Markets and Economy Report (Year In Review)

by Tim Doyle, Chief Investment Officer, CFP®, MBA

In late December of 2020, my 3-year-old son and I went on an adventurous excursion along Clear Creek in Golden, CO. It was a temperamental winter afternoon across the Front Range, and the two of us trudged along the riverfront as a blustery breeze made our teeth chatter and eyes water. Suddenly, my boy stopped, looked up at me – barely able to see through the beanie cap I had pulled down too far over his eyes – and asked “Dada, where does wind come from?”

A question like this reminds me of a quote from Saint Augustine when he reflects upon the concept of ‘time’, in which he states “What is time then? If nobody asks me, I know; but if I were desirous to explain it to one that should ask me, plainly I do not know.”

As I always do when my son surprises me with a question that requires any modicum of complex thought, I floundered for several seconds, mumbling things like “well, you see…ah. What you have to understand is that…um.” This went on for nearly half a minute until I blurted out something I thought might make sense to a 3-year-old’s mind. To his credit – and to my relief – he let it go, either accepting my response or wisely thinking “I’ll just ask mom.”

Answering the question “what happened to the markets in 2020?” is a lot like answering the question “what is time?” There’s just so much to unpack that it can be difficult to know where to begin. As with time – or wind – you intuitively feel the answer more than you can plainly describe it. Yet, there are underlying themes that tie together much of what occurred in financial markets in 2020, so we’ll attempt to cover some of those key topics while briefly looking ahead at what’s in store for 2021.

The Year of the Pandemic

It goes without saying that 2020 will forever be known as ‘The Year of the Pandemic’, when the coronavirus variant COVID-19 stopped the global economy in its tracks, and redefined life as we all know it. On February 26th, in the earlier stages of the pandemic, I penned a letter asking two fundamental questions about the pandemic:

- Will the effects be persistent?

- Will the effects be material?

As we sit here at the beginning of 2021, I think we all know that the answers to those two questions are an emphatic ‘yes’ and ‘yes’. However, we’ve learned that the persistent effects of COVID-19 have been – and will be – more material for some businesses and industries than for others.

In mid-February through mid-March, the stock market experienced a decline that was record-setting for its speed and ferocity. The S&P 500 fell from 3,370 to 2,447 in the span of a few short weeks. However, instead of languishing at these lows, the stock market showed great resilience as the S&P 500 began to rebound and continued on a bumpy – yet steady – ascent throughout the remainder of 2020.

Generally speaking, the resiliency of financial markets throughout the final nine months of 2020 is most directly tied to two things:

#1: Federal Reserve intervention and – to a slightly lesser extent – fiscal stimulus passed by Congress.

