Markets and Economy Report (October 2020)

by Tim Doyle, Chief Investment Officer, CFP®, MBA

Several days ago while standing over a cutting board and prepping dinner for my family, I leaned back and peeked into our living room to check on my son. After all, it was quiet – a little too quiet for those of you who are familiar with 3-year-olds. To my surprise, I discovered my boy sitting in his little blue chair, quietly thumbing through a magazine as he made pensive sounds of appreciation. All that was missing from this scene was a roaring fireplace, a tobacco pipe, a glass of cognac, and a red velvet jacket. No, he wasn’t casually thumbing through this month’s 5280 Magazine or dog-earring recipes in Food & Wine. You see, I came to discover that, in a brilliant stroke of retro marketing, Amazon had released their ace in the hole for the 2020 Holiday Season – A Christmas Toy Catalogue.

Watching my son engrossed by this toy catalogue immediately transported me back to my childhood when my brother and I would lay on our bedroom carpet, shoulder to shoulder, as we gazed upon the Sears catalogue in wonderment (I’m dating myself with this reference). As a child, the holidays had always filled me with such wonder, anticipation and excitement. It’s been a joy to witness my son experiencing those same emotions as he grows older.

Similarly, the beginning of November is a time that I have been focused-on with anticipation and excitement on a professional level. On November 3rd, Americans will cast their ballots – if they haven’t already – in an election that will set the course of our country over the next four years and beyond. This is also the time of year that Destiny Capital’s Investment Committee accumulates and studies data from many of the finest financial research institutions in the world as we conduct our annual Capital Market Assumption review process. In this review, we define key assumptions related to investment returns, interest rates & inflation while also defining the risk/return profile of every asset class in the investable universe from large cap domestic stocks to local currency emerging market debt, and beyond. While our analysis is ongoing throughout the year, this annual review process helps us to refine our portfolio strategies for 2021 while also defining assumptions that our Wealth Planners and Wealth Strategists use when constructing financial plans for our clients.

We look forward to communicating the findings of our Capital Market Assumption review and, for the purposes of this month’s letter, we would like to concentrate on the current state of the U.S. economy and our general outlook on the November election.

