Coronavirus Update: Resiliency, Ingenuity, and Some Positive News

Lately, I’ve been feeling nostalgic for the past and have spent some time thinking about what life was like in the days of yore. Of course, I’m not harkening back to a time in the distant past like the 80’s – I’m talking about February 21st of 2020. Yesterday, I was casually scrolling through my iPhone photo gallery and found some pictures from that day in late February. Each image captured a beautiful moment as my parents, my son and I spent a lazy mid-morning strolling along the Clear Creek Trail in downtown Golden. In these pictures, there were no masks, my parents and their grandson were walking hand-in-hand, and we capped our little adventure by stopping at a restaurant for an early lunch. In recalling that day, I couldn’t help but think, “ah, those were simpler times.”

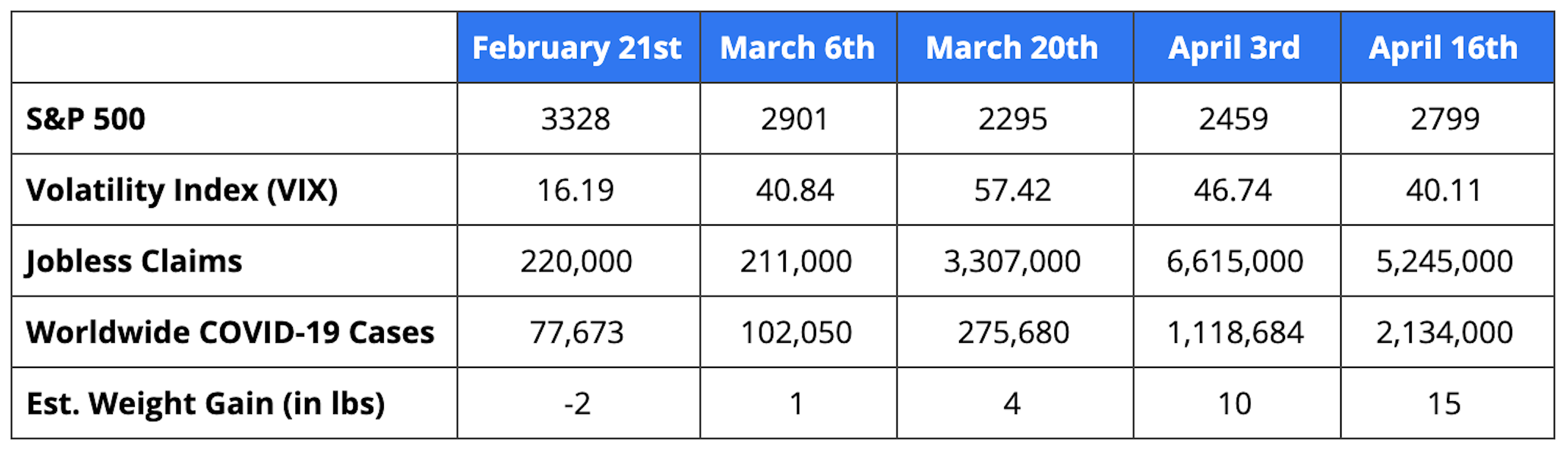

The pace, scope and scale of change we have all experienced over the last 60 days has been extraordinary, and can be summed-up in one word we discuss often at Destiny Capital – volatility. The very definition of volatility is “liability to change rapidly and unpredictably, especially for the worse.” The COVID-19 crisis has somewhat redefined the speed and severity at which volatility can impact both financial markets, the economy and everyday life. To help illustrate this, I put together a few key data points as seen below:

As you’ll note in the data above, financial markets – as measured by the S&P 500 – have rebounded a bit from the lows that were reached in late March. This is despite the fact that jobless claims have skyrocketed and cases of COVID-19 continue to expand, particularly in the United States. You might be asking yourself – what gives? Well, apparently, the Federal Reserve gives…and gives, and gives. We’ve also noted in previous communications that – while the industries immediately affected by the COVID-19 pandemic contribute greatly to payroll jobs in the United States – they contribute less to both total GDP and S&P 500 operating earnings. However, as we progress through earnings season, we’ll start to have a better understanding of how this pandemic is affecting the performance of all industries in the U.S. economy, not just hospitality, transportation, tourism, retail, etc. However, before we get to monetary policy and close out the week with some positive news, we’ll begin with our usual, sobering pandemic update.

COVID-19 Update – as-of April 16th, there were 2,134,000 million confirmed cases of COVID-19 worldwide with fatalities approaching 143,000. Nearly 30% of all worldwide cases have been reported in the United States, with 654,301 confirmed cases nationally and 31,628 deaths. According to the Colorado Department of Health and Environment, there are 8,280 cases locally in Colorado with 1,636 hospitalizations and 357 deaths. New York City continues to be a COVID-19 hotspot with 117,565 cases and over 7,500 deaths.

