Markets and Economy Update – December 2021

Several days ago, I woke and quietly wandered through my house before the typical morning madness began. Coffee in hand, I meandered into my second floor home office and peeked out of the window to survey the weather and gauge how many layers of clothes we were going to have to pile onto our two children that day. I split the shades with two fingers, glanced outside and then squinted as my attention was drawn to my street. On the road and on every paved driveway within sight, I saw an opaque layer of treacherous ice that promised to make the morning drive a bit more hazardous for everyone. “Look’s bad”, I thought, then went to help my kids through their standard routine of waking, brushing, dressing, feeding, playing and dressing some more. Finally, fed and happy, I helped the boys into the garage and into my car, since it was my morning to do daycare and school drop off.

Our house sits on a small hill, so our driveway has a fairly steep incline as far as driveways go. Putting my cell phone on its charging mount, I distractedly began backing out of the garage, down the driveway and to the road. It did not take too long to realize that something was not quite right. My brakes were not responding as I backed down the incline. “The ice!” I remembered, as the rear of my car skidded and veered in a direction that was taking us on a collision course with our mailbox at the edge of the driveway (a design flaw, if you ask me). In that second or two before a seemingly imminent collision, I had a Jedi-like vision of my drivers’ education instructor telling me not to panic and slam the brakes, but rather to gently tap the brake pedal in order to catch some traction. I tapped the brakes several times, and you know what? It worked. I skidded to a halt with barely a foot or two to spare.

That morning, the only thing that hurt was my ego, as I confessed to my inquisitive four year old that I almost hit our mailbox, which I knew was going to lead to roughly 427 questions about my driving skills. I was correct about that assumption. After school drop off, and while listening to a market preview on the radio, I could not help but draw parallels to my near miss that morning and where financial markets stand today.

As we enter a new year, we see a variety of forces beginning to gently pump the brakes on the economy. These forces include the COVID-19 Omicron variant, the labor market and (perhaps most importantly at this stage) the Federal Reserve. So, in this month’s letter, I will touch briefly on each topic to talk about how each impacts the general outlook for the year ahead, and what it might mean for investors.

The Omicron Variant

Some of you may notice that this month’s communication is arriving a little later than usual. Well, unfortunately, after years of prudent behavior, masks, vaccines and gallon upon gallon of hand sanitizer, COVID-19 snuck its way into our home by hitching a ride on my four year old. Like countless other households this year, my small family of four spent Christmas and the beginning of the new year in isolation, doing our best to maintain sanity while entertaining two small children for roughly two weeks. This made for a challenging writing environment, as you might imagine. The good news is that we have all emerged from isolation healthy, happy and sane, but the truth is that COVID-19 is absolutely everywhere, as seen in the chart below.

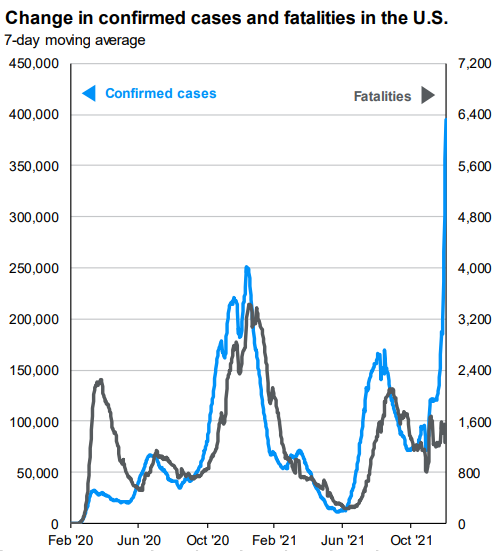

Source: JP Morgan Asset Management Guide to the Markets

The growth in COVID-19 cases due to the Omicron variant is nothing short of staggering. It is almost literally “off the charts”. However, when it comes to fatalities, we are experiencing a bit of a deviation in the pattern seen during previous spikes in case numbers. In short, we have not yet seen an increase in fatalities despite such a dramatic surge in cases. Clearly, fatalities are a lagging indicator in this context, but it is becoming clearer that the Omicron variant carries symptoms that are less severe than previous COVID-19 strains.

