Markets and Economy Update – July 2021

In mid-July, I had some business-related travel that forcefully yanked me out of my prolonged hibernation, and, before I realized what was happening, had me buckled in at seat 23A of a United Airlines flight. In some ways, the trip felt like running at full sprint after a relatively sedentary year of video meetings and elastic waisted pants. Yet the airport, the flight, the Lyft ride and in-person group meetings all felt so familiar and energizing after such a strange and isolating year and a half.

I was finally done with COVID-19. However, I later came to worry that perhaps COVID-19 might not be done with me. A week after my business trip, I found myself in a drive-through line at a local Walgreens waiting for a rapid COVID test as I battled worsening cold and flu symptoms. To quote Michael Corleone in The Godfather III: “Just when I thought I was out, they pull me back in!”

Thankfully, and not surprisingly, the test was returned negative, but the experience proved to be a stark reminder that some risk remains, particularly as more contagious COVID-19 variants emerge. Still, I do not let that experience hinder my outlook as either a citizen or an investor. After all, it was a joy to have dinner with colleagues, to collaborate with my peers and to have a conversation without realizing that I had been muted for the prior 37 seconds as I obliviously rambled on.

As I have said in previous letters, there is a lot to be excited about, and it should come as no surprise to anyone that we will encounter a few potholes and unforeseen detours on the road to recovery. Therefore, in this month’s letter, I will review some headwinds that investors may face in the form of COVID-19 and inflation while also considering potential tailwinds from infrastructure and earnings.

COVID-19 Update

Until a few months ago, I began each monthly Markets and Economy letter with a COVID-19 update detailing domestic and global data along with a progress report as we inched toward recovery. I suspended these COVID-19 updates earlier this year, given that case numbers were drastically falling as vaccines became widely available and America slowly began to reopen.

However, in recent weeks, we have been learning more and more about the Delta variant that has emerged as the primary COVID-19 strain across the country (83% of new cases), bringing COVID-19 back into sharp focus as a potential risk to individuals and investors.

According to the director of the Centers for Disease Control (CDC), Dr. Rochelle Walensky, “The Delta variant is more aggressive and much more transmissible than previously circulating strains. It is one of the most infectious respiratory viruses we know of and that I have seen in my 20-year career.” That statement is sure to raise a few eyebrows. The transmissibility of the Delta variant is why we are seeing case numbers rise in areas across the country, and the CDC is even recommending stark changes to their masking guidance.

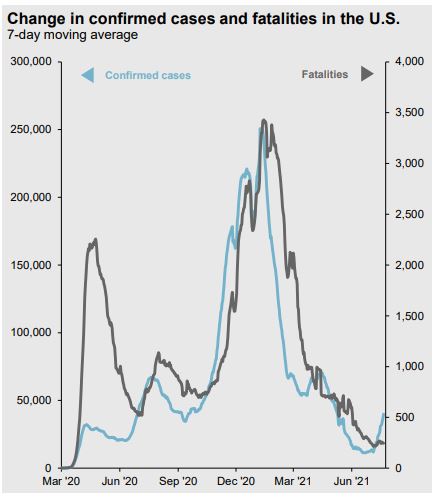

However, as you will see in the graph below, case numbers and fatalities in the U.S. are nowhere near where they were at during the surge in late 2020/early 2021, and experts do not expect fatalities to rise to the levels we saw over the past six to nine months, either.

Source: JP Morgan Asset Management – Guide to the Markets

Despite a concerning trend of new cases, the U.S. is in a much different place than it was during the summer of 2020. Testing is readily available, with rapid tests that provide results in as few as 30 minutes. Treatments and medications are accessible, and some appear to be effective in keeping hospitalized patients from getting worse. We have three widely available and highly effective vaccines that were developed to combat the initial Alpha strain of COVID-19, and scientists seem fairly optimistic that these current COVID-19 vaccines remain effective against the Delta variant.

As an example of vaccine efficacy, a Public Health England analysis found that the Pfizer-Biontech vaccine is 88% effective against symptomatic Delta, and 96% effective against hospitalization. I should note that this study is pre-print and has not yet been peer reviewed. The efficacy of the Johnson & Johnson vaccine against the Delta variant is also unclear at this time, although the same Public Health England study showed that the AstraZeneca (non-mRNA) vaccine was 60% effective against symptomatic disease, and 93% effective against hospitalization.

Given the effectiveness of the vaccines, it is encouraging to know that 80% of individuals aged 65 and older have been fully vaccinated, as this demographic represented the vast majority of COVID-19 fatalities since the pandemic began in 2020.

