Markets and Economy Update – July 2023

After my wife and I had our first son almost six years ago, we became increasingly amazed at how easy he was to parent as he grew out of the infant stage. We discovered a child that was obedient, he was patient, he was even-tempered, he played nicely with other kids, and so forth. Terrible twos? No way! Still, my wife and I attributed his behavior and demeanor to ‘luck of the draw’ versus any innate parenting skills we might’ve possessed. This perception became cemented as fact when, in the depths of the 2020 pandemic, our second boy came along. I’ll never forget the one evening that my wife, while holding the baby, looked up at me and said, “I’m pretty sure we’re going to deal with meltdowns with this one.” You know what they say about mothers’ intuition.

While our second son is an amazing child in almost every way, we grew to learn that he has a fierce sense of independence. If there’s something to be done, he wants to do it himself. This ‘independent-streak’ also resulted in my wife and I having to implement more boundaries, consequences, and overall a greater sense of discipline when boundaries were breached. There are thousands of parenting books that reference tools and techniques for creating and enforcing appropriate boundaries with a child, and one thing most of these books have in common is a sense of timing. You redirect unwanted child behavior in the moment, not days, weeks, or months later. A parent would never create a ‘teachable moment’ due to an incident or behavior that happened weeks or months prior.

So, when I learned that one of the big three credit rating agencies, Fitch, made the punitive decision to downgrade the credit rating of the United States from AAA (highest rating) to AA+ (second highest rating), the first thing I thought was “this timing seems really odd.” After all, the contentious debt ceiling crisis in Congress was resolved nearly two months prior, and future debt ceiling issues may not re-emerge until early 2025.

The last – and first – U.S. credit rating downgrade came in 2011 in the immediate aftermath of a very heated debt ceiling standoff between Democrats and Republicans. Here’s a brief chronology of what happened late in the 2011 debt ceiling stalemate that ultimately led to the downgrade:

- May 16, 2011 – Treasury Secretary, Timothy Geithner, announced that the U.S. Treasury was being forced to utilize ‘extraordinary measures’ (aka accounting tricks) for the U.S. to meet its funding obligations. Geithner projected an ‘X Date’ of August 2, 2011. This ‘X Date’ would represent the date that the U.S. Treasury could no longer meet its obligations, potentially resulting in default.

- July 25, 2011 – Both Democrats and Republicans outlined dueling deficit reduction proposals. Both President Obama and Speaker of the House, John Boehner, separately addressed the nation regarding the debt ceiling.

- July 31, 2011 – After weeks and months of haggling, President Obama announced a bipartisan agreement to lift the debt ceiling.

- August 1, 2011 – Congress passed a bill to lift the debt ceiling by a vote of 269-161

- August 2, 2011 – Senate passed a bill to lift the debt ceiling by a vote of 72-46, thus averting a default.

- August 5, 2011 – Standard & Poor’s announced a downgrade of the U.S. credit rating from AAA to AA+.

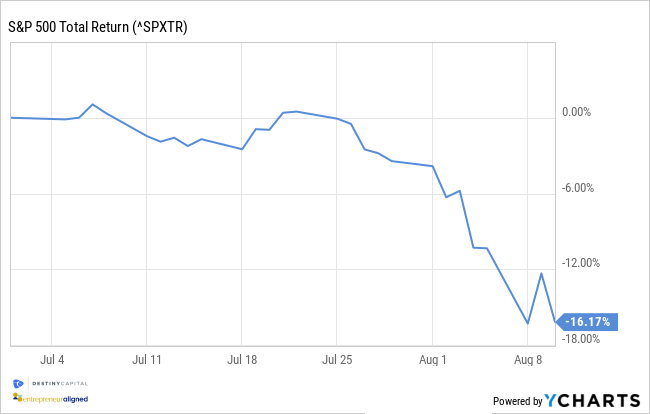

Throughout this timeframe, uncertainty abounded and financial markets experienced tremendous volatility with the S&P 500 declining over -16% between early July and early August, as seen in the chart below.

S&P 500 Total Return – July 1, 2011 – August 10, 2011

In their rationale, Standard & Poors stated, “the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenge.” Standard & Poors also referenced the near and mid-term uncertainty surrounding levels of U.S. debt.

As I’ve written in previous letters, it’s interesting to see that history doesn’t repeat itself, but it often rhymes. While the timing of the downgrade might seem odd, Fitch’s rationale behind the rating change sounds familiar. Below are a few examples taken directly from Fitch’s press release:

- In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters.

- The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management.

- The government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process. These factors, along with several economic shocks as well as tax cuts and new spending initiatives, have contributed to successive debt increases over the last decade.

