Markets and Economy Update – November 2023

Year-End Reflections

Each quarter, our entire Destiny Capital team gathers and connects for several days of internal meetings, lessons, discussions, training sessions, events, and more. These ‘team weeks’ have been vital in creating and cultivating our firm’s amazing culture, and allows our distributed, nationwide team of professionals to uncover ways in which we can improve in our efforts to help our clients live remarkable lives.

In October of 2023, one of our ‘team week’ group sessions included a book club, of sorts, where each member of our team was tasked with reading The Psychology of Money, by Morgan Housel. The general premise of the book is that people don’t make financial decisions based entirely on data from a spreadsheet. They make decisions at the dinner table where personal history (their own unique view of the world), ego, pride, marketing and odd incentives become scrambled together in guiding individual choices. Each member of our team found the book to be highly interesting and incredibly insightful as we viewed it through our own personal and professional lens, and this led to some truly fascinating conversations.

As I sit here reflecting upon the past year of economic activity, one particular chapter of this book titled “The Seduction of Pessimism” continues to percolate in my mind. Based on the chapter title, I think it’s fairly easy to extrapolate what this section of the book is about. Much like the phrases “Sex Sells” and “If It Bleeds, It Leads”, the “Seduction of Pessimism” portrays how, generally speaking, pessimistic portrayals of doom and gloom often draw far more focus and attention than optimistic outlooks, and this can impact decisions pertaining to money.

If you’re a pundit on a business news channel and talk about steady employment and moderate domestic growth in the U.S. throughout 2024, you aren’t going to draw many eyeballs. However, if you proclaim that the U.S. is doomed to experience an imminent 2008-style economic collapse, then your interview will probably be featured in prime-time.

Looking back over the course of the past year, there was a lot that could’ve seemingly derailed financial markets throughout 2023, including:

- Concerns of persistent high inflation.

- Continued Fed rate hikes in February, March, May, and July of 2023. This led to increasing fears of over-tightening and tipping the U.S. into recession.

- Ongoing war between Russia and Ukraine.

- The banking crisis in March that resulted in the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank.

- The tense debt ceiling debate and fears of potential default.

- The unexpected Moody’s downgrade of the U.S. credit rating from AAA to AA+.

- A sudden $2.36 trillion rise in the U.S. National Debt between June 1 and November 30th.

- The persistent rise of the 10-year U.S. Treasury rate between May and October.

- War between Israel and Hamas, and the threat of regional contagion.

- The potential for a U.S. government shutdown (averted for now).

In reviewing a daunting list like this, it can be easy to see why pessimism can be so seductive. Each of those topics had (or have) the potential to derail financial markets, at least for a time.