The U.S. Economy – Reaching a Plateau

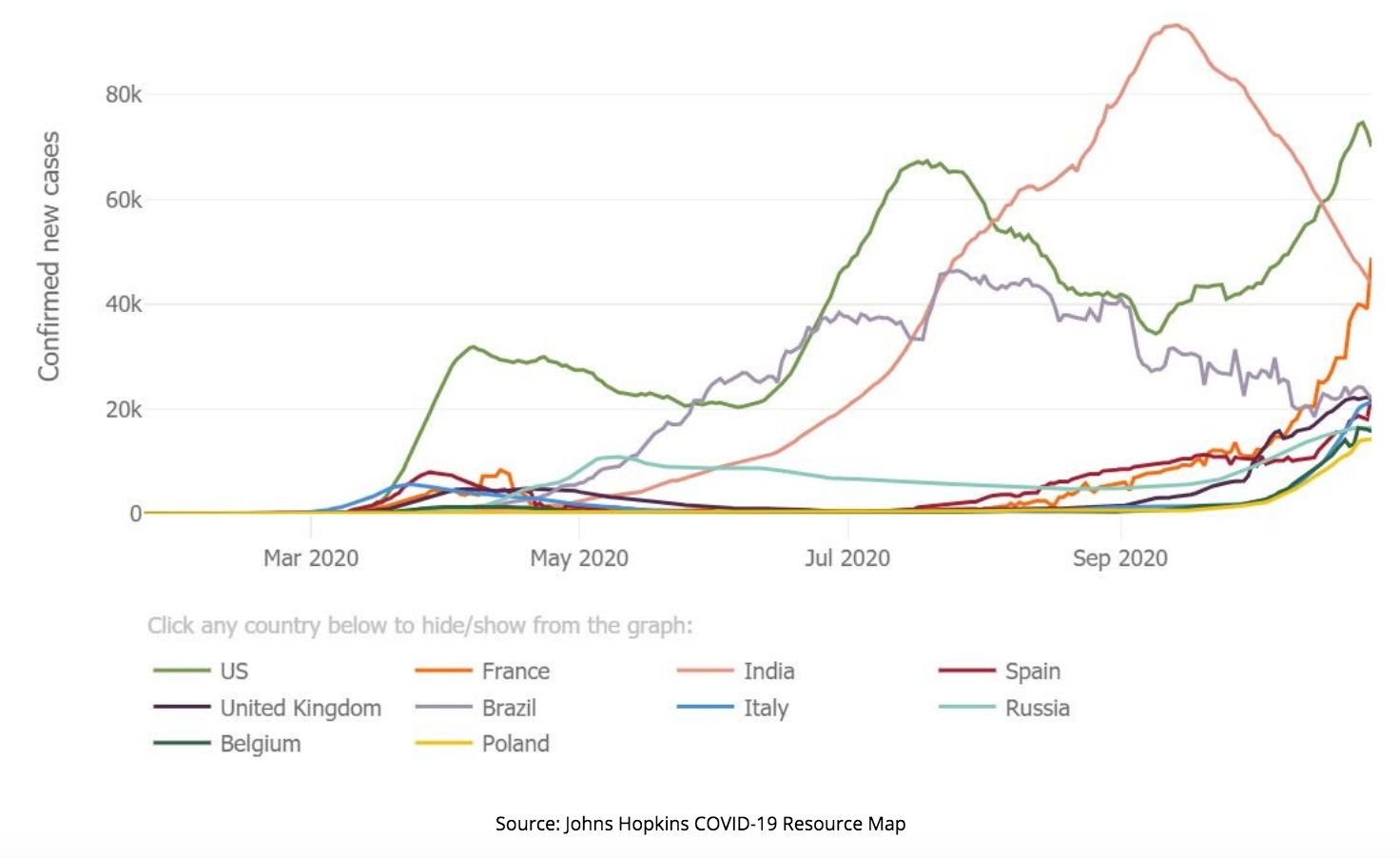

Clearly, it’s impossible to talk about the U.S. economy or financial markets without mentioning the COVID-19 pandemic. These topics are irrevocably intertwined. The chart below illustrates an alarming resurgence of COVID-19 not only in the United States, but across the globe as illustrated in Chart A. The increase in COVID-19 cases – coupled with the erratic market behavior that is typical in the weeks prior to a presidential election – has caused a dramatic +30% spike in market volatility as measured by the CBOE Volatility Index (VIX) since October 23rd.

Furthermore, state and local restrictions are being implemented in areas across the country. For example, on October 27th – in Colorado where Destiny Capital is headquartered – the City and County of Denver increased to a Level 3 Safer at Home Restriction. This is one level below a mandatory Stay at Home order.