- Medium-term fiscal challenges related to an aging population and rising healthcare cost (i.e. – greater future spending on Social Security and Medicare).

While each of the points outlined above might sound somewhat damning, they aren’t exactly new developments. We are also nearly two months removed from the debt ceiling confrontation and subsequent resolution. As such, Fitch’s announcement of the credit rating downgrade surprised many economists and investors across the globe. I assure you, I didn’t have a credit rating downgrade on my radar when the announcement was made at 5:13pm on August 1st.

I also found it peculiar that Fitch took the step of predicting a recession in Q4 2023. This prediction is at-odds with many analysts, researchers, and economists these days. In fact, the Federal Reserve recently removed a U.S. recession from their economic outlook.

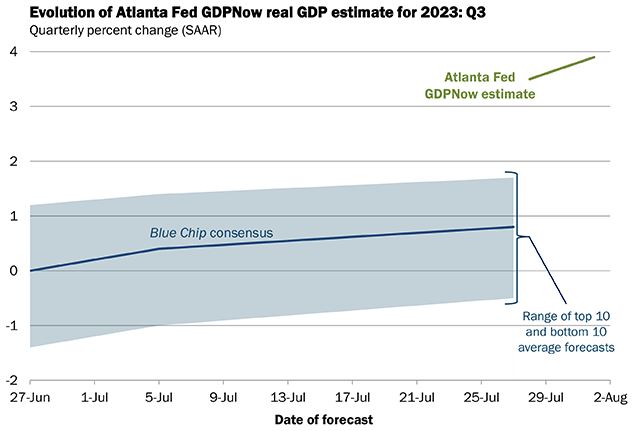

When looking at economic growth, according to the Atlanta Fed, Q3 2023 Gross Domestic Product (GDP) growth is currently estimated to be an eye-popping 3.9%, as seen in the chart below.

Source – Atlanta Fed GDPNow

While the Atlanta Fed has been more accurate than not in recent years, we should note that their estimates can fluctuate quite a bit over time. We expect Q3 2023 GDP growth estimates to come down a bit in the weeks ahead but, barring something unforeseen, it’s hard to envision that the U.S. economy will come to a grinding halt in Q4 of 2023.

What does this mean for investors?

When it comes to the Fitch downgrade, the primary question quickly becomes – what does this mean for investors? Are we destined for another -16% short-term selloff in the S&P 500 like we saw in 2011?

Clearly, the downgrade reinserts an element of unwelcome uncertainty into financial markets. Over the past sixteen months, the vast majority of investor uncertainty revolved around Fed policy and interest rates. It’s unfortunate that this downgrade suddenly occurred at a time when investors were gaining better clarity around peak interest rates and the impact of monetary policy on both the economy and financial markets moving forward.

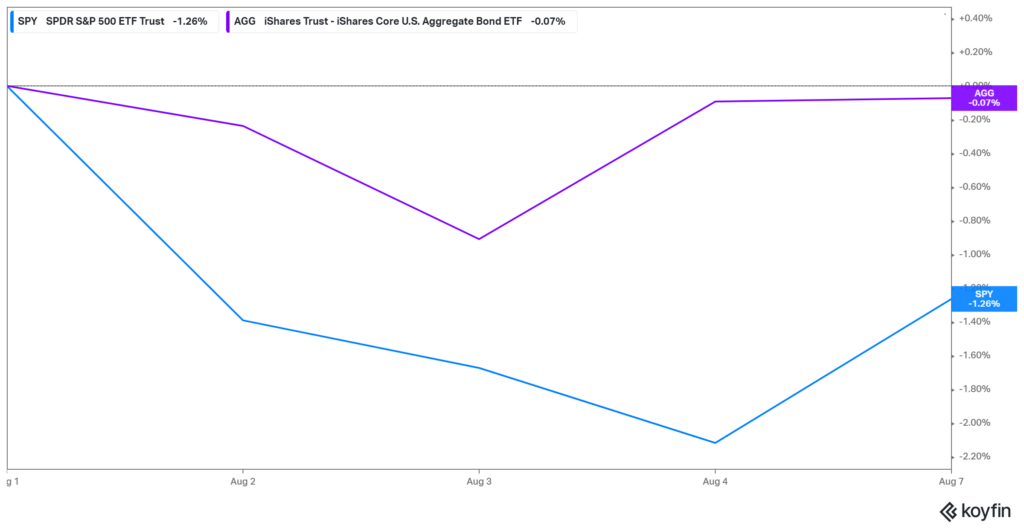

In the immediate aftermath of the Fitch announcement, I think it’s safe to say that the market’s reaction to the downgrade has been fairly muted relative to what we saw in 2011. As you can see in the chart below, the S&P 500 is down about -1.29% while the U.S. bond market is down a mere -0.07%.

