Markets and Economy Update – July 2022

Throughout my life, there have been quite a few tense moments when I anticipated a harsh response to what I deemed to be a negative situation or outcome. As a kid, that might have been a time when I came home with a teacher’s note deriding my behavior as a class clown. As a teenager, it could have been the time when a parent caught me joyriding in the family car with friends at age 14, in the state of New Jersey, where licenses are issued at age 17. As a young adult, before the existence of Uber and Lyft, perhaps it was a time or two when a 10am golf foursome with buddies ended with a midnight call to a significant other, sheepishly requesting a ride home from the pub. These are purely hypothetical examples, I assure you.

What if, during each of these scenarios and to my utter surprise, the impending doom was met with understanding, compassion or even humor? A simple look, smirk or knowing shake of the head would erase all anxiety about further retribution or repercussions beyond my own guilt, shame and, in the case of the third scenario, an impending and crippling headache.

Well, as we entered the last week of July, I felt similar apprehension when anticipating how financial markets might react to three crucial events: The Federal Open Market Committee (FOMC) meeting ending July 27th, the Q2 Gross Domestic Product (GDP) report on July 28th and the Personal Consumption Expenditures (PCE) inflation report on July 29th. That is one heck of an economic trifecta with each being capable of affecting the trajectory of financial markets for days or weeks to come.

Picture me glued to my computer monitors with a single bead of sweat rolling down my forehead, nervously refreshing S&P 500 and Nasdaq pre-market futures as the Bureau of Economic Analysis’s (BEA) GDP report was released to the public at 8:30am Eastern Standard Time on Thursday, July 28th. Then, imagine my surprise not only at seeing GDP come in at -0.9%, well below the 0.5% consensus estimate, but to see stock market futures largely remain resilient, as investors absorbed this news not only in pre-market action, but throughout the trading day.

The same could be said the next day as the PCE report disappointed investors, reporting headline PCE at 6.8% vs. a consensus estimate of 6.6%. Still, we did not see a steep, reactionary selloff. If there is a song that could encapsulate my thoughts at this time, it would have been C&C Music Factory’s 1991 hit “Things That Make You Go Hmmmmm.” If that reference does not out me as a Gen X’er, I do not know what will.

Clearly, action throughout the month of July has been fast and furious with markets accelerating and ascending towards the end of the month. So, in this month’s letter, we will dive into key topics including our cast of usual suspects: the Fed, inflation, earnings and asset class performance. Now, for the first time in over seven months, we will move on to some good news.

Asset Class Performance

There hasn’t been a lot for investors to celebrate year-to-date in 2022, to put it kindly. In last month’s letter, I noted that after periods of prolonged volatility it is also important to keep portfolios positioned for an eventual rebound and not focus solely on continued downside protection. In fact, I have used the words “resilient” or “resilience” exactly 2,472 times in my public communications since the 2020 pandemic began and, finally, we have begun to see our first glimpses of market resilience in quite some time.

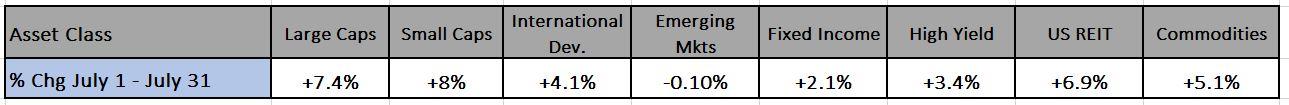

Since June 30th, key asset classes have experienced bounces nearly across the board as seen below, with the only exception being emerging market equities, which didn’t lose much ground, but remained relatively flat relative to other asset classes:

Source: Destiny Capital, JP Morgan Asset Management

Furthermore, riskier sectors like technology experienced a more pronounced rebound, rising roughly +15% in the month of July and over +17% since the market bottomed (for now) in mid-June. Is this rebound simply fool’s gold? A market head-fake? Is it the beginning of a new 10 year bull market? While I would love to see the latter scenario play out, it is important to remain grounded and understand that uncertainties still remain, so we will focus next on the Fed and their continued fight against inflation.

