CIO Tim Doyle Shares Key Points Regarding Market Volatility

By Tim Doyle, CFP®, MBA

On Monday, July 19, 2021, financial markets opened sharply lower as fears about the spread of the COVID-19 Delta variant reverberated across the country. Given these concerns, I assembled some general thoughts that I shared with our Destiny Capital team. As a fully transparent organization, we thought we would share these thoughts with our valued clients and partners in case they have similar questions or concerns related to COVID-19, market volatility and early results from the Q2 earnings season.

COVID-19 Delta Variant

The underlying concern at the heart of recent volatility is the COVID-19 Delta variant that is causing confirmed new case numbers to rise in states across the country. According to health experts, the Delta variant is far more contagious than the original COVID-19 Alpha strain, and symptoms tend to be slightly different. For example, Yale Medicine infectious disease expert Dr. Inci Yildirim reported, “It seems like cough and loss of smell are less common. And headache, sore throat, runny nose and fever are present based on the most recent surveys in the U.K., where more than 90% of the cases are due to the Delta strain.”

Still, scientists are fairly optimistic that current COVID-19 vaccines remain effective against the Delta variant, but that only applies to the fully vaccinated population who have received two doses of the Moderna or Pfizer mRNA vaccines. As an example of vaccine efficacy, a Public Health England analysis found that the Pfizer-BioNTech vaccine is 88% effective against a symptomatic Delta variant and 96% effective against hospitalization. I should note that this study is a pre-print that has not yet been peer reviewed. The efficacy of the Johnson & Johnson vaccine against the Delta variant is also unclear at this time, although the same Public Health England study showed that the AstraZeneca (non-mRNA) vaccine was 60% effective against symptomatic disease and 93% effective against hospitalization.