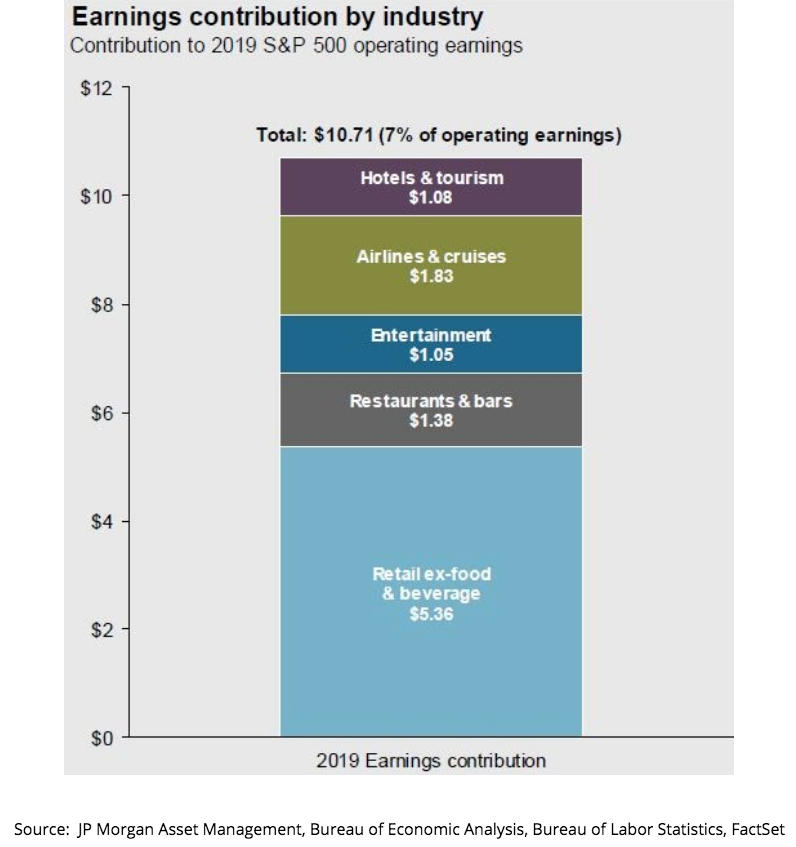

#2: The fact that the industries hardest hit – Retail ex-Food & Beverage, Entertainment, Restaurants & Bars, Hotels & Tourism, Airlines & Cruises – made up only 7% of S&P 500 operating earnings in 2019, and the highest percentage of unemployed workers tended to be lower-wage earners.

To be clear, this is not to understate the fact that we have significant populations of our country who are suffering greatly due to unemployment, food scarcity, and the coronavirus itself. My intention is to only explain why, in 2020, we seemed to experience a disconnect between ‘the economy’ and ‘the markets’ while a pandemic rages-on and 10.7 million Americans remain unemployed.

Fed Intervention

In hindsight, one of the most trying times of my career occurred between March 6th and March 20th of 2020. This is when pandemic fears and liquidity concerns in bond markets peaked, leading to volatility that saw long-term, intermediate-term, and short-term corporate bonds decline roughly -27%, -14%, and -11% respectively. This is not the type of behavior investors seek in their fixed income allocations, to state it mildly.

Acting decisively, the Fed cut the fed funds target rate to zero on March 15th and – on March 23rd – Fed Chairman, Jerome Powell, announced the intention to create the Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF).

The PMCCF was designed to assist with the funding of new bond and loan issuances so corporations could continue to borrow and remain viable throughout the pandemic, while the SMCCF was intended to provide liquidity for outstanding corporate bonds in secondary markets where the majority of retail investors – like you and me – trade.

Specifically, the SMCCF established a Special Purpose Vehicle (SPV) to purchase qualified bond Exchange Traded Funds (ETFs) in the secondary market, providing much needed liquidity and support. Bond markets immediately stabilized, and ultimately recovered in the subsequent days, weeks and months.

It’s difficult to overstate how unprecedented it was for the Fed to intervene in secondary markets by stating their intention to purchase bond ETFs, including investment grade and – to a lesser extent – even some high yield (aka ‘junk’) bonds.

In every college ECON class across the country, students learn that the Federal Reserve has several different levers to pull in its efforts to ‘heat-up’ or ‘cool-down’ the economy, and these common tools tend to be open market operations (buying & selling treasury securities), adjusting the federal funds rate, and raising or lowering the reserve requirements for banks.

Purchasing corporate bond ETFs in the secondary market isn’t exactly in the standard Fed playbook, but the PMCCF and SMCCF (among many other facilities created by the Fed in 2020) were successful in supporting the American economy, stabilizing markets, and improving investor confidence at a time it was waning significantly. In short, the Fed acted aggressively and decisively to support the U.S. economy and aid financial markets.

It is also my personal belief that this Fed intervention may have had a broad psychological effect on many investors, encouraging risk-on behavior even during a time of substantial economic uncertainty. After all, if the Fed is willing to go to such lengths to support the economy and aid financial markets, who’s to say that they won’t do that again, providing a backstop against future event-driven volatility?

Clearly, I don’t agree with the idea that it is wise to increase risk posture in the middle of a pandemic, but perhaps this psychological and behavioral shift can help to explain why the S&P 500 experienced such a rapid recovery that immediately began after the Fed announced substantial intervention measures in mid March.

Fiscal Stimulus 1.0 and 2.0

Roughly two weeks after the Federal Reserve reduced the fed funds target rate to zero on March 15th, the U.S. Senate voted 96-0 to approve a $2 trillion stimulus package that included key features like direct payments to citizens, suspension of student loan payments, a boost to unemployment benefits, the Payroll Protection Program (PPP) for businesses, eviction/foreclosure protections, and support for airlines, hospitals, and gig workers. This stimulus was generally seen as an attempt to ‘bridge the gap’ between the onset of the pandemic and eventual recovery.

Over nine months later – on December 21st – Congress voted to approve the latest $900 billion stimulus bill, and it was signed into law by President Trump on Sunday, December 27th. This new stimulus package includes the following:

-

- Direct Payments: qualifying households receive direct payments of $600 for each adult and $600 for each dependent. These payments are based on 2019 income, and phase-out for individuals and married couples with Adjusted Gross Income over $75,000 and $150,000, respectively.

