Markets and Economy Report (Election Update)

[et_pb_section][et_pb_row][et_pb_column type=”4_4″][et_pb_text]

by Tim Doyle, Chief Investment Officer, CFP®, MBA

In a historic turn of events on Sunday, November 29th, the Denver Broncos played an entire professional football game without a quarterback. Given that I vociferously support a different NFL team (and concerns about player health notwithstanding), I initially had a pleasant moment of schadenfreude when thinking about the many ardent Broncos fans on Destiny Capital’s staff. Then, because my life tends to revolve around investing and financial markets, I made a comment to my wife about the importance of diversification and risk management, to which she promptly – and justifiably – rolled her eyes.

One of Destiny Capital’s core tenets of investing is that we construct customized portfolios of diverse, non-correlated asset classes with a focus on long term risk-adjusted performance. While I am ignorant of the exact circumstances that led to the Broncos QB issues, I thought it was an interesting real-world example of the importance of diversification and the avoidance of risk-concentration in the age of COVID-19. Much of long-term investing revolves around ‘staying in the game’ by mitigating extreme levels of volatility that lead to emotional decisions that have dire financial consequences. When risk is too heavily concentrated, event-driven downside risks are exacerbated. The Broncos experienced this downside in Sunday’s 31-3 loss to the New Orleans Saints.

