Markets & Economy Update – INFLATION: ENDGAME

When it comes to setting important thresholds, humans really seem to like round numbers. 10,000 steps in a day for weight loss. A .300 batting average for hitting excellence in baseball. Eight glasses of water each day for optimal hydration. The four percent rule for portfolio withdrawals in investing. A 100 quarterback rating in football. The four-minute mile in track and field. Honestly, is a 4:01 minute-mile any less of an achievement than running a mile in four-minutes flat?

There’s another target threshold that has entered the public discourse over the past three years – the Federal Reserve’s 2% inflation target. For years, economists and investors nervously wrung their hands each month as each inflation report was released. Each month, CPI and/or PCE would remain elevated, and Fed Chair, Jerome Powell, would declare, “the Committee is strongly committed to returning inflation to its 2 percent objective” as he began each and every post-Federal Open Market Committee meeting press conference.

After another mixed inflation report was released a few weeks ago, one of Destiny Capital’s Client Wealth Strategists asked me, “why does the Fed think that 2% is a good target, and how committed are they to getting there?” I immediately thought, “Now that’s a great question to address in the next investor letter!”

Unfortunately, inflation continues to be a key factor influencing stock and bond market returns so, this month, we’ll try to outline the Fed’s ultimate end game as it relates to inflation in 2025 while also touching on what we’ve learned from the first few days of the Trump presidency.

The Elusive 2% Target

When Woodrow Wilson signed the Federal Reserve Act in 1913 and created the central banking system of the United States, the text of the Act must’ve included language like “the Federal Reserve shall henceforth maintain stable prices with inflation growth not to exceed 2% per annum”, right? I mean, this 2% inflation target is a core tenet of the Federal Reserve that’s been etched in stone since the entity’s inception, hasn’t it? Well, would it surprise you to learn (if you don’t know already) that the inception of this 2% inflation target hearkens all the way back to the distant year of 2012? That’s so long ago that the iPhone 5S hadn’t even been released yet!

Clearly, I’m being a bit facetious, but it’s fascinating that the Federal Reserve, economists and pundits across the globe refer to this 2% target as if it were a mathematical constant like Pi = 3.14 or a part of natural law like 9.81 m/s2 reflects acceleration due to gravity. For nearly a hundred years, the Fed operated without a publicly disclosed target for inflation. What changed and why?

Decades ago, two countries led the way in advocating for enhanced central bank transparency as it relates to inflation. In 1990, the Reserve Bank of New Zealand publicly announced a 2% inflation target and, soon after in 1991, the Bank of Canada did the same.

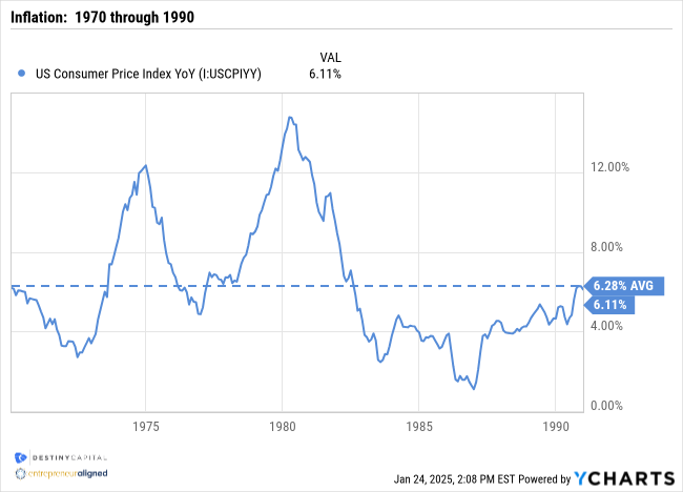

The actions of these other central banks spurred a lot of dialogue among certain Federal Open Market Committee members who felt that it was imperative that the Fed publicly announce their own inflation target. Remember, from 1970 through the end of 1990, the U.S. saw fluctuating levels of inflation that averaged over 6% per year, as you can see in the chart below. Perhaps publicly stating an inflation target would help provide a light at the end of a tunnel for a public who had been suffering due to elevated prices for decades.

Meanwhile, internally among FOMC members, a 2% inflation target was generally accepted as suitable, if not optimal. However, confidentiality around this target was deemed imperative. After one meeting at the time, Fed Chairman, Alan Greenspan, went as far as to warn FOMC members that “if the 2 percent inflation figure gets out of this room, it is going to create more problems for us than I think any of you might anticipate.”