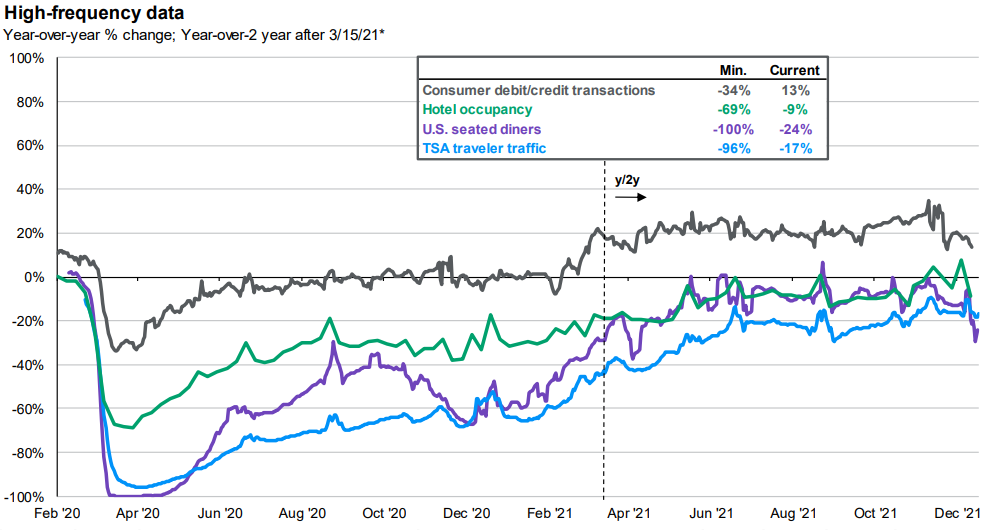

Unfortunately, this does not mean that the spike in COVID-19 cases is not having an effect on the United States economy. As you will see in the high frequency data below, we are seeing a fairly rapid decline in activity such as Transportation Security Administration (TSA) travel, seated diners and hotel occupancy. As we have seen over the course of the pandemic, airlines, cruise lines, restaurants, bars and other leisure and hospitality businesses are bearing the brunt of the surge.

Source: JP Morgan Asset Management Guide to the Markets

However, during this recent spike in cases, the impact does not quite end there. In fact, I would imagine that we all have likely experienced impacts in our own lives in recent weeks due to one key factor: workforce absenteeism. Airplanes have been grounded as airlines struggle to staff flights. I have relatives who cannot get prescriptions refilled because pharmacists are home with COVID-19. Supermarket shelves appear barren. This is not entirely because of some underlying supply chain issue, but because there are not enough healthy workers to stock them.

As someone whose wife is a nurse, I witness first hand the strain on the healthcare system. This strain is not necessarily because of an enormous spike in hospitalizations, but because doctors and nurses have either contracted COVID-19 themselves, or because they are required to remain home to care for someone in their household who has the virus. This short-term worker shortage has also exacerbated an already fragile and important aspect of our economy: the labor market.

The Labor Market

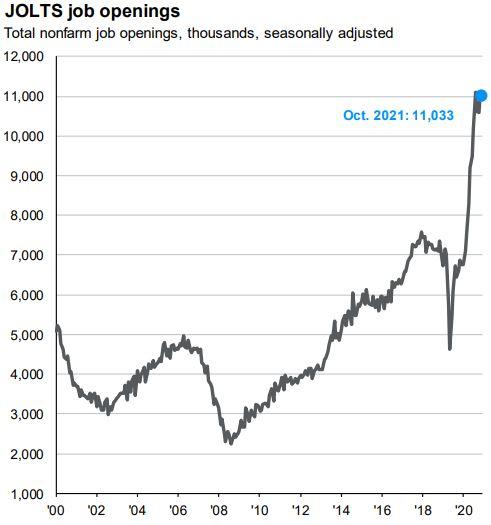

Regardless of industry, if you are an entrepreneur or business manager, you are likely acutely aware of how difficult it is to find qualified talent to fill certain positions. As you can see below in the Bureau of Labor Statistics (BLS) Job Opening and Labor Turnover Survey (JOLTS) report, there were roughly 11 million total nonfarm job openings in October.

Source: JP Morgan Asset Management Guide to the Markets

Not only are there open jobs available, but we have seen such a dramatic increase in departures in recent months that many in the media have dubbed this phenomenon The Great Resignation. As you will see in the top chart below, over 4.1 million workers quit their jobs in October of 2021.

