Markets and Economy Update – March, 2023

As the father of two young boys, I have cultivated insight and developed certain parenting tactics that have been helpful in a few key areas. One tactic is the art of distraction, which is vital when dealing with a frequently temperamental toddler. As an example from the not-too-distant past, perhaps I made the unforgivable mistake of cutting (or not cutting, depending on the day) a certain little boy’s waffle at breakfast. As a parent, you know the signs of trouble as soon as the plate is set on the table. This is when the distraction instinct kicks in, and just as the first wail of discontent begins in the child’s lungs, you quickly find anything at hand (a magazine, kitchen tongs, the water bill) and expressively present it to the child as if it is the most unique, fascinating thing in the world. Thirty seconds later, you will have a quiet, content child happily trying to eat a waffle with kitchen tongs.

Another area where I have gleaned some wisdom is in expectation setting. With young children, be very wary of timelines and timeframes. When I ask, “Wouldn’t it be fun if we went to the aquarium next month?” my five-year-old somehow hears, “Put on your shoes, bud, because we’re going to the aquarium right now!”

I have thus learned to surprise my children with pleasant news. Spilling the beans too soon can result in questioning the equivalent of, “Are we there yet? Are we there yet?” for days and weeks. I dare not even mention the word “playground” unless we are literally pulling into the parking lot of a playground.

As an investor, the irony is not lost on me that, back in late 2022, I had earmarked the March 21-22 Federal Open Market Committee (FOMC) meeting as a critical event for investors. Since marking that event, I had been tapping my wristwatch and anxiously glancing at the calendar as the days passed until the meeting occurred.

Why was that meeting so important? Well, for months, I had believed that the March meeting could potentially be a turning point for monetary policy, and, subsequently, for investors. Was I right?

Well, as you may be aware, March was a very eventful month for financial markets, and I will start this letter with a brief overview of the Silicon Valley Bank (SVB) crisis and then move into monetary policy and the Fed’s important March meeting.

March Madness

This year, March Madness had less to do with college basketball and more to do with bank crises. In case you missed our last blog and/or the March webinar, here is a quick Cliff’s Notes (remember those?) version of what happened to Silicon Valley Bank in early-to-mid March:

-

For many years, Silicon Valley Bank’s primary customers for both lending and deposits were cash-hungry tech startups of varying sizes along with many executives.

-

When interest rates were near zero, SVB invested in longer-term United States Treasury bonds in order to eke out a few extra basis points of yield.

-

Moving into 2022, inflation went from transitory to persistent, and the Fed raised interest rates after their March meeting.

-

Then, the Fed raised interest rates again, and again, and again, and again…

-

As rates increased, SVB’s portfolio of long-term United States Treasurys declined drastically. By October of 2022, 10-to-20 year Treasurys had fallen over -30%.

-

Throughout 2022, venture funding dried up a bit, causing SVB’s business depositors to withdraw cash to fund operations and growth.

-

To meet depositor needs and shore up their financial situation, SVB was forced to sell their Treasury holdings at steep losses and then issue $2.25 billion stock.

-

Moody’s downgraded SVB’s deposit, and issuer ratings were downgraded to Caa2 and C (hint: that’s very bad).

-

Word spread among depositors, with social media serving as an accelerant, that the bank may not have been able to meet the withdrawal needs of depositors.

-

A $42 billion bank run ensured.

-

SVB stock plummeted, and trading was halted.

-

The Federal Deposit Insurance Corporation (FDIC) seized the bank on Friday, March 10th.

-

By Monday, March 13th, a joint statement was made from the Fed, The FDIC and the U.S. Treasury.

Keep in mind that, while the timeline above seems somewhat linear, most events were taking place concurrently. In roughly three business days, the bank went from attempting to shore up financials to being seized by the FDIC. The pace and severity of the events would have caused angst amongst depositors of any bank, let alone regional banks with a similar profile to SVB.

Clearly, the joint statement was reassuring for both depositors and financial markets. In the days that followed, the threat of contagion eventually lessened a bit, and financial markets had seemingly moved on. The question then became, “Will the banking crisis affect monetary policy?” Thankfully, we only had to wait a little over a week to get that answer (after the Federal Open Market Committee meeting concluded on March 22nd).

