Markets and Economy Update – January 2021

Over an investor’s lifetime, there may be a handful of occasions when he or she feels like Wile E. Coyote chasing his prized Road Runner in that classic, old Looney Tunes cartoon. Despite the best-laid plans and the elusive Road Runner nearly within their grasp, investors may suddenly find themselves plummeting off of the edge of a cliff to their inevitable doom, only to realize that they’ve fallen onto a trampoline that miraculously sends them hurtling back into the sky. However, in the cartoon, this is when Wile E. Coyote tended to let down his guard and bask in his glorious, weightless ascent, thinking, “All is well”.

As investors, we don’t quite get that luxury. History, experience and data tell us that there could be a rocky ledge overhead that brings our ascent to an unexpected and painful halt. It was nearly one full year ago that the COVID-19 pandemic abruptly pushed financial markets off of a cliff in one of the most ferocious and sudden market declines in history. Yet, in mid-March, the Federal Reserve laid out a well-placed trampoline, cushioning the fall and beginning to shift momentum back in the opposite direction.

Here we are a year later, and from the perspective of the S&P 500 index, it’s almost like 2020 never happened. I’m sure many of us wish we could experience similar selective amnesia about the past 12 months. However, as we all know, a lot has happened over the past year that may affect financial markets in 2021 and beyond. So, in this letter, we’ll attempt to cover a few key topics including a Q4 2020 earnings update, some of the “rocky ledges” that could affect the market’s potential ascent and the hot topic of the day – Reddit and GameStop versus hedge funds.

Q4 2020 Earnings

I am sure that many of us can understand Boeing CEO David Calhoun’s sentiment when, during a January 27th earning’s call, he said, “2020 was a year like no other. Our world, our industry, our business and our communities were facing unprecedented challenges – and we’re still in the midst of it.” Boeing went on to report staggering losses of roughly $12 billion in 2020 as jetliner deliveries were cut in half, and the struggling airline industry canceled orders. Still, as we’ve experienced throughout the course of this pandemic, there continue to be industries that struggle mightily, while others manage to survive and thrive.

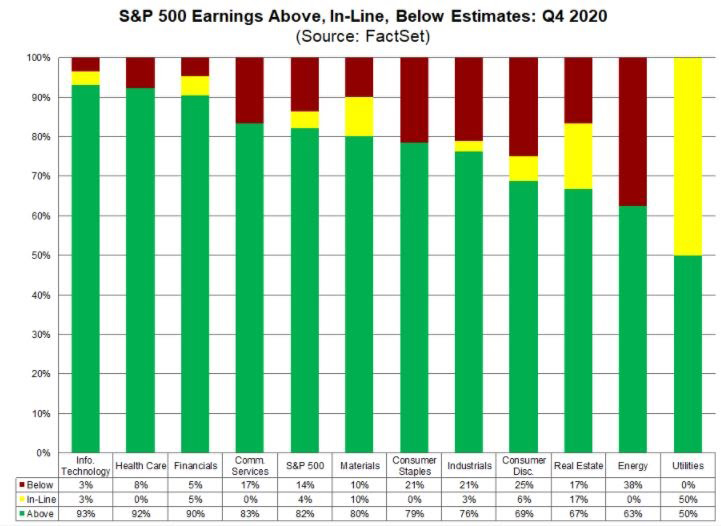

Overall, Q4 2020 earnings (with 37% of S&P 500 companies reporting as-of this writing) are off to a decent start with 82% of companies reporting earnings per share above consensus estimates. Leading the pack are a familiar group, including Information Technology, Health Care and Financials and Communication Services, as seen in the chart below.

In aggregate, companies are reporting earnings that are +13.6% above consensus estimates, which is well above the five-year average of +6.3%. These earnings beats have stocks soaring to new all-time highs, right?

Not quite.

In fact, companies that have reported Q4 earnings surprises have seen an average price decrease of -1.5% in the days immediately before and after their earnings release.

Despite the better-than-expected numbers, this market behavior is not too surprising given that many stocks were trading at elevated valuations to begin with, and some were “priced to perfection”, as many in our industry say. Beyond the numbers, it’s also important to pay attention to the forward guidance of these companies. Many corporate leaders still describe a challenging road ahead as they continue to adapt to the lasting effects of COVID, changes in consumer behavior and the realities of working with a new Biden administration.

Potential Challenges Ahead

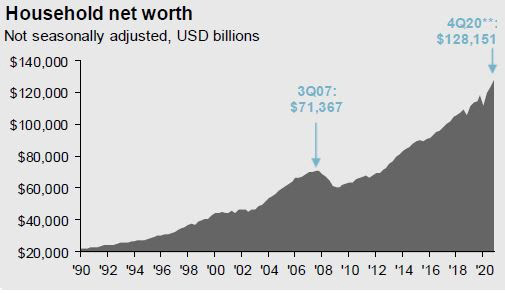

We’ve said many times that we expect that 2020 will forever be known as “The Year of the Pandemic”, and we hope that 2021 will be seen as “The Year of the Recovery”. Many often compare the economic fallout of the pandemic to the great financial crisis of 2008, yet these recessions are different in many ways. One key difference can be seen in the general financial health of the average American household.

As seen in Chart A below, the household net worth of U.S. citizens in Q4 2020 is roughly 80% higher than in Q3 2007.

Chart A

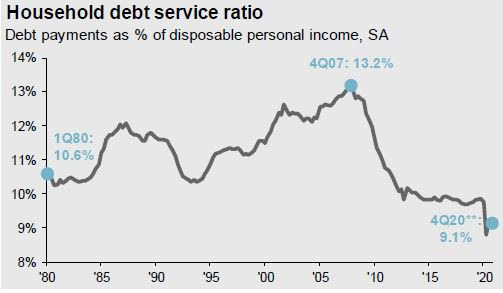

Furthermore, despite a short term uptick due to the pandemic, household debt payments as a percent of disposable income (the household debt service ratio) have fallen considerably since the highs reached in late 2007, as seen in Chart B below.