The rapid spread of COVID-19 in the United States has helped to reinforce the necessity for severe social distancing measures. However, this social distancing has cost over 22 million American jobs and has put many businesses – small and large – on the brink of closure. Given the magnitude of these issues, we are seeing equally unprecedented activity by the Federal Reserve which, last week, unveiled new monetary policy aimed at combating any long-lasting damage to the U.S. economy.

Monetary Policy Update – on Thursday, April 9th, Fed Chairman Jerome Powell announced that the Fed would be creating and/or expanding nine lending programs that would allow the Fed to lend directly to states, cities and midsized businesses. It is estimated that these loans could reach up to $2.3 trillion in aggregate. Clearly it will take some time – and likely a dedicated communication – to unpack every initiative that the Fed has unveiled in recent weeks. Still, the stock and bond markets have reacted favorably to recent monetary policy decisions, and Jerome Powell has stated that the Fed has tried to assist “the priority areas where we thought help was needed. As we identify other areas, we won’t hesitate to move.”

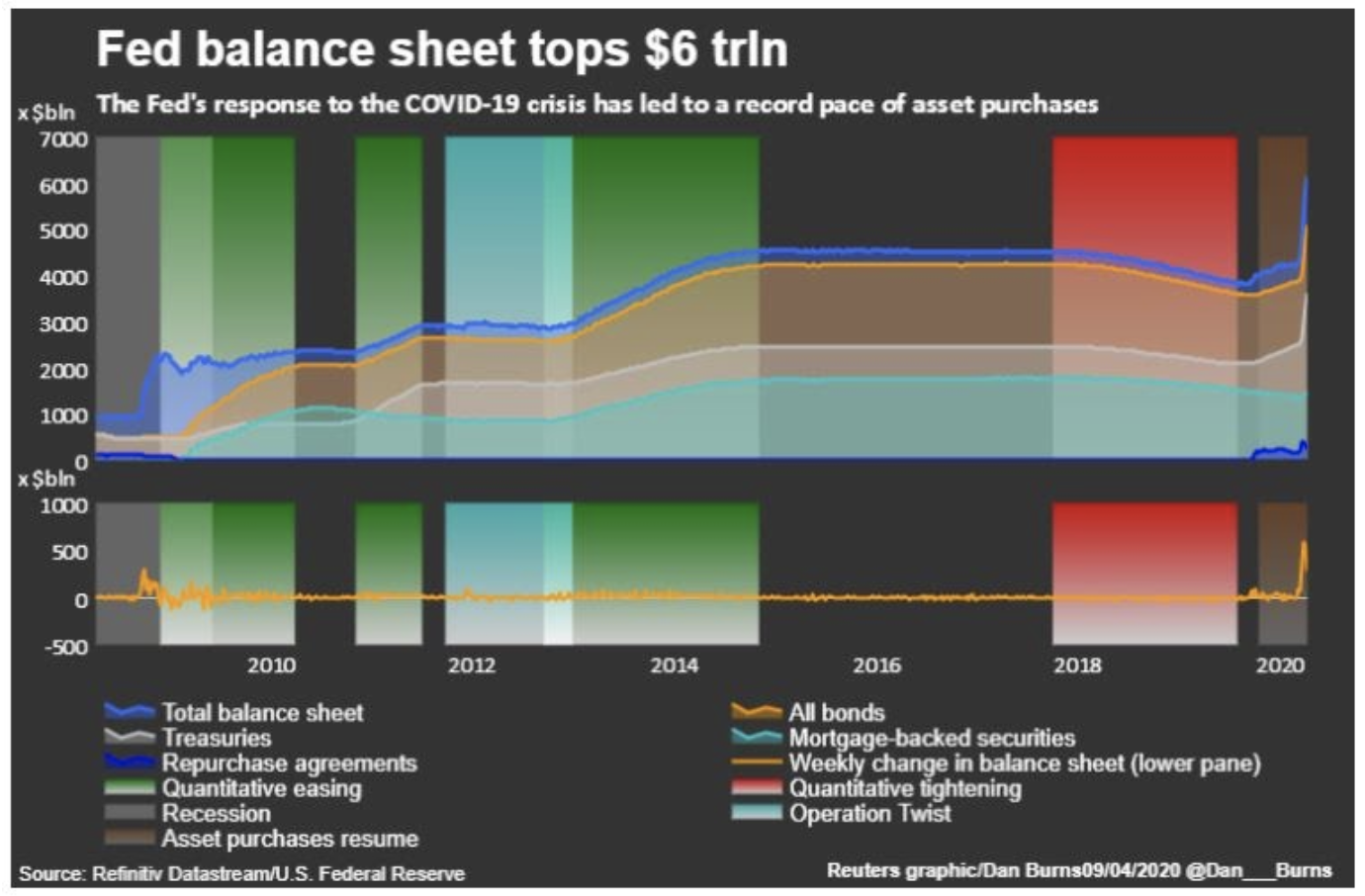

We may be witnessing some lessons learned from the 2008 financial crisis given how aggressively and decisively the Fed has acted throughout this pandemic. Former Federal Open Market Committee members from the 2008 era have expressed regrets about acting a bit too slow or indecisively to stem the size and scope of the great recession. Today’s Federal Reserve clearly won’t be accused of that. However, there may be unforeseen consequences of the Fed’s recent actions which may not be felt for months or years to come. These are truly uncharted waters as the Fed’s balance sheet has reached historic levels due to recent monetary policy initiatives.

(Source: Reuters/Refinitiv Datastream/US Federal Reserve)

Resiliency, Ingenuity, and Some Positive News – To close this week’s update, I would like to end on a bit of a positive note. Those who know me well know that I am, for lack of a better term, a bit of a ‘foodie’. I love to cook, and one of my favorite pastimes is exploring local restaurants, trying new cuisines, then testing new recipes and new techniques at home. I’ve lived in the Berkeley neighborhood of NW Denver for nearly a decade, and it pains me to drive down Tennyson Street and throughout the neighborhood to see local restaurants either shuttered or displaying handwritten signs imploring the public to order takeout meals or delivery. Several days ago, I visited the website of a newer restaurant that caught my eye when it had opened in the area. I thought – there’s no way a new, higher-end restaurant will survive in this type of brutal environment. However, when visiting the restaurant’s website – to my surprise – I wasn’t greeted with a ‘Closed for Business’ notification. Instead, I found an alert that said “Order one of our Weekly Meals” where, on Mondays, customers can pick-up 5 different prepared dinners for 1, 2 or 4 people. They come fully prepared and ready to heat and serve. I thought to myself – this is genius. This is the type of simple innovation and adaptation that gives me hope in our economy and faith in our communities. I talk each week about the resiliency and ingenuity of the American economy, and this is such a wonderful, simple example of that.

