPI reading, as illustrated below, garnered so much attention after 20+ years of inflation that has been relatively held in check.

We know that the United States economy is currently in an inflationary period. The only questions that seem to remain now are: How long will inflation last? How high will it go? What does this mean for investors?

What Does This Mean for Investors?

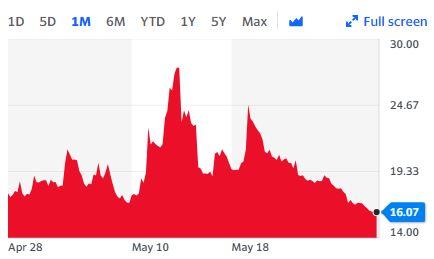

On May 12, 2021, the BLS released its April CPI report in which Headline CPI came in at 4.2%. This was the highest number since the 4.9% increase in September of 2008. As a result, market volatility, as measured by the CBOE Volatility Index (VIX), spiked dramatically (see chart below) while the S&P 500 briefly declined nearly -4%.

When the S&P 500 sold off, and volatility spiked around May 12th, this was not necessarily because of investor fears over the base effects of inflation. It is my contention that investors got spooked because growing and persistent inflation may require the Fed to act. As we detailed earlier, inflation is generally caused by an overheating economy. What will be one of the first steps that the Fed takes to combat inflation due to a red-hot economy? They will raise interest rates. Businesses and investors tend to enjoy a red-hot economy and low interest rates, so the idea of raising rates sooner than anticipated is generally considered negative news by businesses and investors.

Was the immediate reaction to the 4.2% CPI number overstated? Probably. We have to remember that the Federal Reserve has been anticipating inflation for months. In fact, several weeks ago, Fed Chairman Jerome Powell stated, “We expect that as the economy reopens and hopefully picks up, we will see inflation move up through base effects. That could create some upward pressure on prices.”

The Federal Reserve views inflation as both inevitable and transitory. When reading about the Fed in the coming months, I imagine that you will hear the words “patiently accommodative” quite often. The Fed understands that they have openly set investor expectations that interest rates will remain at-or-near zero, potentially through all of 2022. They understand the consequences that a course correction will have on the economy and financial markets. Hence, they intend to remain both patient and accommodative.

We also must remember that stable prices are not the only mandate that exists at the Fed. The Fed also has the burden of helping the economy achieve full employment and, with unemployment sitting at 6.2%, they still have some ground to cover in achieving their general unemployment rate target of 4%.

It is my personal belief that at the Federal Reserve, lowering the unemployment number and supporting the pandemic recovery currently take precedence when compared to combating inflation, for now. We then must ask the question, “What would cause the Fed to change their priorities as it relates to unemployment, pandemic recovery and inflation?” I think that to answer that, we have to understand what causes inflation to be more persistent versus transitory. To identify that, economists tend to look at two things:

-

substantial changes in consumer spending behavior

-

persistent pattern of rising wages

Changes in consumer spending behavior are somewhat hard to define, so I will provide an example. Let us say that my wife and I are in the market for a new washer and dryer. We have a current set that is approaching the end of its life cycle, so we are therefore considering an appliance upgrade over the next 12 – 24 months. However, if we expect that, due to inflation, that the washer and dryer set might substantially rise in price over the next 12 – 24 months, we might accelerate that timeframe and purchase the washer and dryer immediately. This type of consumer behavior is somewhat ironic, given that this type of activity, if widespread, will help inflation expectations become reality.

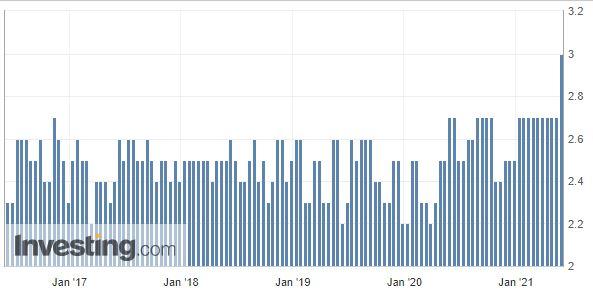

One indicator we can analyze when trying to predict consumer behavior is the University of Michigan 5-Year Inflation Expectations survey of consumers. This latest chart released on May 28, 2021 shows a jump in consumer five-year inflation expectations from 2.7% in April to 3% in May. Clearly, it remains to be seen whether or not those inflation expectations will result in substantial changes in consumer behavior, but this is something to monitor closely.