- Enhanced Unemployment Benefits: individuals receiving unemployment benefits would be eligible for a $300/week subsidy for an additional 11 weeks. The bill also extends unemployment benefits for up to 50 weeks – an increase of the standard 26 weeks offered by most states.

- Small Business Support: $325 billion has been allotted to support small businesses, including $284 billion for 1st and 2nd Payroll Protection Program (PPP) loans. Also announced in this bill is the fact that businesses that received PPP loans would be able to deduct the payroll costs and other expenses covered by forgiven loans.

- Rental Assistance: $25 billion has been allotted to assist tenants who are in arrears on their rent. It also extends the federal eviction prohibition until the end of January 2021.

- Grants for Child Care Providers: there will be $250 million in grants for the Head Start program, and $10 billion in grants for child care providers.

- Industry-Specific Support: this would primarily apply to Airlines, Community Banks, Entertainment Venues, Farms, and Rail & Transit.

While this stimulus is much-welcome relief to many who desperately need it, the markets have largely shrugged off this news, wondering if it goes far enough to bridge the gap to recovery. Clearly, we are beginning to see a light at the end of the tunnel with multiple vaccines in distribution, and lawmakers have to weigh dire need versus burgeoning deficits, which leads us to our next topic – the industries hardest hit by the pandemic, and their impact on financial markets.

Persistent and Material Impact

It is widely accepted that the restaurant industry is one of the most difficult to achieve lasting success, with nearly 80% of restaurants going out of business within the first 5 years of operation. Couple those statistics with pandemic restrictions and changes in consumer behavior, and you are looking at a very difficult proposition.