The bottom line is that COVID-19 remains a risk. According to the Federal Open Market Committee’s comments from their July 28th meeting, “The path of the economy continues to depend on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.”

In a recent press conference, Jerome Powell also stated, “What we’ve seen though is with successive waves of COVID over the past year and some months now, there has tended to be less in the way of economic implications from each wave. And, we will see whether that is the case with the Delta variant, but it’s certainly not an unreasonable expectation.” Health and safety concerns notwithstanding, we share Powell’s sentiment, and believe that financial markets have proven resilient in the face of the COVID-19 pandemic over the past year and a half, and we’d expect that resilience to continue barring a severe change of trajectory in the coming weeks and months.

Inflation

On July 13th, the Bureau of Labor Statistics announced that the Headline Consumer Price Index (CPI) for the month of June came in at 5.4%. This is an inflation measurement we have not seen in decades. However, as we have mentioned in previous letters, we tend to take a similar view to the Federal Reserve and many other economists in that we believe that this inflation is largely transitory and primarily caused through a variety of temporary influences including base effects, fiscal stimulus, supply chain issues, loose monetary policy and pent-up consumer demand. In short, this may be a transition to the “new-old normal” where sub-2% inflation is a thing of the past, and we see inflation, on average, in the 2%-3% range over the next 10 years.

Inflation can be frightening, especially for retirees on a fixed income or individuals or families who hold significant amounts in cash where purchasing power erodes. However, the inflation story has evolved over the past few months, quelling some immediate concerns about hyperinflation that might’ve caused headlines in April and May of this year. I will provide two quick examples.

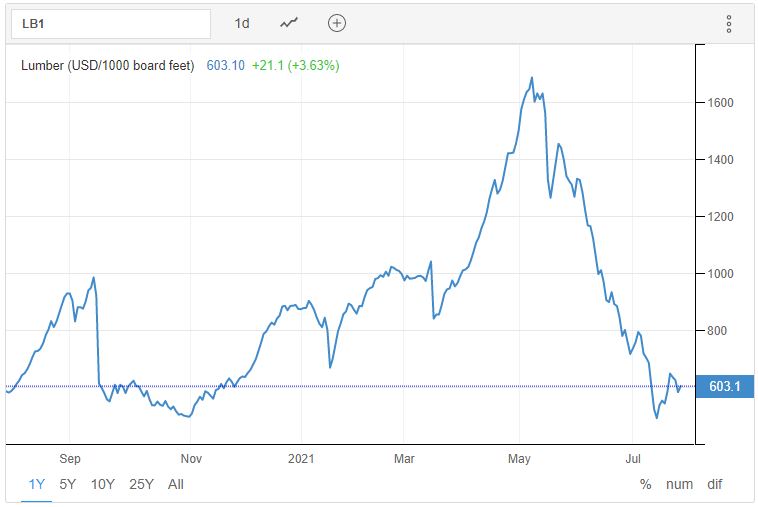

In late April/early May, lumber made headlines as prices spiked to extraordinary heights, causing homeowners across the country to think, “I sure picked the wrong spring to build a deck!” However, we have since seen lumber prices fall precipitously from over $1,600 per 1000 board feet in early May back down to roughly $600 per 1000 board feet in a few short months, as seen in the chart below. What was once thought to be a hint towards hyperinflation has since receded from the headlines.

Lumber Price Chart

Source: TradingEconomics.com

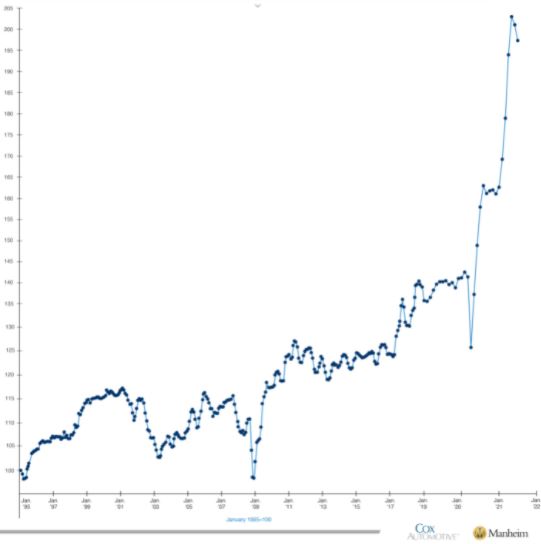

In recent weeks, concerns have turned to used car prices, which have spiked as seen in the Manheim Used Car Price Index chart below.