Why was Greenspan hesitant to publicly announce an inflation target? Well, he didn’t want the Fed to paint itself into a corner. It’s a situation that’s not much different than the Fed finds itself in today.

For example, if a 2% target was widely known and inflation rose to 2.5%, then economists and the general public would expect the Fed to create conditions that would ease the labor market (ie – cost jobs) to bring inflation back to targets, and that’s not necessarily a position the FOMC wanted to find itself in. Greenspan preferred to leave a little bit of wiggle room for the Fed to navigate such thorny issues. After all, the Fed has never announced an official target for the unemployment rate. While it’s widely believed that ‘full employment’ is considered an unemployment rate of 4%, it’s not something the Fed has officially declared as a target. Therefore, if the unemployment rate rises from 4.0% to 4.3%, the American public may notice, but the Fed may have a bit more latitude in navigating the labor market than if they had set a firm target of 4%.

To make a very long story short, Alan Greenspan eventually exited as Fed Chairman, Ben Bernanke took his place, and Bernanke had much different views around transparency at the Federal Reserve. Therefore, in January of 2012, the Fed released its Statement on Longer-Run Goals and Monetary Policy Strategy which officially announced the Fed’s 2% inflation target.

The Last Five Pounds are Always the Hardest

For investors, the problem with inflation is largely due to inflation’s impact on Fed policy and interest rates. Among other things, higher interest rates raise the cost of capital, which can be costly for smaller companies seeking to borrow to fund operations and/or facilitate growth. This can negatively impact both the top and bottom lines of an income statement.

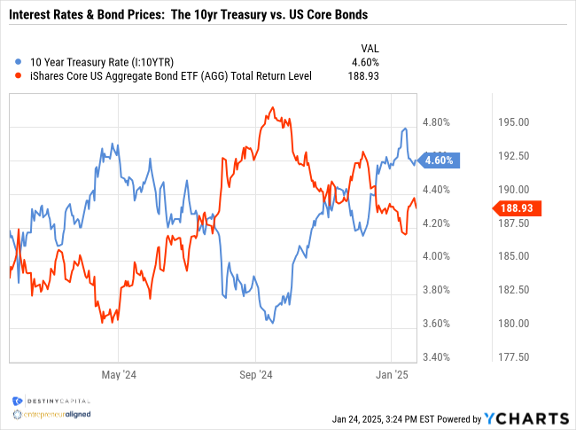

Persistent inflation also leads to perpetual uncertainty around forward-looking interest rate expectations, and this can wreak havoc on bond markets. This can be seen in the chart below which shows some wild oscillations in the 10-year U.S. Treasury rate (blue) along with the subsequent movement in bond prices (red) over time. As interest rates move higher, bond prices decline – and vice versa. Regardless, this is more price volatility than we’d ideally like to see in a calendar year as the 10-year Treasury fluctuated between 3.6% and 4.8% from January of 2024 through today.

As I mentioned earlier in this letter, one of the key questions asked by my colleague here at Destiny Capital was “how committed is the Fed to reaching its 2% target?” If you ask the Fed overtly, they will say that they are absolutely committed to reining-in inflation, as higher prices can often be most damaging to the most vulnerable in our country.

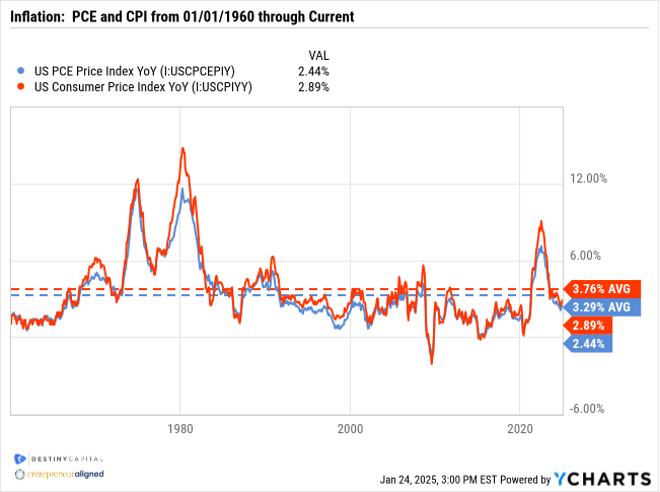

However, if you look at current inflation levels from a historical perspective, today’s year-over-year inflation figures don’t look too bad. As you can see in the chart below that shows inflation from 1960 through today, PCE (blue) inflation has averaged 3.29% while CPI (red) has averaged 3.76%. Both of those historical averages are well above today’s level of 2.4% (PCE) and 2.9% (CPI).

