Markets and Economy Update – September 2022

Regrettably, I count myself as one of the many unfortunate people worldwide who endure long-term, chronic pain. Nearly a decade ago while at a gym and doing a simple butterfly exercise, I apparently twisted a centimeter in the wrong direction, ruptured a disc in my cervical spine and life has never quite been the same. In the immediate days and weeks that followed the rupture, I met with doctors, surgeons and physical therapists as I desperately sought relief.

During a consultation with my neurosurgeon, he delivered the grim news that I was weeks, if not days, away from a spinal fusion. Nerve damage had caused significant atrophy in my arm and hand. Surgery seemed imminent, and it probably would have been a foregone conclusion if I did not have one vital thing – perspective. You see, pain is not a stranger in my family, as both of my parents have been navigating similar issues for decades and have had more surgeries than any of us care to remember.

This perspective forced me to be patient and tread carefully. I knew firsthand that the cure could often be worse than the disease, so to speak. Aggressive, invasive treatments often have unforeseen outcomes, success is far from certain and there are often tradeoffs to consider. In my case, I was patient despite a steep and prolonged decline in quality of life. Through therapy, I reversed much of the atrophy and held on to the belief that through being patient and enduring some near-term pain, a remedy would ultimately present itself that would leave me better off in the long run. This was not a time to be nearsighted.

As I watched Fed Chairman Jerome Powell deliver his speech and answer press questions at the conclusion of the Federal Open Market Committee (FOMC) meeting on September 21st, I could not help but draw parallels to my own experience with pain, as outlined above. With each sentence Powell spoke, it became more and more apparent that the Fed has completely lost patience with inflation. They appear fully committed to ramping up their aggressive, invasive policies. The problem is that solving inflation through interest rate policy is a lot like conducting spinal surgery with a hammer and a dull chisel. Certain pain now does not necessarily mean less or no pain later.

The Fed continues to be the key driver of the economy and, subsequently, financial markets. Financial markets have two distinct characteristics: they are forward-looking, and they loathe uncertainty. With the Fed’s shifting policies throughout 2022, uncertainty is at its peak. It is often difficult to envision what may materialize in the weeks and months ahead as it relates to Fed policy and its impact on the economy.

In this month’s letter, we will talk a little bit about what happened throughout the month of September, what the Fed has said and done and what it means for financial markets going into the final quarter of the year.

Moving goalposts

As an investment manager, decision-making has been challenging throughout 2022, to say the least. It is like being a general contractor and being handed significantly revised blueprints every one to two months in the midst of a build.