Chart A

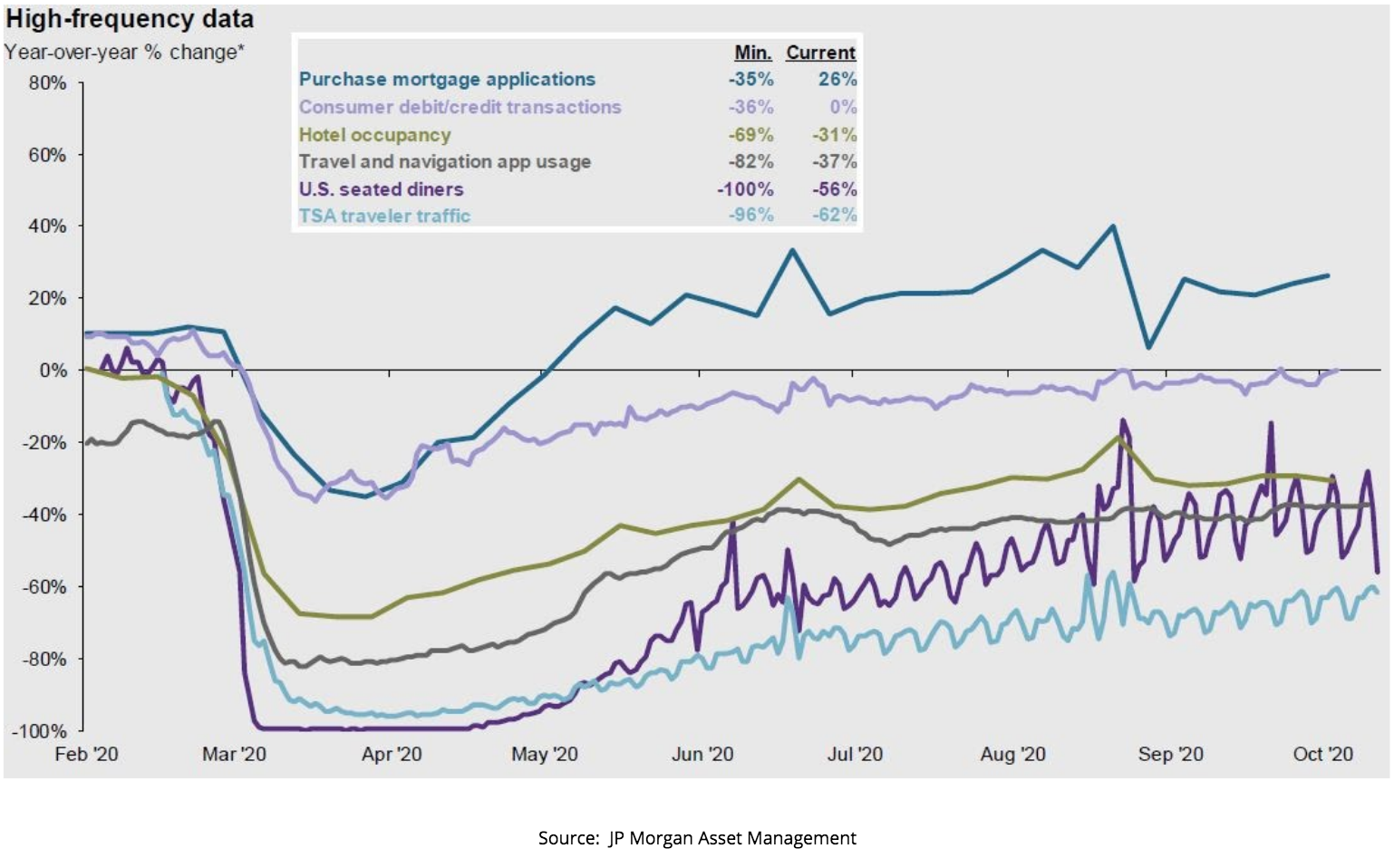

Prior to the recent resurgence in COVID-19 cases in early October, we had begun to see leveling-off in activities like air travel, hotel occupancy, and seated diners as seen below in Chart B. After all, our path toward economic recovery is not just about what people can do, it’s about what people will do while the risk of contracting the coronavirus remains. New restrictions and increased pandemic fears will likely only exacerbate the critical issues being experienced by struggling industries such as air travel, restaurants, hospitality, etc.

