Markets and Economy Update – November 2021

As the calendar year winds down and we move into December, some of us may spend time reflecting on the past year with gratitude for the things that brought us joy. After all, as citizens, community members and investors, many of us have a lot to be thankful for. Yet, as an investment manager and cynical East Coast native, I cannot help but look back on the past 11 months with a bit of a Festivus mindset when thinking about certain strategies, investments or economic forecasts that did not quite go as planned and caused excessive stress throughout the year.

For those of you unfamiliar with Festivus, it is a holiday tradition invented by wacky Seinfeld TV show character Frank Costanza that involves an aluminum pole and practices such as The Airing of Grievances and Feats of Strength. My favorite part of the ridiculous Festivus tradition is/was The Airing of Grievances, in which a person details all of the ways in which they have been disappointed throughout the previous year. In true year-end Festivus spirit, I am beginning this month’s letter with my own Airing of Grievances – Markets & Economy Edition. I will start with a familiar target – COVID-19.

COVID-19 – Omicron Variant

Every few months, I spend about a week traveling for business, usually on a quarterly cadence to systematize and condense time away from my wife and two young boys. Throughout 2021, it seemed like every time I received my United Airlines flight reminder text, I learned of a new COVID-19 variant that had the potential to make travel a bit more hazardous.

We know very little about the new Omicron variant at this stage. Initial World Health Organization (WHO) reports indicate that Omicron is a highly mutated variant of COVID-19 that may potentially be more contagious than the Delta variant and could evade some of the immunity offered by the existing suite of vaccines. The emergence of this new variant caused some volatility and uncertainty in financial markets over the final week of November.

We do not know to what extent the Omicron variant is more contagious, dangerous or vaccine-resistant than previous strains. If you read my description of Omicron in the paragraph above, you will notice a lot of words like “may“ or “could“. Outcomes are far from certain at this stage. We do know that government officials in the United States and across the globe are preparing as if Omicron will be the dominant COVID-19 strain in the coming months. Preparations include the familiar slate of vaccinations, testing, masking and in some cases, travel restrictions.

What does this mean for investors? We know that the tragic public health consequences and loss of life due to COVID-19 have far outweighed the overall economic impact during previous spikes in case numbers. In fact, we have seen a diminishing economic impact as each new variant is discovered. Across the world, individuals and businesses have evolved (or are evolving) to exist in a world in which COVID may be a perpetual threat. In fact, prior to writing this section, I conducted a meeting between two businesses and six participants, each of whom were in separate locations spread across three different time zones. That meeting may have been executed much differently two years ago, in a pre-COVID world.

Clearly, certain business models cannot be as nimble, and we look at the usual suspects like restaurants, hotels, airlines and others in the leisure and hospitality industries as those who may experience the most severe setbacks due to a spike in COVID cases. We also know that outbreaks can take a toll on our public health system. As someone who is married to an oncology nurse working out of a hospital setting, I can tell you that burnout is real among healthcare providers.

As I wrote in the summer of 2020, we know that that the hardest hit industries (restaurants, hotels, travel, etc.) make up a very small portion of S&P 500 operating earnings and, therefore, investors are somewhat insulated from the immediate effects of a spike in pandemic cases and the business disruptions these cases may cause. We also know that advancements in mRNA vaccine technology can allow for agile adjustments to existing vaccines in order to combat new and potentially more dangerous strains of COVID-19. In fact, Pfizer CEO Albert Bourla stated that a new Omicron-specific vaccine could be produced in under 100 days.

If an outbreak of Omicron occurs and the strain proves to be a bit more resilient and dangerous than previous variants, we can likely expect the Federal Reserve to pump the brakes a bit when it comes to potential future rate hikes and even the pace of their asset purchase tapering initiative. This could keep interest rates lower for longer, which corporations should like as it will keep their borrowing costs at a minimum.

It is obviously too early to make any definitive predictions as it relates to the Omicron variant, but we will be sure to communicate more as we learn more about how this and any future strains may impact investors. For now, we will move on to the subject of our next grievance- emerging market equities.