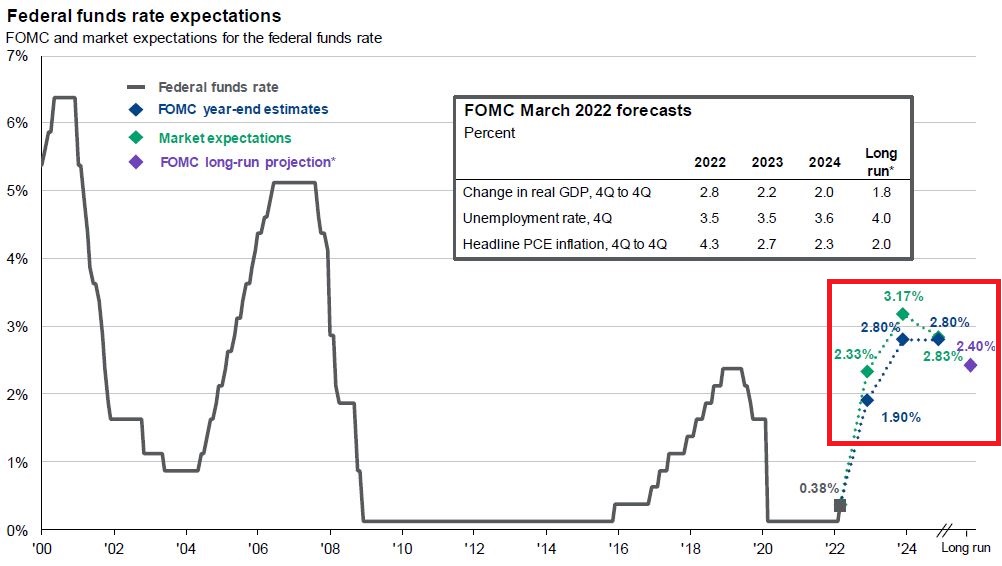

The Fed has continuously moved the goalposts throughout the year as it relates to interest rate projections and monetary policy decisions. These policy changes are often foundational when it comes to the economy and financial markets. To illustrate the ride investors and investment managers have endured, we will look at the two federal funds rate charts below.

As recently as last March, the Fed had predicted a federal funds rate of 1.90% by the end of 2022, and a rate of 2.80% by the end of 2023. This is illustrated by the blue diamonds in the Chart A below. Given that the fed funds target rate was 0.0% to 0.25% at the beginning of 2022, an increase to a 1.90% target would certainly qualify as an aggressive shift in interest rate policy.

Chart A: Federal Open Market Committee Estimates – March 2022

Source: Federal Reserve, JP Morgan Asset Management – Guide to the Markets

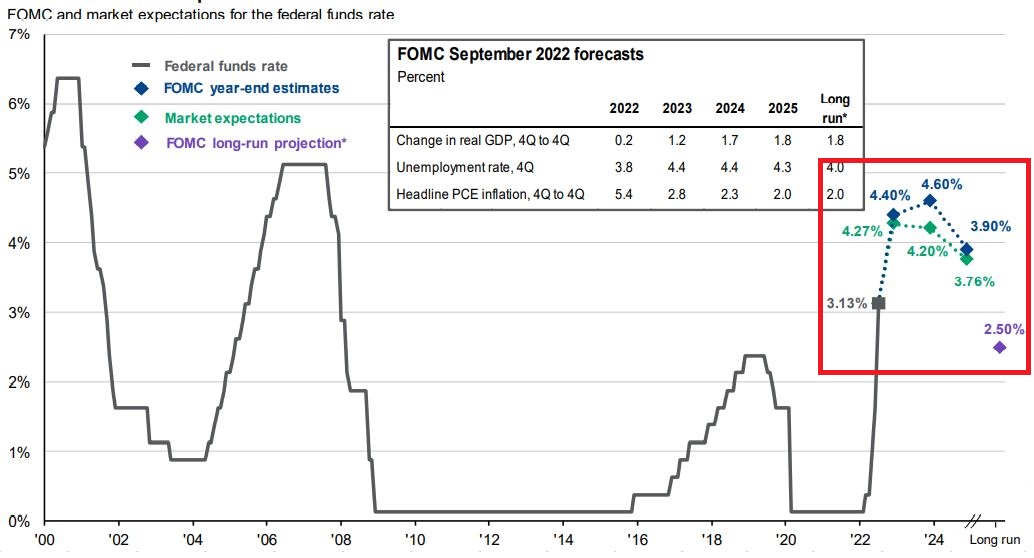

Fast forward a few months to September, and we see a significant shift in policy with the Fed becoming far more hawkish. In its latest projections released after their September 20-21 meeting, the FOMC estimates that the fed funds rate should rise to 4.40% by the end of 2022. This increase is illustrated by the blue diamonds in Chart B below.

Chart B: Federal Open Market Committee Estimates – September 2022

Source: Federal Reserve, JP Morgan Asset Management – Guide to the Markets

That shift in policy represents a 250 basis point (2.50%) difference in just six short months. That is like adding three more levels to the blueprints of a new ranch home after the foundation has been laid and the framing is underway.

