Markets & Economy – Rapid Fire February Update

On a recent Saturday night, my son played in a rec league basketball game and, I have to say, there are few things more unintentionally entertaining than watching 10 seven-year-olds run-and-gun up and down the court for forty minutes. There were mid-court collisions, random timeouts so the boys could tie their shoes, kids jacking-up 3’s that fell five feet short of the rim, steals, fast-breaks, rejections and even a few made baskets. The game had it all! I have to admit, I never really envisioned spending my Saturday nights as an adult crammed into a folding chair along the sidelines of an elementary school gym, but I’m adjusting.

As I alluded to, this game had a rapid fire pace, which certainly made it entertaining. In fact, the pace mimicked what I’ve been experiencing every morning as I power-up my computer and digest what is transpiring across the domestic & global economy. It is an understatement to say that changes are coming fast and furious, and it can be difficult to keep up. So, for this month’s investor letter – and in the spirit of my son’s recent basketball game – I thought I’d provide a semi-rapid-fire update on a handful of key topics that investors should be aware of. Well, in full disclosure, it’ll be as rapid-fire as I can get when covering some fairly complicated topics. We’ll start this month’s letter by discussing the quasi-entity referred to as the Department of Government Efficiency, or DOGE, and we’ll devote a little extra time to this topic given that it has garnered a lot of attention from investors in recent weeks.

DOGE Ball

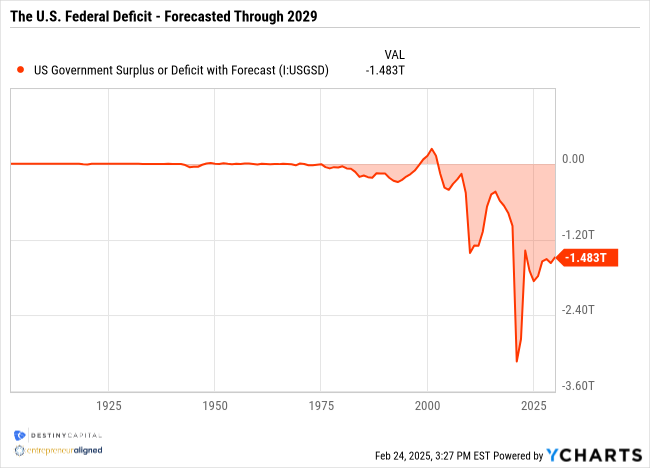

As we’ve covered many times in previous investor letters, the U.S. government has a spending problem. In short, the government consistently has expenditures that far exceed revenues (taxes) each year. In 2024, the federal deficit was a staggering $1.85 trillion – well above the initial $1.5 trillion forecast from the Congressional Budget Office (CBO). There appears to be no end in sight to this trend and forecasts predict that the deficit will hover around $1.5 trillion or more each year through 2029, as you can see in the chart below.

In keeping with my semi-rapid fire theme, below is a bullet point summary of where we currently stand with government spending, the deficit, DOGE, and what it might mean for investors:

- To cover the annual budget deficit, the federal government borrows money by issuing U.S. Treasuries. The U.S. must pay interest on this debt to investors, just like any other debt-like instrument.

- If deficits remain high and the U.S. has to borrow more and more each year, we could see interest rates (such as the 10-year U.S. Treasury) remain elevated as investors demand more compensation for absorbing $1.5 to $2.0 trillion of debt each year.

- The 10-year U.S. Treasury is also an important baseline/benchmark rate for other forms of debt such as mortgage rates, corporate bonds, student loans, and more. If the 10-year Treasury rate remains high, the cost of capital will remain high. This can impact consumers and corporations alike.

- As interest rates remain elevated, the cost of servicing this government debt remains extremely high. For fiscal year 2025, debt service is forecasted to cost $952 billion – or 14% of the total federal budget. Therefore, interest payments alone are budgeted to be more than Defense spending (12%) and only slightly less than Medicare (16%) spending.

- In an attempt to reduce waste, fraud, and regulation, the Trump Administration created a quasi-entity referred to as the Department of Government Efficiency, or DOGE. DOGE’s efforts are being led by high-profile entrepreneur Elon Musk.

- In recent weeks, DOGE has been making rapid and aggressive cuts across many government agencies with the stated goal of reducing government spending by $1 to $2 trillion.

