Markets and Economy Update – February 2023

A few months ago, I was exercising at my gym and briefly rested on a piece of equipment as a raucous gaggle of early 20-something dudes wandered past. I sipped from my water bottle and raised an eyebrow as I did a brief inventory of the group, noticing the abundance of iPhones in hands, flat brimmed caps, ultra slim jogger pants or calf high socks paired with shorts cut to a thigh level that would have made Larry Bird blush during his playing days with the Celtics. Back in my day, that type of outfit would have had you hanging from the school’s flagpole by your underwear before first period.

However, the days passed and I began to recognize an odd trend each time I visited the gym from then on. To my astonishment, as I scanned the crowd from my elliptical perch, I realized that virtually every man under a certain age (let’s call it 35) was dressed like that raucous gaggle of dudes. If anything, I realized that I was the one who stood out as odd with my curve brimmed baseball cap pulled low and jogging pants that left plenty to the imagination. I felt quite solitary and reflective as I pedaled my elliptical that day, I tell you.

As if in some continuous episode of The Twilight Zone, I also began to notice my inability to decipher certain posts on social media outlets like Twitter. For example, one afternoon, I came upon a social media invite from a crypto venture capital firm that referenced a “lush brekky wit frens”. Upon reading that, I slowly put my phone on my desk and walked away.

Now, this letter is certainly not intended to be my “Get off my lawn!” moment. In fact, it is a bit of the opposite. I suppose that members of every generation eventually have their moment of clarity when they realize that they are suddenly out of touch with younger generations. It probably starts with the year you do not recognize the names of any Grammy winning artists and then spirals from there. In fact, I guarantee that many of my colleagues at Destiny Capital read this with a knowing smirk as they think, “Poor Tim. He is just realizing this now?” Alright, so maybe I sprinkle in a few too many GIFs, 90’s sitcom references and awful “Dad jokes” during team collaboration. I will also be deep in the cold, cold ground before I stop double spacing after a period. (tap tap)

The American consumer

When it comes to understanding the United States economy and financial markets, I think a cross-generational perspective can be helpful in explaining what is happening today, particularly when it comes to the ever important topic of the American consumer.

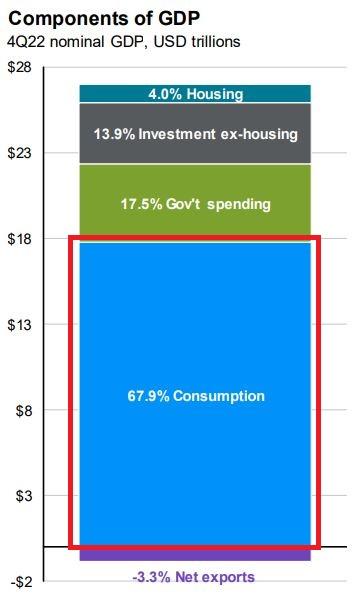

Why is the consumer so important? Well, it is important to note that roughly 68% of the United States Gross Domestic Product (GDP) comes from consumption, as seen in the chart below. As goes the consumer, so goes the economy and, by extension, the financial markets. As such, I will spend the majority of this month’s letter understanding this enigmatic element of our economy while providing the standard updates on inflation and the Federal Reserve. I may even sprinkle in a few 90’s pop culture references to remain on brand.

Source: JP Morgan Asset Management

FOMO and YOLO

“I’m with it. I’m hip.” – Dr. Evil

To solidify my cross-generational street cred, I will begin with two internet acronyms that gained notoriety throughout 2021, as old folks like me began to hear more and more about FOMO (fear of missing out) investing and YOLO (you only live once) spending.

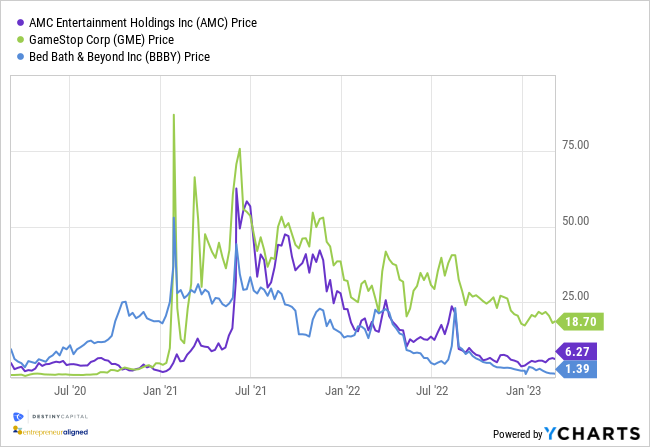

FOMO spurred “meme stocks” that were birthed in the conversational website Reddit’s subchannels and pumped stocks like GameStop, Bed Bath & Beyond and AMC to lofty new highs. Day trading gained popularity across younger demographics because, in the mind of these newly minted speculators, stocks “only go up” and they did not want to miss out on the bounty. The FOMO steak has lost some sizzle over time, as markets became volatile and these stocks plummeted from 2021 highs, leaving late entry speculators with significant losses, as seen in the chart below.