Manheim Used Car Price Index

Source: Cox Automotive & Manheim Consulting

This price surge appears to be caused by a number of factors, including pent-up demand, supply shortages, semiconductor scarcity and demand from car rental companies who scuttled their fleets as rental demand fell last summer. As these supply bottlenecks loosen, we fully expect used car prices to come down, although not quite as quickly as we saw with lumber due to the fact that the semiconductor supply issues may take a bit longer to resolve.

Wages and Consumer Expectations

As stated earlier, we expect a return to the “new-old normal”, where inflation matches and/or for a time exceeds Federal Reserve targets and the long-term projections of economists. While there are many influences that may cause higher, more persistent long-term inflation, there are two key inputs that we will review today – wages and consumer expectations.

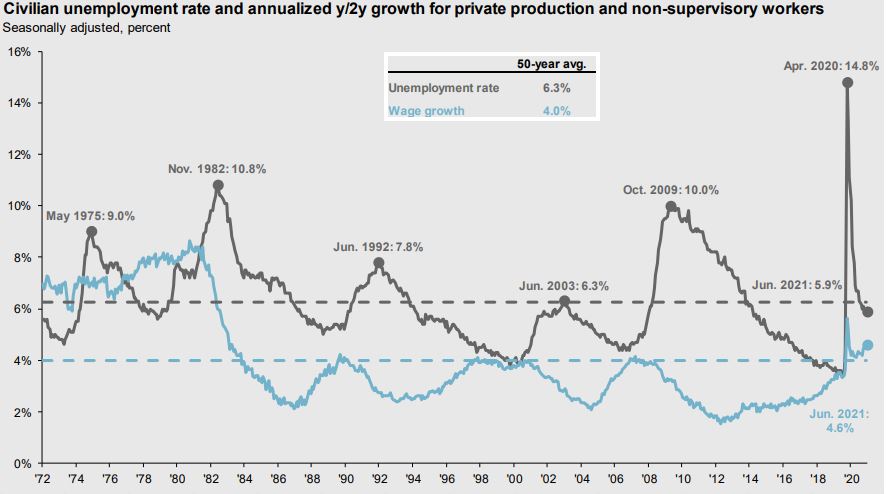

First, we have seen wage growth accelerate in recent quarters. As you will see illustrated by the light blue line in the chart below, wage growth has historically withdrawn after reaching a resistance level of 4% growth.

Source: JP Morgan Asset Management – Guide to the Markets

In 2021, wage growth has pushed through this resistance to reach 4.6% in June. Wage growth tends to make inflation a bit more persistent as those extra dollars flow into the economy. After all, as you can imagine, most employers will not be able to approach employees three months from now and say, “I know we agreed on that $18 per hour wage, but we’re gonna go ahead and cut your pay down to $15 per hour on your next paycheck.”

We may see persistent higher wages at this stage, especially as labor shortages have employers across the country struggling to fill jobs. The labor market is a topic that is worthy of its own dedicated letter, but will leave that for another day.

We also know that inflation can be somewhat of a self-fulfilling prophecy when it comes to consumer behavior. In a previous letter, I used a washer and dryer purchase as an example. If a household is in the market for a new washer and dryer, and they believe that (due to inflation) a washer and dryer set is going to be considerably more expensive in six, 12 or 18 months, that household may decide to pull the trigger on a purchase now rather than wait and risk higher prices in the future. If consumers exhibit similar behavior in aggregate, then that can push up prices for a broad basket of goods and services.

