Markets and Economy Update – March 2022

By: Tim Doyle, CFP® – Chief Investment Officer

In early February, I had a brief back-and-forth with a Destiny Capital colleague discussing some of the news emerging out of Ukraine and Russia. I outlined some potential implications related to oil prices, economic fallout and the market’s reaction based on a number of potential scenarios. In that discussion, I described what I considered to be a worst-case scenario with oil prices spiking to $125 and potentially beyond, an immediate market selloff, crippling sanctions, increased risk of recession in Europe and so forth. Paraphrasing, I said, “But that scenario would require tanks rolling through the streets towards Kiev. It’s really hard to imagine that Putin would push things so far. This is 2022. This is posturing. This is leverage.”

Here we are over a month later, and that previously unthinkable scenario has played out before our eyes. On February 24th, Russia began its full scale invasion of Ukraine. Since then, millions of Ukranians have either been displaced or remain in harm’s way, and the names of cities like Kiev, Kharkiv and Mariupol are now as familiar to many as Rome, Paris or Munich. At the onset of the invasion, oil prices spiked immediately, crippling sanctions were enacted and financial markets continued to experience turbulence in the form of daily volatility driven by the headlines of the day.

At Destiny Capital, one of our key core values is empathy. As such, it can be difficult to focus on the market ramifications of war when we know that so many are paying a far steeper price than enduring market volatility. However, much like during the COVID-19 pandemic, it is important for investors to departmentalize emotion and focus on the new and evolving data that emerges throughout a variety of challenging environments. Therefore, this month’s letter will remain focused on key themes that we expect to impact financial markets throughout the remainder of 2022, and we will begin with the Fed and its escalating battle against inflation.

The Fed and Inflation

Throughout 2021, we were constantly trying to glean insight into which two of the Fed’s three mandates (full employment or stable prices) would take precedence in the minds of Federal Open Market Committee (FOMC) members. That insight would, we hoped, allow us to predict the path of future policy decisions related to the Fed’s balance sheet and the direction of interest rates. In 2022, there is absolutely no ambiguity. The Fed has grown increasingly concerned about stable prices and has its sights fixed firmly on aggressively fighting inflation.

In his March 16th press conference, Fed Chairman Jerome Powellannounced a 25 basis point (0.25%) increase in the federal funds target rate and indicated that there could be SIX (count ‘em) additional 25bps rate hikes throughout the remainder of 2022. The median projection for the federal funds rate at the end of 2022 is 1.9%. This is a full percentage point higher than was projected as recently as December of 2021.

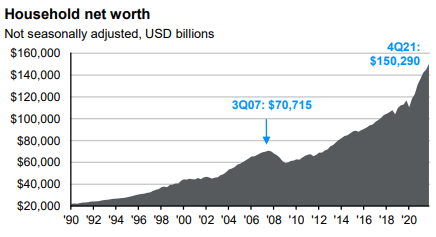

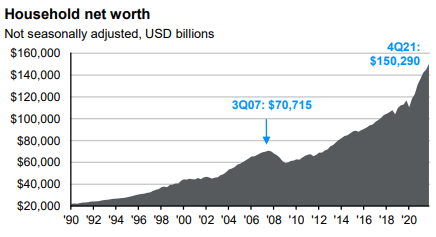

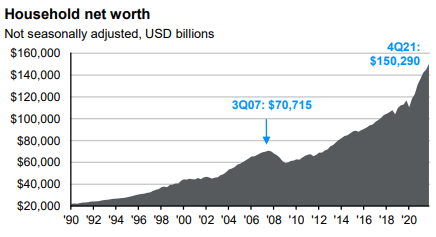

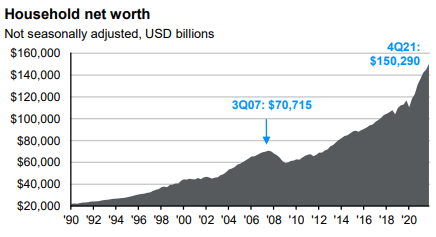

Powell publicly states that he is convinced that the economy is on strong enough footing to withstand aggressive Fed tightening. Generally speaking, there is data that supports this stance. Corporate balance sheets are strong and consumer finances are much healthier than during previous cycles of Fed tightening. In the United States, household net worth figures reached all time highs in the 4th quarter of 2021, and the household debt service ratio remains at historical lows, as seen in the two charts below.

