The New Bitcoin ETFs – What You Need to Know

On January 11th, eleven new spot Bitcoin exchange traded funds (ETFs) began publicly trading after receiving authorization by the Securities and Exchange Commission (SEC). Bitcoin and other cryptocurrencies often draw quite a bit of interest when new developments emerge, so we wanted to provide some thoughts and context around these new products.

First, let’s start by acknowledging the biggest, and most ironic, elephant in the room. In the Bitcoin white paper released by Satoshi Nakamoto back in 2008, the very first line of the abstract claims that Bitcoin is “a purely peer-to-peer version of electronic cash that allows online payments to be sent directly from one party to another without going through a financial institution.”

Essentially, the initial appeal and novelty of Bitcoin was the fact that it removed any need for a financial intermediary like a brick and mortar bank. Bitcoin users trust the code and trust the integrity of the blockchain. In this ecosystem, a financial intermediary (bank or other financial institution) becomes obsolete.

So, it’s quite ironic that access to Bitcoin is now available in an ETF form that requires market makers, trade desks, exchanges, custodians, and many other intermediaries in order to transfer Bitcoin ownership. Essentially, all novelty and underlying intent is lost when Bitcoin is available in an ETF wrapper. Somewhere, Satoshi Nakamoto (who is largely believed to be a fictional amalgam of multiple contributors) is shaking his head and doing a face-palm.

What is a ‘Spot’ Bitcoin ETF?

Many investors may not realize that Bitcoin ETFs have been available for many years now. However, these existing products are not spot price ETFs, and are largely tied to derivatives (futures) markets. A ‘spot’ ETF means that the fund actually holds Bitcoin for investors, not derivatives. The spot Bitcoin ETF structure is akin to an investment in a spot gold ETF where there is a trust that manages a pool of physical gold for fund investors.

What is the advantage of investing in a spot ETF vs. directly investing in the underlying asset itself? Well, the primary advantage of buying an ETF is efficiency and simplicity. Let’s continue with our gold example to expand on this.

If an individual wants exposure to gold as an investment, they have the option of mining their own gold, purchasing and storing physical gold bars and/or coins, or purchasing one of many spot gold ETFs.

Mining for gold is obviously very expensive and extremely inefficient. When purchasing physical gold, there are some hurdles (and extra costs) around purchasing gold through an intermediary, shipping and insuring the gold, securely storing the gold, then removing the gold from secure storage, finding a buyer and obtaining a fair price if you need to eventually sell your bars and/or coins.

With a spot gold ETF, it’s very easy to obtain access to gold as an investment. You simply purchase shares in any increment, hold these shares in a brokerage account or IRA, and your investment will participate in any rise or fall in the price of gold over time. Then, if you decide to sell, you can quickly and efficiently exit your position – either partially or entirely – with a simple trade.

Ironically, when it comes to obtaining access to Bitcoin, the choices are almost identical to acquiring physical gold. An investor can mine for Bitcoin which can be costly and energy inefficient. He/she can purchase Bitcoin directly which may require a level of technical aptitude around cybersecurity, digital wallets, complex passwords, sending/receiving Bitcoin, and more. So, for many, it may be far more uncomplicated and efficient to simply buy shares of an ETF if they are simply hoping to participate in any potential Bitcoin price appreciation in the coming years.

What is Destiny Capital’s Stance on Bitcoin and Bitcoin ETFs?

As recently as three years ago, blockchain was hailed as the next great disruptive technology. Who needs an attorney executing contracts, or title companies facilitating a home purchase, or even an exchange to buy/sell stocks when it can all be facilitated via blockchain tech?

Bullish sentiment and the seemingly limitless potential of blockchain sent the price of cryptocurrencies like Bitcoin and Ethereum to staggering new heights around November of 2021 when the Bitcoin price peaked at roughly $67,600 per coin.

Yet, that excitement and momentum quickly faded, and the price of Bitcoin fell roughly -70% between November of 2021 and June of 2022 as inflation soared, the Fed raised rates, and a risk-off sentiment permeated nearly every asset class. Beyond that, when it comes to blockchain technology itself, the status quo tends to have a lot of financial incentive to avoid being counted among the ‘disrupted’. As a result, right now, there is very little intersection between Bitcoin, blockchain, and the ‘real’ economy.