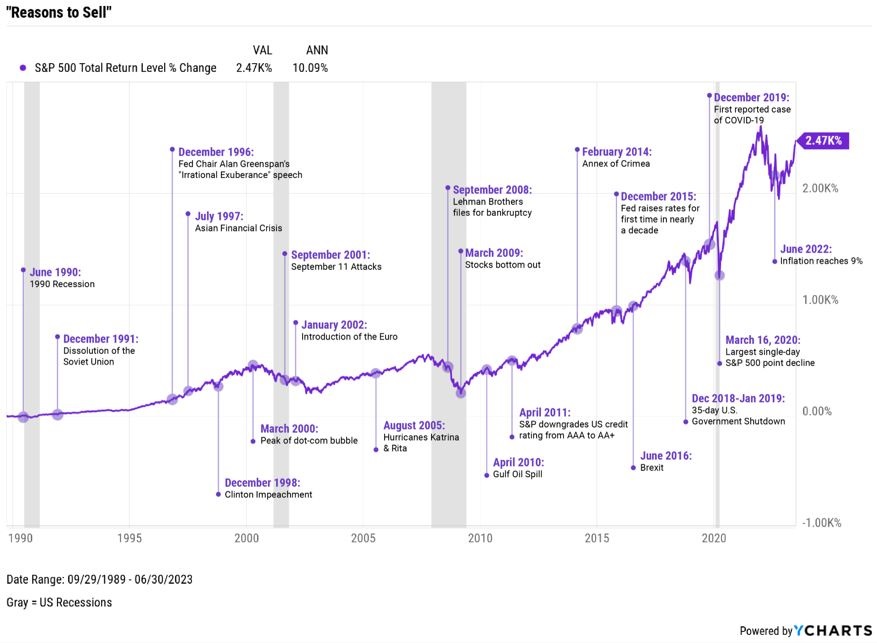

However, the bullet-point list above reminds me of one of my favorite charts that shows the upward trajectory of the stock market despite a litany of disruptive and historically significant events. In short – investors can always find a reason to sell and ‘park’ assets on the sidelines, and 2023 was no different based on the pace and severity of events that might’ve forced a bear market.

Perhaps it’s the rapid pace of disruption & change, the uncertainty caused by war across two key regions, or the way that negative events are forced into our consciousness through a form of social media-induced osmosis, but it’s clear that public pessimism has been persistent. In fact, the chart below shows that consumer sentiment remains well below pre-pandemic levels, despite a tremulous rebound over the course of the past year.

Yet, when it comes to financial markets, here we are nearing the end of the calendar year, and most major asset classes are up year-to-date with the S&P 500 leading the pack, as you can see in the chart below.

In looking at the year-to-date performance chart above, one thing becomes apparent. At +18%, the S&P 500 is far outperforming all other major indexes, including the Dow Jones Industrial Average (the DJIA represents only 30 very large companies), the Russell 2000 (small caps), the U.S. bond market, and U.S. Treasuries. Therefore, this year’s rally doesn’t appear to be entirely widespread.

We can then look even deeper under the hood to identify a trend that has truly been unique to 2023, and that has been the emergence of the ‘Magnificent Seven’ companies – Apple, Microsoft, Meta, Google, Amazon, Tesla, and NVIDIA. These seven companies not only comprise nearly 30% of the entire S&P 500 index as weighted by market cap, but they’ve also driven the vast majority of the performance of the stock market throughout 2023. This is made starkly evident in the chart below.

S&P 500 vs. S&P 493 vs. S&P 7 – 12/30/22 through 11/30/2023

As you can see, the year-to-date return for the combined S&P 7 (Apple, Microsoft, Meta, Amazon, Google, Tesla, NVDIA) is roughly +70% as-of November 30th. The S&P 493 (the rest of the S&P 500 with those 7 companies removed) is up only +5%. This means that the Magnificent Seven stocks account for roughly 14% of the 18.97% year-to-date return for the entire S&P 500 index.

We simply haven’t seen something to this magnitude where omitting or including a handful of companies from a diversified investment portfolio might result in dramatically different returns.

What has driven the performance of these select few companies? Well, yes, they all happen to be incredibly innovative and insanely profitable companies but, for the most part, they also have one other thing in common. In one way or another, they are (or are projected to be) innovators in the realm of artificial intelligence (AI).

