Markets & Economy Update – The Year in Review

As I’ve grown older and personal time has become a rarity, I still find myself trying to carve-out a brief window of time to watch a little college or NFL football on some weekends. While I care far less about outcomes (particularly with my alma mater) than I might’ve in my early twenties, I am still drawn to the sport, regardless of who might be playing. In the many decades I’ve consumed the sport of football, I’ve come to learn that there are a handful of ‘attention seeking’ positions where, if a player’s name keeps popping up during the broadcast, that usually means that he’s doing a great job. For example, if TV commentators mention a wide receiver’s name eight to ten times throughout a game, that’s probably a good indication that he’s caught a heckuva lot of passes. That’s a good thing for his team.

Conversely, there are certain positions in the sport where the opposite is true. For example, if you’re an offensive lineman and your name is mentioned eight to ten times during the broadcast, that usually means that you’re either consistently getting beat by your defensive opponent or getting called for a lot of penalties – or both. That’s bad. So, for positions like offensive line or even cornerback (the guys covering the wide receivers), they want to fly under radar. No news is good news. If nobody is talking about them, that’s a great thing because that usually means they’re doing their job and doing it well.

For investors, stock market volatility is a lot like an offensive lineman during a football broadcast. No news is good news. We don’t want to hear volatility mentioned in a TV broadcast of any kind, and that’s largely been the case in 2024. In fact, if I had to point out one defining characteristic of financial markets throughout 2024, it would probably be the lack of volatility the stock market experienced throughout the year.

This dynamic can be seen in the chart below that details the CBOE S&P 500 Volatility Index (VIX) in 2024. As a reminder, the higher the VIX, the more volatility investors can expect stocks to experience during each trading day. The long-term average VIX level is roughly 19.5. At Destiny Capital, we consider volatility to be ‘elevated’ when the VIX exceeds 20.

As you can see in the chart above, volatility was abnormally tame throughout 2024 and well below the aforementioned historical average (19.5). Yes, we had a short-lived volatility spike in August when the Bank of Japan unexpectedly raised interest rates, but that was largely viewed as an anomaly. Investors also displayed some frayed nerves in the weeks leading to the election, but that’s very common during an election year.

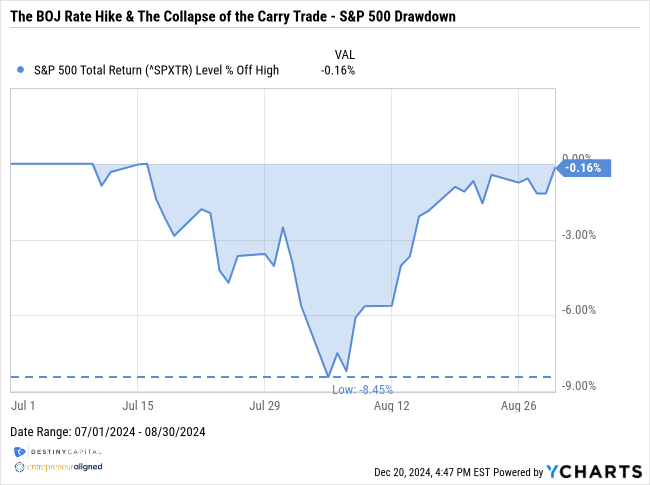

Regardless, it’s important to note that this lack of volatility is abnormal. On average, the S&P 500 experiences an annual intra-year decline of -14% in any given calendar year. This year, the largest drop in the S&P 500 index was roughly -8%, and this occurred in conjunction with the unexpected Bank of Japan rate hike referenced earlier. In that case, markets rebounded sharply and erased nearly all losses in less than a month. This can be seen in the S&P 500 drawdown chart below.

Another unusual anomaly in 2024 was the bullish (positive) investor sentiment that persisted throughout the year. To assess investor sentiment, The American Association of Individual Investors (AAII) conducts a weekly survey that asks investors whether they are bullish (positive), bearish (negative) or neutral about the stock market over the coming 6 months.

