CIO Mailbag | Tariffs and Trade Policy – What does this mean for investors?

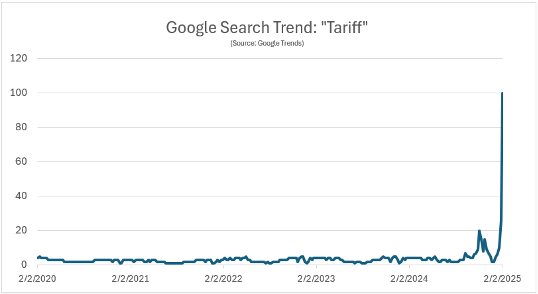

In recent days, news headlines and social media feeds have been flooded with updates and opinions about the trade policies implemented by the new Trump administration. In fact, as you can see in the chart below, Google searches for the word “Tariff” peaked at all-time highs on February 2nd. Curiosity abounds.

At Destiny Capital, tariffs have been a topic we’ve been monitoring closely for quite some time and even highlighted in our post-election letter to investors back in November of 2024. Now that we have a bit more clarity on the use of tariffs by the Trump administration, we can attempt to gauge the potential impact of trade policy on the U.S. economy and financial markets.

It’s also important to note that this situation is incredibly fluid and circumstances seem to change every time I refresh my web browser. So, we’ll start with a brief overview of what has happened to-date before we move on to what it might mean for investors.

First, we’ll begin by defining what a tariff is. Ultimately, a tariff is a tax on goods imported from overseas. When the U.S. government implements a 5%, 10% or 25% tariff on foreign imports, these tariffs (taxes) are paid by the U.S. corporations importing these goods. Top importers in the United States include familiar names like Walmart, Target, The Home Depot, Lowes and IKEA.

Typically, a federal government might impose tariffs for any number of reasons, including to protect domestic producers/manufacturers, to support fledgling industries, to protect consumers, to correct trade imbalances (trade deficits) and more. Tariffs also generate revenue for the federal government, just like any other tax.

In this current scenario, the Trump administration appears to be acutely focused on the following issues as the impetus for tariffs – illegal immigration, illegal drug production (particularly the powerful synthetic opioid fentanyl) and the subsequent smuggling of drugs into the United States. This is evident in the titles of the three executive actions that President Trump signed on February 1, 2025:

- Imposing Duties to Address the Flow of Illicit Drugs Across Our Northern Border

- Imposing Duties to Address the Situation at Our Southern Border

- Imposing Duties to Address the Synthetic Opioid Supply Chain in the People’s Republic of China

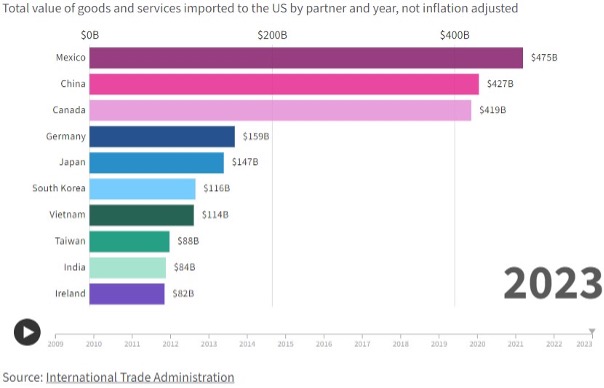

These executive actions outlined 25% tariffs on both Canada and Mexico (with a carve-out for 10% tariffs on certain Canadian energy resources) as well as 10% tariffs on Chinese imports that are in addition to existing tariffs. Currently, Mexico, China and Canada are America’s top three import partners – in that order – as you can see in the chart below.

There are a few important points I’d like to make at this stage. To begin this letter, I stressed that this tariff situation is very fluid. In investor parlance, ‘fluidity’ equates to uncertainty. If you’ve ever read one of my previous investor letters or watched Destiny Capital’s webinars in the past, you’ll know that I often state that uncertainty can lead to fear, and fear can lead to stock market volatility. So, if significant uncertainty persists around trade policy and the use of tariffs, we can likely expect stock market volatility to soon follow.

