Silicon Valley Bank Update

Reading any headlines that incorporate words like “collapse”, “failure” and “bank” in any order is bound to trigger some anxiety. For me, my mind vividly flashes back to a workday in 2008 when I sat at my desk at my job with JP Morgan, frantically reading updates about the newly emerging financial crisis. I sat near Wayne, a revered, kind, gentleman with salt and pepper hair and a calm, baritone voice that would have made the singer Barry White proud. That day, Wayne sat with his head in his hands repeating, “Oh, Tim. No, no, no. This isn’t happening. Tim, this doesn’t happen.” I immediately thought, “If Wayne thinks something is bad, it’sbad.” Wayne’s dejected and disbelieving tone was in response to first discovering that a JP Morgan cash-equivalent money market fund pegged to the United States dollar had declined in value for the first time in its history. This was akin to a dollar being valued at $0.97 cents. Suddenly, our perception of a system that we had relied on our entire lives was suddenly shifting before our very eyes.

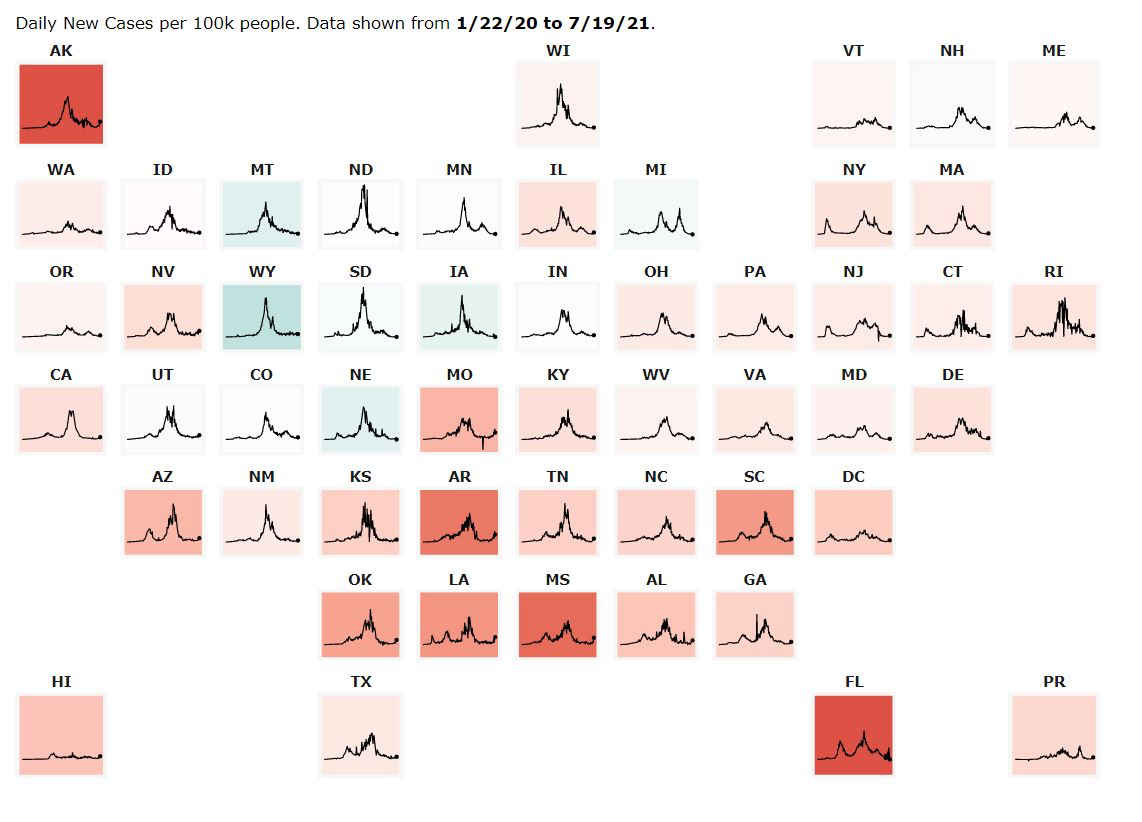

Around Wednesday of last week, we began to hear grumblings about steep losses at Silicon Valley Bank (SVB). Then, in nearly the blink of an eye, a bank run ensued as worried depositors rushed to withdraw assets, the stock of SVB plummeted, trading was halted and the Federal Deposit Insurance Corporation (FDIC) had shut the bank down by Friday. With $209 billion in total assets, Silicon Valley Bank was the 16th largest bank in the United States, as seen in the chart below. SVB’s failure represents the second largest since Washington Mutual ($307 billion) failed in 2008 and was ultimately acquired by JP Morgan Chase.

Source: The New York Times, Federal Reserve Board

As we entered the weekend, investors, bankers and depositors across the country were left wondering, “What’s next? Is this 2008 all over again?” To answer those questions, I will examine the root causes of the Silicon Valley Bank collapse. Purely from an investment and risk management perspective, and with empathy for all involved in this crisis, I found the SVB situation utterly fascinating, and will get into that shortly.

Banking basics and unintended consequences

In overly general terms, banks make money by accumulating cash deposits from business customers and individuals like you and me. The bank keeps a portion of that cash in reserves, and it generates revenue by lending those cash deposits out to other individuals and businesses while collecting the interest payments. In addition to lending, banks can also invest cash deposits in a portfolio of investments, thus making even more money on deposits.

I will talk first about the failure of SVB’s investment portfolio, as it is a familiar narrative to what investors generally have experienced since early 2022. Since late 2021, I have written ad nauseam about the dangers of the Federal Reserve going too far and too fast when raising interest rates. There could be unintended and unforeseen consequences, I argued. Well, what has happened to Silicon Valley Bank is a prime example of an unintended consequence, and I will now explain how and why.

