Markets and Economy Update – October 2022

I will always fondly remember my favorite job as a youth. This job definitely was not my 5am paper route or my long stint as a pump jockey at the Route 31 Amoco gas station in New Jersey. No, my favorite job was one I held over four consecutive summers, when a few buddies would pile into my tiny Plymouth Laser and we would drive to a bucolic private school campus in Gladstone, New Jersey where we worked as a part of the school’s seasonal landscaping and maintenance team.

Alas, I didn’t solve complex combinatorial mathematics problems on a classroom chalkboard each night like Matt Damon’s character Will Hunting from the movie Good Will Hunting. No, my friends and I painted, planted flowers and trees, whacked weeds, mowed, moved furniture, had unfettered access to our own maintenance truck (big mistake) and played a lot of chess. That is right, chess.

You see, one day our boss approached my small crew and proclaimed that we were all great employees who worked hard. A little too hard, in fact. He suggested that we ease up and take our time with some of our projects and keep up appearances but take our foot off the pedal a bit. So, we did what our boss said and, during a few self-prescribed breaks each day, we began playing chess using an old board we found in a classroom. I have to say, we were highly competitive and got semi-decent at the game. Quite a few matches lasted up to a week.

Through playing those many rudimentary games of chess, one technique that really stood out to me was the concept of sacrifice. I began learning that to entice your opponent into an erroneous move, you might have to risk sacrificing a bishop, a knight or even the coveted queen in order to trap your opponent’s king. Conversely, a player might have to give up an essential chess piece in order to protect their king and live to play another day.

Given their intellectual backgrounds, I would imagine that each Federal Open Market Committee (FOMC) member has played a game or two of chess and, right now, the FOMC is playing defense. The Fed has two primary mandates; stable prices (inflation) and full employment. Inflation is clearly the king given the current environment. In order to save their king, the Fed appears to be willing to sacrifice other key pieces of the economy, namely jobs and the housing market. So, we will focus this month’s letter on the Fed’s most recent meeting, its outcome, the areas of the economy that the Fed may sacrifice and what it may mean for investors.

Groundhog Day

You will likely notice that this letter is hitting your inbox a little later in the month than is typical. This delay is purposeful, and is primarily due to the most recent FOMC meeting that wrapped-up on November 2nd. The outcome of this meeting was far too important to ignore in this latest update, so I decided to pause the Markets and Economy Update until we had an opportunity to digest the Fed’s most recent policy decisions.

When listening to Fed Chairman Jerome Powell’s press conference on the afternoon of November 2nd, I immediately felt like Bill Murray’s character Phil Connors in the film Groundhog Day, waking up, yet again, to Sonny and Cher’s “I Got You Babe” on the radio. Another FOMC meeting, another 0.75% rate hike and another shifting narrative about inflation and interest rates.

The meeting started well enough, with a prepared, written statement that excited investors when it read, “In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

This was the first time that the Fed has recognized the lag with which monetary policy permeates the economy. Investors immediately read this as a positive sign that the Fed may be willing to pause rate hikes at some point in the near future, and the S&P 500 reacted favorably in the moment after the release of the Fed statement at 2pm ET.

As is typical with these Fed press conferences, that optimism was short lived, as seen in the S&P 500 chart below that shows intraday price movements when the prepared statement was released at 2pm, and then again, when Powell commenced his press conference at 2:30pm.

Source: YCharts

Soon into his press conference, Powell stated, “Both a strong labor market report but particularly the Consumer Price Index (CPI) report, do suggest to me that we may ultimately move to higher levels than we thought at the time of the September meeting.” That is when all optimism faded, and when I may or may not have woven a tapestry of obscenities that still echo throughout my office to this day.

Throughout our previous communications, we have spoken ad nauseam about the Federal Reserve “moving the goalposts” and fundamentally shifting the foundational pieces of our economy.

Still, this time, it took just 40 days and one CPI report for the Fed to, yet again, upwardly revise their future target for the fed funds rate. How much higher will they go? It is clearly impossible to say with any conviction. This then leads to investor uncertainty and, as we all know, financial markets do not like uncertainty.