S&P 500 (SPY) & U.S. Aggregate Bond (AGG) Total Returns – 08/01/2023 – 08/07/2023

The Standard & Poor’s downgrade came on the heels of months and months of fighting between Democrats and Republicans. Tensions were extremely high in 2011 and the U.S. teetered dangerously close to a catastrophic default. This was fresh on the minds of investors when the S&P downgrade occurred, adding to the already-elevated levels of anxiety.

The 2011 downgrade was also a first, and whenever something happens for the first time, the path ahead can look fraught with peril. In 2023, investors can look back on the previous S&P downgrade and think, “well, the U.S. credit rating fell from AAA to AA+ and nothing catastrophic happened, so do we need to panic?”

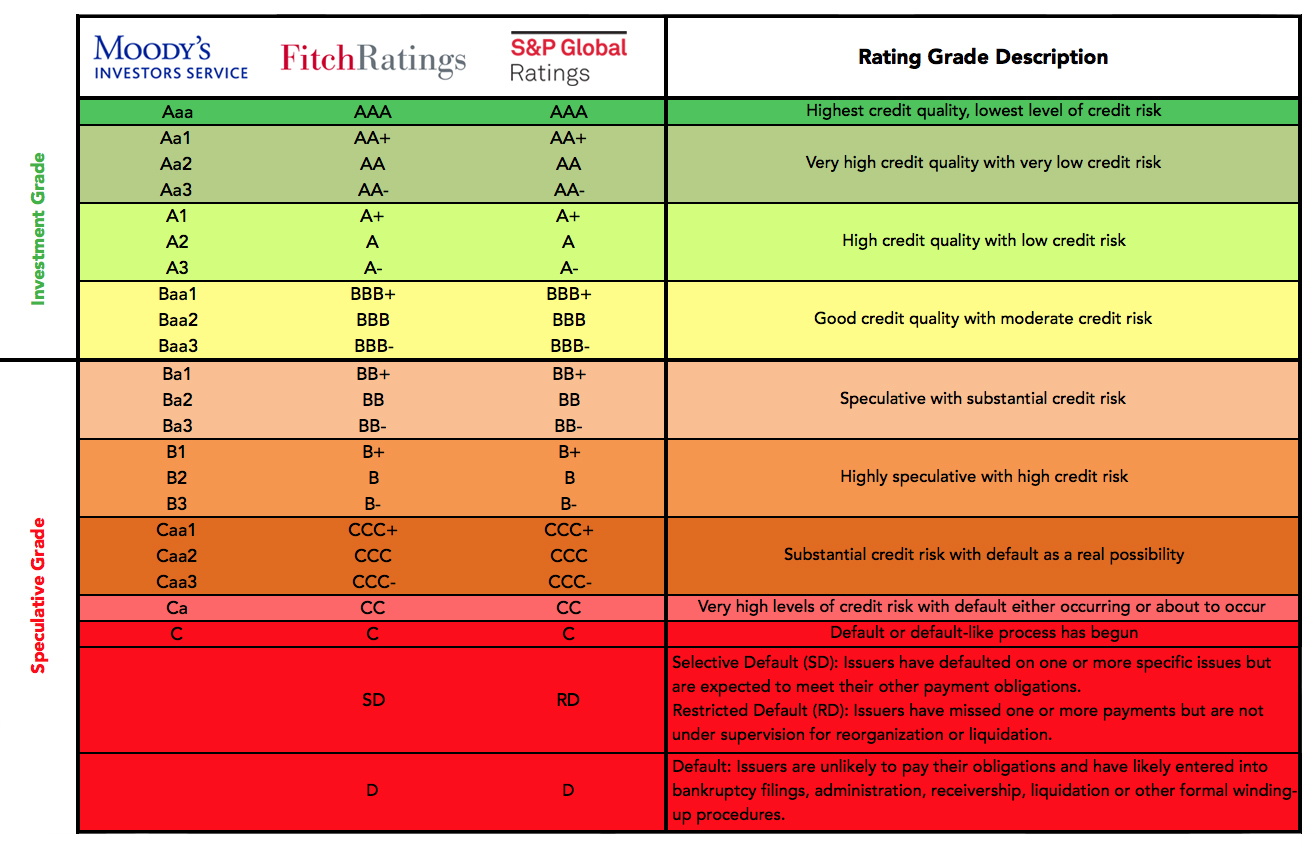

We’ve also seen a trend in the corporate world where credit ratings seemingly mean less and less. There was a time when a AAA credit rating was seen as a corporate badge of honor. Today, there are only two AAA rated corporations in the United States – Johnson & Johnson and Microsoft. Most other corporations are happy with an Investment Grade (BBB-) rating and, over the past decade think, “when there’s cheap access to debt, is the AAA rating really worth all of the financial discipline required?” As you can see in the chart below, an AA+ rating is still very strong and indicates a very low risk of default.