Chart B

What does this mean? To be clear, we have large swaths of people in our country who are struggling considerably due to federal, state and local restrictions and the changes in consumer behavior brought about by the COVID-19 pandemic. However, generally speaking, American households are on stronger financial footing after the 2020 recession than they were after the 2008 recession. This is a good thing, right?

Yes and no.

Yes, a stronger American consumer will be better positioned to unleash pent-up demand as pandemic fears recede. This may lead to rapid economic growth that will provide much-needed support to the industries and individuals hit the hardest by this pandemic. However, this consumer-driven growth, coupled with significant fiscal stimulus and loose monetary policy, runs the risk of overheating the economy, which could increase inflation, raise long-term interest rates and provide unique, new challenges for the economy in the years to come. Furthermore, while stimulus was, and is, essential to stabilizing the economy in 2020 and 2021, it comes with a hefty price tag, which may be paid for down the line in the form of higher individual and/or corporate tax rates.

While we don’t expect these issues to affect investors in the near-term, we will be keeping a keen eye on the Federal Reserve, inflation and interest rates over the course of the year. We don’t anticipate any action regarding personal or corporate taxes in 2021. In fact, it is hard to imagine a time when there will be the necessary political will (or votes) to raise taxes either on businesses or American citizens. It may be a forced reality that arises in the coming years as deficits become untenable, and the potential for higher taxes should be discussed when implementing long-term financial planning strategies.

We would also be remiss if we didn’t list the COVID-19 pandemic as a substantial near-term risk for the global economy and financial markets. We have two largely effective vaccines currently in circulation, with Johnson & Johnson recently unveiling data regarding a new single-dose vaccine that displayed 72% efficacy against moderate and severe cases in the U.S., with varying results in Phase 3 trials in other countries.

However, we also continue to learn about alarming new COVID-19 variants popping up across the globe. These variants are significantly more transmissible than the baseline virus, and this is causing renewed concern about infection rates and stresses the urgency of vaccine distribution and adoption. While experts believe that the current vaccines will be effective against the new COVID-19 variants, this is something that will be under extreme scrutiny in the days and weeks ahead. Meanwhile, the standard methods for avoiding the coronavirus, such as effective masks, social distancing and handwashing remain effective deterrents.

Reddit Alert

In recent days, the attention of the investing world has been acutely focused on brick and mortar video game retailer GameStop and the Reddit forum WallStreetBets. Clearly, there is still much to learn about this evolving story, but initial reports tell a tale that is somewhat familiar to many in our industry, although not previously executed at quite this scale.

It’s been reported that WallStreetBets’ Reddit forum participants coordinated an effort to drive up the price of GameStop stock using option strategies and outright stock purchases in an effort to squeeze hedge funds that were short (betting against) GameStop and, to a lesser extent, several other struggling companies like AMC and Bed Bath & Beyond.

This caused a massive price surge as Redditors plunged into these stocks and hedge funds covered their short positions, incurring massive losses. As an example, GameStop stock surged from roughly $20/share in mid January up to $325/share at market close on Friday, January 29th. New estimates suggest that short sellers have lost roughly $19 billion on GameStop alone in 2021. And here we thought that 2021 was going to be less chaotic than 2020.

The exact motive for this activity remains somewhat elusive, as some WallStreetBets participants have communicated a desire to make greedy hedge funds pay a steep price for betting against sentimental favorites, while others simply seek to profit.

Regardless of motive, this activity has some of the hallmarks of a classic pump-and-dump scheme, and while it’s likely far too late for warnings, participants should proceed with caution. A pump-and-dump is the practice of (through coordination and/or misrepresentation) encouraging investors to buy a stock to artificially inflate the price. Then, the coordinators exit at elevated price levels, profiting from the short term rise while remaining investors suffer sometimes significant losses as the stock ultimately plunges. If convicted, a pump-and-dump participant can face consequences ranging from fines to jail time.

Again, the exact methods and motives are still unclear at this point, so it is difficult to frame this activity as strictly right or wrong. Regardless, it’s important to recognize that while some may profit significantly, there will also be many who potentially didn’t understand the risks, entered the fray late in the game and will lose much more than they can afford. At a current market cap of just over $22 billion for GameStop, it is very hard to imagine that there won’t be significant profit-taking activity in the days and weeks ahead.

While it is very unlikely that this event will directly impact any of Destiny Capital’s investors, there will undoubtedly be fallout at many levels – some intentional, some not. In fact, one likely unintentional consequence affected the popular State Street SPDR S&P Retail ETF (XRT), which experienced $700 million in outflows (or roughly 80% of the fund’s total assets). To be clear – this ETF is not owned in any Destiny Capital portfolios. Even so, this ETF is somewhat unique given that fund redemptions are delivered in-kind, meaning that an investor can exchange ETF shares for the underlying stocks held in the fund. It is theorized that the fund’s massive outflows are due to investors who redeemed shares of the ETF in an effort to obtain in-kind receipt of the elusive GameStop shares.

We expect significant regulatory and legal scrutiny of these events in the coming days, weeks and months. Ultimately, whether it’s ivory tower hedge funds or twenty-somethings in their basement, it is never a good thing when financial markets are the subject of manipulation of any kind, causing long-term investors to question whether or not financial markets are rigged for-or-against them. We can’t let tantalizing headlines and get-rich-quick schemes allow us to forget that things that appear too good to be true are too good to be true, that investing involves ethics and that compound interest is a wonderful thing.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.