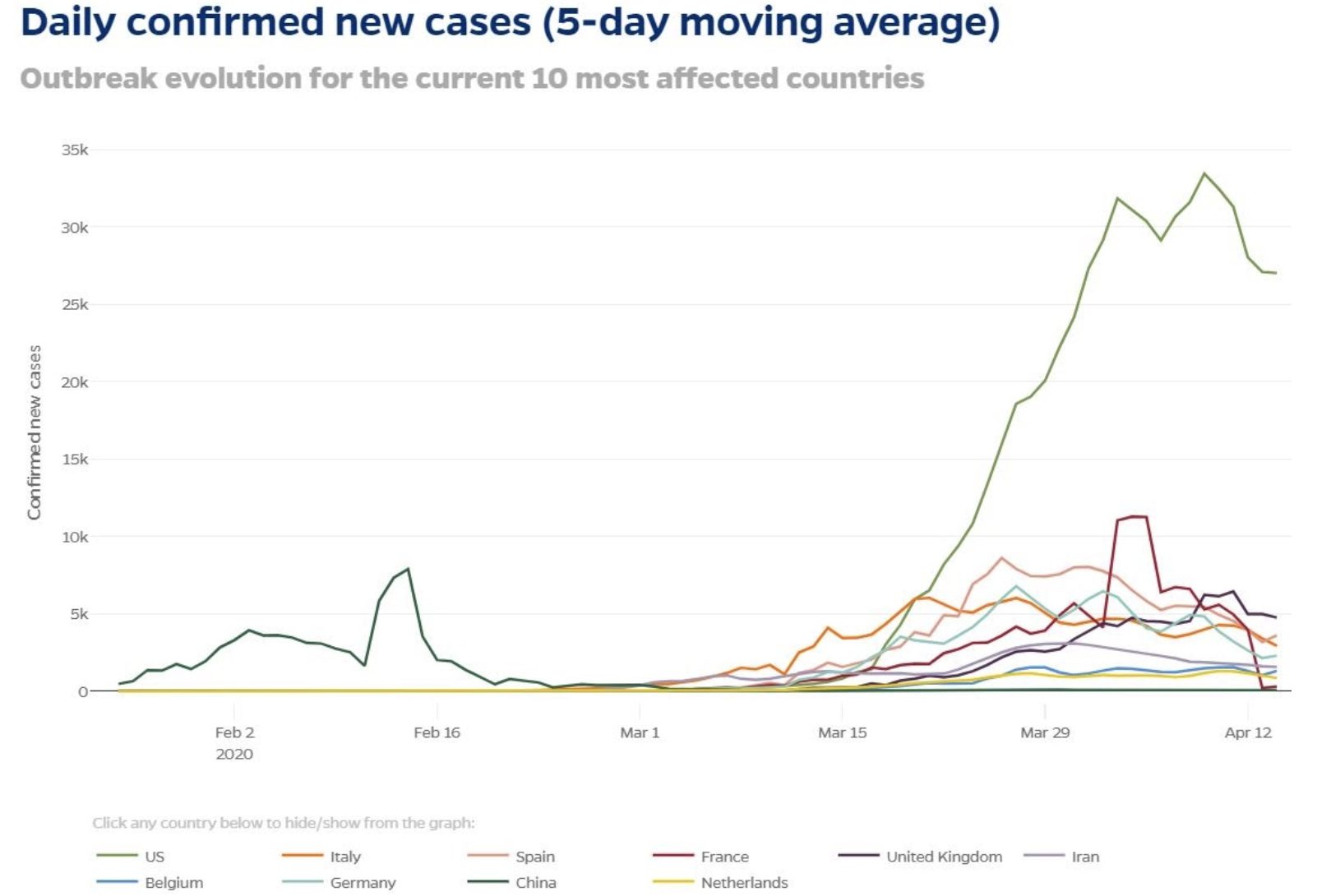

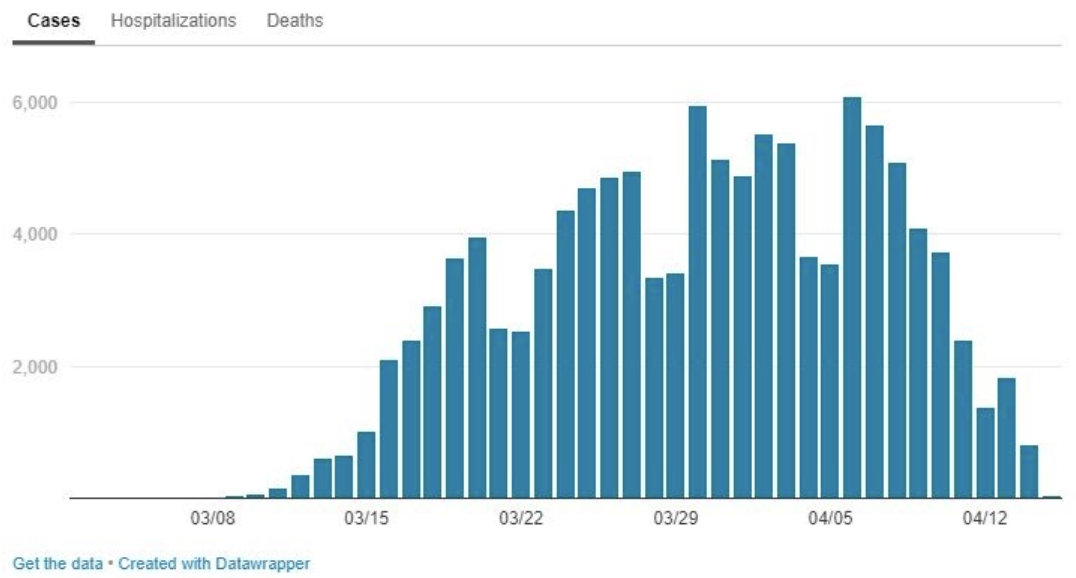

We are also seeing other positive developments emerge. China recently lifted the coronavirus lockdown in Wuhan, China and I’m sure many of us – with a little jealousy, I’m sure – have viewed images of people congregating and celebrating in the streets after months in isolation. Furthermore, as seen in Chart A below, the 5-day moving average of daily new COVID-19 cases appears to be levelling-off in the 10 most affected countries. This illustrates that social distancing may be working, and that the sacrifices being made by people across the world may be making an actual impact in slowing the spread of this pandemic. This trend can also be seen in Chart B, which shows the number of daily cases reported in New York City.

CHART A

(Source: Johns Hopkins COVID-19 Map)

CHART B

(Source: NYC.gov)

I’ve also seen a new trend emerge in the data distributed by Johns Hopkins, and this trend is a significant increase in coronavirus recoveries (see the chart below). Clearly, it’s far too early to predict the ultimate impact of COVID-19 as measured either by the economy or total loss of life. Still, after a gut-wrenching 40+ days, I think we all could stand to end the week with some positive developments.

(Source: Johns Hopkins Coronavirus Map)

Over the coming weeks, we will be closely analyzing corporate earnings and tracking new COVID-19 developments. In the meantime, please stay safe, be well, and know that we are here for you if there is anything you need.