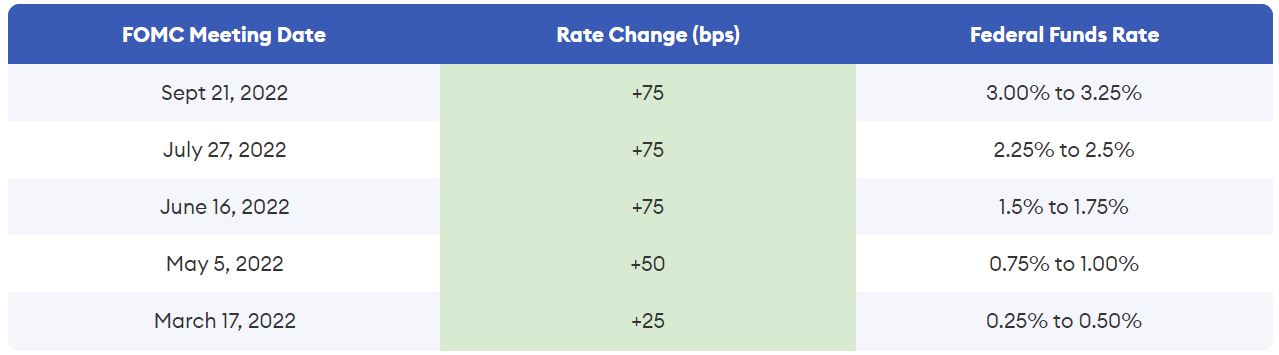

In its history, the FOMC has never (ever) initiated back-to-back 0.75% rate hikes. In 2022, they have already initiated three consecutive 0.75% rate hikes, as seen in the chart below.

Source: Forbes Advisor

If year-end FOMC projections are to be believed, we are in store for a fourth 0.75% rate hike on November 2nd, and another 0.50% hike on December 15th to get the Fed to its 4.40% estimate by year-end. When considering this, quite a few alliterative words come to mind: unprecedented, unbelievable and unexpected.

How did we get here?

This shift in mindset was really brought about by the inflation numbers released in August and September, with the September Consumer Price Index (CPI) report being an apparent tipping point. In the August CPI report (released September 13th), both Headline and Core CPI came in higher than expected at 8.3% and 6.3%, respectively. Consensus estimates were for Headline CPI at 8.1% and Core CPI at 6.1%, so these figures disappointed investors. While some prices like airfares contracted, there were persistent elements of inflation, namely food and shelter, that elevated concerns. For example, the food index experienced its smallest monthly increase since December of 2021. However, the food at home (grocery store) index still rose 0.7% and the food away from home (restaurant) index rose 0.9% in August.

Meanwhile, one of the stickiest elements of inflation remains the shelter index. Both rent and owners’ equivalent rent rose 0.7% in August. Owners’ equivalent rent is a rather convoluted formula that essentially estimates the price that a homeowner could rent their home for (even though they are not), and it makes up a considerable portion of the shelter index. So, while the housing market appears to be softening due to significantly higher mortgage rates, it may take quite a bit of time for the price effects to flow through to the inflation numbers.

The September 13th CPI report, among other inputs, led to the 0.75% rate hike in September, and a very interesting press conference by Jerome Powell after the FOMC meeting on September 21st. During these periodic Fed press conferences, I find myself talking to the television or laptop screen like some fans might narrate (that is, yell at the refs, coaches and players) during a National Football League or college football game. Specifically, I get irked if or when a reporter is not asking a specific question that I think will provide some true insight.

Finally, a good reporter from Reuters pinned down Powell regarding the FOMC’s forward projections, particularly as it relates to the potential of a fourth consecutive 0.75% rate hike on November 2nd, then another 0.50% hike in mid-December.

Powell finally conceded, “You’re right that the median for the year-end suggests another 125 basis points of rate increases.” While Powell hedged and said that other FOMC participants argued for a 100 basis point (1.00%) increase in the fed funds rate, it became apparent that the true consensus was to raise rates as quickly as possible by year end and early into 2023, and it would take a considerable change in the trajectory of inflation to alter that outcome.