Chart B

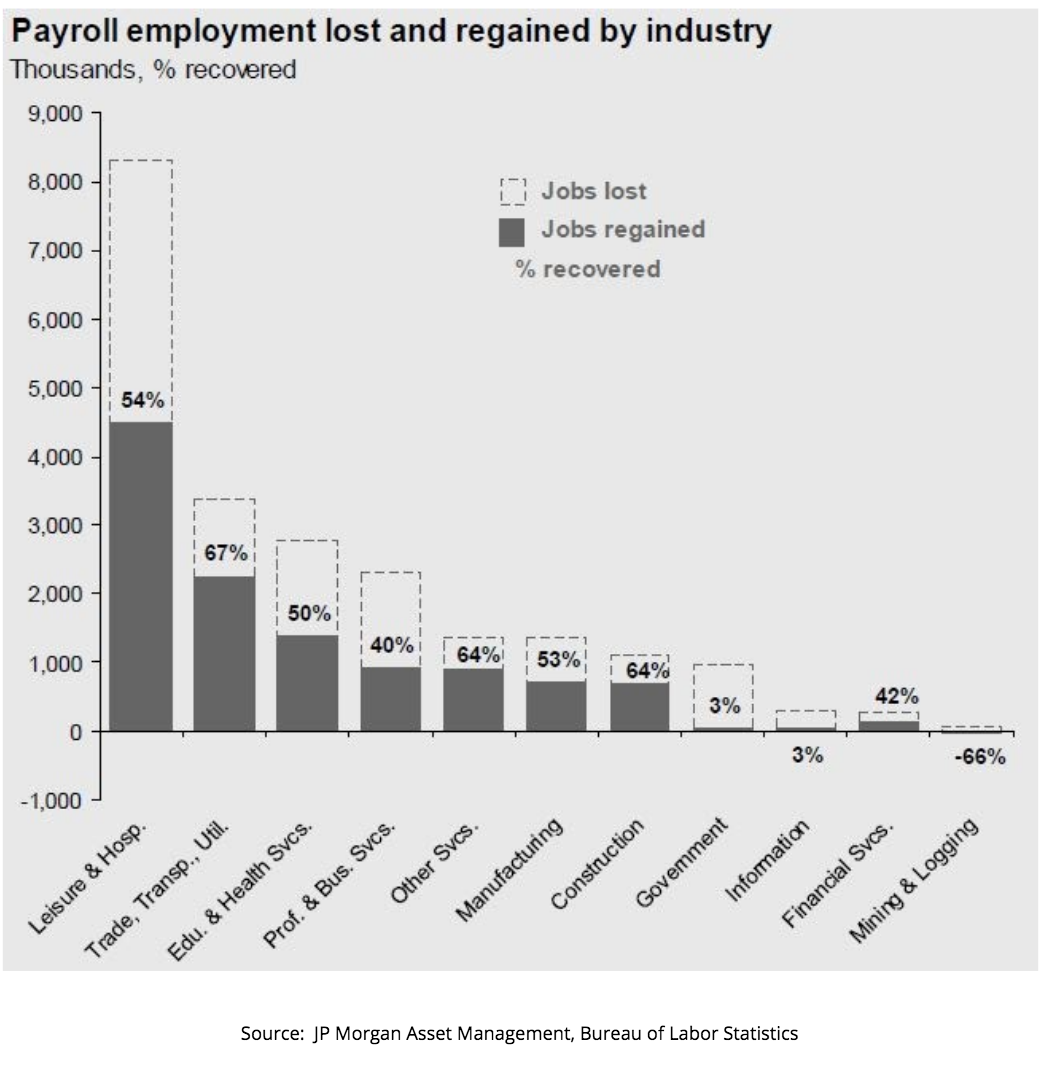

Chart C also illustrates a leveling-off when analyzing employment numbers and calculating jobs lost during the pandemic vs. jobs regained. It should come as no surprise that restaurants and hotels that, at best, are operating at 50% capacity/occupancy only need to rehire roughly 50% of the employees that were initially laid off between February and April of 2020.