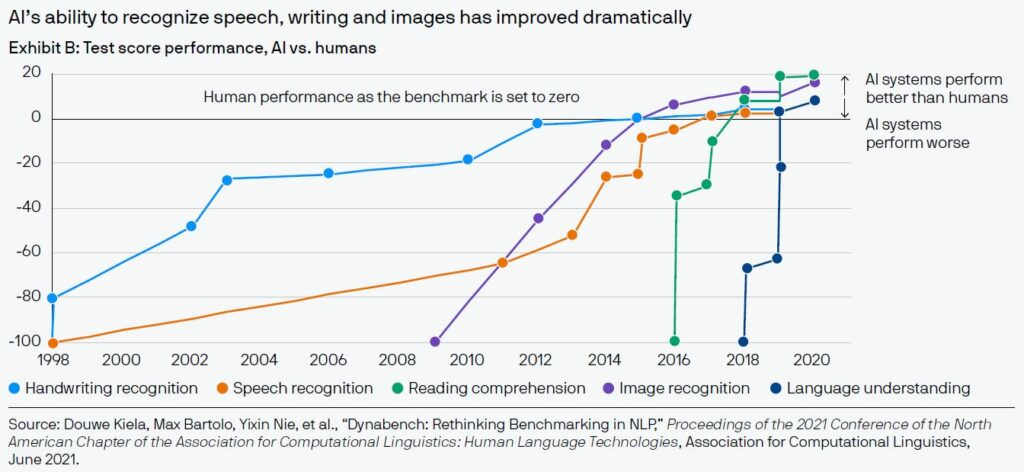

In recent years, we’ve seen the abilities of AI accelerate in areas like handwriting recognition, speech recognition, reading comprehension, image recognition and language understanding. In fact, as you can see in the chart below, the capabilities of AI in each of these realms now exceeds the capabilities of humans based on certain AI vs. human tests.

Furthermore, around this time last year (November 30, 2022), the world became enthralled as ChatGPT, a natural language processing tool driven by AI, was released by OpenAI. Given ChatGPT’s capabilities, this tool helped to ignite the imaginations of investors around the potential for AI. Investors are constantly seeking innovations with the potential for disruption. To many, the emergence of AI and its ability to ‘disrupt’ is viewed similarly to the advent of the computer, the internet, and the iPhone. We all know how transformative these technologies can be.

Moving into 2024, we expect AI to be a keen focus for businesses and their investors. As we all know, disruption can be either (or both) positive or negative, depending on perspective.

Fed & Inflation Update – Is it Over?

I’m not a huge fan of scary movies, and I may or may not watch them with a baseball cap or nearby pillow subverting my vision during tense scenes. In many of these movies, I’ve noticed a trend where the film’s hero seemingly vanquishes the ‘bad guy’ and breathes a gigantic sigh of relief. Serene music begins to play and the hero smiles until he or she finally learns that the real killer is slowly creeping out of the closet right behind them. It’s not over!

This is how I feel when it comes to inflation and Fed policy. Yes, there are times when I find myself breathing a substantial sigh of relief when seeing that year-over-year inflation is falling and projections that we are at peak interest rates. Then there’s that pessimistic (there’s that word again) side of me that doesn’t allow me to lower my guard for even one moment. After all, we’ve seen substantial meeting-to-meeting changes in Fed policy for nearly two years now.

However, there’s some positive news to share when it comes to inflation and Fed policy, and it’s hot off the presses. In fact, this month’s letter was delayed slightly due to the Consumer Price Index report released on December 12th, then the Federal Open Market Committee meeting that concluded on December 13th.

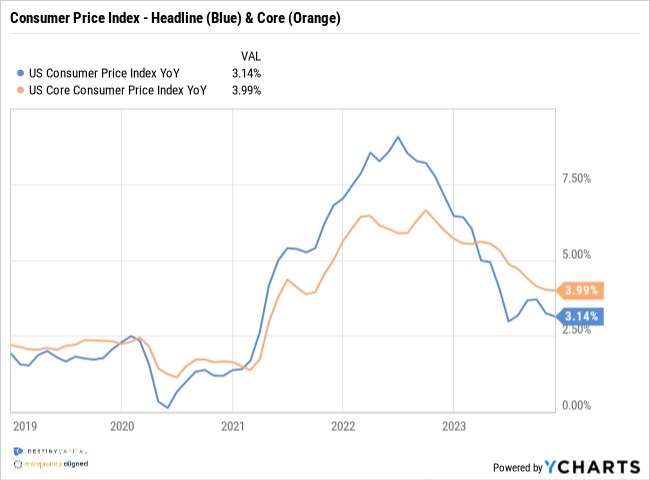

When it comes to prices, the latest CPI report showed that inflation continues to fall with Headline CPI coming in at 3.1% and Core CPI at 4%. Both of these figures were in-line with consensus estimates, meaning that there were no negative surprises for investors.

