CIO Mailbag – Question: How has the current investment strategy evolved given recent market conditions and economic trends?

Foundations of Our Investment Strategy

When it comes to investing at Destiny Capital, there will always be certain constants regardless of where we are in the economic cycle or what’s transpiring in financial markets. Our investment strategy will always diversify portfolios across a variety of asset classes in an effort to optimize returns and manage risk. Allocation decisions will be based on data and not subjective emotion or ‘gut feelings’. As investors, we are disciplined and adhere to our process, thesis and values even throughout the most difficult times.

However, it’s important to note that just because we are disciplined investors doesn’t necessarily mean that we are unyieldingly stubborn. So, in addressing this particular mailbag question we’ll outline, in detail, a relevant scenario in which our investing strategy shifted over time due to changing risk/reward dynamics in a key asset class – emerging market stocks.

A Changing Economic Landscape in China

In the chapter titled ‘No One’s Crazy’ in his book The Psychology of Money, author, Morgan Housel, contends that personal experiences during an individual’s formative years can impact their relationship with both money and investing throughout their lifetime. At an intuitive level, this is a thesis that I tend to agree with.

A generalized example might be an individual who grew up during the Great Depression. Due to their personal experiences during this troubled economic time, this person might be a bit more frugal when it comes to spending and more risk-averse when it comes to investing.

When it comes to my own formative experiences, I vividly recall being somewhat of a ‘greenhorn’ investor in the early 2000’s. This was the time when the dot com bubble burst, which sent the U.S. stock market plummeting. In the aftermath of the dot com recession, I recall watching with envy as financial markets in the Eurozone, Japan and emerging market regions dominated while the stock market in the U.S. plodded along in comparison.

The Rise and Fall of Emerging Markets

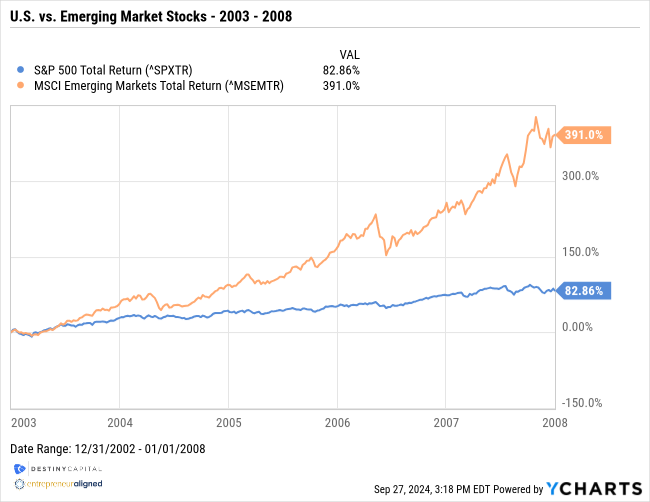

The mid 2000’s were a particularly good time for emerging market stocks as, in the five year period between 2003 and 2008, the MSCI Emerging Markets Index returned a staggering +391% versus a paltry, by comparison, +82% for the S&P 500, as seen in the chart below.

In hindsight, this time period was influential as it helped to solidify my belief that emerging market stocks could play an important role in a diversified investment portfolio. While that’s hardly a scandalous or outrageous viewpoint, it’s a perspective that has evolved over time and has, in turn, impacted our investing strategy here at Destiny Capital. What changed? Well, let’s first start with something fundamental – corporate earnings.

When investors talk about earnings, they are talking about profits. As a stock investor, you want the companies in which you are investing to become more and more profitable over time. After all, earnings growth is the primary driver of long-term shareholder returns. So, all things being equal, if aggregate corporate earnings continue to grow over time, we should see the stock market move higher.

Despite a few bumps in the road, U.S. corporations have largely done a good job of facilitating earnings growth over the past fifteen years. Unfortunately, the same cannot be said for corporations in other regions across the globe. The chart below helps to illustrate this. This particular chart shows earnings growth since 2005 in the U.S., China, Japan, Europe, and more. As you can see as indicated by the gray line, earnings growth has moved considerably higher in the U.S. since 2009. However, you’ll notice that other regions across the globe have not been able to grow earnings as successfully. In fact, we’ve seen a significant decline in earnings in China since 2018, as indicated by the purple (magenta?) line.

Source: JP Morgan Asset Management – Guide to the Markets

China’s Economic Transformation

In China, this declining trend certainly caught the eye of Destiny Capital’s investment committee years ago, particularly when considering whether or not emerging market stocks were an asset class worthy of investor capital.

I should note that, in investor parlance, China is largely considered an ‘emerging’ economy. So, when we refer to ‘emerging markets’ as an asset class, China is a significant cohort because Chinese stocks represent the largest regional allocation of the MSCI Emerging Markets Index. Other emerging economies include India, Brazil, Taiwan, South Korea, and so forth.

Yes, as the previous chart indicated, earnings growth has declined in China and that, on its own, has been discouraging for investors. However, even more troubling is what happened to the once-flourishing Chinese tech sector in late 2020-2021.

The Chinese Tech Sector Crackdown

What happened? Well, the Chinese government, via the SAIC (The State Administration for Industry and Commerce), suddenly implemented aggressive and severe regulations that nearly crippled many of China’s largest tech companies. In justifying this intense crackdown, the Chinese government cited antitrust laws, data privacy concerns, counterfeiting, and more. Critics of this action cited their belief that these regulations were implemented because these companies, and their high profile CEO’s, were growing a bit too powerful and may be undermining the will of the Chinese Communist Party.