The YOLO spending behavioral mindset may help to explain why there is such persistent consumer spending despite elevated inflation, Fed tightening and fears of a potential economic downturn on the horizon. In fact, I think that consumer behavior and behavioral finance in general is an area where the Fed miscalculated quite a bit when forecasting the impact of their policy decisions.

Throughout 2022, the Fed thought, “To lower inflation, we need to kill aggregate demand by raising rates to restrictive levels. This should create economic outcomes that should stop consumers from spending. Lower demand will eventually lead to lower prices as supply and demand reach a better equilibrium over time.” That seems to be a very pragmatic approach, as you would expect from the Federal Reserve. However, many of us have been investors and human beings long enough to know that what people should do and what people will do are often two very different things.

Emerging from COVID hibernation

Entering 2022, the vast majority of United States citizens had been living in a state of fear and uncertainty for nearly two, long years. The COVID-19 pandemic restricted lives and impacted psyches at a visceral level, and many people lost dear friends and family members. Yet, we somehow managed to navigate through that period and looked at 2022 as a time where, virtually unencumbered, we could emerge from COVID-19 hibernation and fully enjoy the fruits of life once again.

Suddenly, that pesky inflation went from transitory to persistent, and growing, by March of 2022. Once again, consumers were expected to tighten belts and put travel plans, big-ticket purchases, dining, hobbies, leisure, etcetera on hold until inflation was tamed. That plan has not exactly panned out as the Fed had hoped.

Cost be damned, many consumers rightfully seemed determined to spend in ways that, they hoped, would improve their quality of life after multiple years of restrictions. After all, the COVID-19 pandemic taught us all that life is short. You only live once.

United States consumer resilience

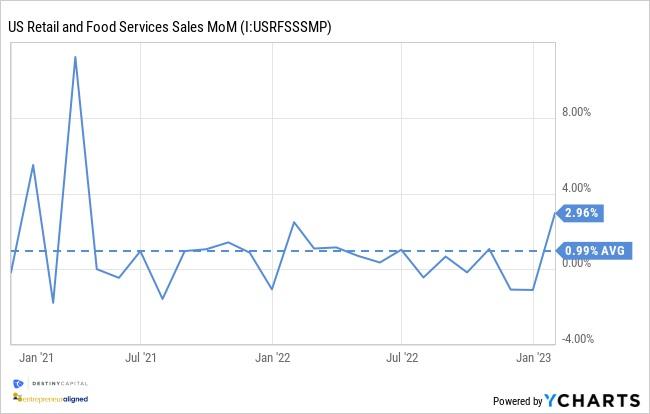

Consumers remained resilient throughout all of 2022. A few cracks began to appear in the armor in the last two months of the year, when retail sales fell into negative territory in November and December. This consumer development piqued our interest here at Destiny Capital, but we are well aware of the fact that consumer behavior can shift suddenly and unexpectedly. That is exactly what happened in January of 2023 when retail sales bounced +3% on a month-over-month basis, a rate not seen since March of 2021, as seen in the chart below.

Looking ahead

Are there challenges on the horizon for the United States consumer? To help us understand the consumer mindset on a forward-looking basis, we look at the US Future Consumer Index, which was a report released in December of 2022 by Ernst & Young. Among many other things, the report began by asking consumers questions about the state of the economy. The responses below likely will not surprise you.

Source: Ernst & Young US Future Consumer Index

Clearly, based on these responses, there are concerns about inflation and the general state of the economy. However, that does not seem to be impacting purchase behavior yet, at least. According to Ernst & Young’s report, “There is a gap between feelings and actions. Americans seem to be cutting costs, with 49% saying they are spending less on nonessentials, 37% purchasing only the essentials and 64% saying they will be more aware and cautious about spending in the future.”