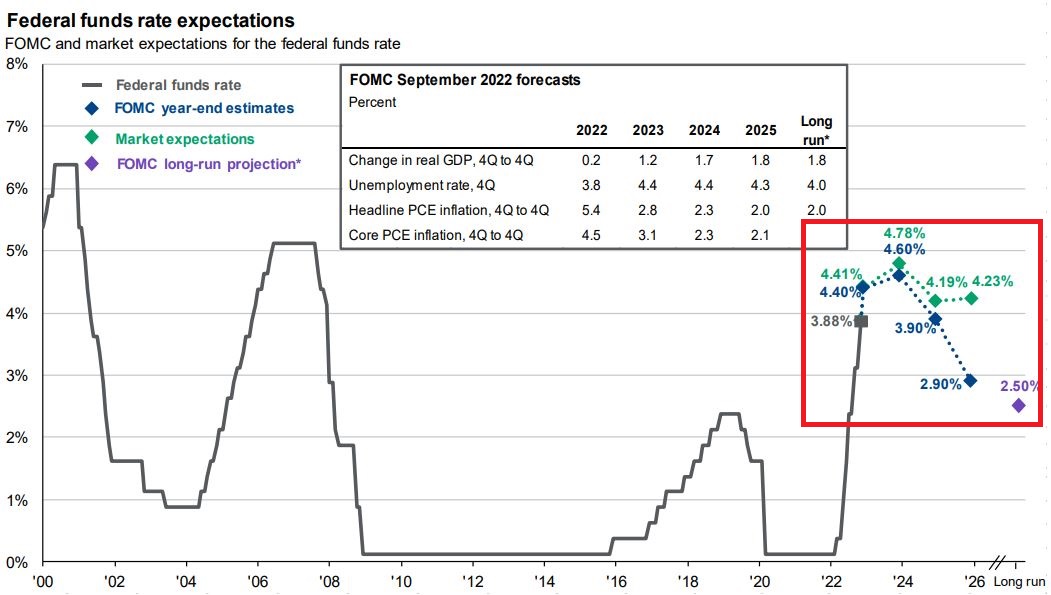

As it stands now, investors are pricing-in a 4.41% year-end target for the Fed funds rate in 2022 and a 4.78% target for year-end 2023. Both of these figures are higher than the September FOMC projections of 4.40% and 4.60%, respectively, as seen in the chart below (with the September FOMC projections in dark blue and the market expectations in green).

Source: JP Morgan Asset Management – Guide to the Markets

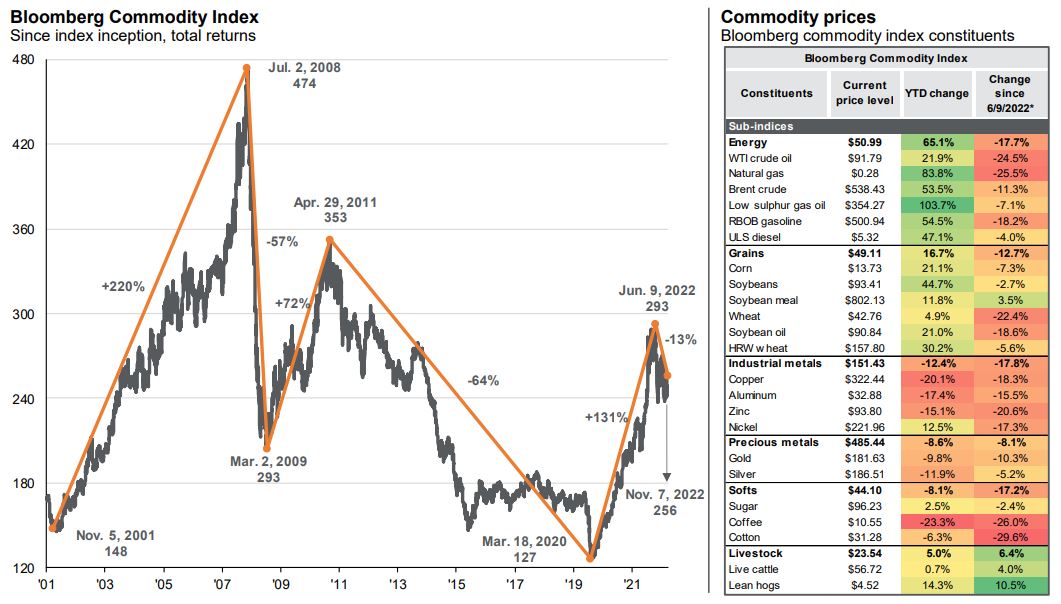

Again, the question then becomes, “Is monetary policy having any effect?” Yes, we have seen energy prices roll over slightly, although oil and gasoline prices spiked a bit in October before settling back down to current levels of about $85 per barrel for oil and $3.80 per gallon of regular unleaded gasoline. Clearly, those prices are still elevated on a year-over-year basis.

