Markets and Economy Update – Interest Rates – How Low Will They Go?

One unanticipated element of parenthood that has really brought me joy over the years has been observing and experiencing the curiosity and inquisitiveness in my two boys. Mundane things like a glass elevator in a hotel or a moving-walk at the airport suddenly become thrilling objects of wide-eyed fascination. However, with this inherent inquisitiveness and curiosity comes questions. Lots and lots of questions. This summer, we took a family trip to the Outer Banks in North Carolina, which turned out to be a wonderful and memorable time. This trip also necessitated a long nine hour car ride each way with two young children. To pass the time, I played an internal game of ‘who will break first, me or my wife?’ when it came to the unrelenting barrage of questions that came from the two mouths in the back seat of our SUV. Somewhere in Virginia, I grinned triumphantly as my wife finally proclaimed, “Boys, enough! Please, let’s just play the quiet game for a bit.” Incidentally, the ‘quiet game’ lasted all of seven seconds.

Nonetheless, now that my eldest son has hit the ripe old age of seven, some of his questions have become a little more philosophical in nature. In fact, a few weeks ago, I got the inevitable “which one of us do you like better – me or my brother?” question from him. I tried not to fall back on the old “I love you both equally” line, and I hope that I navigated his inquiry in a way that will leave the least amount of emotional scarring.

Still, this conversation with my son made me realize that the Federal Open Market Committee (FOMC) is likely going to be addressing a similar question in the next few Federal Reserve meetings. You see, the Fed has a dual mandate – to maintain full employment and keep prices stable (low inflation). For the Fed, the question isn’t necessarily which mandate they like better, but which should receive the most immediate attention when it comes to policy-setting priorities. This is an important distinction, and the Fed’s favor of one mandate over the other could shape the near-term trajectory of financial markets. What will the Fed do between now and year-end? Well, that’s something we’ll try to address in this month’s letter.

Uncertainty Around Interest Rates

Since early 2022, inflation has been the ‘problem child’ for the Fed and has necessitated a tremendous amount of attention when it comes to policy priorities. In child-rearing terms, inflation ended up getting sent to military boarding school to get whipped into shape.

Fortunately, as you can see in the chart below, we’ve seen positive progress on inflation as the Headline Consumer Price Index (CPI) has fallen from over 9% in June of 2022 to 2.53% in August of 2024. In July, the Personal Consumption Expenditures (PCE) inflation report showed Headline PCE of 2.5% and Core PCE of just over 2.6%. Remember, Core PCE is the Fed’s preferred measure of inflation.

U.S. Inflation: Year-Over-Year CPI & PCE

While the U.S. has made positive progress on inflation over the past two years, it has yet to reach the Fed’s 2% target for Core PCE.

In the meantime, we’ve seen some cracks emerge in the labor market over the last few months with the unemployment rate rising to 4.2% while job creation has stalled. As you can see in the two charts below, monthly job gains (in blue) have trended lower while total job openings (in green) have fallen from over 12 million in 2022 down to 7.6 million in the latest Job Openings and Labor Turnover Survey (JOLTS) report. Total job openings are starting to approach pre-pandemic levels.

If the Fed were to aggressively cut rates from here, they would be taking an expansionary policy approach intended to grow the U.S. economy. Theoretically, this economic growth would help to foster job growth and keep the labor market at-or-near full employment. However, an expanding economy could potentially boost aggregate prices which could cause inflation to spike once again. What’s the Fed to do?

For years, the Fed has kept interest rates at restrictive levels despite widespread criticism from economists, investors and pundits. They’ve consistently messaged restraint and the need to proceed with caution, lest the U.S. experience a double-spike of inflation similar to what occurred in the 1970’s and early 1980’s.

At this point, it appears inevitable that the Federal Reserve will begin reducing interest rates with the first cut occurring at the Fed’s meeting on September 18th. Fortunately, a majority of investors appear to be in agreement that a single 0.25% cut will emerge from this meeting which will reduce the federal funds target rate from 5.25%-5.50% down to 5.00%-5.25%. As you can see in the chart below, investors ascribe a 71% probability to this occurrence.