Source: JP Morgan Asset Management Guide to the Markets

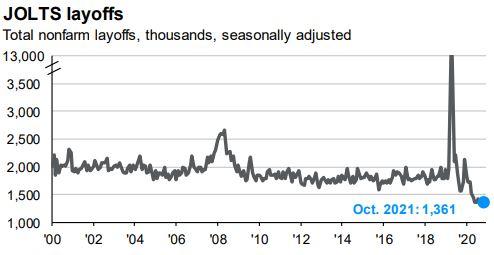

Meanwhile, employers are desperately trying to retain workers. Layoffs are nearly at the lowest point since the BLS began releasing their JOLTS data in 2000, as you will see in the chart below.

Source: JP Morgan Asset Management Guide to the Markets

Why are so many workers quitting their jobs while so many openings remain vacant? It is difficult to define exactly what is causing this phenomenon with any certainty. As with any trend that involves human behavior, the answer is highly nuanced, and there are likely a combination of factors to consider:

COVID-19 impacts that include hesitancy due to safety and health concerns

COVID-19 impacts that require a worker to remain at home due to challenges with childcare or dependent care

Workers often experiencing their largest pay increases when switching jobs to a new employer

Government stimulus efforts that may allow workers to remain on the sidelines longer than they otherwise might

Post-pandemic shifts in worker sentiment brought about by existential questions related to purpose. Questions like, “Is this what or who I want to be and where I want to spend my waking hours five days per week?”

It could also simply be true that, as Harvard labor economist Lawrence Katz said, “I think we’ve really met a once-in-a-generation ‘take this job and shove it’ moment.”

Regardless of reason, the labor market is clearly straining the United States economy, and this issue is only compounded due to COVID-related absenteeism that will likely carry through the entire month of January 2022. With bountiful job openings and the unemployment rate at 4.2%, this leads us to the entity that easily has the biggest and heaviest foot available to pump the brakes on the economy: the Federal Reserve.

The Federal Reserve

On December 14th and 15th, the Federal Reserve held its two day meeting. As I have mentioned in many previous communications, the Fed’s primary mandate includes three key goals: maximum employment, stable prices (2% inflation target) and moderate long term interest rates.

From their December meeting, it became clear that the Fed has shifted its sights from its maximum employment goal towards fighting inflation, and we now finally have some guidance related to timing and tactics. To reference a term you may hear used by many in our industry, the Fed’s sentiment has turned “hawkish”, which means their policies are less likely to be accommodative through lower interest rates and other expansionary policies.

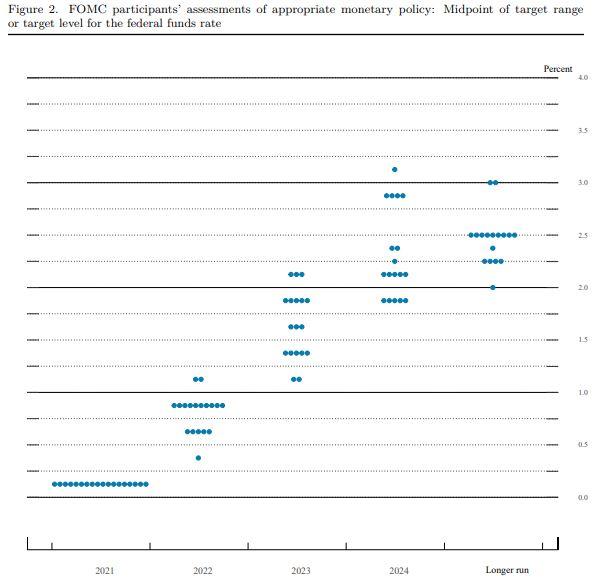

The Fed’s new guidance is specifically related to two key areas of monetary policy: asset purchase tapering and interest rate hikes. To little surprise, the Fed has decided to accelerate the pace of its asset purchase tapering program in January by cutting its monthly purchases of mortgage backed securities by $10 billion and treasury securities by $20 billion. Again, this was somewhat in line with what Fed Chairman Jerome Powell outlined to Congress in November of 2021. However, most importantly, we now have some guidance on the Fed’s interest rate policy. To highlight this, I will use the Federal Reserve’s Dot Plot, a chart I have not had to reference in quite some time. The Dot Plot illustrates each Federal Open Market Committee (FOMC) member’s assessment of appropriate monetary policy as it relates to the target federal funds rate. Each member’s assessment is represented by a blue dot between the target federal funds rate they deem appropriate in each calendar year. As you will see below, a majority (10) of FOMC participants believe that the fed funds target rate should reside between 0.75% and 1.00% in 2022.