Chart C

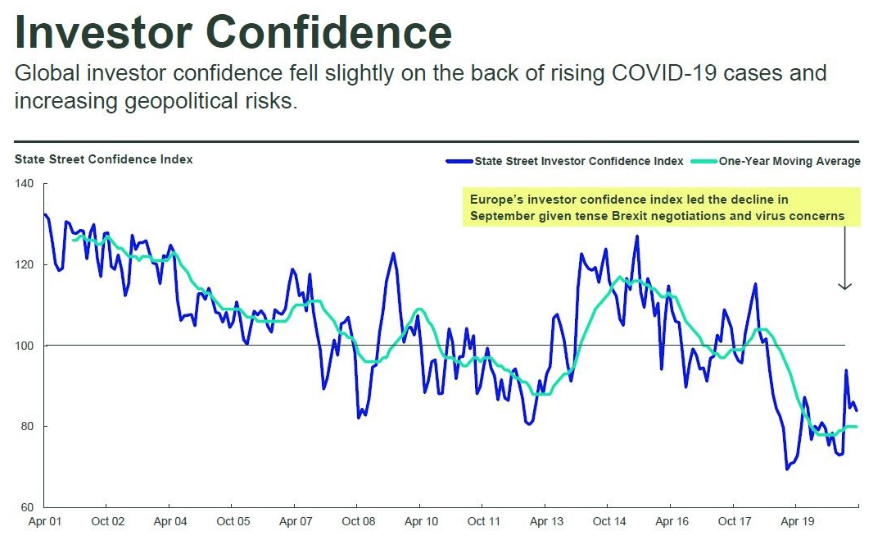

What does this mean for investors? It means we can expect more of the same. We can expect markets to ebb and flow and remain reactionary to swings in sentiment with acute focus on the pandemic. As seen in the State Street Global Investor Confidence Index below (Chart D), we are seeing investors take a pause in optimism after the market rebound experienced over the summer months.

Chart D

We fully expect to see market volatility between now and the end of 2020, primarily due to the pandemic. If COVID-19 cases continue to climb and cities, states and countries implement mandatory stay at home orders, we can expect markets to react negatively to this. If effective fiscal stimulus is approved, it is likely we can expect markets to react favorably in the short-term.

Regardless, we know – based on statements by the scientific community – that there will eventually be an effective vaccine for COVID-19. Unlike other recessions we’ve experienced in the past, we can easily identify the cause & effect relationship that is precipitating our country’s economic woes, and we have a sense that this is a finite event.