September 2024 Fed Meeting – Target Rate Probabilities

Source: CME Group – FedWatch Tool

However, there appears to be far less investor consensus around the path of monetary policy beyond the September Fed meeting. As you can see in the chart below, investors have disparate opinions about how far interest rates will fall by year-end with 44% pricing-in rate cuts totalling 1.00%. Meanwhile, nearly 37% of investors are pricing-in 1.25% or more of rate cuts, which would see the fed funds target rate fall all the way to 4.00%-4.25% or below.

December 2024 Fed Meeting – Target Rate ProbabilitiesSource: CME Group – FedWatch Tool

What does this dispersion of opinion and lack of short-term investor consensus tell me? It tells me that there’s uncertainty amongst investors and, as we all know, when there’s uncertainty, market volatility can soon follow.

For example, let’s pretend that the Fed ‘only’ reduces interest rates 0.75% by year end. Well, according to the probabilities outlined above, that would mean that 81.2% of investors will have gotten it wrong. If that turns out to be the case, I’d imagine that we could see elevated volatility in financial markets to close-out the year. To be clear, that’s not what I am predicting, but is an example of how markets may react due to a specific, yet uncertain, outcome.

I’m not a betting man. In fact, I cringe when I lose $2 on a horse race at the track and I haven’t been to ‘play the ponies’, as my father would say, in many years. Still, if I were a betting man, I’d wager that we’ll see a patient and cautious approach by the Fed in the coming months. This means that I am in the camp that envisions rates roughly 0.75% to 1.00% lower by the end of ‘24. The Fed has been too patient and deliberative over the past 2 years to risk a spike in inflation due to a rushed policy reversal.

Ultimately, this is a question of which alternative has the most downside – having unemployment climb or inflation spike? In keeping with the racetrack metaphor, between the two Fed mandates, inflation is the tougher horse to corral, and likely warrants a more cautious approach when it comes to interest rate policy.

Frankly, I’m surprised to see nearly 37% of investors pricing-in 1.25% (or more) of rate cuts by the end of ‘24. For those investors calling for (or expecting) aggressive rate cuts, I have a word of warning. Be careful what you wish for. If the Fed is suddenly cutting interest rates by 0.50% or more in two of the next three meetings, that likely means that there are underlying issues with the U.S. economy that necessitate an aggressive policy reaction. In short, if aggressive rate cuts emerge, that’s likely going to mean bad news for the U.S. economy and bad news for stock market investors.

Fortunately, we won’t have to wait very long (if at all, depending on when this letter is released) to see inside the minds of the Federal Open Market Committee. This is because, on September 18th, the Fed will release its Summary of Economic Projections which will provide estimates on the path of key economic indicators like U.S. GDP, the unemployment rate, inflation, and interest rates. In fact, investors will get to see the Fed’s projections for year-end interest rates, and I would expect the probabilities outlined above to change drastically based on the data released by the Fed on September 18th.