Too far, too fast

For over a year, even before the Fed began raising interest rates, I argued that the Fed should be wary of raising rates too far, too fast. I was of the opinion that a rapid pace of rate hikes could have unintended consequences throughout the economy and/or financial system. What did the Fed do? Well, in 2022, they embarked on one of the most aggressive rate hiking cycles in United States history, as seen in the chart below, including 425 basis points (bps) of hikes in 2022 and another 50 bps in 2023.

Source: Forbes Advisor – Federal Funds Rate History

In fact, in late February, all indications were that the FOMC was going to raise rates another 50bps (0.50%) and then implement another 25bps (0.25%) hike or two prior to the end of 2023. Suddenly, we finally experienced one of those unintended consequences that I was talking about, and the trajectory of monetary policy looks much different today than it did when March began.

You see, when the Fed raises interest rates, it affects the price of bond investments, because bond prices and interest rates have an inverse relationship. When interest rates rise, as they did precipitously in 2022, bond prices fall. However, we have never quite seen prices fall to the extent that they did in 2022. Below is a chart that illustrates the returns of United States Treasury bonds of differing maturities from January 1, 2022 through the end of October 2022, as the bond market bottomed out.

I would imagine that SVB’s portfolio managers could never envision that their Treasury positions could lose between -20% and -30% in less than a year. Keep in mind that Treasurys have virtually no credit risk, as they are backed by the full faith and credit of the United States. In Economics 101, students are taught to use the three month Treasury as the “risk free rate” in a variety of equations and calculations.

In 2021, Destiny Capital’s investment committee was faced with a similar predicament. Moving into 2022, we strongly believed that rates were going higher and we therefore attempted to reduce exposure to interest rate risk in our client portfolios.

At the time, were we tempted by the higher yields offered by longer duration bonds? Yes, but we were adamant that the risk was not worth the reward in that environment and allocated accordingly. SVB’s managers made a different choice, and it resulted in the collapse of their business. Their plight, however, was a relatable one, because most long-term investors would consider long-term Treasurys as a relatively safe investment with limited downside risk. In 2022, and largely due to Fed policy, that turned out not to be the case, due to an unintended consequence of aggressive tightening by policymakers.

Where do we go from here?

In his post-FOMC meeting press conference, Fed Chairman Jerome Powell made a statement that drew the rapt attention of just about every investor when he said, “We no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation, instead we now anticipate that some additional policy firming may be appropriate.”

Earlier in 2023, Powell confirmed that disinflation was, in fact, occurring, and that he envisioned a path ahead without a significant economic downturn or an extreme increase in unemployment. At the time, that was a meaningful, significant statement. However, his above statement made after the March 22nd meeting carries even more weight, because it signals an actual shift in monetary policy. Ongoing and perpetual rate hikes may not be necessary to quell inflation, and this helps investors by limiting a significant source of uncertainty.

On the day after the March 22nd FOMC meeting, markets revised their year-end federal funds target rate from 5.26% down to 4.35%. This meant that, based on Powell’s comments and the Fed’s economic projections, the markets feel that the Fed will eventually lower the federal funds target rate later in 2023. That stands in stark contrast to the “higher for longer” messaging we have received over the past several FOMC meetings and every moment in between. Clearly, the banking crisis impacted the Fed’s policy decisions, resulting in this sudden shift.