- It is far too early and there is too much uncertainty at this stage to predict what these DOGE cuts might mean for the U.S economy and investors. It is likely that we will also see many legal challenges to DOGE’s initiatives, so this could take quite some time to shake-out.

- Elon Musk and the Trump administration have recently floated the idea of a DOGE dividend of $5,000 sent to eligible Americans. The ‘dividend’ would be funded through savings generated by the DOGE cost-cutting efforts. This is a topic I’d like to expand upon a bit next, as it could potentially impact the U.S. economy in unintended ways.

A DOGE Dividend – Is it a Good Idea?

As mentioned in the previous section, Elon Musk and the Trump administration have recently expressed interest in potentially distributing checks to Americans that are funded through any savings generated by the DOGE program. While I’m sure a $5k check would be welcomed by many across the country, there is worry that stimulus like this could add upward pressure on prices during a time when inflation is already above the Federal Reserve’s 2% target.

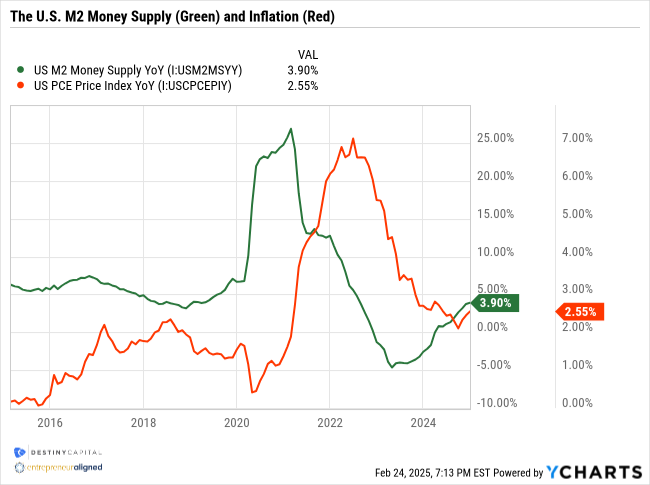

To expand on this point, it’s important to look at the M2 money supply in the United States over time, particularly back when the Fed eased monetary policy and the Trump administration first issued stimulus checks in 2020 in response to the COVID-19 pandemic. The M2 money supply refers to cash (bills & coins in circulation), savings deposits, checking accounts, CDs, and so forth. A meaningful increase in the M2 money supply is generally seen as a precursor for inflation.

While this is an overgeneralization, if you have more cash chasing goods and services, this can drive up prices – assuming there isn’t a subsequent increase in the supply of goods and services.

This inflationary dynamic can be seen in the chart below which shows a significant year-over-year spike in M2 money supply (green) in March of 2020 as the COVID-19 stimulus kicked-in. This was subsequently followed by a significant spike in inflation (red) months later as aggregate prices rose.

Again, many unknown still remain and we’re speaking almost entirely in hypotheticals at this stage, but this is a topic to keep an eye on. Am I predicting 9% year-over-year inflation if checks are delivered to Americans? No. However, any upward pressure on prices could prolong the pain for consumers as they are forced to absorb high and higher prices, which leads us to our next topic – sticky inflation.

Eggsistential Crisis?

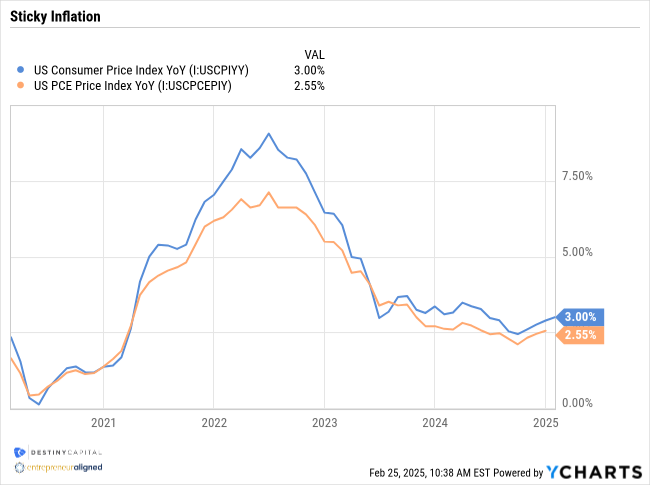

Back in September of 2024, both the Federal Reserve and investors were breathing a sigh of relief as inflation continued its descent to 2.4% (CPI) and 2.1% (PCE). In hindsight, any optimism that inflation had been tamed was premature, as we’ve since seen CPI rise back up to 3.0% and PCE climb to 2.5%, as you can see in the chart below.