FOMC Meeting Results

In their July 26-27th meeting, the FOMC announced their decision to increase the Fed Funds Target Rate from 1.50%-1.75% to 2.25%-2.50%, a 75 basis point increase. This represented the Fed’s second consecutive 75bps rate hike, thus continuing their aggressive fight against inflation. This 75bps rate hike was largely anticipated and investors, including myself, were glued to Jerome Powell’s post-meeting press conference, attempting to glean some kind of indication of forward guidance.

While most Fed commentary is fairly boilerplate, even in a press conference setting, two parts of Powell’s press conference stood out to me. First, Powell was repeatedly pressed on whether or not the U.S. was currently in a recession. He, in turn, repeatedly stressed that he believed the U.S. was NOT in a recession, despite the fact that Q2 GDP was to be released the next business day.

There was no parsing. There was no statement of, “Well, we will see what GDP says tomorrow and I will make an assessment then.” He was decisive without hedging in saying, “So, I do not believe the U.S. is currently in a recession, and the reason is that there are just too many areas of the economy that are performing too well.” He stated this fully knowing that the GDP numbers released the next day could be somewhat contradictory to his assessment.

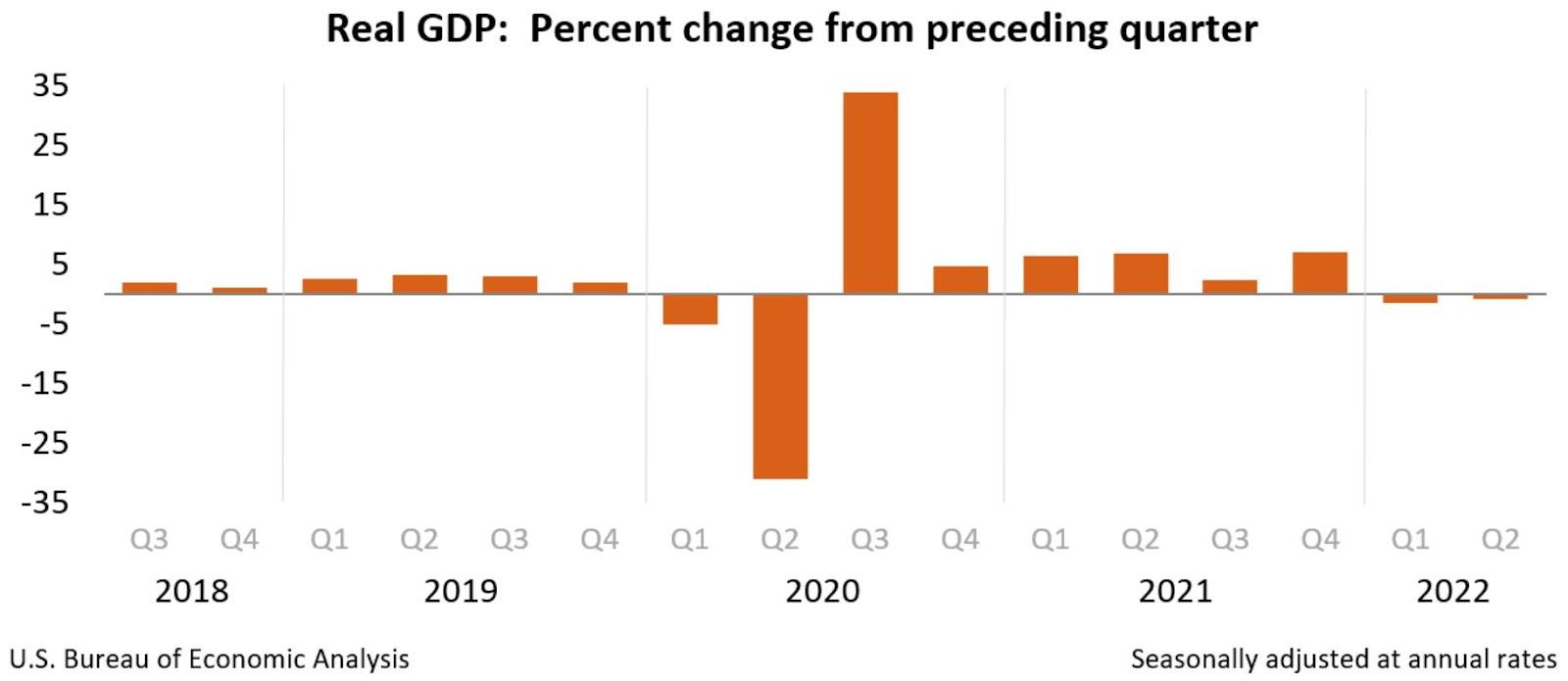

Was/is Powell wrong? I think most in the public understand the general definition of a recession as two consecutive quarters of negative growth as measured by GDP. So, with Q1 and Q2 2022 GDP coming in at -1.6% and -0.9%, respectively, many would view that as a recession signal.

However, the true definition of a recession is much more nuanced and infuriatingly vague. Who ultimately makes the call? Do Rachel Maddow and Tucker Carlson arm wrestle for the right to make that official determination on cable news? Alas, the answer is, “No”, and we are stuck defining yet another acronym, NBER, for the National Bureau of Economic Research.

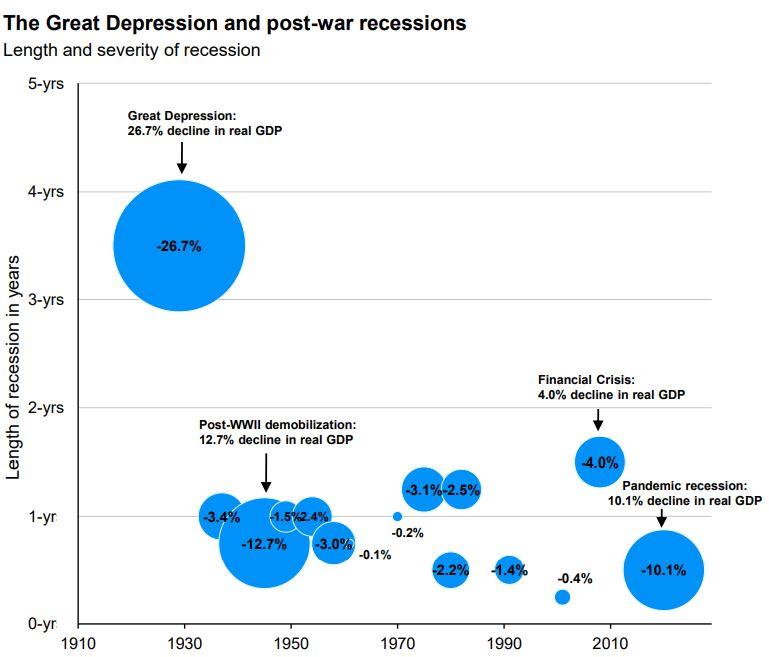