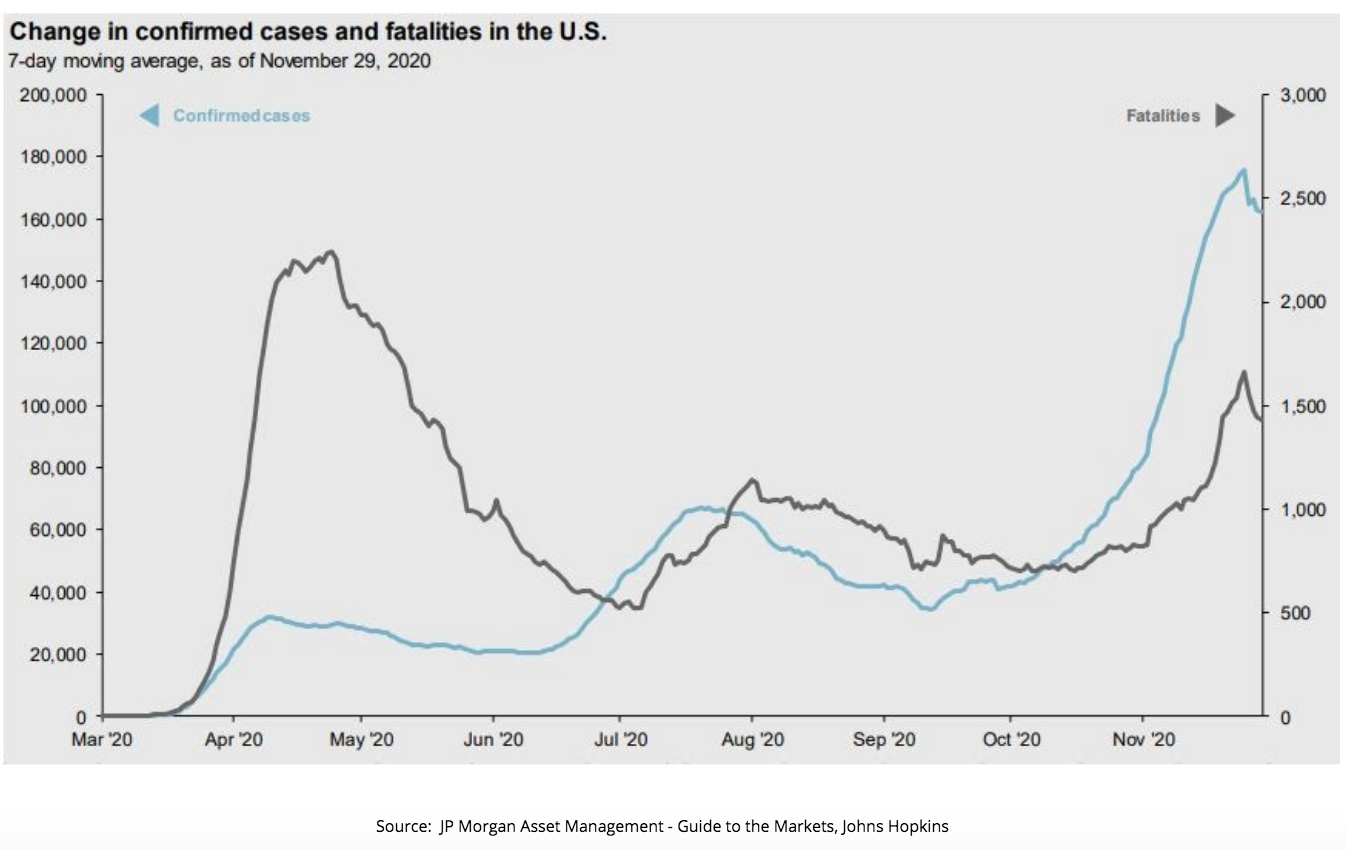

When it comes to financial markets, equities responded favorably during a month in which we saw a precipitous rise in daily confirmed new COVID-19 cases, as seen in Chart A below. This just goes to show that, if this pandemic has taught us anything about financial markets, it’s to expect the unexpected.

Chart A

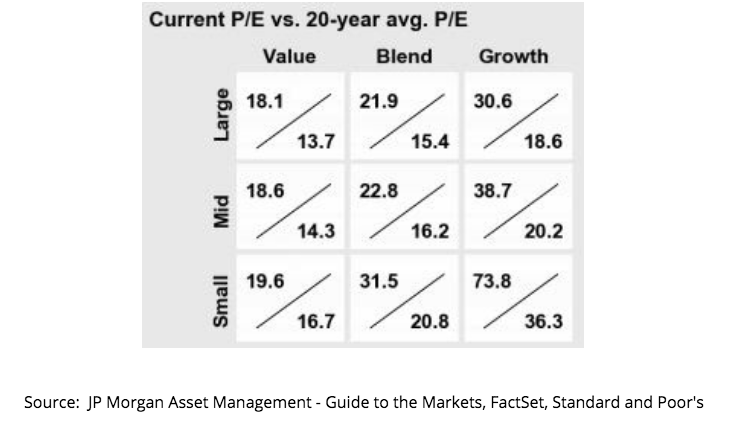

November was also a month in which Large Cap Growth stocks took a backseat to Emerging Market, Small Cap, Mid Cap, and Large Cap Value stocks. This rotation was hardly surprising given current valuations of Large Cap Growth, which has a current forward P/E of 30.6 vs a 25-year historical average of 18.6. Whereas – as a comparison – the forward P/E of Large Cap Value stands at 18.1 vs. a 25-year average of 13.7 as illustrated in Chart B.