“Bond Investing 101” tells us that bond prices and interest rates have an inverse relationship. If interest rates decline, bond prices rise. If interest rates rise, bond prices fall. Why do bond prices decline when interest rates rise? Well, let us say that in January of 2022, I bought a high quality corporate bond that pays a 2.5% coupon until it matures in 2030. Then, let us say that the environment is different six months later, interest rates increase and comparable corporate bonds with a similar maturity and credit profile now pay a 4.5% coupon. Would that make my 2.5% bond look relatively unattractive in the eyes of secondary market investors? In short, yes, and that would be reflected by a lower price for my 2.5% bond in the open market.

How is this relevant in the case of Silicon Valley Bank? Well, it is apparent that SVB hoped to make more money on deposits through investment activity. Therefore, they purchased significant quantities of longer-term United States Treasury bonds because the longer-term Treasury bonds were paying slightly higher rates than shorter-term instruments. Remember, they made these purchases when short term United States Treasurys were paying around 0.20% and 10 year Treasury might be closer to 1.50%.

A relatable plight

SVB’s plight is a relatable one to investment management firms like Destiny Capital. We faced very similar decisions when it came to fixed income allocations in our client portfolios. Heading into 2022, the bonds that paid the strongest yields were also the ones that were the most sensitive to interest rate movements. The tradeoff between yield and interest rate risk was not one that we were willing to make, so we transitioned to low-duration bonds to weather the cycle of interest rate normalization.

For example, our most conservative fixed income positions (money market aside) tend to include short-term (one year to three) Treasuries. Typically, these short-term Treasuries might represent a 3%-5% allocation target across our fixed income exposure (not of total portfolio). Knowing that we were facing the potential for higher interest rates, we were proactive in 2021 by increasing our allocation to short-term Treasuries from roughly 3% or 5% to closer to 35%-40% percent of our recommended fixed income allocation. It was an aggressive move (in a very conservative way) but ultimately paid off. SVB’s risk calculations were a bit different, and the bank no longer exists.

I have been in this business long enough to know that the sentence, “It could’ve been worse,” is never a winning argument with investors when discussing performance. It is not something I would ever want to hear, and nor should anyone else. However, SVB’s situation helps to exemplify just how unusual 2022 was for the fixed income market largely due to the Fed’s ultra-aggressive interest rate policies and a shifting narrative over time.