The NBER is the official recession scorekeeper and, according to NBER, their traditional definition of a recession is, “. . . a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The committee’s view is that while each of the three criteria (depth, diffusion and duration) needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another.”

So, as you can see, there is some subjectivity involved which helps to explain why there has been so much general confusion and potential disagreement among the public. One thing that is true, however, is the fact that not all recessions are created equal, and this is a point I have tried to convey to investors over time. The chart below helps to illustrate this, and it reminds us that recessions can vary in both length and severity as measured by the decline in real GDP.

Source: JP Morgan Asset Management, BEA, NBER

So, if we are currently in a recession, early indications are that it could (I truly hope) potentially be a mild one.

Now, back to the Fed’s statement and Jerome Powell’s commentary. The final point that stood out to me was how the Fed began their official FOMC statement with the following sentence, “Recent indicators of spending and production have softened.” This does not seem like much, but as someone who has studied writing, first impressions tend to matter. The first few lines can really set the tone, and the Fed wanted to make a point. While I am not comparing the Fed’s first line to the opening of A Tale of Two Cities or, “It was a bright cold day in April, and the clocks were striking thirteen,” from George Orwell’s 1984, it still emphasizes an important message.

This opening line is the Fed’s equivalent of stating, “While you might not see all the numbers yet, our policies are having the desired effect in killing aggregate demand which will ultimately lead to lower inflation.” Let us assume my interpretation of this message is correct. If so, it begs the question, “Are the Fed’s policies, coupled with other key factors, having the desired effect?”