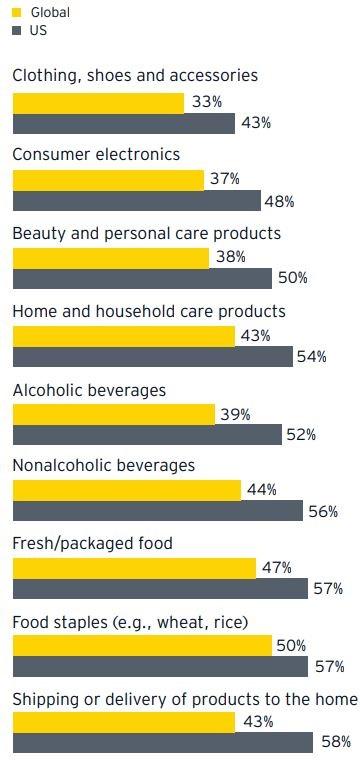

However, when you look at each individual spending category, consumer sensitivity to prices has not altered purchase behavior across most categories, even discretionary spending. This is very different from consumers outside of the United States who are more likely to buy inexpensive alternatives, purchase less or stop buying altogether. This is exemplified in the numbers below that show purchase patterns comparing United States and global consumers and whether or not they buy from some of the more price-sensitive categories of goods.

Source: Ernst & Young US Future Consumer Index

The above-mentioned report ultimately concluded, “Despite a potentially looming recession and prices of goods at an all-time high, U.S. consumers will continue to do what they do best — consume. If we’ve learned anything from past downturns, it’s that Americans will buy their way out of a recession. And the latest Index shows us those habits are hard to break.”

2023 indicators

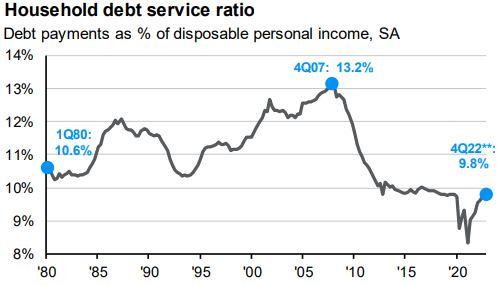

Moving further into 2023, two indicators we are keeping an eye on include the household debt service ratio, which measures debt payments as a percentage of disposable income. In Q4 of 2022, household debt service rose to 9.8%, which is in line with pre-pandemic levels, as seen in the chart below.

Source: JP Morgan Asset Management – Guide to the Markets

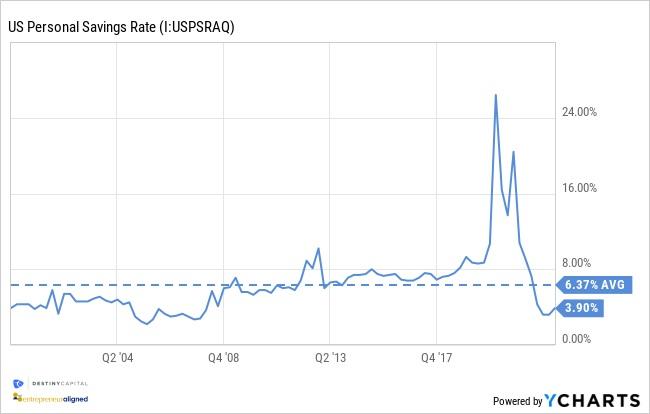

While that is far below the alarming 13.2% peak of Q4 2007, it is still something to keep an eye on. Will consumers grow too dependent on credit to fund purchases? We also saw the personal savings rate fall to roughly 3.9%, which is below pre-pandemic levels, as seen in the chart below.

Yes, wage growth has stalled, but the bottom line is that with the unemployment rate at 3.4% and roughly 1.8 jobs available for every job seeker, United States consumers remain well positioned to continue doing their part to keep the economy resilient in the quarters ahead. This now brings us back to inflation and the Fed, so I will conclude this month’s letter with a brief update.

Inflation and the Fed

“Do you ever have déjà vu?” “I don’t think so, but I could check with the kitchen.” – Groundhog Day

Another month, and we heard yet another familiar tune and shifting narrative from the Federal Reserve. On February 1st, the Federal Open Market Committee concluded their latest meeting. As expected, the FOMC raised the federal funds target rate by 0.25%. Fed Chair Jerome Powell gave an unusually positive assessment of the inflation situation in the United States. This provided investors with a small glimmer of hope that the Fed’s aggressive rate-raising cycle might be coming to an end in the months ahead.