Source: JP Morgan Asset Management – Guide to the Markets

The labor market continues to be very tight with employers adding 431,000 jobs in March, while the unemployment rate fell to 3.6%. Furthermore, wage growth leapt to 6.7% in February, which was well-above the 50-year average of 4%, thus adding to consumer strength but also tossing more fuel into the inflationary fire as seen in the chart below.

Source: JP Morgan Asset Management – Guide to the Markets

While it may grow tiresome to parse every word uttered by the Fed Chairman and every FOMC member, we believe that Fed actions could potentially have the most significant impact on financial markets in 2022. We experienced this market sensitivity immediately after the new year, as markets sold off due to a combination of the Omicron variant and rumors of hawkish Fed policy, including a potential 50bps rate hike in March (which obviously never materialized). Volatility then ramped up again due to Russia’s invasion of Ukraine.

While we are all relatively familiar with volatility in the stock market, we have not quite grown as accustomed to volatility in bond markets, so I think it is worth touching on some of the activity we have seen across the spectrum of fixed income assets largely due to Fed policy changes.

Fixed Income Markets

Let us start with some bond basics, for those of you who may need a refresher. A bond represents a debt security that is typically issued by a corporation, municipality or government. While a stock represents ownership, a bond is similar to an IOU, where an investor lends the corporation/municipality/government money. In return for this loan, the investor receives a specified rate of interest throughout the life of the bond and then receives a repayment of principal once the set period of time expires (maturity). These periodic interest payments are also often referred to as coupon payments.

Given that bonds are often issued with a fixed rate of interest, this means that bond prices are sensitive to movements in interest rates over time. Generally speaking, bond prices have an inverse relationship to changes in interest rates. This means that when interest rates fall, bond prices tend to rise. When interest rates rise, bond prices tend to fall.

Why does this inverse relationship exist? Here is an example. Let us say you purchased a AA (high quality) corporate bond in 2021 that offered a 2.5% coupon. In 2021, a 2.5% coupon may have been considered attractive relative to prevailing rates for high quality fixed income investments. Fast forward to late 2022, and high quality AA corporate bonds now pay a 3.75% coupon with roughly a similar maturity. Wouldn’t a new bond with a 3.75% interest rate make your current bond with a 2.5% coupon less attractive to other investors? While there may be plenty of caveats, the answer to the previous question is most likely, “Yes”. This would be reflected in the price that a buyer would be willing to pay for your bond in the open market. The opposite is true in a falling rate environment where your 2.5% AA corporate bond may be much more attractive to investors than newly issued AA corporate debt at 1.75%.

In early 2022, instead of bond prices becoming incrementally impacted by 25bps interest rate increases over the course of the year, bond markets immediately priced-in an entire year’s worth of rate hikes over a number of weeks. Bond markets basically said, “Well, seven rate hikes in 2022 are inevitable, so let us just get the price adjustments over with.” While this is exceedingly frustrating for bond investors, it is a part of what we consider a rate normalization process where, in order for bond investors to benefit from increased compensation down the line in the form of higher interest rates, we must experience some price volatility in the short term. We clearly anticipated this pricing dynamic, which is why we positioned our fixed income allocations to focus on bonds that are the least sensitive to interest rate fluctuations.

Moving forward, we see a more attractive landscape for fixed income investments, and we look forward to a time when a portfolio can generate 3%-5% income without significant market volatility. We also know that it’s impossible to predict the path of interest rates over time. While markets are predicting seven rate hikes in 2022 alone, that does not mean that the Fed cannot change or reverse their course after several rate hikes. We saw the Fed reverse course as recently as 2018-2019, and fixed income investments benefited greatly during this cycle.