I think investors went through all of grief’s five stages of denial, anger, bargaining, depression and acceptance throughout the course of Powell’s press conference. In fact, during these conferences, I have a habit of tracking in-the-moment market reactions, and I saved the intra-day S&P 500 chart seen below using the S&P 500 ETF (SPY) as a proxy. Keep in mind, Jerome Powell spoke at 2:00 pm that day. The press conference apparently did not get off to a good start.

S&P 500 Chart – September 21, 2022

Source: Koyfin

The action in the chart above reminds me of the “she likes me, she likes me not” game that my generation played as kids where, with each petal removed from a daisy, we would ask whether or not our grade school crushes liked us or not. With every sentence, as with each petal removed from the daisy, investors were trying to gauge whether they liked what Powell was saying, or not. In the end, investors did not like what Jerome Powell had to say, and markets descended further to close out the month of September.

Why don’t many investors, analysts and economists like this policy? Well, financial markets can immediately try to react to Fed policy by attempting to price in certain eventualities. As we have seen in 2020 and throughout the course of 2022, major market reactions can occur in a few trading days after a major Fed announcement. However, it takes time for Fed policies to truly seep into the economy. A policy decision in March may not truly be reflected throughout the economy for months or quarters to come. Therefore, there is a growing fear that the Fed is doing too much too fast. As I alluded to earlier in this letter, aggressive and invasive action can have unintended consequences, and certain pain now doesn’t necessarily mean less or no pain later.