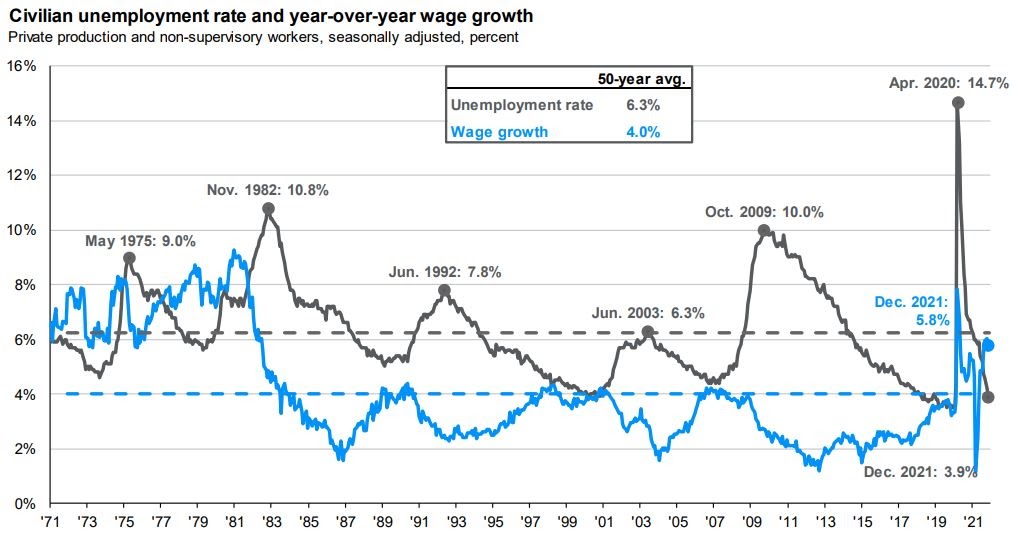

After this latest meeting, the Fed also released economic projections for 2023, with Gross Domestic Product (GDP) at 0.4% versus 2.1% in 2022, the unemployment rate at 4.5% versus 3.6% currently and Core PCE inflation at 3.6% versus 4.6%, currently.

Source: Federal Reserve

Those numbers might indicate paltry growth, a rise in unemployment and lower inflation over the course of 2023. So, it is clearly mixed news that is exactly in line with what the Fed is hoping to achieve as slow growth + softer labor market = lower inflation. This will allow for rate normalization and stronger growth in 2024 and beyond.

Still, with projected GDP growth at 0.4%, the Fed’s estimates might indicate that the United States economy could be hovering around negative recessionary growth territory throughout the year. Furthermore, rising unemployment in addition to slow growth is bad for financial markets, right? Well, not so fast.