Treasury bond performance

SVB purchasing 10+ year Treasury bonds is not something that is necessarily beyond the pale when it comes to investment decisions. United States Treasurys are considered ultra-high-quality and fully liquid investments. These bonds are backed by the full faith and credit of the United States and, therefore, have virtually no credit risk.

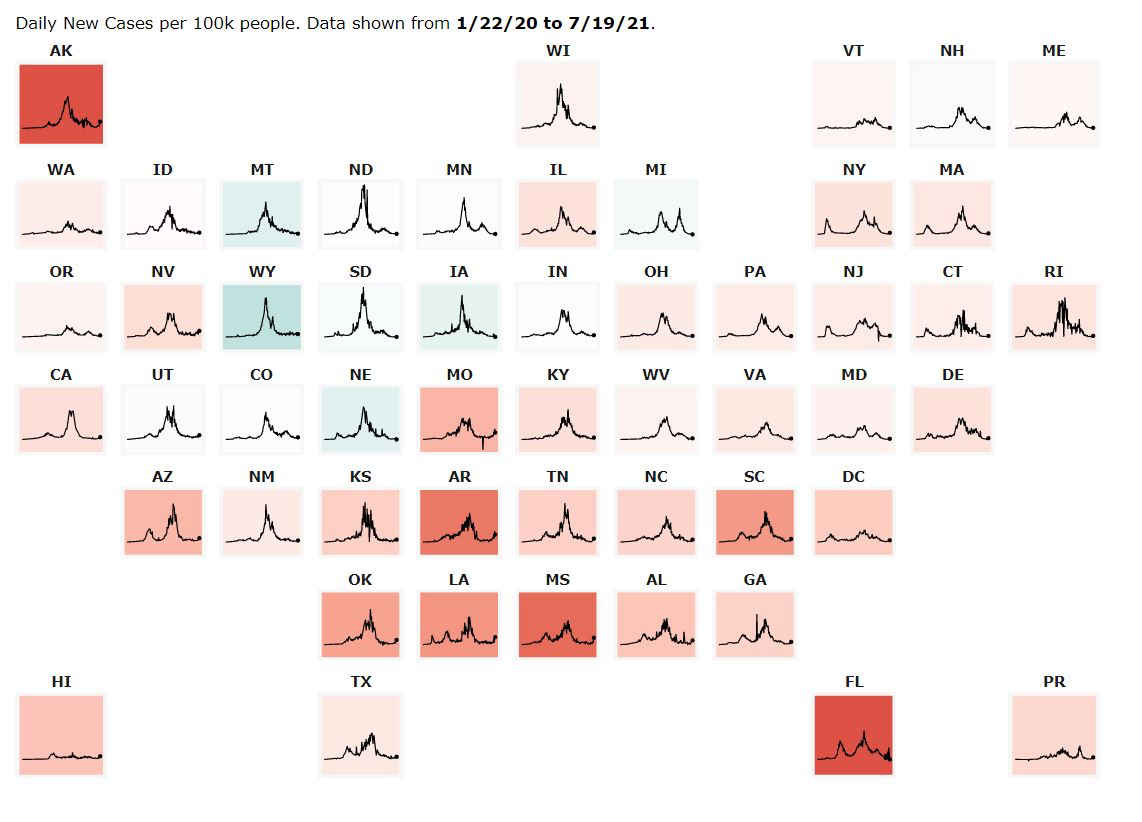

Yet, look at the chart below (US Treasury Bond Performance (1-3yr, 7-10yr, 10-20yr, 20+yr) 01/01/2022 through 10/25/2022) where we illustrate the performance of a variety of Treasury bonds from January 1, 2022 through October 25, 2022, when the bonds essentially bottomed out. As proxies for these bonds, we are using Exchange Traded Funds (ETFs) to represent the Treasury bonds of varying durations.