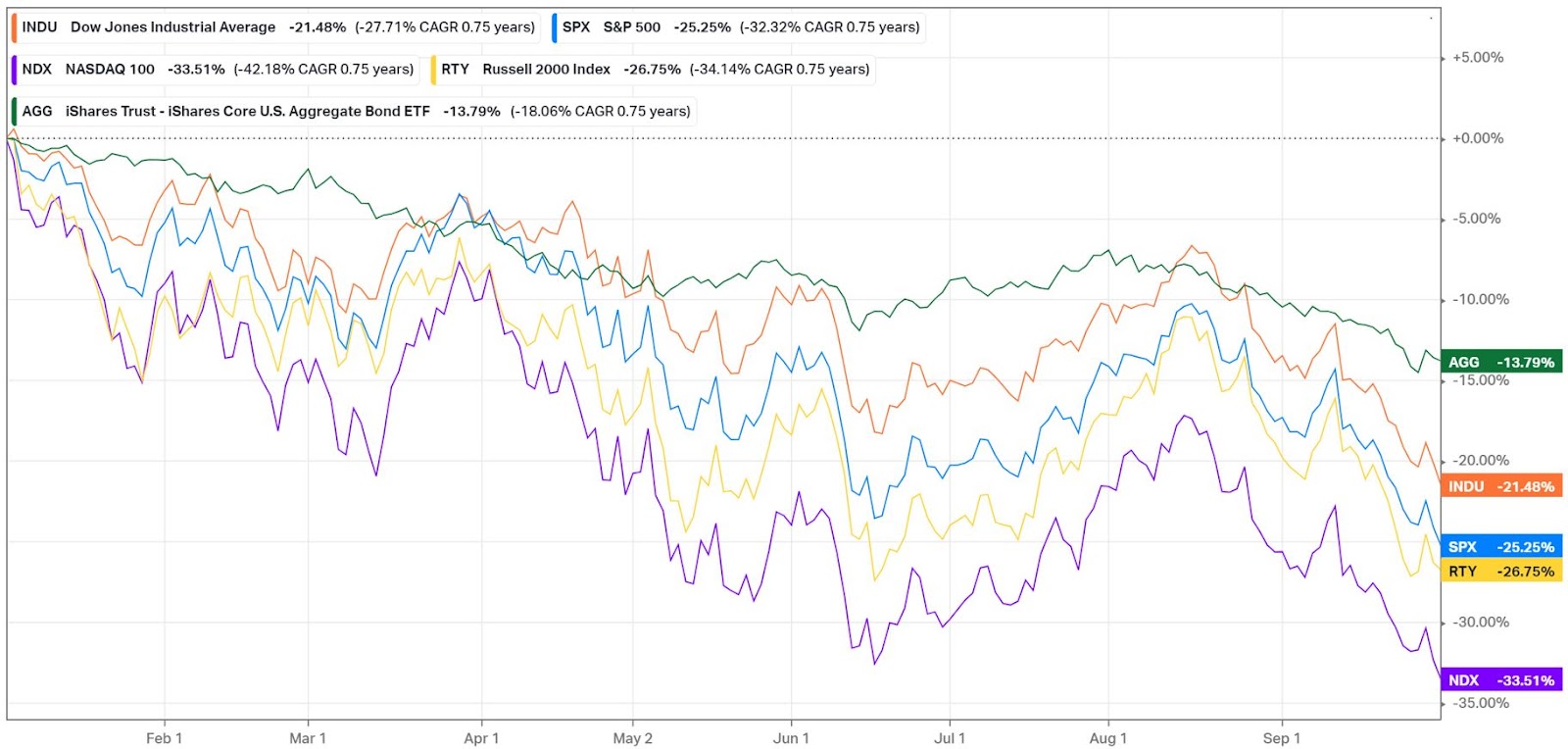

This is the fear that investors felt after Powell wrapped up his September 21st press conference, and the subsequent market decline leaves us with the depressing year-to-date chart below, where we summarize the performance of a few key indexes.

Key Indexes – YTD Performance Through 9/30/2022

Source: Koyfin

I realize that this chart may be difficult to read, so I’ll summarize the year-to-date numbers below as of the end of September.

- U.S. Aggregate Bond Index: -13.79%

- Dow Jones Industrial Average: -21.48%

- S&P 500 Index: -25.25%

- Russell 2000 Index: -26.75%

- NASDAQ 100 Index: -33.51%

As is usual, markets appear to be pricing-in a worst case scenario as we enter what looks to be an interesting and unusual time for the United States economy.

What does this mean for investors? Bad is the new good.

As I have not-so-gracefully aged over the years, it seems like conventional wisdom has stated that each new decade brings a renewed perspective on life and aging. “Thirty is the new 20”, they said during my 30th birthday. “Forty is the new 30”, friends proclaimed after I aged yet another decade. Then, the pandemic came, and I suddenly aged 30 years in roughly 18 months, give or take. When it comes to investing in 2022, bad is the new good, and this is a trend we expect to see play out over the final quarter of the year and into 2023.

Since the onset of the 2020 COVID-19 pandemic, there has, at times, seemed to be a bit of a divergence between real-world economic realities and performance in financial markets. For example, in July of 2020, the unemployment rate sat above 10% and economic uncertainty abounded, yet the S&P 500 was continuing its rapid ascent from March of 2020 lows.