When looking more broadly at commodities, we have seen a general decline in prices from the June 9th highs when looking at energy, grains, industrial metals, precious metals and softs (sugar, coffee, cotton), as seen on the far right column of the chart below.

A decline in commodity prices is generally a good thing when combating inflation. However, as we have stated in previous communications, the Fed needs to see changes in two key areas in order to affect the stickier elements of core inflation. These key areas are the labor market and the housing market, so we will first briefly touch on this unusual and unique labor market.

Labor market update

In order to impact the demand-pull elements of inflation, the Fed needs to see a weaker labor market in terms of both jobs and wage growth. When people work, they get paid. When people get paid, they tend to spend. If they get paid even more, people tend to spend even more. If there is full employment and above-average wage growth, then the Fed fears that demand could continuously outweigh supply and cause prices to rise. This is clearly an over-simplification of a very complex issue, but the Fed has overtly stated their desire to see a weakening in labor markets. So, given its aggressive rate posture, has Fed policy impacted the labor market at all in recent months? When looking at the data, it is difficult to say, and it is a very nuanced scenario given the current imbalances in the labor market.

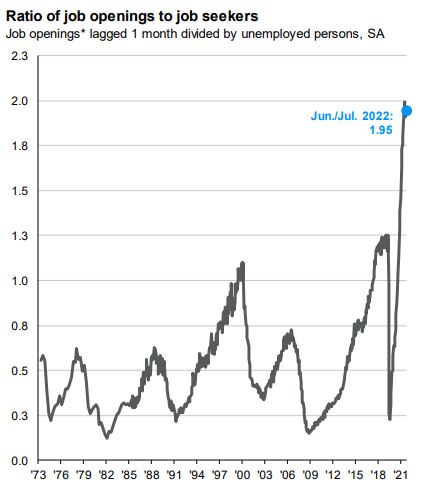

As seen in the chart below, the ratio of job openings to job seekers has fallen, but still remains historically elevated at 1.77 jobs open per job seeker. Employee departures have fallen from their heights of the Great Resignation, as seen on the top right of the chart, but continue to remain elevated.

Source: JP Morgan Asset Management

Meanwhile, companies appear hesitant to let workers go, with layoffs near their lowest levels in decades, as seen on the bottom right of the chart above.

Then, on November 4th, the Bureau of Labor Statistics released their jobs report showing that total nonfarm payrolls increased 261,000 in October, exceeding consensus estimates. Meanwhile, the unemployment rate climbed from 3.5% to 3.7%.

While all of this news is great for the American worker, it is generally viewed as a negative by investors, because the Fed is justifying much of its hawkish policy decisions based on the strength of the U.S. labor market. If we see larger cracks forming in the labor market in the weeks and months ahead, that could give the Fed good reason to pause. While we are seeing shifts in the labor market, how much is too much? How far is the Fed willing to let the labor market decline before they are reminded of their mandate of full employment?