Clearly, one item that is getting a lot of headlines these days is the price of eggs, as we’ve recently seen egg prices exceed highs last seen in early 2023, as you can see in the chart below.

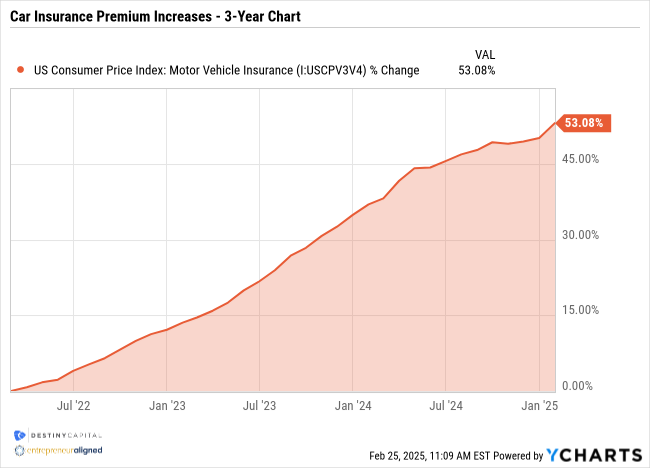

Obviously, the recent spread of avian influenza (bird flu) is having a significant impact on egg supply, while egg prices are also being pushed higher through elevated labor, feed and fuel costs. However, beyond eggs, consumers are also experiencing higher year-over-year prices for transportation (+8%), gas utilities (+4.9%), shelter (+4%) and food away from home (+3.4%).

It’s interesting to note that ‘transportation’ includes items like new and used vehicles, vehicle repairs & maintenance, airline fares, and even auto insurance. In fact, I’m sure many of you have noticed steep increases in your car insurance premium payments in recent years, as prices have increased +53% over the past three years alone, as seen in the chart below.

The First Few Days

What does this mean for investors? Well, it likely means that the runway to 2% inflation has been extended quite a bit, and this doesn’t include any potential impact of tariffs on key trading partners like Mexico and Canada. Higher inflation means less purchasing power for consumers, and also means that the Fed is likely to keep interest rates unchanged until they see meaningful progress towards lower aggregate prices in the quarters ahead. This may continue to constrict the U.S. economy and limit growth, although both corporations and consumers have proven incredibly resilient in navigating this high rate environment without slipping into a recession.

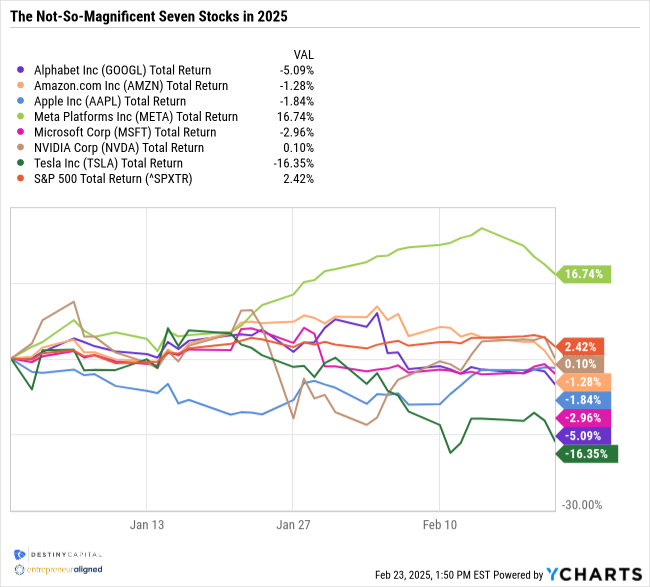

The Not-So-Magnificent Seven in 2025

One of our key areas of focus heading into 2025 was to see whether or not the Magnificent Seven stocks – Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla – would continue to drive market performance as they had in the prior two calendar years. In 2023 and 2024, these seven stocks produced a combined return of +76% and +48%, respectively, which significantly contributed to the performance of the S&P 500 index overall.