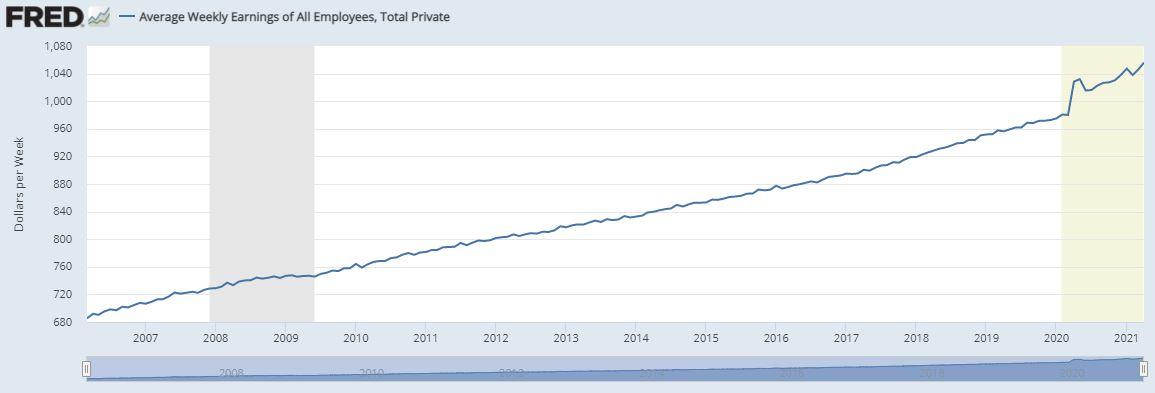

When studying wage data, we see a mixed bag of news from our standard indicators. When looking at hourly wage growth, we do not see much that would indicate a substantial jump in wages. However, if we look at average weekly earnings of private employees, we see a fairly significant deviation from the long-term trend line. Therefore, wages will be something that we and the Fed will likely be keeping a very close eye on.

When it comes to portfolio allocations, there are also some asset classes to limit or avoid entirely during periods of extended inflation. Clearly, all investors should have an emergency cash reserve of 3 – 6 months’ worth of expenditures. However, most cash and savings accounts pay little in the way of interest these days, so the purchasing power of cash immediately erodes during times of inflation. In short, cash has no way of keeping up with inflation, so cash assets tend to have negative real returns during inflationary periods.

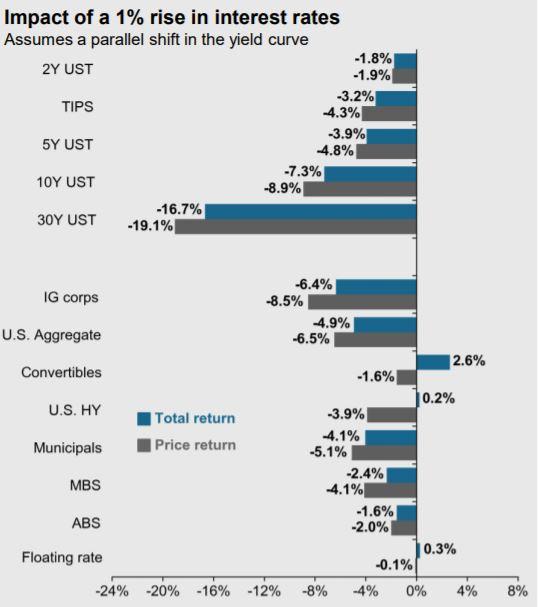

Long-term fixed assets such as long duration bonds not only suffer during times of inflation, but can also be negatively affected if the Federal Reserve decides to combat inflation by raising interest rates. Interest rates and bond prices have an inverse relationship, meaning that bond prices fall when interest rates rise.

The chart below shows the hypothetical impact of a 1% rise in interest rates. As you can see, prices of longer duration bonds such as 30 Year U.S. Treasury bonds are expected to decline significantly if interest rates rise by just 1%. While long duration bonds typically belong in a diversified portfolio due to increased yields, we believe that they should be avoided entirely at this time.

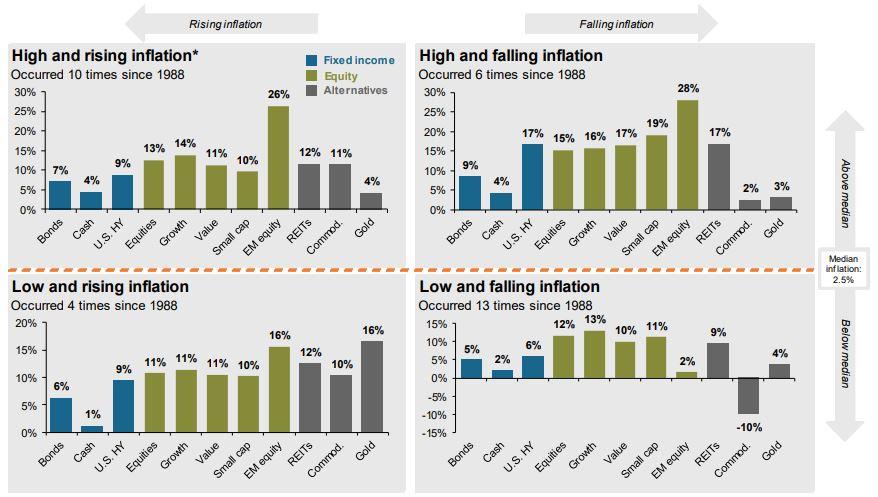

Conversely, assets that have historically performed well during times of inflation include equities (particularly Emerging Market Equities), real assets (including real estate), Treasury Inflation Protected Securities (TIPS) and even Gold. The chart below details historical returns during a variety of inflationary environments, including times of low and rising Inflation, as we are experiencing now.

At Destiny Capital, we have purposely constructed client portfolios with the goal of providing resilience during times of inflation, and we believe our clients are very well positioned for the current environment. When looking at the economy and financial markets, there is a lot to be excited about as the pandemic wanes and the economy continues to expand and thrive.

We will maintain a keen eye on inflation indicators and Fed sentiment in the coming weeks, as additional fiscal stimulus (checks, enhanced unemployment benefits and child tax credit payments) continues to be absorbed into the economy. If inflation begins to look more persistent, then we will be sure to communicate that belief and potentially adjust portfolio allocations accordingly.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.