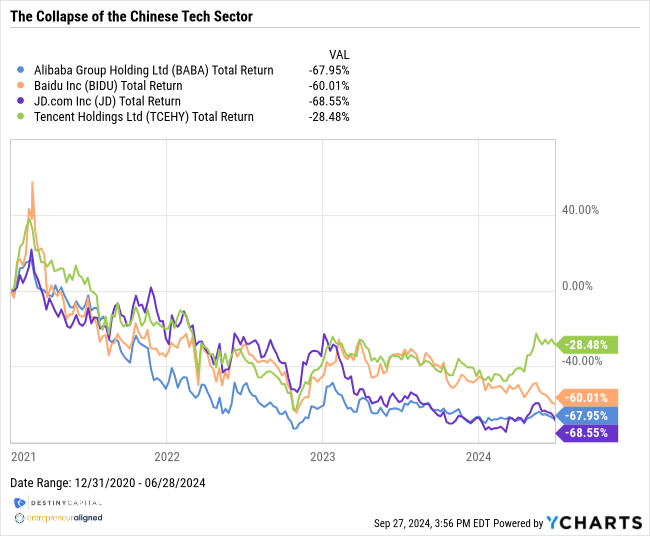

Regardless of the reason, this government intervention led to an unprecedented destruction in shareholder value of some of the largest and most influential corporations in the world.

Let’s try to put this in context. In October of 2020, the Chinese tech giant Alibaba had a larger market cap than Meta (formerly Facebook), and Meta was the 4th largest company in the S&P 500 index at the time. This, therefore, made Alibaba the 4th largest company in the world, behind only Apple, Microsoft, and Amazon.

As-of this writing in September of 2024, and largely due to Chinese government intervention, Alibaba’s market cap fell from its October of 2022 peak of $858 billion down to around $167 billion by late October of 2022. That’s $691 billion in market cap that eroded in just two years. Meanwhile, since late October of 2020, Meta’s market cap has soared from roughly $800 billion to over $1.425 trillion.

The same collapse in shareholder value was seen across the Chinese tech sector, including other corporate behemoths like Baidu, Tencent, and JD.com, as seen in the chart below.

This action by the Chinese government led to a seemingly irreversible erosion of trust between long-term investors and Chinese stocks.

But wait, there’s more! In the late 1990’s and early 2000’s, China was a surging economy that was the envy of the world as it produced roughly 8%-10% in GDP growth year-after-year. However, as you can see in the chart below, there’s been a meaningful and steady decline in GDP growth in China over the past decade, which is a significant concern for investors in Chinese stocks.

China faces structural challenges with an aging population and a collapse of the Chinese real estate market that has bled into the country’s banking sector. Issues have been further exacerbated in recent years due to China’s stringent “zero-COVID” policies that shuttered production in some of the country’s most vibrant economic regions. As you might imagine, consumers have therefore grown pessimistic and this has been reflected in their reduced spending patterns over recent years. Add up all of these issues and one thing is clear – challenges abound for the world’s second largest economy.

Yet, investors will always be drawn to stocks that may be deemed underpriced and/or corporations that possess strong earnings growth potential. In fact, we have recently seen a short-term rebound in earnings growth in China in recent quarters. Furthermore, as-of this writing, the Chinese government has announced an economic stimulus package believed to be worth about 7.5 trillion yuan ($1.07 trillion USD), and this has facilitated a bit of a near-term bounce in Chinese equity markets.

Will this stimulus be enough to push the Chinese economy and, by extension, emerging market stocks higher in the coming months and years? Perhaps. But a more important consideration is whether or not investors can have faith that a repeat of the 2020/2021 tech sector crackdown won’t occur again if the Chinese government suddenly deems that a corporation, or its executive leadership, has grown too powerful. Moving forward, who’s to say that any Chinese stock, as was the case with Alibaba, can’t see roughly 80% of its market cap destroyed due to extensive, targeted regulations?

Adapting Our Investment Strategy

When it comes to allocating capital here at Destiny Capital, we carefully weigh the risks of an investment relative to the potential reward. In the case of emerging market stocks and allocations to Chinese equities, in particular, we believe we made the right choice several years ago in eliminating exposure to this particular asset class in favor of investment opportunities that, our research showed, had a more favorable risk/return profile.

The Future of Emerging Markets in Our Investment Strategy

We continuously monitor whether or not Chinese equities and, by extension, emerging market stocks, are worthy of capital allocation. Can this recent round of government stimulus cause Chinese stocks to surge higher in the short-term? Absolutely. In fact, I’d be surprised if that doesn’t happen, as significant government stimulus often creates a ‘sugar high’ in affected markets. Does that mean that we should immediately seek exposure to these investments? Not necessarily. Ultimately, trust is something that can take a lifetime to build, and mere moments to destroy. When it comes to investing in Chinese equities, as the old saying goes, fool me once, shame on you. Fool me twice, shame on me. In our view, China still has a long way to go in regaining any semblance of trust among long-term stock market investors.

Looking for more insights from our CIO? Check out our previous CIO Mailbag post: “AI’s Impact on Investment Opportunities in 2024” In this article, Tim Doyle explores how AI is impacting investment opportunities in 2024 and beyond. Read it here to gain valuable perspectives on market volatility and long-term investment approaches.

Do you have your own question? Ask it here.

Transform Your Retirement Strategy

Discover the three-legged stool approach for a stronger financial foundation.

_____________________

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services provided by Destiny Capital Corporation, a registered investment adviser.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.