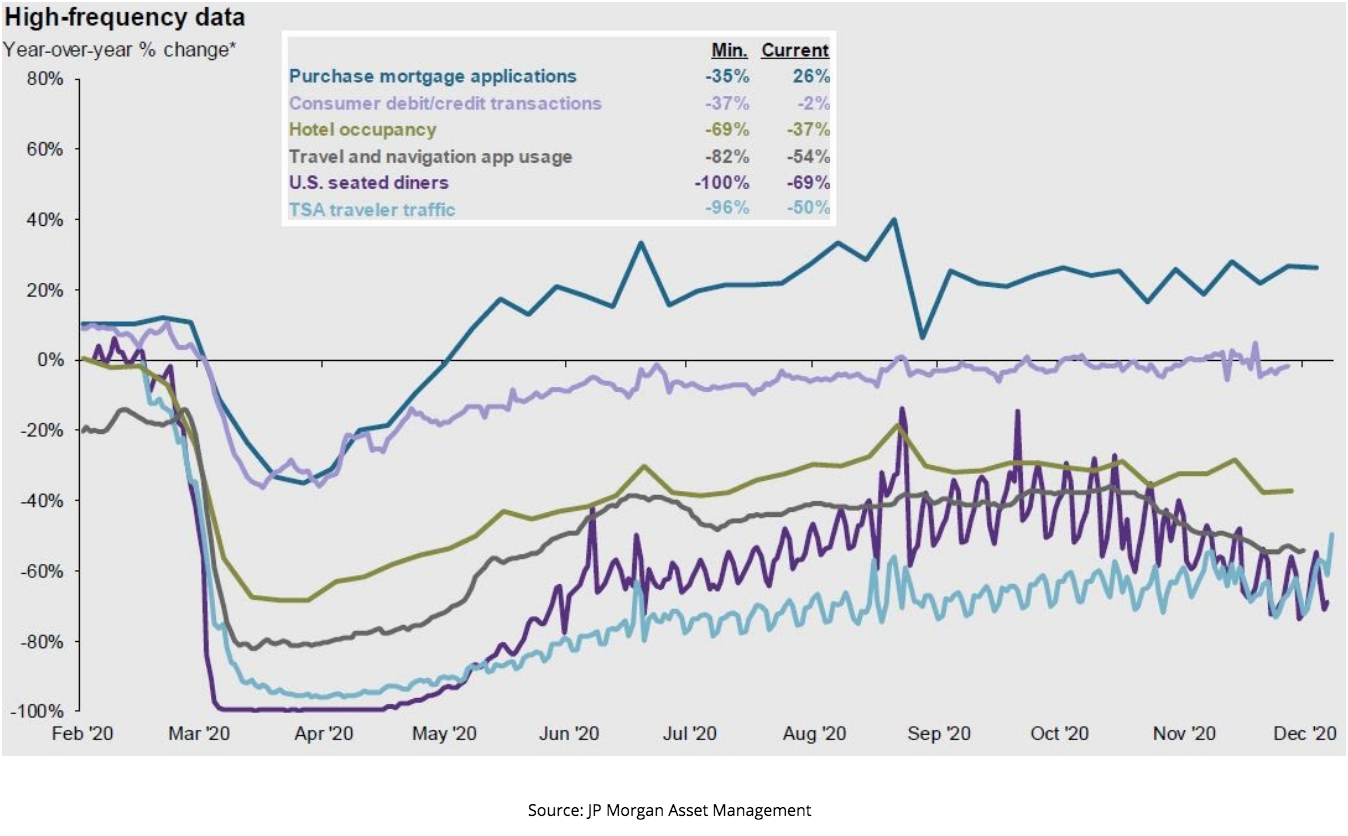

I’ve stated many times that the road to economic recovery isn’t about what people can do, it’s about what people will do while the risk of contracting COVID-19 remains. COVID-19 has clearly affected consumer behavior across the hardest hit industries, including restaurants & bars, retail ex-food and beverage, airlines & cruises, hotels & tourism, and entertainment. The high frequency data below shows a leveling-off or reduction in hotel occupancy, U.S. seated diners, and travel app usage. Only TSA traveler traffic has seen a short term spike due to holiday-related travel.

These industries also count for large swaths of the 10.7 million unemployed workers in the United States today. However, unlike the financial crisis of 2008, we see two key differences in how this crisis has affected financial markets.

First, using the S&P 500 as a proxy for ‘the market’, these hardest-hit industries make up only 7% of S&P 500 operating earnings, as seen in Chart A below. Therefore, while not insignificant, the negative effect is far less than it would be if COVID-19 happened to be a digital virus that crippled Information Technology, Financial, and Communication Services companies across the country.