Emerging Market Equities

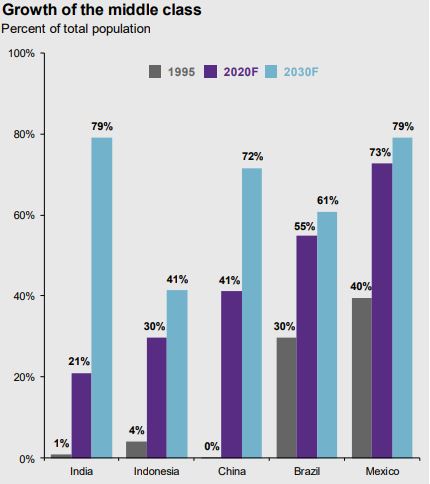

If you had asked me in late 2020 what asset classes I thought might be the top performers in 2021, emerging market equities probably would have been near the top of the list. Emerging market equities are broadly defined as stocks from emerging economies such as China, India, Russia, Brazil, Mexico and others. While these economies can be somewhat volatile, they also offer strong growth prospects and a surging middle class of consumers, particularly in India and China, as seen in the chart below.

Source: JP Morgan Asset Management

During the first two months of 2021, emerging market equities came screaming out of the gate and had advanced over 12% from Jan 1, 2021 through mid-February. Our thesis was playing out, as I expected a big year from emerging markets as the pandemic recovery spread globally and growth really started to accelerate in many of these regions. At the time, emerging market equities were outperforming domestic large caps and United States real estate (REIT), among many of the other top performing asset classes in 2021. Then, surprisingly, we started to see a somewhat rapid sell-off in Chinese tech giants like Alibaba, Tencent, JD, Baidu and others – all of which are significant holdings in nearly all emerging market investments.

At the time, it was somewhat unclear as to why these companies were selling-off, as their fundamentals would not suggest a massive decline in stock value. We then learned that the Chinese government had begun to crack down significantly on these tech giants, citing issues like monopolistic practices, data and privacy issues, consumer protection, etc.

To give you some context of the size of these companies and their subsequent decline, I will look at the poster child company Alibaba for what happened in China in 2021. As a relative comparison, and as of this writing, the market capitalization (stock price x shares outstanding) of United States tech behemoth Meta (formerly Facebook), is roughly $860 billion. In November of 2020, the market cap of Chinese tech giant Alibaba was over $830 billion. Today, it is roughly $325 billion. The stock prices of many of the other tech giants such as Tencent, JD.com, Baidu and others lost significant value as well.

Regardless of motive, the Chinese government and their actions inserted a tremendous amount of uncertainty, in general, into investing in emerging market equities and Chinese equities. Add to that increasing inflation, projected tightening of central bank policies across the globe and higher energy prices, and we have a different emerging market investment landscape than we saw twelve months ago. Does that mean that all emerging market stocks are bad? Not at all. It just means we have additional inputs to consider when calculating long-term exposures to these markets in our client portfolios.

While the trajectory of certain assets can be frustrating when they deviate from projected paths, it is also important to understand that this is the nature of investing. As Nassim Nicholas Taleb writes in his book Fooled By Randomness, “A mistake is not something to be determined after the fact, but in light of the information available to that point.” Markets evolve. Governments and central banks intervene. Pandemics happen. This is why, at Destiny Capital, we abide by our core values of investing, which include words and phrases like “data driven” and “disciplined”. Our exposures to certain assets and the selection of asset managers are carefully calculated and adjusted over time as market conditions evolve.

I now move on to my next grievance which, thankfully, is not investment-related.

Giants 13 – Eagles 7

Now, on to my final and perhaps most deserving grievance – the Philadelphia Eagles versus New York Giants game on November 26th. The Eagles offense had seven points, four turnovers and played some of the worst football I have witnessed in decades. To make matters worse, I actually attended this game at MetLife Stadium in the Meadowlands. Enough said.