Inflation – A light at the end of the tunnel?

In July, investors received two inflation reports in CPI and PCE which reported worse than expected inflation at 9.1% and 6.8%, respectively, for the month of June. I hate to admit it, but Twitter is often the most expeditious resource for obtaining breaking news and relevant economic data, sometimes even before an official report is posted online. So, when I saw the first 8:29 a.m. tweet on June 13th reporting CPI at 9.1%, I audibly groaned and thought to myself, “I really hope this is a hoax.” I quickly refreshed the BLS website to find out that no, the 9.1% reading was not, in fact, a hoax.

However, since mid-June, we are seeing some hopeful signs that headline inflation may be starting to roll over a bit. One obvious indicator comes from the energy sector, where oil prices have fallen from roughly $122 per barrel in mid-June to roughly $95 at the end of July.

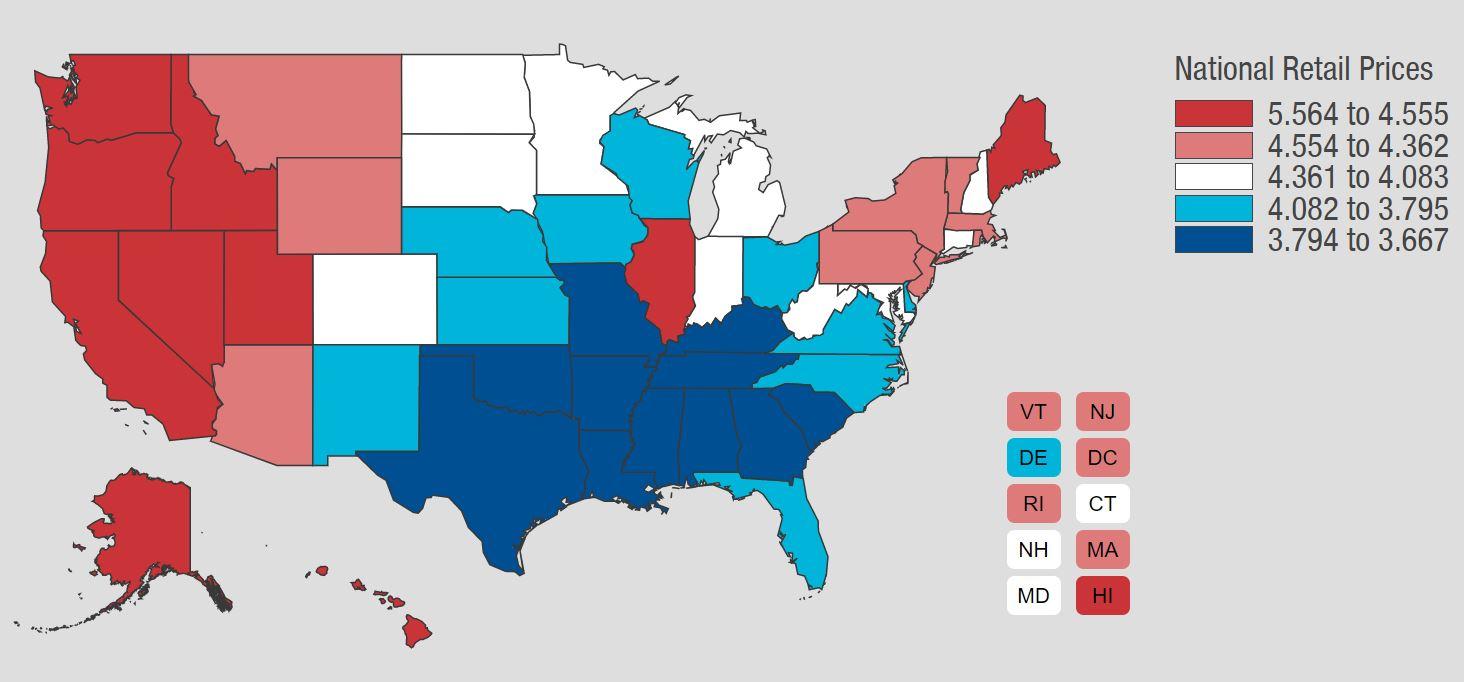

Furthermore, Americans are seeing prices at the pump decline significantly, with the national average of regular unleaded gas priced at just under $4.21 per gallon, as of this writing, after peaking at $5.016 on June 16, 2022 according to AAA. Below is a chart that illustrates the range of regular unleaded gas prices across the country, and you will see just over 20 states with regular unleaded gas prices ranging from $3.66 to $4.08. While, clearly, gas prices are still elevated from the $3.18 average from one year ago, it’s reassuring for consumers to see prices compress a bit from recent highs.