Furthermore, when it comes to Bitcoin as an investment, we find it very difficult to quantify any type of valuation to gauge whether or not it is over/undervalued as an asset. Bitcoin generates no cash flow, pays no dividend, nor pays a coupon as an incentive for investment.

Not unlike gold, the price of Bitcoin is largely driven by supply and demand dynamics. Its price is whatever someone is willing to ascribe to (and pay for) it. However, with gold, there is a much longer and viable track record as an investable asset. Heck, as recently as 1971, the currency of the United States was directly tied to gold via the gold standard. Unlike Bitcoin, gold also currently has practical ‘real world’ use-cases in jewelry and semiconductor manufacturing, to name just two quick examples. As such, gold is more widely accepted by investment managers than Bitcoin as an investable asset class despite many parallels.

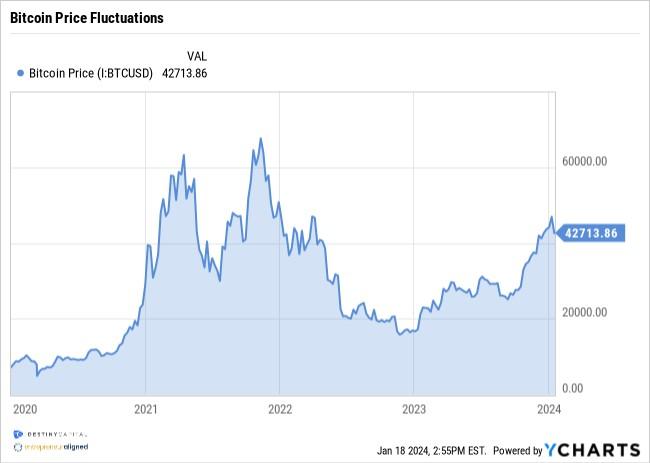

The bottom line is that we, at Destiny Capital, still view Bitcoin as a speculative investment that may continue to experience wild price fluctuations. Therefore, it may not be suitable for many investors who may get a little queasy during such an erratic rollercoaster ride. To illustrate this, we look at the chart below that shows the change in Bitcoin price between January 1, 2020 and January 17, 2023.

As you can see above, the price appreciation of Bitcoin has been substantial, but also extraordinarily volatile. Returns may vary substantially depending on entry point. If you purchased Bitcoin in early November of 2021 and held it through early 2024, you still haven’t come close to recovering your initial investment. Remember, a -70% loss requires a subsequent 230%+ gain to fully recover. That’s a daunting feat unless the investor has a strong stomach and very long-term time horizon for their Bitcoin investment.

Another very important variable to consider regarding these new Bitcoin ETFs is the fact that Bitcoin can be bought and sold twenty four hours-a-day, seven days-a-week on crypto exchanges. However, shares of the new ETFs can only be bought or sold during traditional market hours from 9:30am-4:00pm ET, Monday through Friday and excluding holidays. Based on historic volatility, it’s not unthinkable to imagine that the price of Bitcoin could sell-off -20% to -50% overnight or over a weekend due to an event-driven risk, and investors who seek to exit their ETF position won’t be able to do so until markets reopen.

Given many of these considerations, and more, we are not actively recommending Bitcoin or Bitcoin ETFs for inclusion in client portfolios. That stance, of course, will be reevaluated over time. If a client or potential client is interested in a speculative investment in a Bitcoin ETF, we are happy to discuss your objectives and potentially facilitate a purchase.

Innovations are exciting, and we are very interested to see what’s in store for Bitcoin and blockchain technology in the years ahead. If our stance on Bitcoin and investment recommendations evolve over time, we will be sure to communicate this with each of you. In the meantime, please don’t hesitate to reach out to your Destiny Capital team if you have any additional questions around Bitcoin, your investments, or your personal financial plan.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services provided by Destiny Capital Corporation, a registered investment adviser.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.