Source – CTSchoolFinance.com

Fitch also reiterated that there are areas of exceptional strength in the United States that support a very strong credit rating. This includes a large, advanced, well-diversified and high-income economy supported by dynamic business involvement. The U.S. dollar is also the world’s preeminent reserve currency which gives the government exceptional financing flexibility.

Also, in an odd twist, Fitch’s 2023 recession prediction may undermine their credibility to some in the investment community. Could the U.S. see negative GDP growth in Q4 2023? Potentially. However, it’s difficult to imagine that we’ll see broad economic conditions, particularly the labor market, deteriorate to levels that will have the National Bureau of Economic Research (NBER) make an official recession declaration.

Markets have ebbed and flowed and volatility has increased a bit since the Fitch announcement was made after market close on August 1st. However, for many investors, it seems as though attention has already shifted back to earnings season, for which we’ll provide a brief update next.

Earnings Season Update

As-of August 4th, we’ve seen 84% of S&P 500 companies report Q2 2023 earnings. Generally speaking, earnings have been very solid with 79% of companies reporting earnings that are above estimates. This is well-above the 10-year average of 73%. The Information Technology sector is leading the way, with 92% of companies beating estimates, followed by Consumer Staples (88%), Healthcare (88%), Consumer Discretionary (86%) and Communication Services (81%).

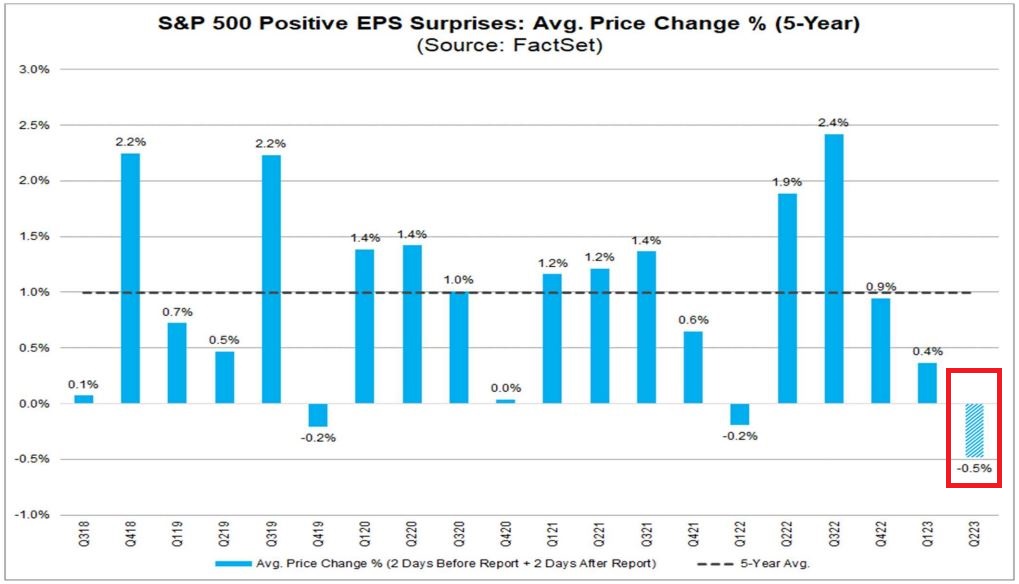

In an odd and somewhat unusual twist, investors are actually punishing stocks that have reported positive earnings surprises. So far, we’ve seen stocks that have reported positive earnings surprises actually fall an average of -0.5% in the two trading days after earnings were reported. This represents only the third time this has happened over the last 5-years, as seen in the chart below. Over the past 5 years, the average stock price increase after beating earning estimates has been +1%, as you can see in the chart below.