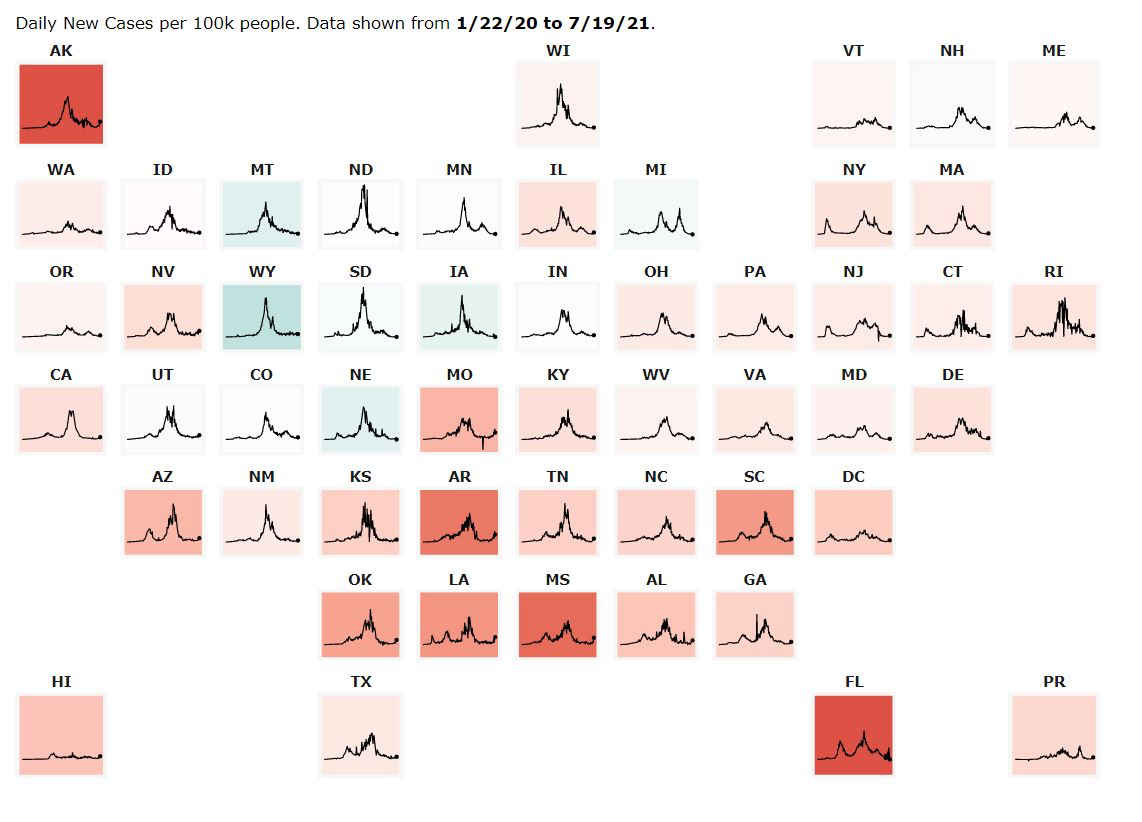

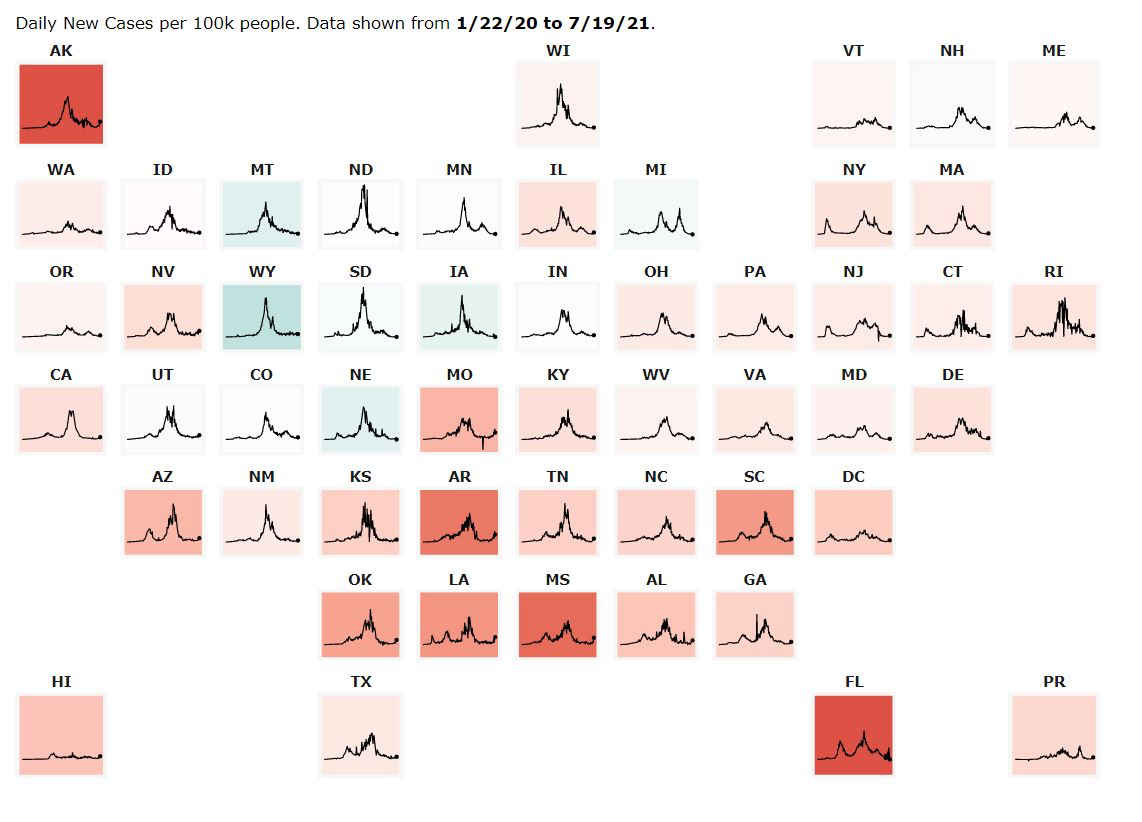

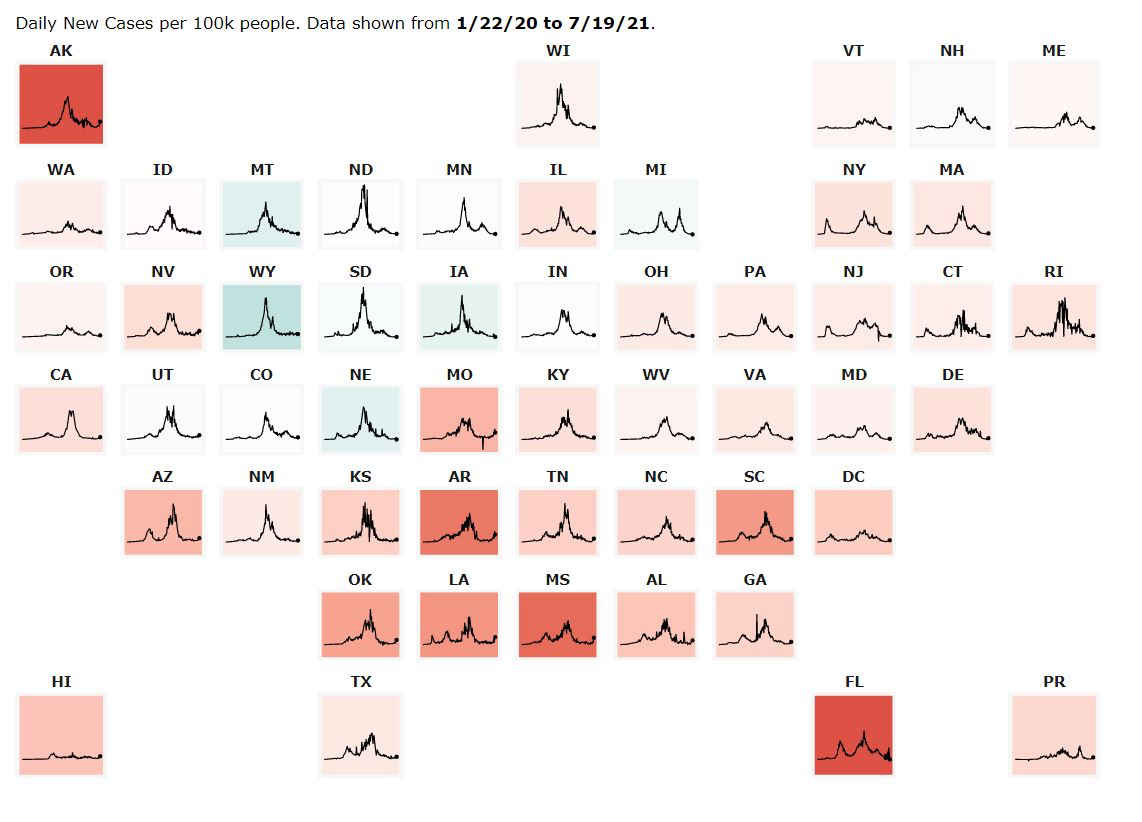

Clearly, the Delta variant is concerning. As it stands now, cases are nowhere near where they were at the end of 2020 or early 2021. However, the trend lines in certain states are raising concerns about potential economic impact. Given the efficacy of the vaccines, health experts believe that there could be hyperlocal outbreaks in certain communities across the country.

US COVID-19 Case Trends

Source: Johns Hopkins Coronavirus Resource Center

Confirmed New COVID-19 Cases – Florida

Source: Johns Hopkins Coronavirus Resource Center

Potential Market Volatility

It is important to stress that volatility is common. In fact, this past year’s relatively muted volatility is the exception and not the rule (although I think we all earned a respite from volatility after the steep and accelerated sell-off in February and March of 2020). Still, when markets are on a constant ascent for extended time periods, it is easy to forget that volatility is an inconvenience that investors must endure at times.

Below is one of my favorite charts in highlighting market volatility. This chart illustrates intra-year declines along with the calendar year returns of the S&P 500. More often than not, you will see an intra-year sell-off of 8%, 10% or even 20%. This leads to an average intra-year drop of -14.3%! Despite this volatility, calendar year returns have been positive in 31 of the past 41 years.

Source: JP Morgan Asset Management – Guide to the Markets

Thus far in 2021, we have only experienced a drop of -4%, meaning that (historically speaking) we may be due for a correction in the coming quarters. These types of corrections are neither fun nor predictable, but they are normal. This is why our team focuses on risk management and diversification. They allow investors to stay in the game when volatility inevitably strikes.

Why Are the Markets Rebounding Today?

I like to remind our team that volatility can be experienced both on the downside and the upside. Also, as we all know, market activity can sometimes be counterintuitive.