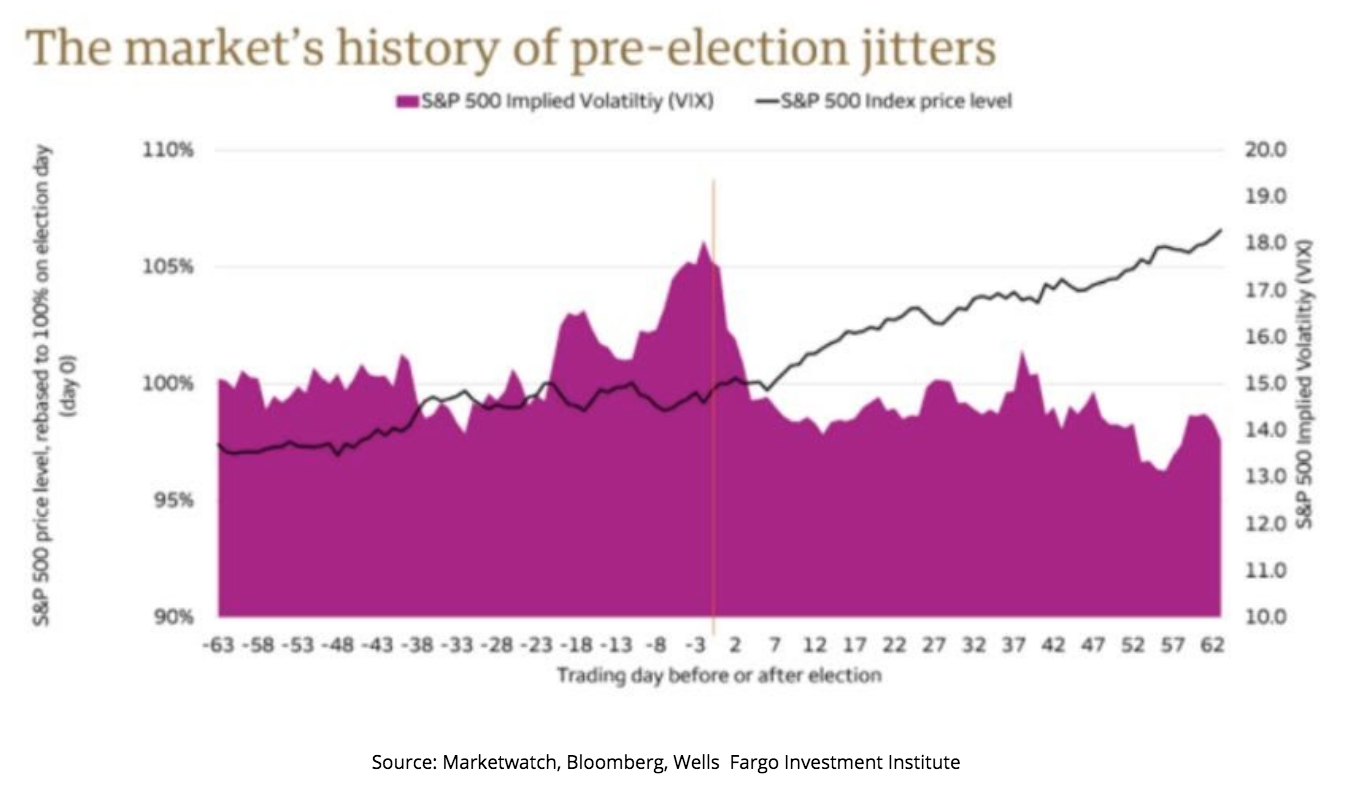

Until the time that a vaccine is widely available, diversification among asset classes is paramount in order for investors to weather short term volatility and remain invested for the long run. We do expect market volatility around the election, although historically most of the volatility (as measured by the CBOE Volatility Index) is experienced during the lead-up to the election, as you can see in Chart E below. This leads us to our next topic – the long-awaited 2020 election.

Chart E

The Election

According to data provided by the U.S. Elections Project, we’ve seen very strong turnout in early voting. Roughly 80 million votes have been cast so far, with 52 million by mail and 28 million in-person as of October 29th. According to the New York Times, these numbers are roughly double the turnout at this stage of the 2016 election.