Furthermore, in our investor letter after the November election, I communicated my belief that tariffs may be utilized as a negotiation tool to generate leverage and gain concessions from foreign governments. At this stage, trade policy and the use of tariffs appear to be playing-out as predicted.

We saw our first glimpse of trade policy in action on January 26th when the Trump administration imposed tariffs on Colombia when the Colombian government initially refused to accept two military aircraft carrying deported Colombian migrants. In response, President Trump immediately imposed 25% tariffs on all Colombian goods entering the United States and threatened to increase tariffs to 50% within one week.

Additional punitive measures included a travel ban for Colombian government officials, visa revocations for these same officials, as well as economic sanctions. Colombian President, Gustavo Petro, quickly responded by enacting tariffs on all U.S. exports entering their country. Ultimately, in under 24 hours, the dispute was resolved, concessions were made, Colombia accepted the returned migrants, and all tariffs were lifted. However, this brief trade war set the tone that the Trump administration appeared willing to implement tariffs for reasons that have very little to do with trade and everything to do with the priorities of the Trump administration. As mentioned earlier, the executive actions signed by President Trump included language almost entirely devoted to illegal immigration and opioid production and smuggling.

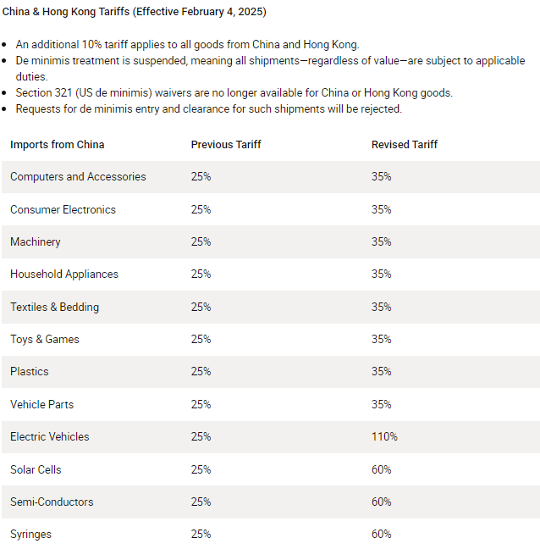

As it stands today, as of this writing, the tariffs on both Canada and Mexico have been ‘paused’ until March of 2025 to allow for additional negotiations. The additional Chinese tariffs went in force on February 4th and affect Chinese imports as follows:

With regard to Canada and Mexico, I would imagine that the Trump administration is seeking some kind of public commitment of troops and/or resources at the northern and southern border, along with other assurances related to immigration and drug trafficking. When it comes to China, the Trump administration likely wants strong commitments to crack down on the production of synthetic opioids like fentanyl in their country.

While this strategy may ultimately prove to be effective, there are economic risks involved, particularly if tariffs are imposed on one or more of our key trade partners over an extended period of time. These risks include:

Inflation: if long-term tariffs are in place for an extended period, we could potentially see aggregate prices move higher. Using hypothetical round numbers, let’s assume that, prior to tariffs, Walmart paid $10 per pack of 12 tube socks imported from Mexico. Let’s now assume that a 25% tariff is applied to all Mexican imports, so Walmart now must pay $12.50 for those same tube socks ($10 to the Mexican manufacturer, $2.50 to the U.S. government due to the tariff). Walmart now has two options. The company can either absorb the price increase on tube socks and other tariffed goods which will likely lower profits – or – they can pass the added cost on to the consumer through higher prices.

In my experience, corporations don’t like to report lower profits to shareholders during earnings calls, so it’s likely that consumers will pay higher prices for tube socks and any other product impacted by tariffs. These elevated prices, in aggregate, would then cause inflation measures like the Consumer Price Index (CPI) to move higher. After recently navigating a painful period of elevated inflation over the past three years, that’s an outcome that most U.S. consumers would prefer to avoid.

Tit-For-Tat Tariffs and Lower GDP Growth: if tariffs persist with one or all of our trade partners, we could see retaliatory tariffs emerge on U.S. exports. We already saw this from both Canada and China who threatened to enact equivalent tariffs on products exported from the U.S. into Canada and China. If this occurs, there may be less demand for U.S. products from these foreign trade partners. Lower demand may equate to lower production, which could hinder the growth of Gross Domestic Product (GDP) in the United States.