This leads me to my point. While there is research and logic behind the Fed’s 2% inflation target, it’s important to note that it’s still a somewhat arbitrary number (see: humans like round numbers). Clearly, over extended time periods, elevated inflation can impact the long-term financial goals of investors. However, like running a 4:04 minute mile vs. a 4.00 minute mile, is there a meaningful enough difference between 2.4% year-over-year inflation vs. 2.0% over the short-term (12-18 months) to risk far higher unemployment rates and/or tipping the economy into recession?

As 2025 continues to progress, it is my belief that the Fed will find itself at a crossroads. Over the past three years, inflation growth has been all about housing as the shelter index continues to be the largest contributor to each month-over-month increase in the all-items index. In fact, I’d imagine that many FOMC members are a bit surprised that higher interest rates did not meaningfully impact the housing market over the past two years. This dynamic can be seen in the chart below that shows the rise of 30-year mortgage rates along with the shelter index. Since the beginning 2023, mortgage rates have hovered between 6% and nearly 8%, yet the shelter index has risen unabated.

Ultimately, there are only so many levers the Fed can pull to impact the U.S. economy. Therefore, if inflation – and specifically shelter prices – remains elevated throughout 2025, we may see the Fed shrug and say, “guys, there’s only so much we can do through monetary policy alone.”

I believe that the Fed will then put the onus on Congress and fiscal policy to impact housing costs through expanding supply, not just hindering demand. This may mean more subtle pressure on policymakers to impact housing supply through affordable housing initiatives, home-buyer credits, builder incentives, zoning reform, reducing red tape, public/private partnerships, supporting innovation in manufacturing (prefab/modular housing), and more.

Will inflation ever revert back to the Fed’s 2% target? I imagine so, but remember, just like with any diet, the last five pounds are always the hardest. The U.S. economy has made tremendous progress in getting inflation far lower than it was in the summer of 2022. However, to get back to 2%, it’ll likely require a combination of monetary and fiscal policy initiatives by the federal government, which leads us to our final topic of the day – the first few days of the presidency of Donald Trump.

The First Few Days

The last few days have been anything but uneventful. In fact, as-of this writing, President Trump has signed roughly fifty executive actions on issues such as immigration, foreign policy, energy policy, climate policy, healthcare policy, diversity/equity/inclusion DEI initiatives, and many more.

After the November election, we identified and communicated several policy initiatives that are likely to be of keen interest to investors in the first days, weeks, and months of the Trump presidency. These primary areas of interest are trade policy (tariffs) and tax policy (corporate tax cuts). So far, we haven’t seen any initiatives or announcements related to either tax or trade, so investors remain in a wait-and-see mode.

Clearly, immigration has been an early focus of the Trump administration, and immigration policy can potentially impact business sectors like agriculture, construction, and hospitality & leisure. As it stands now, a great deal of uncertainty remains around the implementation of these immigration initiatives, so the potential impact on investors remains unclear.

Over the past few days, the Trump administration and artificial intelligence (AI) research organization, OpenAI, announced a $500 billion initiative to build AI infrastructure across the United States. This initiative has been dubbed Project Stargate, and has significant funding commitments from corporations like Softbank, Oracle, MGX and more. Over the past two years, a select few companies have been the primary beneficiaries of ‘the AI trade’. Will additional resources devoted to AI expansion begin to ‘spread the wealth’ and benefit organizations beyond the top 10 S&P 500 companies? This is something we’ll be monitoring very closely as the details of Project Stargate become a bit clearer.

As you can imagine, this post-inauguration news is coming at us fast and furious, and we’ll be sure to update our investors on any government initiatives that may impact our outlook. In the meantime, please don’t hesitate to contact our team if you have any questions or concerns as we close a fast-moving first month of 2025.

Transform Your Retirement Strategy

Discover the three-legged stool approach for a stronger financial foundation.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Advisory services offered through Destiny Capital Corporation, an Investment Adviser registered with the U.S. Securities & Exchange Commission.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.