Earnings Season Recap

While much of this letter has included some tongue-in cheek cynicism, I still truly believe that investors have had a lot to be thankful for throughout 2021. In most cases, Q3 earnings came in strong, and Q4 projects an estimated earnings growth rate of 20.9%. If that growth rate materializes, it will be the fourth straight quarter of earnings growth above 20%.

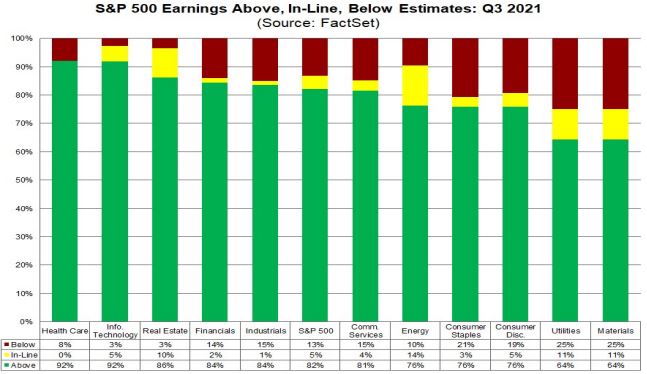

As you can see below, the Healthcare and Information Technology sectors were leaders with over 90% of reporting companies exceeding earnings expectations.

Source: FactSet

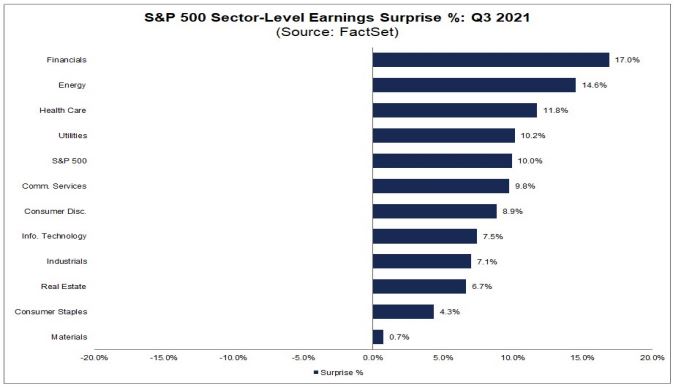

When looking at the magnitude of the earnings surprise, we see that the Financials (+17%), Energy (14.6%) and Healthcare (+11.8%) sectors lead the pack within the S&P 500.

Source: FactSet

Heading into 2022, analysts project that the S&P 500 may report a record high bottom-up Earnings Per Share (EPS) of $222.32. If this bottom-up $222.32 number is realized, it will represent the highest annual EPS number since FactSet began tracking this data in 1996. As we all know by now, we can likely take these analyst estimates with a grain of salt. On average, industry analysts have overestimated the final EPS value by +7.2% on average in 18 of the past 25 years. All things being equal, we, as investors, largely prefer to hear about record high projections versus a forecasted decline. As always, we will keep you updated with the latest news and numbers as we head into 2022.

Fidelity

I wanted to finish this month’s letter with a brief note about something I am infinitely thankful for – Destiny Capital‘s new partnership with Fidelity. Many clients and partners have likely heard from our team about this new relationship, and I can not tell you how excited we are to be partnered with the leader in the financial services industry.

For a long time, Destiny Capital has partnered with Pershing (a subsidiary of the Bank of New York), and that relationship has served us and our clients well for decades. However, over the past five years, we have partnered with new and exciting technology vendors that allow us to serve our clients in ways we could not have envisioned ten years ago. In short, we have made a number of investments to better serve our clients, and we needed a partner with the same commitment to innovation, technology and service. We found that partner in Fidelity.

Many of the benefits will be readily apparent to our clients and partners, such as better technology, easier access to data, access to flexible lending platforms and so forth. However, some of the enhancements may be behind-the-scenes, such as better and more efficient trade execution, enhanced Application Programming Interface (API), technology integrations and access to newer and better tools. It is important to note that this change is being made with one primary goal in mind – to better serve our clients and partners. With Fidelity as our partner, I am confident that we can continuously strive to reach that goal as markets evolve, technology changes and our business grows.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.