Housing market update

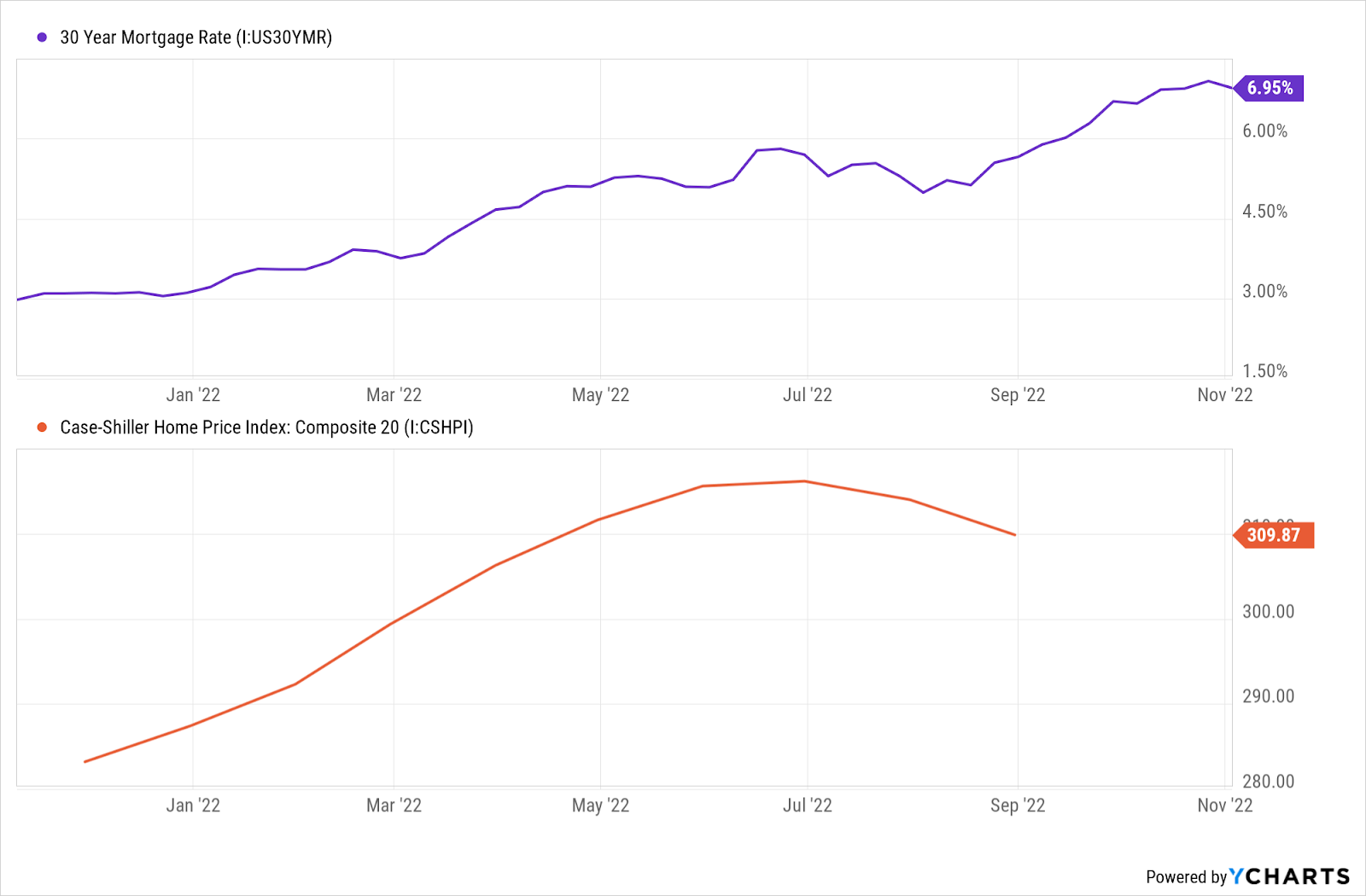

One area of the economy where Fed policy appears to have made an immediate impact is the United States housing market. As illustrated in the top chart below, the Fed’s interest rate policy has driven the average 30-year mortgage rate from the sub 3% level to roughly 6.95% as of November 3rd.

Source: YCharts

Meanwhile, as rates have risen, we have seen home prices roll over, as seen in the chart immediately above from the Case-Shiller Home Price Index Composite 20 showing residential real estate values in 20 major metropolitan areas across the country. This index is calculated monthly using a three-month moving average. Index levels are published with a two-month lag. Clearly, the last report does not reflect current prices, but we would expect the downward price pressure to continue in future months as data is released.

Why is the housing market important to the Fed? Well, shelter is a significant component of CPI with Rents making up roughly 7% of the index and Owners Equivalent Rent representing roughly 24% of the index. Owners Equivalent Rent is a concept that is a bit convoluted, but essentially attempts to measure the price that a homeowner would receive if they were to rent their residence instead of owning it.

With fixed mortgage interest rates so low throughout 2020 and 2021, many homebuyers seemed focused more on monthly payment versus the all-in cost of a home purchase. That math, however, is changing with mortgage rates approaching 7%.

For example, in 2021, a $500,000 30-year fixed loan at 2.99% had a monthly P&I payment of roughly $2,105 and total interest paid of about $257,000 over the course of the loan. Given today’s prevailing 30-year fixed rate (around 6.94%), that monthly payment jumps to $3,293, and total interest paid climbs to about $685,000 over the course of the loan.

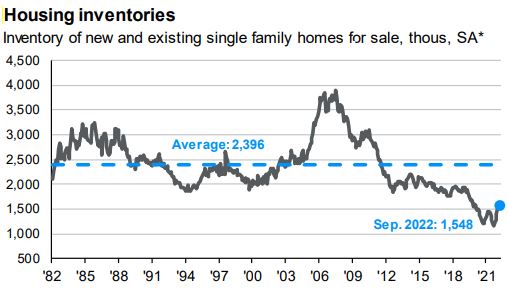

Simply put, certain home buyers will be priced out at certain levels given current rates which, in theory, should reduce demand at current prices. However, much like the labor market, the housing market is historically unique. While housing inventories have ticked up recently, they still remain well below historical averages, as seen in the chart, below.