Chart A

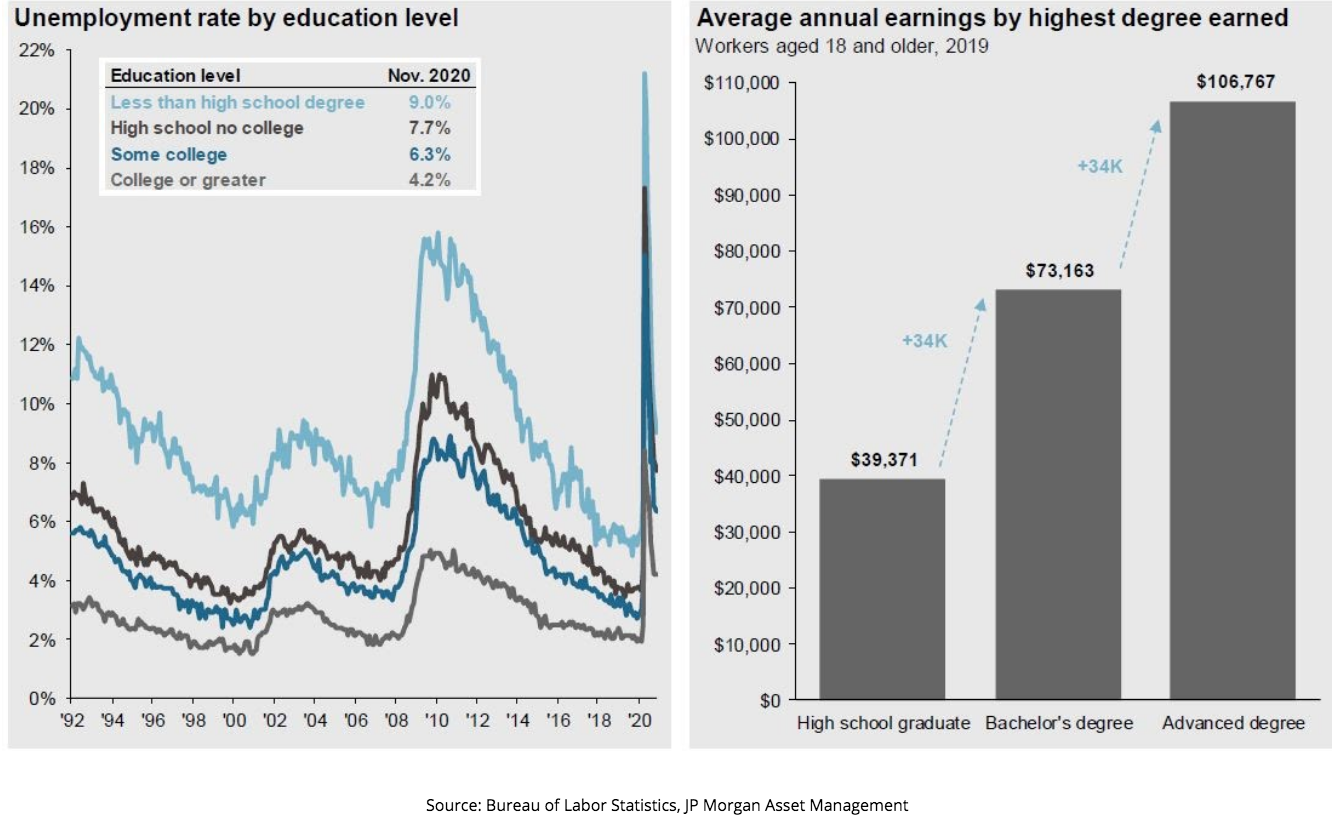

Secondly, we see in Chart B that unemployment has disproportionately affected lower-wage earners, with the unemployment rate for individuals with less than a high school degree at 9.0% vs. 4.2% for individuals with a college degree. This difference was even more exaggerated when unemployment was at its peak several months ago. Lower wage earners tend to be less likely to invest in financial markets, which mutes some of the long lasting effects we’ve seen in previous recessions that impacted higher wage earners in greater numbers.

Chart B

While this letter is intended to focus on financial markets and investing, that does not mean that I am discounting the crushing effect that this pandemic has had on these industries and their workers.

To me, personally, these industries are essential. Airlines connect me with family members who live 1800 miles away. Restaurants introduce me to new cultures & cuisines, while the bar helps to cushion the blow when the check finally arrives. Hotels give me a home away from home and 30-minute, guilt-free scalding hot showers. Movies and concerts give my wife and me a ‘date night’ where we can escape and connect for a few hours.

Money only means so much when you can’t spend it on the things – and people – you love.

It pains me to say that many of these industries may never quite look the same post-pandemic. However, with multiple vaccines approved and currently being distributed, we believe that 2021 should provide a strong rebound for many of these hardest hit industries, as pent-up demand will finally be unleashed. This leads us to our final topic, where we briefly touch on some key topics and trends for investors in 2021.

Key Themes for 2021

Domestic Equities: as detailed in this letter, domestic equities experienced a steady ascension from March lows, and the forward P/E ratio of the S&P 500 has climbed to 22.1x vs a 20-year average of 16.5x. Historically, when P/E’s are elevated to these levels, subsequent year returns have been subdued. Our capital market assumption research also concludes that appropriate equity allocations are essential with a focus on targeted sector overweights.

International & Emerging Market Equities: we expect strong relative performance from emerging market equities and – to a slightly lesser extent – international equities. While our primary focus remains on domestic stocks, we believe that current valuations and the expectation of a weakening dollar provides tailwinds for investing in international & emerging market stocks.

Bonds: generally speaking, fixed income investments typically serve two purposes in a portfolio: reliable income and diversification relative to equities. With interest rates at current low levels – and expected to remain low throughout all of 2021 – we do not expect our bond allocations to generate the income we’ve come to expect in recent years. Therefore, it is essential for bond allocations to be appropriately focused on quality, duration, and correlations relative to equities.

Climate Focus & ESG Investing: Environmental, Social, and Governance (ESG) investing isn’t about changing the world, it’s about understanding how our world is changing. Our investment research team has spent nearly 3-years researching and constructing investment strategies that seek to maximize opportunities and identify risks associated with environmental, social and governance (ESG) considerations (read our: ESG Myths & Realities blog). As the world economy shifts its focus to combat climate change, there will be clear winners and losers in the coming years, and we believe that our Sustainable Impact Strategies are ideally situated to maximize investment opportunities in our rapidly changing world.

While 2020 will forever be known as ‘The Year of the Pandemic’, we hope that 2021 will come to be known as ‘The Year of Recovery’, particularly for those who have been hardest hit by the coronavirus itself, or the economic fallout. I think we are all looking forward to better days ahead.

Until then, please stay safe, stay well, and have a healthy and happy 2021.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.