Chart B

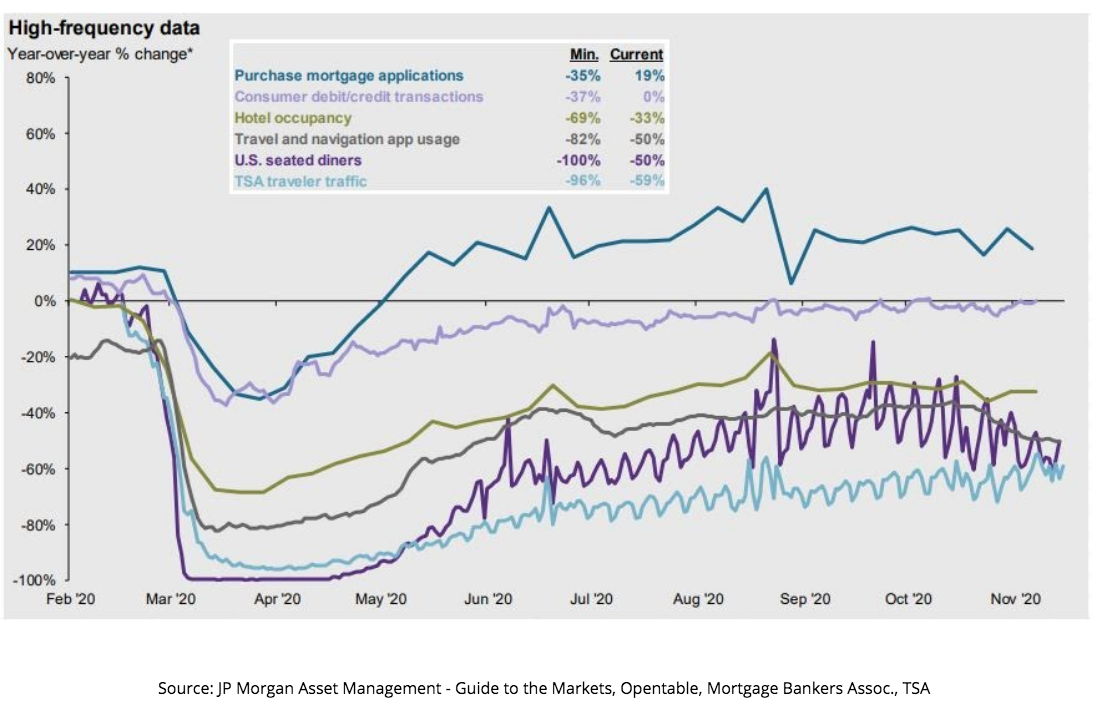

I’ve written many times that it’s never a good idea to bet against the ingenuity and resiliency of the American economy and – generally speaking – the behavior of financial markets has supported this sentiment throughout 2020. Still, as we enter this holiday season and the winter months, it’s hard not to empathize with the small, independent businesses that continue to suffer due to the pandemic. Via a news aggregator service several days ago, I stumbled upon a national news article that highlighted the desperate struggle of the many small businesses on Tennyson Street in my neighborhood in northwest Denver. I drive down this street every day after picking up my son from daycare, and it’s been difficult to watch as several of my favorite restaurants and shops have shuttered permanently, reduced hours or closed until the spring months due to the pandemic.

Months ago, Bobby Stucky, the owner of the highly acclaimed Frasca Food and Wine in Boulder, CO penned a guest commentary in the Denver Post, warning that the restaurant industry could see a mass extinction event in the winter if additional stimulus is not passed. It should come as no surprise that, in Chart C below, we see a gradual decline in U.S. seated diners as much of the country experiences colder weather not conducive to outdoor dining.

Chart C

This begs the question – will there be additional fiscal stimulus passed in the coming weeks? For months, Fed Chairman Jerome Powell has implored Congress to pass additional stimulus to help the individuals and businesses suffering due to both state & local restrictions and short-term changes in consumer behavior. The Fed is doing everything in its power to support and maintain expansionary policies, but more support will be needed to bridge the gap until an effective vaccine is widely available.

As of this writing on December 1st, a bi-partisan group of Senators including Joe Manchin III (D-W.Va.), Mark Warner (D-Va.), Bill Cassidy (R-La.), Mitt Romney (R-Utah), and Susan Collins (R-Maine) held a press conference to propose a $908 billion relief package in an attempt to break the deadlock in Washington DC. It remains to be seen whether or not this most recent stimulus proposal will gain any traction, but any continued delay threatens the stability of an already-fragile recovery.

If Thanksgiving was any indication, this upcoming holiday season promises to be unlike any many of us have experienced in our lifetimes. For instance, I recently learned that my wife just scheduled a virtual Santa appointment for our two boys, and I just shake my head in disbelief at how utterly bizarre this year has been.

For many, social distancing will keep us apart from friends and loved ones, but I take heart in knowing that the light at the end of the tunnel is near. On November 30th, Pfizer announced the first mass shipment of its 95%-effective vaccine, with more on the way. In the wealth management industry, we joke about the worlds ‘pent-up demand to party’, and we look forward to a 2021 full of group dinners, air travel, hotels, concerts, BBQs, sporting events and face-to-face meetings with clients and business partners. In the meantime, please stay safe, stay healthy, and enjoy this holiday season.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Share this

Build a Resilient Retirement

Don’t wait—download our essential retirement guide and start planning for a secure future.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.