Typically, sentiment swings from bullish to bearish (and vice versa) throughout the year as investors react to quarterly earnings, economic data, changes in monetary & fiscal policy, and more. However, investors largely remained very positive throughout virtually all of 2024, which is a rarity.

The chart below helps to illustrate the results of the AAII survey, with a positive number meaning that investors feel optimistic about the immediate future of the stock market.

As you can see encapsulated in the red square above, investors were bullish for nearly all of 2024. This then might become a ‘which comes first, the chicken or the egg’ type of scenario. Did markets perform so well in 2024 because investors were so positive, or did the strong returns cause investor sentiment to remain elevated?

Regardless, the stock market had a very strong year with the S&P 500 leading the way with a +26.4% total return. The S&P 500 was followed by the Dow Jones Industrial Average (+16%), Small Caps (+11%), International Stocks (+5.7%), the U.S. Aggregate Bond Index (+1.04%) and U.S. Treasuries (+0.41%).

In many ways, this year’s performance was similar to 2023 due to the fact that U.S. Large Cap stocks led the way while fixed income (bond) investments struggled.

We also saw a continuation of a trend where the top 7-10 S&P 500 companies produced the lion’s-share of returns. For example, as-of this writing, the Magnificent 7 stocks (Apple, Microsoft, Amazon, Alphabet, Meta, NVIDIA, and Tesla) have a combined return of +51% in 2024. By comparison, the remaining 493 S&P 500 companies produced a combined return of just +12%. This is illustrated in the YTD ‘24 column of the chart below.

JPMorgan Asset Management – Guide to the Markets

Furthermore, the Magnificent 7 companies produced very strong earning’s growth of +33% while the remaining 493 companies in the S&P 500 generated earnings growth of just +4.2%. Profit margins have also been impressive in 2024 with the Magnificent 7 boasting margins of +23.5% vs. +9.3% for the rest of the S&P 500 index as seen below.

JPMorgan Asset Management – Guide to the Markets

Given these impressive data points, you can begin to understand the appeal of investing in these companies. However, with so many investors piling-into these stocks, the S&P 500 index has become extraordinarily top-heavy. For example, as-of this writing, 38.5% of the S&P 500 index is now comprised of the top 10 stocks.

JPMorgan Asset Management – Guide to the Markets

You see, the S&P 500 is a market-cap weighted index. ‘Market capitalization’ is calculated by multiplying a stock’s price by its number of shares outstanding. So, all things remaining equal, as a stock’s price increases over time, so does its market cap. If a company’s market cap increases much faster than the market cap of other companies, it then becomes a larger piece of the pie relative to the overall index.

The chart below helps to illustrate the staggering valuation growth these companies have experienced over the past four years. Less than ten years ago, a $1 trillion market cap seemed like an astonishing, aspirational goal. Today, we now have Apple with a $3.82 trillion market cap. NVIDIA went from a $144 billion dollar market cap on January 1, 2020 to a $3.28 trillion market cap as-of this writing. Truly astonishing.

A key question we are asking as an Investment Committee is whether or not this environment of haves vs. have-nots will persist into 2025 and beyond? Clearly, it may prove difficult to dethrone these top mega cap companies as perpetual strong performers, but expectations are sky high and any earnings missteps may be met with a sharp, negative response by investors.

In fact, while these companies are clearly appealing investments to many, we only have to look back to the performance chart from 2022 to recall a valuable lesson. Selloff’s of the Magnificent 7 stocks ranged from -26.4% to -65.03% with an average decline of -46.03%. Unless you have a prolonged time-horizon for your investments, it can be difficult to endure such volatility. Remember, it takes a +100% return to recover from a -50% decline. This stresses the importance of diversifying not only among stocks, but across a variety of asset classes that behave differently throughout the market cycle.