Source: AAA

Furthermore, markets are seeing lumber prices fall, copper prices fall and even airfares decline in recent weeks. In manufacturing, while concerns about supply chains remain, we are seeing a bit of an easing as reported in S&P Global’s July Manufacturing Purchasing Managers Index (PMI) Report, where a respondent stated, “Supply chain problems remain a major concern but have eased, taking some pressure off prices for a variety of inputs. This has Fed through to the smallest rise in the price of goods leaving the factory gate seen for nearly one and a half years, the rate of inflation cooling sharply to add to signs that inflation has peaked.”

In China, the economic situation remains fluid, with the government sticking firmly to its restrictive zero COVID-19 policy. In recent days, Shanghai posted consecutive days of zero COVID-19 cases for the first time in over a month, easing some concerns in China’s largest city. However, in China’s technology hub of Shenzhen, the government issued “Closed Loop Orders” that would keep workers living and working on site in order to maintain operations throughout a recent surge in cases. All of this is in response to 21 new confirmed cases on July 31st in a city of roughly 18 million. So, while supply chain pressures appear to be easing somewhat in China, the situation remains somewhat unpredictable due to unforeseen complications related to minimal breakouts across the country and the government’s aggressive response.

In short, while there are many indicators that appear to support the thesis that inflation may have peaked and should look a little better in July’s report, we will not know for certain until 8:30am (or 8:29 on Twitter) on August 10th, when the July CPI numbers are released. Until then, focus has shifted back to earnings season, which has just surpassed the halfway mark, so we will close this month’s letter with an update on corporate earnings.

Brief Earnings Update

With roughly 56% of S&P 500 companies reporting, 73% have reported Earnings Per Share (EPS) above estimates, while 66% of companies have reported revenues above estimates. Both figures are below their five year averages of 77% and 69%, respectively, but both are above the 10 year average.

To the surprise of no one, the energy sector is reporting the largest difference in actual versus estimated earnings at +10.1%. The largest oil company in the United States, Exxon, reported quarterly profits of $17.9 billion, the company’s largest ever, while Chevron posted record profits of their own of $11.6 billion. The health care sector came in second, with aggregate earnings coming in 9.5% above estimates.

On the flip side of that coin, the consumer discretionary sector is reporting the largest negative difference between actual versus estimated earnings at -10.6%, with Amazon leading the charge with EPS at -$0.20 actual vs. $0.12 estimated.

Clearly, revenue and earnings numbers aren’t forward looking, but markets in late July were somewhat buoyed by mega/large caps like Alphabet, Microsoft and Texas Instruments, who offered some positive forward guidance. This eased some investor concerns as we headed into the final five months of the year.

There are some investors who argue that a market bottom is reached when negative news fails to send stocks immediately lower. Is that what happened between July 27th and July 29th, when markets failed to overreact to the Fed’s 75bps rate hike or worse than expected GDP and PCE numbers?

While there have been glimpses of optimism across financial markets in recent days and weeks, uncertainties still remain. In addition to daily earnings data, the economy’s next true litmus test will come on August 10th, when the July CPI numbers are released. While there is underlying subjective and objective data that indicates that inflation may be softening, I will believe it when I see a CPI or PCE report that supports that thesis. If inflation does, in fact, reverse course, investors may be able to breathe a brief sigh of relief. However, if the trajectory of inflation remains unchanged, we could be on course for more aggressive Fed activity and more uncertainty inserted into financial markets for at least another month. Until then, we will enjoy this brief calm in the storm and be poised and prepared to communicate our thoughts and strategies depending on information as it is released with near term focus on August 10th.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.