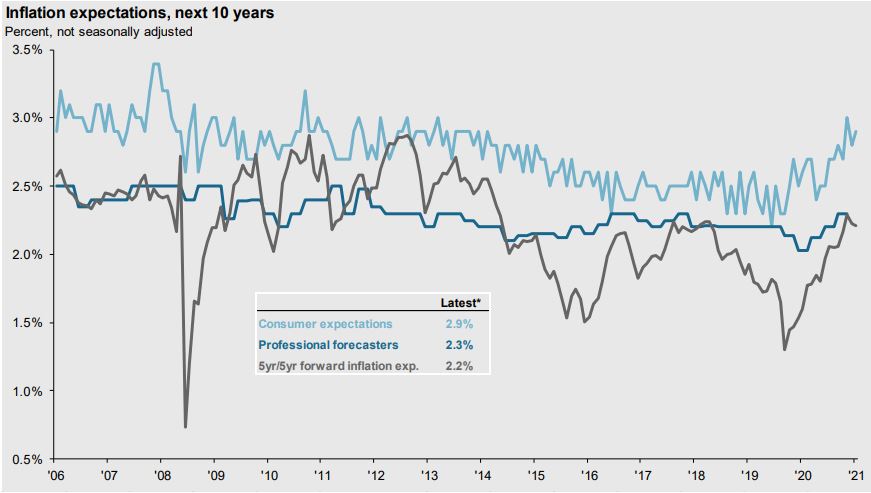

Below, we see a chart that illustrates inflation expectations among consumers, professional forecasters and a 5yr/5yr forward inflation expectation. As you will see illustrated by the light blue line, consumer expectations of long-term inflation have risen in recent months, and we will closely monitor whether or not this affects consumer buying behavior in the coming months, which could continue to drive-up prices.

Source: JP Morgan Asset Management – Guide to the Markets

Infrastructure

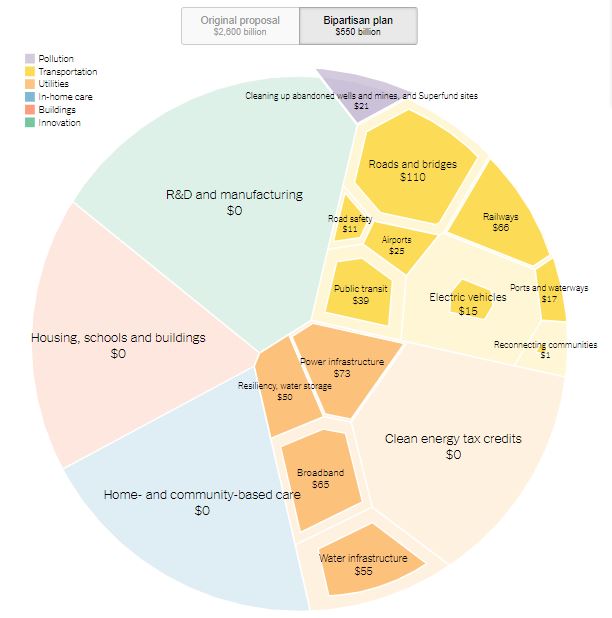

On Wednesday, the U.S. Senate announced a new $1 trillion bipartisan infrastructure deal that will result in $550 billion of new spending. This bill represents less than one quarter of the new spending proposed in the original American Jobs Plan introduced by the Biden Administration in March. While many specifics remain unclear as of this writing, it appears as though this deal focuses on what many might define as core infrastructure projects such as Roads and Bridges, Railways, Airports, Public Transit, Water Infrastructure and so forth.

Illustrated below is a chart constructed by The New York Times which details the breadth and scope of the original $2.6+ trillion original proposal versus the $550 billion bipartisan plan announced this week.

Source: The New York Times

While we expect that any meaningful fiscal stimulus may have a net-positive effect on the domestic economy and financial markets, there are still many unknowns, and the path to implementation is far from certain at this stage. However, it appears as though this plan has some meaningful momentum and cleared an early hurdle by advancing with a 67-32 procedural vote in the Senate. We will continue to report on the infrastructure plan’s progress and any potential investor impact in the weeks and months ahead as we learn more.

Earnings Update

Finally, we turn to earnings season. As it seems with much of 2021, this earnings season is moving fast and furious with, as of this writing, over 24% of S&P 500 companies reporting results. Of these companies, 88% have reported a positive earnings surprise with, on average, earnings that are 19% above estimates versus a five year average of 7.8%. Leading the way is the Financials sector which, so far, is reporting a +30.2% difference between estimated versus actual earnings.

Close behind Financials is the Consumer Discretionary sector (+29.4%), with companies like Nike ($0.93 actual vs. $0.51 expected), CarMax ($2.63 vs. $1.63) and AutoZone ($26.48 vs. $20.13) reporting the largest earnings surprises thus far.

When it comes to revenues, 86% of companies have reported a positive revenue surprise versus a five year average of 65%. In aggregate, revenues have been +4.0% higher than estimates which, if this number holds (and it is very early), would represent the largest difference between actual versus estimated revenues since FactSet began tracking this data in 2008. Similar to earnings, the Consumer Discretionary sector and the Financials sector are reporting the largest revenue surprises of +7.8% and +5.6%, respectively.