Persistent Inflation & A Shift In Fed Guidance (Again)

In another 2023 re-run, investors have been forced to endure elevated inflation and continuous changes to monetary policy from the Fed. As has been the case for nearly two years now, housing costs continue to be a considerable impediment to lowering inflation back to the Fed’s 2% target. The chart below helps to illustrate the key contributors to Headline CPI inflation – Shelter/Housing, Auto Insurance, and Dining, Recreation and other Services.

JPMorgan Asset Management – Guide to the Markets

Trimming inflation down to the Fed’s 2% target is a lot like being on a diet. The last five pounds are always the hardest to lose. However, given the fact that shelter represents roughly 33% of Headline CPI inflation, it’s difficult to envision reaching that 2% target given the status quo. Yes, we are seeing a slight decline in year-over-year rents according to ApartmentList.com, but the supply/demand dynamics of the housing market continue to remain far out of balance.

In fact, Fed Chairman, Jerome Powell, has openly communicated that interest rate policy is not enough to solve the issue of high housing costs. After the Fed’s September meeting, Powell stated, “the real issue with housing is that we have had and are on track to continue to have, not enough housing (sic)…where are we going to get the supply?” Powell has since called on congress to uncover ways to increase supply and to impact all aspects of the housing market that face challenges, including zoning and red tape.

Given the fact that the U.S. economy is largely stable and the labor market remains strong, the Fed agreed to cut the fed funds rate by 0.25% during their latest meeting on December 18th. However, their forward guidance has changed yet again. During their September meeting, the Fed projected a 1.00% decline in interest rates, which implied four 0.25% rate cuts in ‘25.

That projection has been revised and the Fed has announced that they anticipate only 0.50% of rate cuts in ‘25. As we’ve discussed many times in recent years, whenever the Fed deviates from a predetermined course, markets tend to respond negatively. That was certainly the case after the Fed’s December meeting as both stock and bond markets sold-off sharply.

As 2024 comes to a close, rest assured that we remain keenly focused on 2025 and beyond. Our research has us excited and optimistic about what’s ahead for investors. From an earnings perspective, overall earnings growth for the S&P 500 in 2025 is estimated to be a strong +15% with key contributions potentially coming from sectors like Information Technology (+23.2%), Healthcare (+20.7%), Industrials (+19%) and Materials (+18.9%) according to data provider FactSet.

We are also approaching the coming year with the following questions, among many others, whose answers may help to outline both opportunities and obstacles in the year ahead:

- Will the benefits of artificial intelligence impact broader markets and not just the top seven to ten companies?

- In stocks, will the gap between the haves (The Magnificent 7) and the have-nots (S&P 493) begin to close?

- Will potential changes to domestic trade policy benefit the U.S. or slow global growth?

- What effect, if any, will potential deregulation have on investment opportunities in the U.S?

- Will the federal government begin to trim spending or will the deficit (and U.S. public debt) continue to expand?

- Can inflation be tamed and/or will interest rates remain elevated?

- Will opportunities and innovations in private markets continue to become more readily available to non-accredited/qualified investors?

- Will volatility return to normal levels in 2025?

Regrettably, my prediction for that last bullet point is a strong ‘yes’. However, that’s not necessarily a bad thing, but only means that markets will be operating normally once again.

As we close-out another year, I want to be sure and thank all of you reading this letter for making it through yet another long-winded entry, but also for allowing our team to serve you as a trusted financial partner. It’s truly an honor, and not one we take lightly. If you have any questions as we head into this new year, please don’t hesitate to reach out. I would also like to note that I accept questions via our CIO Mailbag, and you can submit questions via e-mail or phone with your Strategist or Coordinator, or via our website here. No questions are off limits, even if you’re just looking for a good dinner recipe. In the meantime, please have a wonderful and safe holiday season, and I’m looking forward to another positive and prosperous year in 2025.

Transform Your Retirement Strategy

Discover the three-legged stool approach for a stronger financial foundation.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services provided by Destiny Capital Corporation, a registered investment adviser.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.