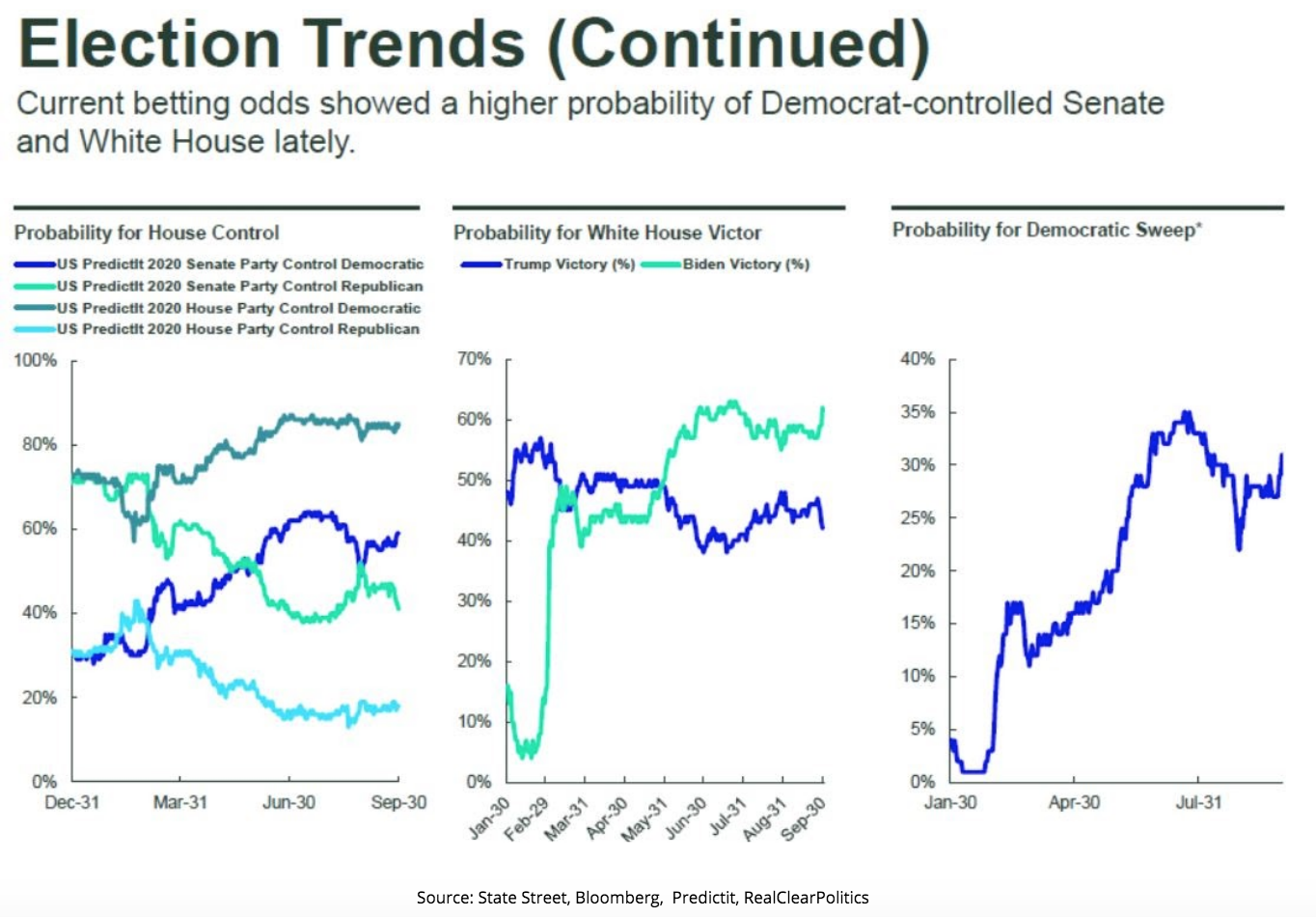

Clearly, we aren’t going to predict the outcome of an unknown event, but we can – for educational purposes only, I assure you – provide charts that illustrate the betting odds of various election results as seen in Chart F below. The charts may be slightly dated, but today’s odds are virtually unchanged from when these charts were constructed several weeks ago. As we can see, the odds of a Democratic presidency sit at roughly 63%, and the odds of the Democrats taking back the Senate have shifted slightly in their favor. Having lived through many close, contentious elections, I think it goes without saying that we need to take these odds with a grain of salt. The outcome of this election is far from certain.