COVID cases are rising, and that could potentially derail the trajectory of the recovery, right? Well, as I have said in every recent market commentary, investors are keeping a keen eye on the Fed. We are wondering when the Fed may get a little more hawkish and begin to talk about tapering and raising interest rates. Well, if the Delta variant is on the rise across the country, that could solve a key investor “problem”. If a resurgence of COVID-19 emerges, the Fed may be less likely to raise interest rates because their progress towards full employment may be hindered and inflationary pressures may wane a bit.

You may think, “Won’t the emergence of a COVID-19 variant be bad for the economy as a whole and, subsequently, for investors?” The answer seems to be both yes and no. With a large portion of the U.S population fully vaccinated, it is hoped that a 2020 style outbreak is unlikely. Even if the pandemic causes somewhat widespread restrictions and mandates, this brings us back to the populations and the industries that were hardest hit by the pandemic in 2020. As we reported last year, the pandemic primarily affected lower wage workers along with industries that comprise a small percentage of S&P 500 operating earnings. This can help to explain why financial markets may remain resilient even while COVID-19 case data becomes more concerning from a public health perspective.

Again, this is more of a “reading the tea leaves” point of view, but we have seen a lot of market activity over the past 12 months that doesn’t exactly fall in line with rational expectations.

Early Earnings Season

Like the messenger ribonucleic acid (mRNA) vaccines, financial markets (as stated above) have proven to be fairly resilient in combating COVID-19. We have just begun our Q2 earnings season, and we expect earnings to be strong. Overall, 8% of S&P 500 companies have reported results, with 85% reporting EPS above estimates. This is well above the 5-year average of 75%. While it’s still very early, this is a positive sign given that most analysts have already made upward revisions to their earnings expectations. So far, earnings are off to a strong start, and we will track this closely in the coming weeks.

We will continue to report on COVID-19, earnings season and evolving market conditions in our standard Markets & Economy Update in early August. In the meantime, please do not hesitate to contact our team with any questions or to understand how your portfolio is positioned to weather inevitable market volatility in the coming weeks, months and years.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.