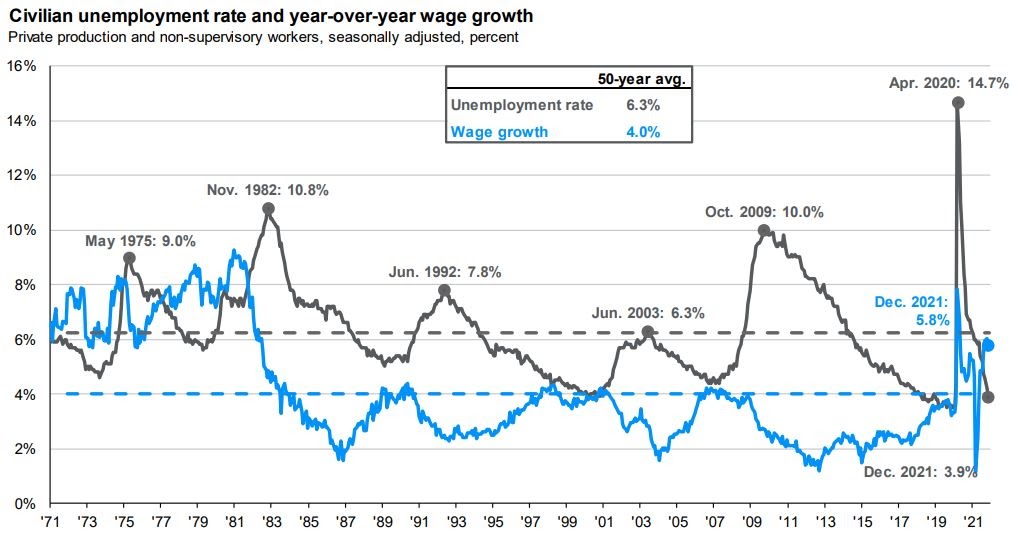

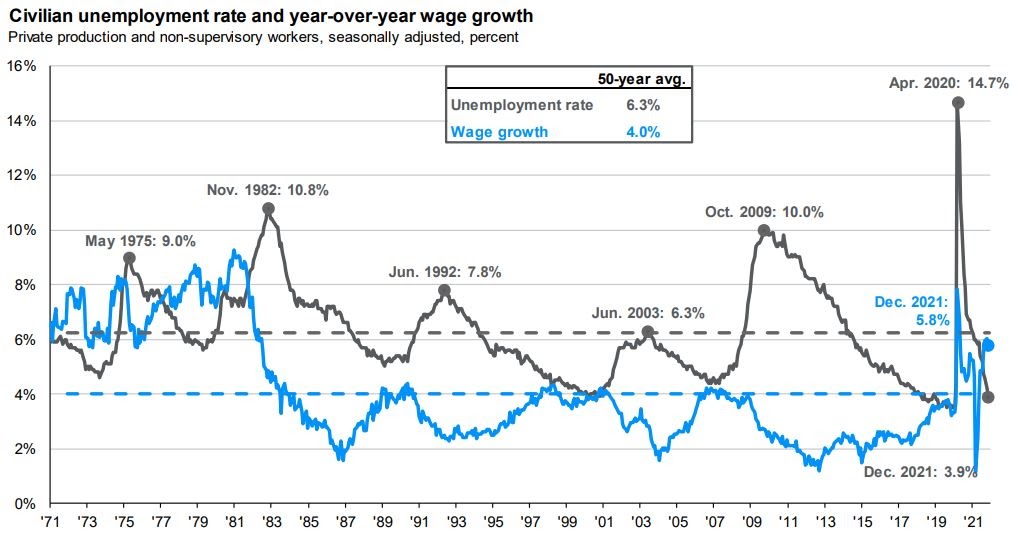

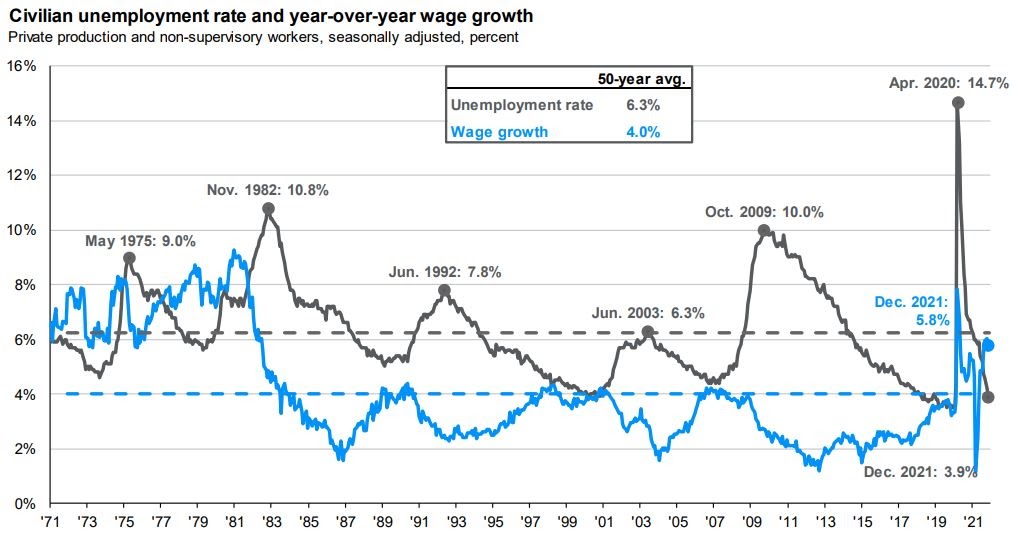

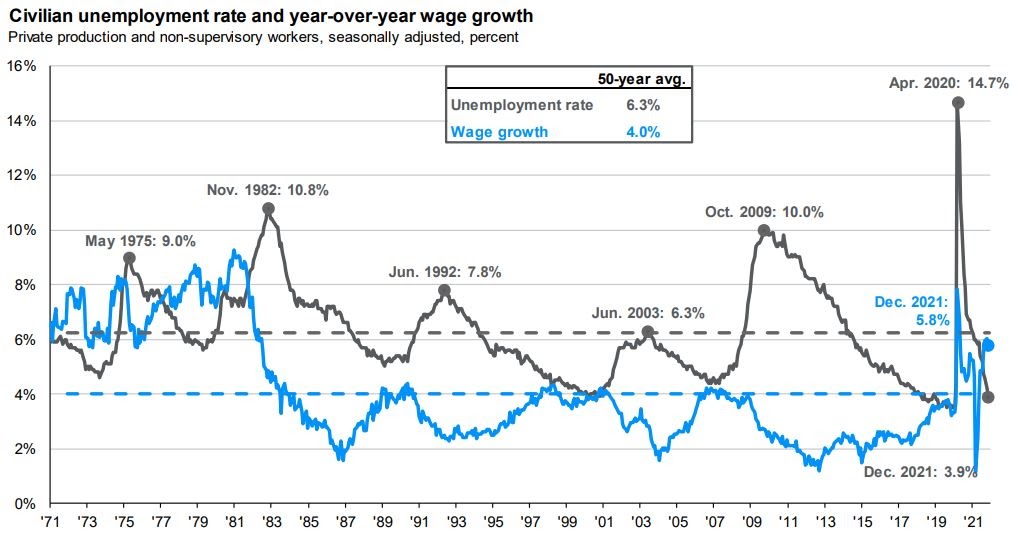

If you look at the charts below, you will see that historically, the S&P 500 (green line) can move higher alongside the unemployment rate (purple line). An unemployment rate moving higher does not necessarily mean that the stock market will decline.

Source: JP Morgan Asset Management

When looking at financial markets thus far in 2023, we have seen a solid performance across indexes with the Nasdaq leading the way at +17.05%, the S&P 500 at +7.50%, the Dow Jones Industrial Average at +2.4% and the Bloomberg US Aggregate Bond index up nearly +3%, as seen in the chart below. We expected for growth stocks to lead the way as markets eventually rebounded, and that appears to be happening in the short run.

For the month of April, we will be keeping a very close eye on the April 12th Consumer Price Index (CPI) inflation report along with the retail sales numbers released on Friday, April 14th. These data points will be key in gauging whether or not the Fed can be as deliberant and patient as investors are hoping it will be when it comes to future rate hikes. While one more 0.25% rate hike is certainly in the cards for May, a negative surprise on the upcoming CPI report could re-insert some uncertainty related to monetary policy. The retail sales report will also help us understand how resilient or not the American consumer is and how that might impact economic growth moving forward.

Client questions

To close, I should note that our team has received some client questions around the banking system. I think many of us have pondered our banking relationships over the past few weeks and wondered whether or not our deposits are safe. For most retail bank customers, the $250,000 