Chart F

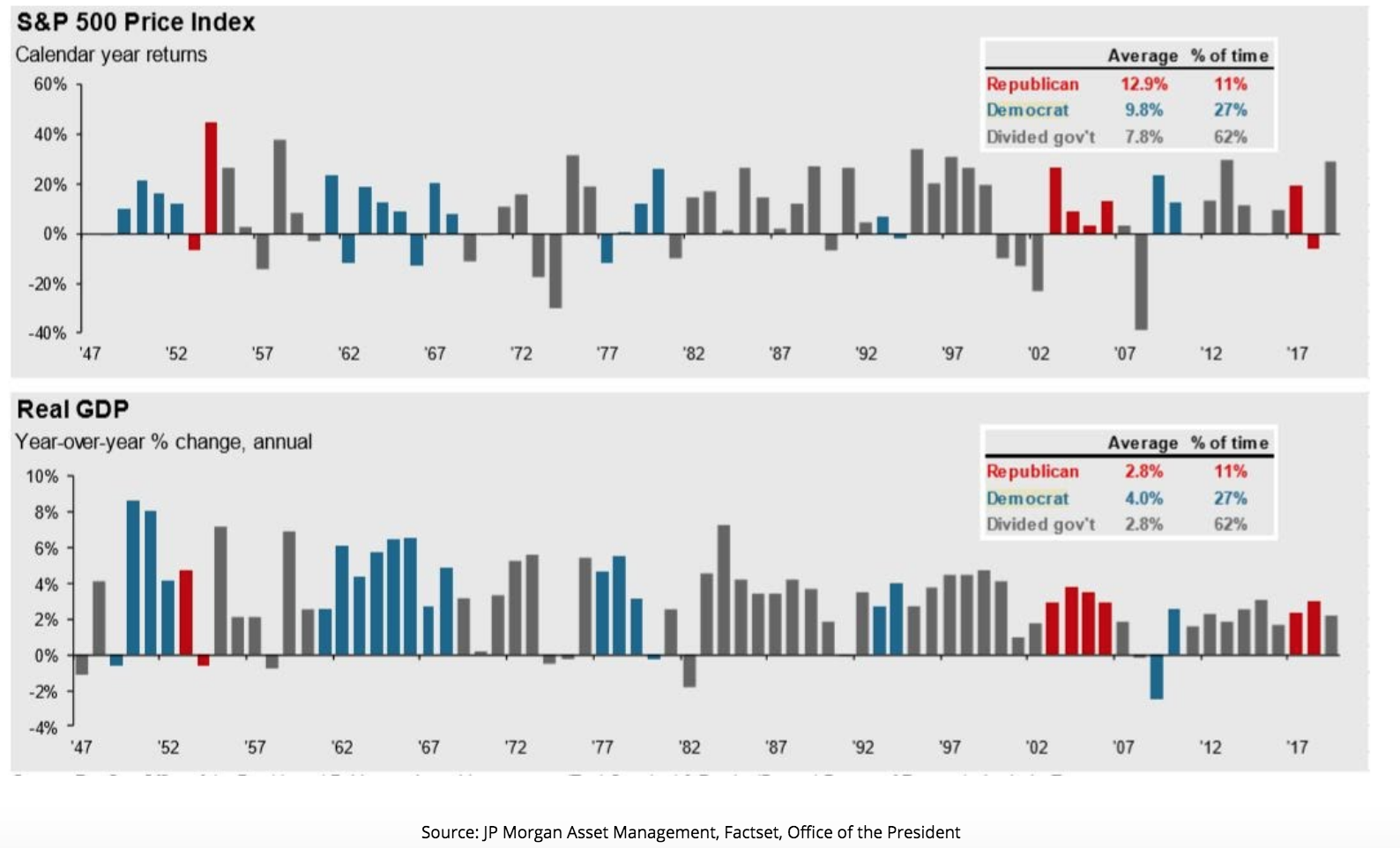

Regardless of the election outcome, it is important to remember that financial markets tend to be apolitical with, on average, strong calendar-year returns during times of Republican control, Democratic control, or split government as seen in Chart G. Failing a macroeconomic event or black swan, any significant market volatility experienced immediately after the election will be purely reactionary and emotional, as the economic impact of any proposed policy initiatives is far from certain. Change in Washington D.C. tends to come at a snail’s pace, and we should have ample time to review, analyze and react to changes proposed by either administration.

Chart G

We fully recognize and appreciate that this election is – and will be – emotionally charged for many. We also know that we are entering a holiday season that will be much different than any of us have experienced in our lifetimes. Several nights ago, I was dicing onions and listening to music over my kitchen’s smart speaker when I heard the recognizable guitar intro of one of my favorite new songs of the past several years – the epically beautiful and touching ‘Summer’s End’ by John Prine.

As is typical with Prine – a legendary singer/songwriter who we tragically lost this year due to COVID complications – the song is filled with lyrics that are so familiar, simple and lucid, yet carry such weight and depth. As Prine rumbled in his signature, calloused voice – the result of cancer that had attacked his vocal chords – he finally arrived at two lines that tug at me each time I hear them:

You never know how far from home you’re feeling

Until you’ve watched the shadows cross the ceiling

I think those two lines will ring true for many of us this holiday season as we remain socially distant from loved ones due to this isolating pandemic. While it’s easy to focus on time lost and memories missed, I remain optimistic about the months and years to come. I have to say, as a cynical New Jersey native and Philadelphia Eagles fan, optimism is not exactly an innate trait of mine. Still, over the past 9 months, I’ve seen our Destiny Capital team and our community emerge from a severe – and often frightening – crisis stronger and more resilient than ever. Many of our conversations with clients over the next 12 months will place a renewed focus on the things that bring them joy, and how we – and their wealth – can support their happiness and fulfillment.

I know I can speak for our team that we are truly looking forward to those conversations.

Stay safe, be well, and don’t forget to vote.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.