Source: The Federal Reserve

This chart indicates that the Fed intends to implement three 0.25% rate hikes in 2022. While the exact timing has not been communicated, analysts and economists generally believe that the initial rate hike will be in June of 2022.

What does all of this mean for investors? Well, through both fiscal and monetary stimulus, the economy and financial markets have been on a bit of a sugar high since March of 2020, and we are entering a period where the Fed intends to pry the giant monetary lollipop from our fingers. With unemployment at 4.2% and a glut of job openings available, the Fed is clearly concerned about inflation, which indicates that it might be less transitory than initially communicated. Clearly, with the Fed’s favorite inflation measure, Personal Consumption Expenditures PCE, at 5.3%, we are well above the target level of 2%, and their recent forecast of 2.6% for 2022 seems slightly optimistic, as illustrated in the chart below.

Source: JP Morgan Asset Management Guide to the Markets

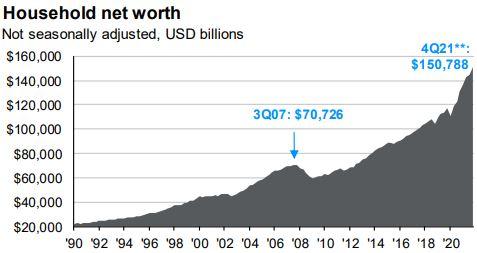

Personally, I still believe that there is a portion of inflation that is transitory, and that we will see prices tame themselves somewhat, particularly when it comes to inflation variables like the price of new and used autos and energy, to name a few. However, with rising wages and household net worth at an all-time high in Q4 2021 (see below), some of the inflation we have experienced over the past year is bound to be stubbornly persistent.

Source: JP Morgan Asset Management Guide to the Markets

Regardless, the Fed will be walking a delicate tightrope in 2022, and each word they utter and action they take will be parsed and dissected by every investor across the globe. Any deviation from the Fed’s assumed trajectory is likely to be met with volatility.

Interest Rate Normalization

Unless we see a sea change in the coming weeks, we appear to be entering a period of interest rate normalization, which can affect the prices of fixed income securities during the normalization process. As such, any Destiny Capital portfolios that hold fixed income securities have been positioned to assets that are intended to curtail the effects of interest rate movements due to both credit quality and bond duration characteristics. Bonds remain an important portfolio diversifier and, once interest rate normalization occurs, investors will once again be compensated with better yields from their fixed income investments.

When it comes to equity markets, we can expect some volatility if the Fed pumps the brakes on the economy too hard and too often through an accelerated pace of rate hikes. That is simply standard operating procedure for when the Fed shifts from dovish (accommodative) policy to hawkish (restrictive) policy. This does not mean that we do not have a positive outlook for 2022. Growth in Q4 2021 was very strong with most analysts expecting Q4 year-over-year Gross Domestic Product GDP to come in at roughly 7%. We expect that growth to continue into early 2022.

While the Omicron variant has pumped those brakes a little bit, there is still a tremendous amount of pent-up demand in the domestic economy and, despite higher inflation, consumer sentiment rose from 67.4 in November to 70.6 in December. Consumption represents roughly 67% of GDP in the United States, and United States citizens, broadly speaking, are ready, willing and able to consume. As I say in nearly every communication when we experience uncertainty, it is never a good idea to bet against the ingenuity and resiliency of the American economy. When it comes to the Omicron variant (and as my grandmother used to say), “This, too, shall pass.”

While painful, there are many experts who believe that the COVID-19 spread due to Omicron could hasten the end of the pandemic. I know that is a prediction and sentiment that each of us would welcome with open arms. Until then, I hope you all begin the new year happy, healthy and (if you’re isolating with children) sane. If you are a client with questions about your portfolio, please do not hesitate to reach out to your Destiny Capital team with any questions.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.