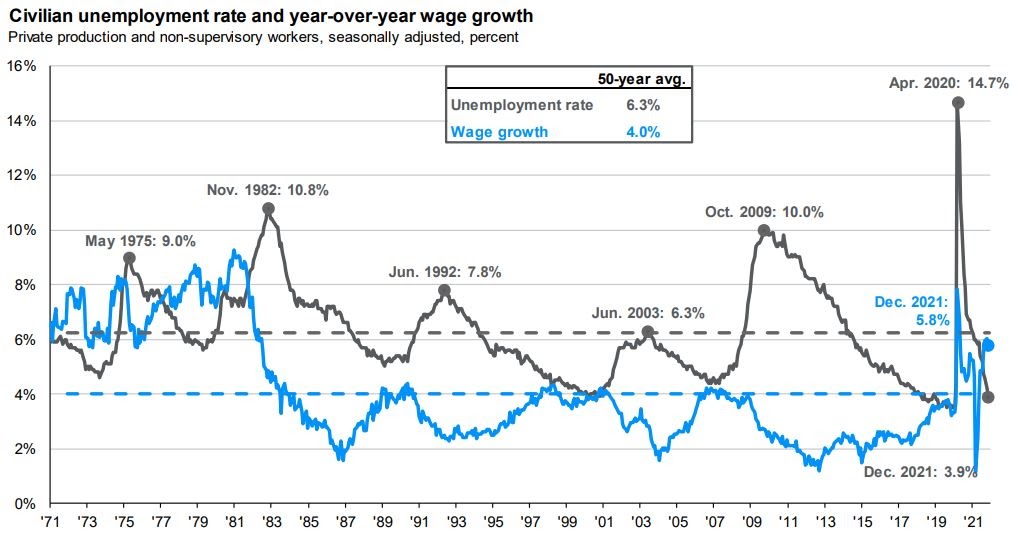

In 2022, investors are now in the uncomfortable seat of rooting for negative economic news. I picture a time when the unemployment rate rises above 4%, and we see clips of the floor of the New York Stock Exchange as traders cheer and clap each other on the back like mission control after the moon landing.

You see, we need things to get a little worse before they are allowed to get better. This will be particularly true in areas of the economy that cause inflation to be more persistent, namely the labor market and the housing market.

In theory, a softer labor market results in lower, or reversing, wage growth. Lower wages and fewer jobs mean less disposable income and less aggregate demand. Less aggregate demand, ideally, should result in lower prices. It is a similar story in the housing market. Higher interest rates equate to higher fixed and variable mortgage rates. Higher mortgage rates challenge affordability at current prices, which should soften demand. Softened demand could result in lower prices to attract buyers. Lower prices could impact the owner’s equivalent rent input of CPI, thus lowering one of the stickier elements of inflation – shelter.

Clearly, these are very over-simplified scenarios, and it has been a very unusual environment in both the labor and housing markets with the number of job openings so high, and housing inventory at lower levels relative to historical trends. Regardless, I would expect markets to react positively to what would otherwise be considered negative news, because this would spur the hope that the Fed could potentially pause or even reverse their restrictive monetary policies.

As long-term investors, we have one unique advantage during times like these – perspective. “This is not our first rodeo,” as they often say in Colorado. Much like my battle with pain, this is not a time to be short-sighted. In my battle, I was exceedingly and frustratingly patient. Yet, I kept envisioning a version of myself five, 10 and 20 years down the road. I had goals. I had plans. I had ambitions, and I did not want to make an emotional decision that might provide some relief in the short-term but that could cause significant issues for my future self. I was ultimately rewarded for this perspective, and my quality of life has improved drastically as a result. My future goals, plans and ambitions remain in play.

As investors, it can be easy to get bogged down, frustrated, emotional and reactive during market declines, particularly ones that are as long lasting as we have experienced here in 2022. However, there will be a time when markets turn and uncertainty begins to fade. It is important to be positioned for when that happens. It can also be helpful to lean on your team of advisors and planners who can answer questions like, “What does this market mean for my goals, my plans and my ambitions?” This type of understanding and knowledge can help investors navigate even the most volatile market environments.

For now, we look ahead to yet another crucial CPI report on October 13th with tempered expectations about the trajectory of inflation. As I have reported earlier in this letter, it will likely take some time to remedy the more persistent inflation inputs, so it is difficult to envision a steep decline in Headline or Core CPI.

We then have the start of earnings season on October 15th before moving into a busy November that kicks off with an FOMC meeting on November 1st and 2nd. Then there are midterm elections, which should draw plenty of interest, scrutiny and projections about what they might mean for financial markets. It is going to be a very interesting and busy final quarter of the year.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. www.destinycapital.com

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.