Market Outlook

Similar to the volatility seen in fixed income markets, equity markets seemed to immediately price-in a worst-case scenario during the selloff from January through mid March of 2022. After all, the Omicron variant was still surging, the Fed was hinting at future action and we experienced geopolitical turmoil in the form of Russia’s invasion of Ukraine. While we remained optimistic here at Destiny Capital, many other investors felt that the outlook was bleak.

Then, on March 16th, the stock market received something it craves above all else – certainty. On this day, as reported earlier, Jerome Powell announced the Fed’s plan for the remainder of 2022, and markets have generally ascended since then with small bouts of volatility here and there. Does this mean that investors are out of the woods and the rest of 2022 will be smooth sailing? Not quite.

In the investment management business, we often compare implementing changes in monetary policy to steering an enormous cruise ship. Any adjustments in trajectory must be measured and minimal, as there can be ripple effects based on the slightest modification. If the helm is swung too far too fast, it can be significantly harder to get the ship back on its desired course.

Inflation is going to be an issue throughout the remainder of 2022, at least. We do, however, expect certain elements of inflation to resolve themselves over time regardless of Fed intervention. The chart below illustrates the key contributors to headline inflation, including energy, new and used autos, food, shelter and restaurants/hotels/transportation.

Source: JP Morgan Asset Management – Guide to the Markets

As shown above, there are certain elements of inflation that we consider to be somewhat temporary. For example, we expect energy prices to fall over time as, we hope, geopolitical tensions ease and supplies adjust to demand. We expect new and used vehicle prices to normalize over time as semiconductor and other key component shortages are resolved.

There may, of course, be some elements of inflation that prove to be resilient. The question then becomes, “How frustrated by inflation will the Fed become if they do not see an immediate reduction in inflation? If inflation fails to decline after a series of rate hikes, will the Fed grow impatient, or worse, desperate?”

To be clear, the Fed does not have many nuanced tools specifically designed for fighting inflation. Rate hikes are more of a blunt instrument designed for one thing – killing aggregate demand. The Fed must slow down the economy without killing it, and that truly is a delicate task.

Since the first round of fiscal and monetary stimulus was received in 2020, the global economy has been like an open bar at a wedding reception. The Fed must now implement a cash bar policy just as all the wedding guests are getting frothy enough to do the chicken dance. The question then becomes, “Will the guests keep drinking and partying? If they raise the price of a beer to $2 and people keep drinking, will an $8 beer then finally cause guests to switch to water?” Only time will tell.

Resiliency

Despite all of these challenges, one word continuously comes to mind when thinking about the state of the world at the end of Q1 2022, and that word is “resiliency”. The citizens of Ukraine have proven themselves exceedingly courageous and resilient. While there truly is no apt comparison for what is happening in Ukraine, we have seen financial markets absorb shock after shock in recent months and years only to rally and reward long-term investors. The challenges of today seem to pale in comparison when thinking about the state of the economy and financial markets as recently as March of 2020.

Relative to the rest of the world, we believe that the United States economy is uniquely positioned to succeed in the year ahead, and our investors are well positioned not only in equities but in fixed income. For example, in recent months, Destiny Capital’s Environmental Social and Governance (ESG) investors benefited by having zero exposure to the Russia/Ukraine conflict. In these portfolios, the enhanced stock screening process identified exposure to Russia as an elevated risk, and therefore eliminated all Russian stocks from all emerging market funds. This added to fund returns while simultaneously reducing risk, which is the primary goal of the ESG stock screening process.

While every client’s portfolio is unique, we may seek to reposition some capital in the coming weeks and months with an enhanced focus on high quality domestic stocks. In fixed income, corporate balance sheets are strong and we actually see some opportunities to generate yield through companies with credit ratings in high yield ranges. This, we hope, will help us continue to navigate the low and rising interest rate environment that is expected to span the remainder of 2022. As I have written time and time again, it is never a good idea to bet against the resiliency and ingenuity of the American economy, and that is certainly not a philosophy we intend to change in 2022.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.