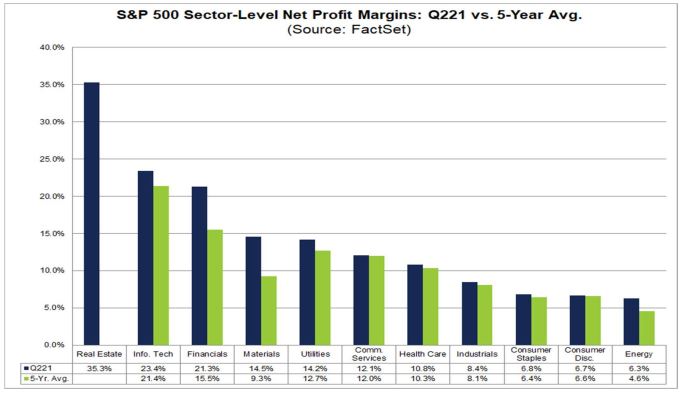

We are also seeing near-record net profit margins for the S&P 500 at +12.4%, which is well above the five year average of 10.4%, as detailed in the sector-level chart below.

Source: FactSet

As we all know, investing is a forward-looking business. While this Q2 data reassures us that many companies have proven strong and resilient (and are even thriving) throughout the pandemic, this does not guarantee that markets will continue the ascent that began in mid-March of 2020.

Folks often ask us, “What is the biggest risk that will derail the markets in the second half of 2021 or the first half of 2022? Will it be inflation? The pandemic? A market bubble?” The honest answer is that the next correction will likely be caused by something that is not currently on the radar of any economist, analyst or investor. After all, who could have foreseen a tragic terrorist attack on domestic soil in 2001, embedded mortgage derivatives that would push financial markets to the brink or a respiratory virus that would bring the global economy to a screeching halt?

Many months ago in 2020, I joked with our CEO, Jarrod Musick, that – at this rate – our next severe correction would come due to an alien invasion. Then, months later, the Pentagon announced that they would be releasing a report on “unidentified aerial phenomena” and my jaw nearly hit the floor.

The Bottom Line

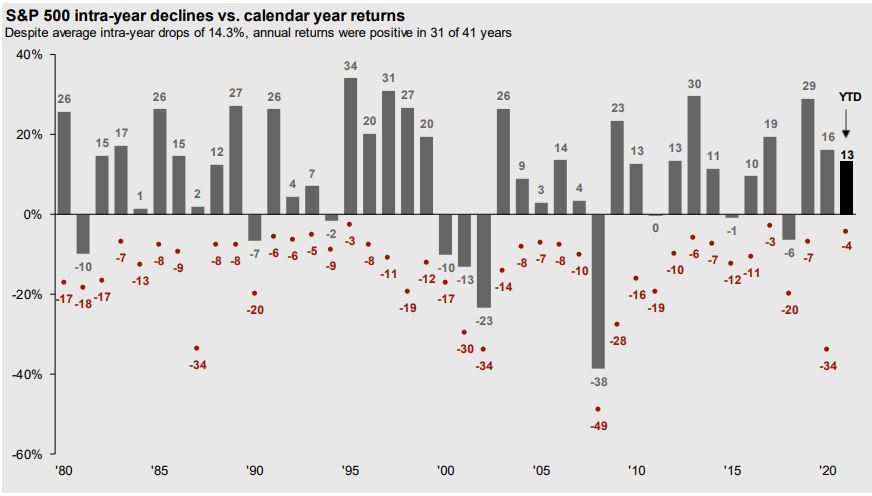

The bottom line is that we expect and are prepared for volatility in the quarters ahead. On average, the S&P 500 experiences an intra-year decline of -14.3%. Despite this volatility, annual returns have been positive in 31 out of the past 41 years, as seen in the chart below.

Source: JP Morgan Asset Management

I will again reference the film The Godfather (II this time) when I quote mobster Hyman Roth, who said, “This is the business we’ve chosen.” When it comes to investing, volatility is an unfortunate reality. Corrections happen. This is why we focus so much on understanding our clients’ personal risk tolerance. We all know it pays off to remain invested over the long term, and that can be challenging during times of significant and unexpected volatility.

This is not meant to end this communication on a negative note, but it is rather a reminder of the realities of investing during a time of prolonged and relatively uninterrupted growth. Again, there is a lot to be excited about, and there will be lots to report on in the weeks and months ahead as we track earnings, inflation, the pandemic and the newly proposed infrastructure package.

In the meantime, I will close with a line I used often during the depths of the pandemic. Please stay safe, be well and let us know if there’s anything we can do to help you navigate these challenging times.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.