At no point when SVB purchased their portfolio of 10+ year Treasurys did the bank envision that these bonds could fall between -20% to -38% in 2022. At least that is what we can glean about their decisions based on their portfolio holdings. Furthermore, SVB likely got caught up in the shifting Fed narrative and, throughout the year, expected either a pause or a pivot. Yet, rates went ever-higher, and SVB’s bond portfolio lost more and more and more. As I have said throughout 2022, constantly shifting Fed policies and pushing rates ever-higher makes it difficult to make high-conviction asset allocation decisions.

Normally, investors might be able to navigate interest rate risk by holding a bond to maturity. For example, if I buy a 4% corporate bond for $1,000 and a maturity date of January 1, 2025, I can simply collect my periodic 4% coupon payments until maturity, when I ultimately receive my $1000 return of principal from the bond issuer. In that scenario, the bond’s price in the secondary market is moot, because I am not looking to sell.

However, it might not always be possible to hold a bond to maturity, and this is when it is important to talk about SVB’s customer base. The bank’s primary customer base was made up of early-stage tech startup companies and executives. With access to venture funding drying up a bit throughout the year, startups and executives began withdrawing money. If withdrawal demand increases enough, a bank might be forced to liquidate investments at a loss and might not be able to hold a Treasury bond to maturity as, perhaps, initially intended. In that case, the bank might have to realize that -20% to -30%+ loss, depending on the bond’s duration. Apparently, this is what happened and snowballed into a full-on bank run that led to Friday’s FDIC takeover.

What comes next?

Rest assured, no Destiny Capital clients have exposure to SVB stock, nor do they have exposure to any of the companies like Roku or Roblox who have disclosed that they had banking relationships with SVB. In the case of Roku, the company had $487 million held at SVB, representing about 26% of the company’s cash.

Our valued partner and custodian, Fidelity, is not a bank. Therefore, protections are slightly different. Fidelity protects client accounts through the Securities Investor Protection Program, or SIPC, which insures client accounts up to $500,000. This coverage is on a per account basis and not combined. So, for example, an investor with a $500,000 personal brokerage account and a $500,000 individual retirement account (IRA) would be covered $500k per account or $1 million total. Fidelity also provides a substantial ‘excess of SIPC’ coverage that will cover amounts well-above the SIPC limits stated above.

As of this writing, we have also learned that the FDIC has seized Signature Bank, a crypto-friendly bank out of New York. We may see additional FDIC seizures over the coming days as regulators proactively assess banks that might have a similar risk profile to SVB. The most immediate and lasting effect could be that of a crisis of confidence among bank customers as they are left wondering if their personal deposits are at risk.

For the vast majority of bank customers, there should be nothing to worry about. However, we may, over time, see additional consolidation in the banking industry as customers seek the safety and security of the top four banks (Chase, Bank of America, Wells Fargo and Citibank) who operate under enhanced scrutiny of regulators and have more stringent requirements placed upon them. Of course, we could see regulators implement more stringent policies to all banks, regardless of size, and I expect we will be hearing much more about this in the weeks ahead.

A reassuring note

On a reassuring note (for SVB depositors, at least), the Department of the Treasury, the Federal Reserve and the FDIC released a joint statement late on Sunday declaring, “Depositors will have access to all of their money starting on Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

The statement further read, “The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today’s actions demonstrate our commitment to take the necessary steps to ensure that depositors’ savings remain safe.”

In some ways, the timing was fortunate for investors in that most of the news about SVB was disseminated and digested late on Friday, giving regulators the weekend to devise a plan and communicate intentions without an overreaction in financial markets. I expect that financial markets will react positively to these late developments, but investors may be wary that another shoe or two could potentially drop in the week ahead.

Looking ahead, the Federal Open Market Committee will have a lot to think about prior to their next meeting that concludes on March 22nd. Due to the collapse of SVB, there will be a lot of public pressure for the Fed to halt future rate increases, which could end up being a positive for financial markets in the weeks and months ahead.

This is a fast-moving situation and news is evolving literally by the minute. Therefore, I will continue to closely monitor any new developments and will continue to communicate if and when necessary. In the meantime, please reach out to our client team with any questions or concerns.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.