FDIC coverage limits are more than enough to make them whole, should the worst happen to their bank. If your bank deposits exceed FDIC limits, I would ask yourselves, “Why not put that excess into our Fidelity money market currently at 4.5%?” Sorry, I am an investor, and I had to mention it.

In all seriousness, it should be much easier for customers to research and assess the banks we trust with our deposits. The FDIC has some resources that, unsurprisingly, are not extremely efficient to locate. There is also a list provided here at the Federal Reserve that details each bank by assets. It can be helpful to get a relative size of your bank, particularly if using a smaller, regional bank. It is also interesting to see the asset drop-off after the top four banks (Chase, Bank of America, Citibank and Wells Fargo). Furthermore, a website like Bankrate can also provide some helpful information, reviews and rankings when analyzing a bank and its products.

Through our trusted custodian, Fidelity, our clients are protected through the Securities Investor Protection Corporation (SIPC). Typically, SIPC would cover up to $500,000 of securities in an account, including a $250,000 limit for cash held in a brokerage account. However, Fidelity also protects investors with their “excess of SIPC” coverage, where there is NO per-customer limit on the coverage of securities and a $1.9 million per customer limit on cash awaiting investment. At Destiny Capital, we hold most client cash in interest-bearing money market funds. Therefore, it is important to note that money market funds are considered a security, not cash, and do not fall under that $1.9 million limit.

If you have any questions about FDIC, SIPC or have any planning and/or investment questions, please do not hesitate to reach out to our team.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.