Attention then shifted to the Fed and their important December meeting. Every other meeting, the Fed releases their Summary of Economic Projections. These projections provide investors with the Fed’s forward-looking estimates for key economic indicators like gross domestic product (GDP), the unemployment rate, inflation, and the federal funds rate. The last time the Fed released their projection data was during their September 20th meeting, and these projections negatively surprised investors by estimating that the federal funds rate would move even higher in 2023, then remain at an elevated level (5.1%) throughout the entirety of 2024.

This is when ‘higher for longer’ language permeated every discussion around the Fed & monetary policy and, subsequently, caused additional volatility in both the stock and bond markets.

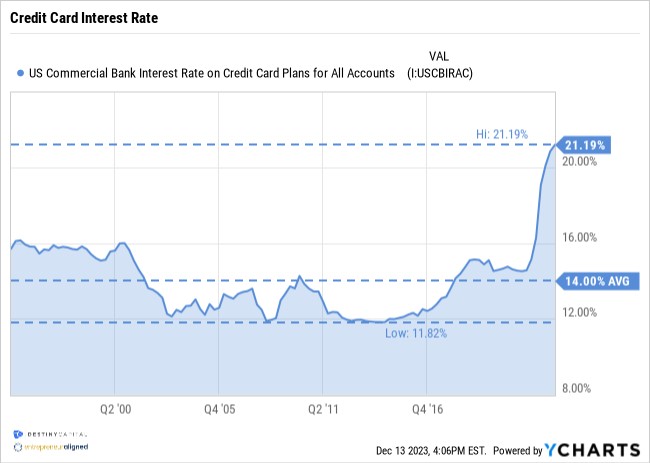

Fast forward to December 13th, and we are seeing a very different story from the Fed. Based on their updated projections, the Fed expects core inflation to fall even further in 2024 as they moved their estimate from 2.6% down to 2.4%. Then, perhaps most importantly for investors, the Fed has slashed their federal funds rate projection for year-end 2024 from 5.1% to 4.6%. This means that we could likely see 0.75% (75bps) of rate cuts in 2024, which would be a good thing for business, investors, and consumers alike.

Is the cycle of inflation and higher interest rates over? It’s impossible to say with absolute certainty. However, investors have been through a long slog since rates began to rise back in early 2022, and seeing deeper rate cuts projected by the Fed is certainly the early Christmas present that investors were hoping for.

Lower rates will be good for businesses seeking to facilitate growth through borrowing, they will be good for home-buyers seeking to lower their lifetime interest and monthly mortgage payments, they will be good new & used car buyers, and they will be very good for folks seeking to pay off credit card debt, as we’ve seen credit card interest rates rise to all-time highs as seen in the chart below.

It’s been quite a ride for investors throughout 2023. While enduring so many critical and stressful events may foster pessimism, I look at this past year from an entirely different angle. For years, I’ve written about the resilience of the U.S. economy and financial markets. For nearly 2-years, investors have endured historically restrictive monetary policy from the Federal Reserve and significant geopolitical & economic shocks.

Yet, gross domestic product (GDP) rose to a staggering 5.2% in Q3, the unemployment rate stands at 3.7%, there are 8.7 million open jobs in America, and financial markets have generally ascended throughout 2023. To me, that demonstrates resilience, and there could be, we hope, some runway left for both stock and bond markets as we close-out the year and move into 2024.

As always, please don’t hesitate to reach out to our team if there are any urgent requests for the end of 2023 or early 2024. Our portfolio managers are busy executing tax loss harvesting strategies where appropriate, but please reach out if you have significant external gains elsewhere that may need to be offset, and we’ll review potential options for additional offsets. From everyone here at Destiny Capital, please have a wonderful and safe holiday season, and we look forward to a healthy, happy and prosperous 2024.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services provided by Destiny Capital Corporation, a registered investment adviser.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.