Source – FactSet Earnings Insights

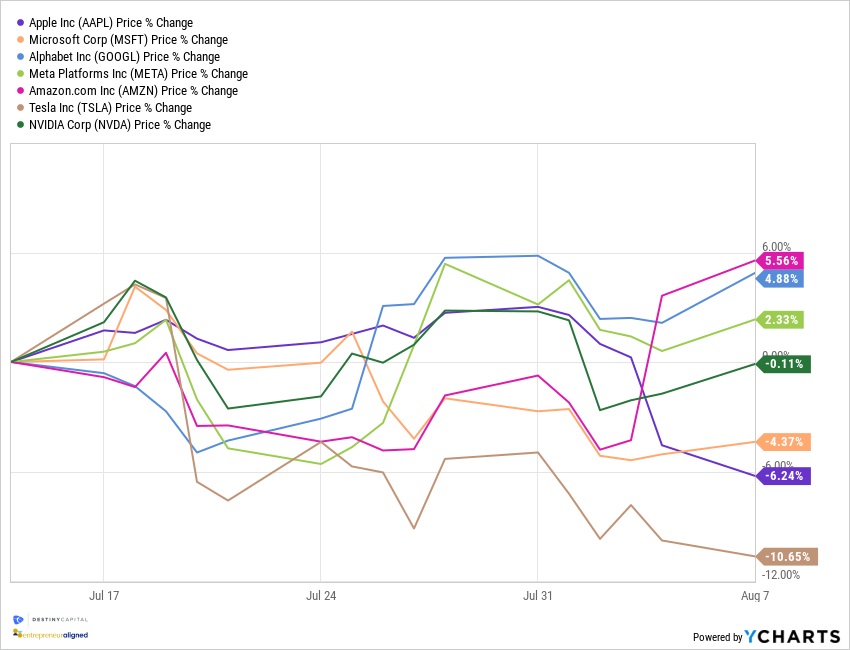

In last month’s letter, I also wrote at length about ‘The Magnificent Seven’ stocks Apple, Microsoft, Google, Meta, Tesla, NVIDIA, Amazon and Alphabet. These stocks, in no particular order, represent the top companies in the S&P 500 as measured by market cap. Incidentally, these seven companies have been helping to drive the general year-to-date rally in the S&P 500 with their well-above average performance. As such, I thought I would illustrate the performance of these companies since earnings season began on July 14, 2023, as seen in the chart below.

The Magnificent Seven – Total Returns from 7/14/2023 – 08/07/2023

As you can see, it’s been a mixed bag for these stocks, but it’s interesting to note that, NVIDIA aside, each of these companies has beaten Q2 consensus earnings estimates (NVIDIA reports earnings on 8/23/23). How could a stock like Tesla beat earnings, yet fall over -10% since the beginning of earnings season? Well, immediately after quarterly reports are released, each company will host an ‘earnings call’ where the CEO, CFO and potentially other executives talk about what happened in the quarter that passed, and what they expect for the weeks and months ahead. This forward-looking commentary is called ‘forward guidance’ and, much like a Federal Reserve press conference, investors parse every word uttered by corporate leaders and try to glean something about the future direction of the stock.

In the case of Tesla, the company beat both Q2 2023 earnings and revenue estimates, but the stock fell because the CEO, Elon Musk, failed to state precise specifications and delivery dates for the long-awaited cybertruck, and also predicted a production slowdown due to factory improvements. This is a frustrating, yet commonplace, occurrence for investors. Still, it will be important to keep an eye on these stocks in the weeks and months ahead as, given the size of their market caps, these companies can have a disproportionate effect on the S&P 500 index as a whole.

Moving forward into August, we’ll be keeping a close eye on any fallout in both stock and bond markets due to the Fitch credit rating downgrade of the United States. Yes, we’ve seen volatility spike a bit since the announcement was made, but we haven’t yet seen volatility rise to alarming levels. To measure this, we tend to look at the CBOE Volatility Index (VIX) which is a real-time index that represents the market’s expectations for the magnitude of near-term price changes in the S&P 500. In short, the higher the VIX number, the more volatility we expect to see in the stock market. Since the Fitch downgrade, the VIX has been in a range of 14 to 17. We tend to get a little bit more alarmed when the VIX is closer to 20-25, as these tend to be times when we might see daily swings in the stock market of +/- 2%.

We also can’t forget about other important data points like inflation, and we’ll get our next Consumer Price Index (CPI) report on August 10th. We then get a Personal Consumption Expenditure (PCE) inflation report on August 31st. There is no Federal Open Market Committee (FOMC) meeting in August, so we get a bit of a break from changes in monetary policy until the next Fed meeting on September 19-20.

In the meantime, summer is winding down, vacations are wrapping up, and the school year is on the horizon for some. Before we know it, the leaves will be changing and we’ll all be digging jeans and long-sleeve shirts out of the back of our closets. This is also a great time to think about those important planning items or goals that you hope to achieve by year-end, so please don’t hesitate to reach out to our team for help or guidance. We are here and ready to help.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.