Source: JP Morgan Asset Management

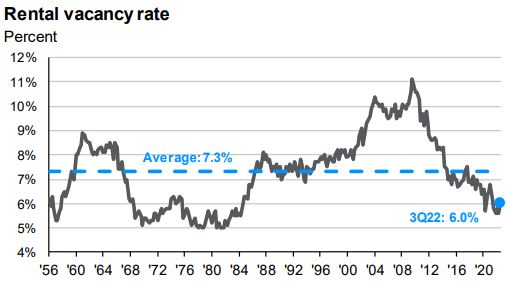

When it comes to the rental market, vacancy rates remained low at 6.0% in the 3rd quarter of 2022, as seen in the Rental Vacancy Rate chart, below.

Source: JP Morgan Asset Management

Again, both the housing supply and rental vacancies may keep the supply and demand equation out of whack. While there is apparent downward pressure on shelter costs, there may be an additional lag before the effect is evident in the monthly CPI numbers – for now.

Earnings update

Let us not forget about earnings season, which is wrapping up with 85% of S&P 500 companies reporting earnings as of 11/4/2022. As expected, the results have been a bit tepid in Q3, with 70% of S&P 500 companies reporting positive earnings surprises and 71% reporting revenues above consensus estimates. In the case of earnings, this number is below the 10-year average of 73%, but the percentage of revenue beats comes in above the 10-year average of 62%.

When it comes to broader financial markets, investors are left with a significant cloud of uncertainty as it relates to Fed policy and the direction of interest rates. Based on the latest FOMC commentary, we know rates will likely go higher than previously communicated in September. Just how high remains to be determined.

As baseball’s great Yogi Berra would say, “It’s deja vu all over again,” as we are left waiting for yet another CPI report on November 10th and the PCE report on December 1st. Beyond that, there is the final FOMC meeting that concludes on December 14th.

However, that does not mean that we sit idle here at Destiny Capital. In fact, it means quite the opposite. We are entering a crucial time of year as a firm. Not only do our team of strategists, planners and coordinators look to implement year-end strategies related to Roth IRA conversions, tax loss harvesting and other key planning items, but our investment team also enters our annual Capital Market Assumption review process.

At this time of year, data becomes available from the top financial research institutions in the world. We collect and aggregate data on just about every asset class in the investable universe and assess its long term investment viability with a focus on features like risk, return, correlations, cost, liquidity, accessibility, performance and much, much more. We also analyze projected trends related to opportunities and obstacles in the years ahead. This deep dive allows us to assess our investments and identify complements, replacements and adjustments to client portfolios.

At Destiny Capital, we are a disciplined, data driven firm that focuses on long-term investing. As investors, this has been the longest period of volatility and adversity that we’ve faced since 2008. I recall the great financial crisis of 2008 vividly, and I am sure many of you do, too.

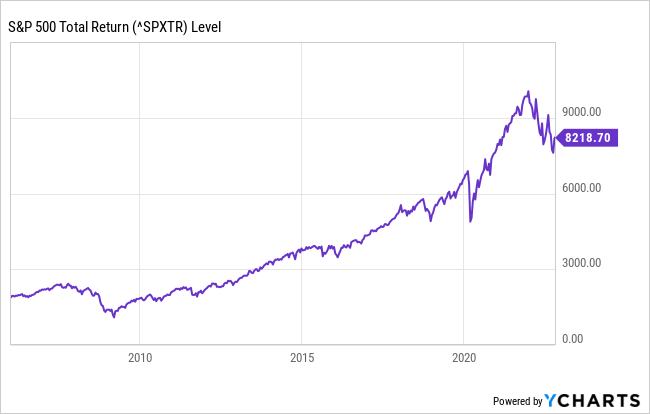

During volatile times like these, I like to review the historical S&P 500 chart below and think of all that we, as investors and citizens have persevered through and overcome over the past 15 years. Yet, I admire and appreciate the overall upward trend.

Source: YCharts

Yes, we face new and unique challenges today, but that is nothing new. I said it throughout the COVID-19 pandemic and I will say it again now. It is never a good idea to bet against the resiliency and ingenuity of the American economy. These have been uniquely difficult markets, but there will be opportunities that present themselves in months and years ahead. We value the trust of our clients and partners immensely, and we look forward to sharing our perspective as we close out the year by working diligently and tirelessly on your behalf.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.