Higher Unemployment: piggybacking on the point above, if there is less demand for U.S. goods, layoffs could emerge in the industries most affected by export tariffs. Furthermore, there are many companies, both big and small, that are heavily reliant on imports from our trade partners. These companies may not be in a position to readily pass-off price increases to consumers. Therefore, corporations reliant on both imports and/or exports may trim their workforce in order to maintain certain profitability levels. In large enough numbers, this could cause the unemployment rate to tick higher.

Erosion of Trust: while this is a less tangible impact, there could be a lingering effect when it comes to future agreements around trade or areas of mutual interest. This is because, as recently as 2018, President Trump, along with Mexican and Canadian leaders, signed the United States / Mexico / Canada Agreement (USMCA), which was a free trade agreement that modernized and replaced the North American Free Trade Agreement (NAFTA). The USMCA officially went into effect in July of 2020, and included provisions for dispute settlement that would attempt to avoid contentious issues like tariffs. The Trump Administration’s current trade policies could cause both allies and adversaries to question the commitment of the U.S. when it comes to agreements such as the USMCA.

Summary

When it comes to the risks outlined above, I would consider most of these outcomes to be possible, but far from probable. We do not consider a protracted trade war with our three largest trade partners as our ‘base case’ for the U.S. economy moving forward, and we do not believe we are alone in that outlook.

This is evidenced by the stock market’s reaction, or lack thereof, to the executive actions announced on February 1st. If investors truly believed that significant tariffs would be in place for the next 6-12 months, we’d likely be experiencing a stock market correction in the -10% to -20% range. Instead, markets remain in a wait-and-see mode as negotiations continue. My general belief is that concessions will be made, agreements will be reached in the days and weeks ahead and, six months from now, thoughts of a trade war with key trade partners like Mexico and Canada will seem like a distant memory. The relationship between the United States and China is a bit more complicated, but the U.S. economy is far less singularly reliant on Chinese imports than it was between 2008 and 2018.

Furthermore, over the past decade, financial markets have grown increasingly ambivalent about politics in Washington D.C. Recent ‘crises’ around the debt ceiling are an example of this. Every so often, there is a tense standoff in Congress around the debt ceiling, the potential for default, and an agreement is ultimately reached in the 11th hour that kicks the can down the road another ninety days. Many years ago, investors would grow skittish and volatility would spike during these contentious standoffs. In recent years, however, investors tend to view these standoffs as ‘noise’ and politics-as-usual, and market reactions tend to be muted. For now, we appear to be seeing a similar dynamic at play with the politics of the new Trump administration.

The blunt reality is that no one truly knows what outcome will emerge from this current trade dispute. As indicated earlier, a tremendous amount of uncertainty remains. As investment managers at Destiny Capital, one of our core principles is that we remain disciplined as investors. We make high conviction investment decisions based on data, not subjective emotion or gut feelings. As investing great, Peter Lynch, once said, “The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them.” That quote is a good reminder during times like these.

While news headlines may seem alarming, the underlying fundamentals of the U.S. economy and financial markets remain strong. Furthermore, with the emergence of artificial intelligence (AI) technology, we may be at the forefront of a new technological era that has the potential to rival the advent of the personal computer, the internet and the iPhone. The potential for innovation is exciting. That doesn’t mean there won’t be bumps along the way. The path of financial markets is anything but linear. Regardless, our outlook for stock and bond markets remains the same as it did in the days and weeks before President Trump took the oath of office.

As a reminder, this is also a good time to rely on sound financial planning. At Destiny Capital, our talented team of strategists and coordinators can model many hypothetical outcomes to illustrate how various scenarios might impact your financial future. These are often the ‘sleep better at night’ conversations that are so important when anxiety is elevated. Detailed financial planning helps to add some certainty to an uncertain situation and, we hope, empowers our clients to focus less on the stock market and more on the people and activities that bring them joy.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services provided by Destiny Capital Corporation, a registered investment adviser.

Do you have your own question? Ask it here.

Transform Your Retirement Strategy

Discover the three-legged stool approach for a stronger financial foundation.

_____________________

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.