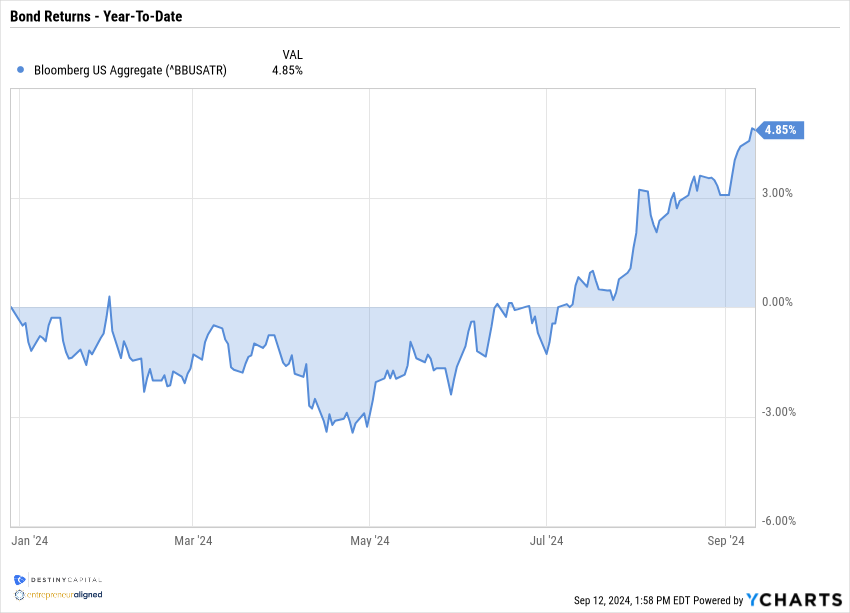

A Rebound in Bonds

To close this month’s letter, we’ll focus on one key asset class that has had a re-emergence, of sorts, in recent months. Since August of 2020, the bond market has been mired in a historic drawdown that has lasted over four years. As investors, we’re constantly asking ourselves ‘where do things go from here?’ when it comes to asset class selection and allocation decisions. While there’s uncertainty around the pace of rate cuts, one thing is certain – interest rates are going lower from here.

Over the coming quarters, barring an economic calamity (see: pandemic or other black swan event), we expect interest rates to normalize. What exactly do ‘normal’ interest rates look like? Is it a Fed funds rate of 2.5%, 3%, or even 4%? That’s impossible to predict. However, we know that current interest rate levels are too restrictive to allow for the U.S. economy to function normally over the long-term.

As long-term investors, you may know that there exists an inverse relationship between interest rates and bond prices. As interest rates rise, as they have in recent years, that means that newly issued bonds will offer higher interest rates than those found in existing bonds. As a result, there will be less demand for existing bonds that offer these lower interest rates, thus causing the prices of those bonds to fall. Conversely, if interest rates fall, existing bonds with higher interest rates will draw more market demand than newly issued bonds, thus pushing the prices of existing bonds higher.

In recent months as investors have grown more certain that we’ll see lower interest rates in the near-term, we’ve seen bond prices climb. As you can see in the chart below, the U.S. Aggregate Bond Index had been mired in negative territory for the first half of 2024. Since then, and as rate cuts have grown closer on the horizon, we’ve seen a reversal of fortune in fixed income, with the U.S. bond market rising over +8% since the late-April lows. This puts the U.S. Aggregate Bond Market Index at nearly +5% on a year-to-date basis.

This is a welcome occurrence for investors, as bond allocations have finally helped to provide some portfolio returns as well as serving as a ballast against short-term stock market volatility. Finally, fixed income allocations are operating as intended within a portfolio, which is to generate reliable income, reduce overall volatility, and appreciate in value during times of declining interest rates.

As a firm, our immediate focus now shifts to the September Federal Reserve meeting on September 18th. As I’ve mentioned earlier, the Fed’s Summary of Economic Projections will give us the most insight into the path of interest rates in the coming months. We’ll also be keeping a keen eye on the PCE inflation report on September 27th and the next CPI report on October 10th. If substantial progress is made and inflation declines further than anticipated, then the Fed could potentially cut rates a bit more aggressively in future meetings. However, that is not our base-case and I expect the stubborn shelter index to stay elevated and remain a thorn in the side of the Fed as they seek to lower inflation to their 2% target. As such, and as I indicated earlier in this letter, I anticipate the Fed to proceed with caution when it comes to monetary policy.

This has been a fast-moving year and we are also growing ever-closer to the presidential election. Regardless of which side of the aisle you find yourself on, an election can elevate anxiety around the path of our nation, our economy and, subsequently, financial markets. At this time, we are not anticipating any portfolio adjustments solely due to an election outcome, but please don’t hesitate to reach out to our team if you have any questions or concerns as we proceed into the final quarter of 2024.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services provided by Destiny Capital Corporation, a registered investment adviser.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.