While it’s still very early in the year, we’ve seen this dynamic shift a bit thus far in 2025 with only Meta outperforming the S&P 500 index on a year-to-date basis. In fact, five of the Magnificent Seven stocks are in negative territory this year with Tesla stock down over -16%. This can be seen in the chart below.

Over the past two years, financial markets have largely been divided into the ‘haves’ and the ‘have-nots’ as the Artificial Intelligence trade pushed the prices of these high-profile tech stocks ever higher. For the first time in quite a while, we’re seeing the remaining 493 S&P 500 companies contribute to performance, which helps to stress the importance of diversification not only across asset classes, but within asset classes like large cap stocks.

All That Glitters

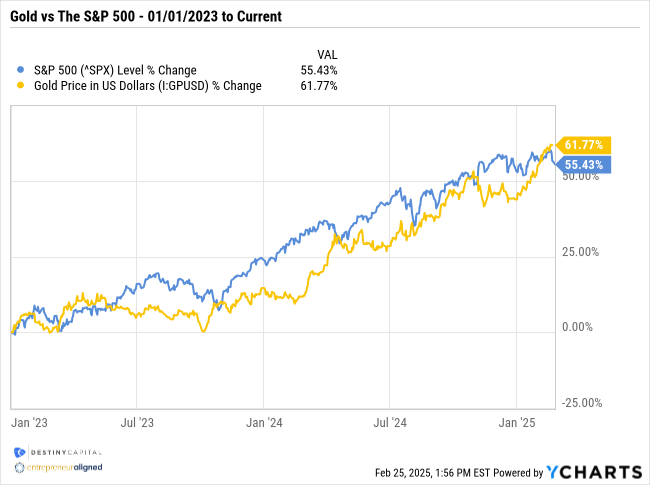

When it comes to gold as an investment, it’s an asset that’s often front-and-center as we’re bombarded with ‘buy gold’ advertisements during times of significant market volatility or when inflation is climbing. However, with markets surging over the past two years and inflation declining from its 2022 highs, it’s been interesting to note that gold has been one of the top performing assets since the beginning of 2023, as you can see in the chart below that compares gold vs. the S&P 500 index.

At Destiny Capital, we view gold as an ‘alternative’ asset class given that it has a very different profile than public/private equity and public/private credit. With gold, performance is primarily driven by supply and demand dynamics and, over the past few years, demand has been substantial. This has particularly been the case for one important source – central banks. In fact, countries like China, Russia, India and more have been purchasing gold in droves. Over the past three years, central banks – in aggregate – have purchased the following amounts of gold according to the World Gold Council:

2022: 1,082 Metric Tons

2023: 1,037 Metric Tons

2024: 1,045 Metric Tons

This demand was difficult to envision several years ago, but has been the key driver of gold’s ascension from roughly $1,800 in early 2022 to just over $2,900 as-of this writing. The key question is whether or not this central bank demand can continue in perpetuity. Without such demand, price increases could stall, particularly relative to the steep rise experienced over the past three years. Clearly, central bank demand and investor inflows into gold funds will be something we’ll be keeping an eye on.

Brief Earnings Update

We’ll close this month’s letter with a very brief earnings season update now that over 77% of S&P 500 companies have reported results for Q4 2024. According to FactSet, the blended year-over-year earnings growth rate for the S&P 500 is +16.9% which is well-above the 11.8% consensus estimate. If this figure holds, it will represent the highest year-over-year earnings growth rate reported by the S&P 500 index since Q4 of 2021. Given that earnings growth is a key driver of returns, the quarterly results thus far can generally be viewed as positive.

However, it’s important to note that financial markets are forward-looking, and a tremendous amount of uncertainty remains, particularly around the trade policies of the Trump administration. If you are curious about our take on potential tariffs, I would encourage you to read my latest CIO Mailbag post that delves into this topic. As it stands now, 25% tariffs on all Mexican and Canadian imports are set to go into effect in early March. We will be watching this situation very closely and, as always, we will communicate with you in the days and weeks ahead if there are events that may impact our long-term investment outlook.

——————————

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Advisory services offered through Destiny Capital Corporation, an Investment Adviser registered with the U.S. Securities & Exchange Commission.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Transform Your Retirement Strategy

Discover the three-legged stool approach for a stronger financial foundation.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.