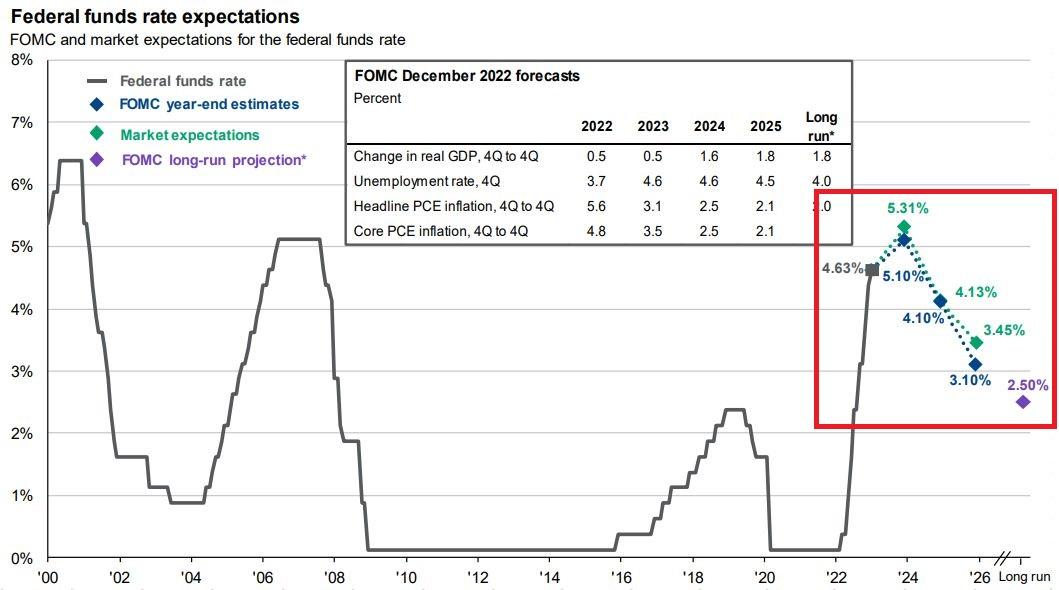

Then, in mid-February, the Bureau of Labor Statistics released the January CPI report that showed headline CPI at 6.4% and core CPI at 5.6%. Yes, inflation continued to decline, but these CPI numbers were above the consensus estimates of 6.2% for headline CPI and 5.5% for core. Since then, Fed messaging has been more hawkish, spurring fears that the FOMC could raise the fed funds rate to well above their current 5.10% target for year-end 2023. In fact, for the first time in quite a long time, the markets are pricing-in a fed fund target rate ABOVE current FOMC projections, as seen in the chart below (with market expectations at 5.31% vs. the FOMC estimate at 5.10%).

Source: JP Morgan Asset Management – Guide to the Markets

What does this mean? Well, it means more volatility could be ahead as both business and investors attempt to navigate uncertainty around fed policy. This is no different than what investors have experienced for the past twelve calendar months dating back to March of 2022, when the FOMC first began raising rates and predicted a year-end federal fund target rate of 1.00% for the end of 2022. Reminder: they were way off.

We get our next CPI report on Monday, March 13th. The next FOMC meeting concludes on March 22nd. Suffice it to say, that is going to be a fascinating and busy two weeks. Upon the conclusion of the March 22nd Fed meeting, investors will finally get their next “dot plot” from the FOMC which illustrates the year-end interest rate target for 2023 and beyond. I expect that we will see most respondents rise well above the current 5.10% projection and may go at least another 25 to 50 basis points (and possibly even higher for a few FOMC members) above the current projection.

Keeping you informed

Until then, we will keep you posted and informed on all new developments. While 2022 was a long and frustrating year for investors, it has certainly been fun hearing from our client teams as they share many of the YOLO experiences that our clients have embarked on over the past year.

As financial planners and investment managers, we literally live for the moments when a client approaches us with questions like, “What does this do for my plan?” or statements such as, “I want to take my adult kids and grandkids on a two week cruise.” Or maybe they state, “I want to help my son put a down payment on his first home.” They might also say, “I just want to live in an Italian villa for a summer.” Their ideas do not have to be big ticket items, either. We work every day to create the moments when we can help our clients find meaning in money. Having a plan and leaning on your advisory team can help navigate any near-term uncertainty around financial markets. So, if there’s anything that will help you live your best life, please do not hesitate to give us a call or send an email. I think we can even text these days! After all, as the kids say these days, YOLO.

—

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.