Optimize Business Equity: Turn Company Value Into Personal Wealth (Without Guesswork)

If most of your net worth is tied up in your company, it can feel like you’re doing well on paper—but still unsure how (or when) that value becomes personal security. The goal of equity optimization is simple: build, protect, and translate business value into clarity, confidence, and control for your next chapter.

Key takeaways

- Equity optimization starts long before a sale; it’s a set of decisions you make year after year.

- The “best exit” is the one that fits your goals, taxes, and timeline—not just the highest headline price.

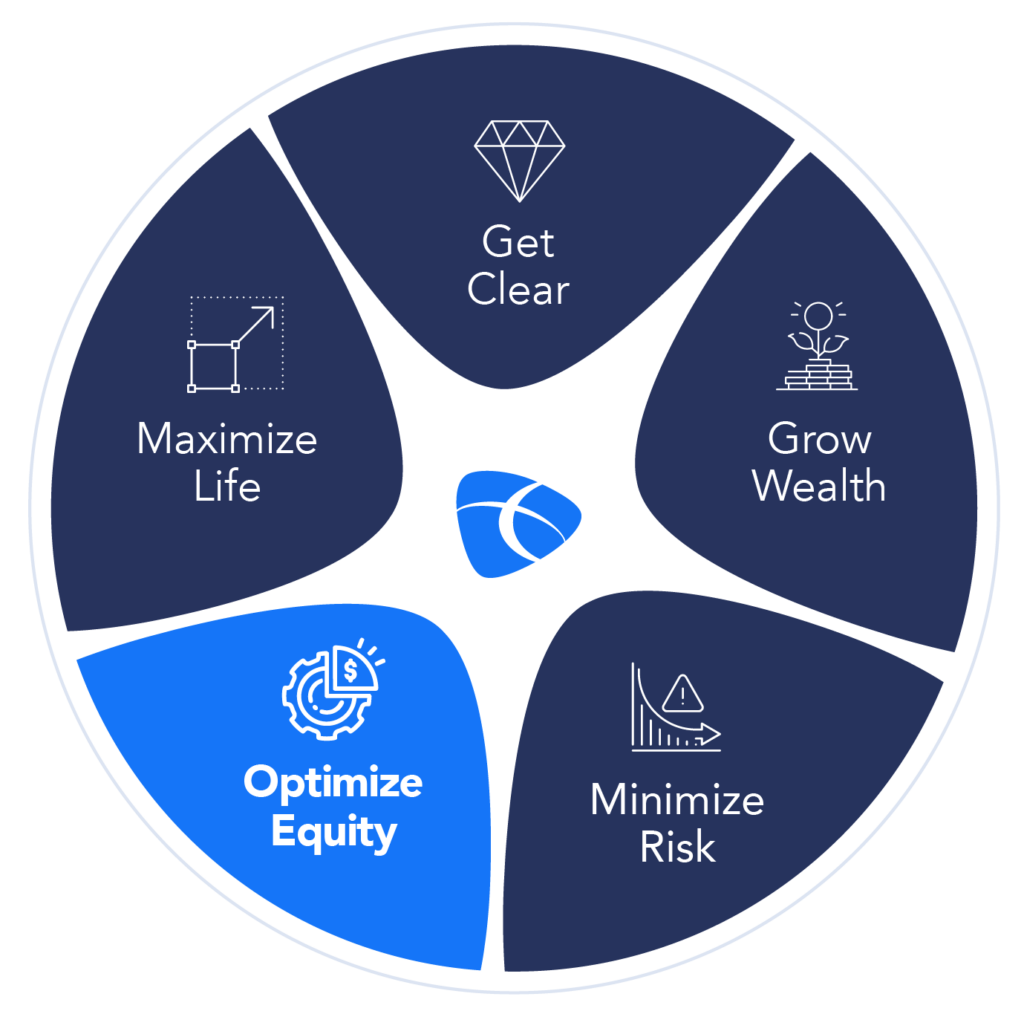

- A structured process (like PWOS™) helps coordinate your business decisions with your personal wealth plan.

What does it mean to “optimize equity”?

Optimizing equity means treating business value as part of your personal wealth strategy—not a separate project you deal with later. It includes strengthening the drivers of value, reducing avoidable risks, and planning for how proceeds may support retirement income, philanthropy, or your next venture.

Many owners stay busy in the business but postpone the decisions that can make an eventual transition smoother and more tax-aware. Our team works with business owners to reduce overwhelm and make this planning feel doable long before a deal is on the table. Here’s a sample sequence to help you think through key components of equity planning.

- Step 1: Clarify the outcome you want (timeline, lifestyle, legacy, and “enough”).

- Step 2: Understand what drives value in your business today (and what could reduce it).

- Step 3: Revisit entity structure and tax strategy as the business evolves, since the “right” setup may change over time.

- Step 4: Model exit paths—internal transition, third-party sale, or family handoff—and compare tradeoffs beyond price (timing, risk, taxes, control).

- Step 5: Coordinate the plan with your financial professional, CPA and attorney so deal structure, tax planning, and legal documents support the same goal.

How PWOS™ connects business and personal plans

Destiny Capital’s Personal Wealth Operating System™ (PWOS™) is designed to help business owners coordinate equity decisions with cash-flow planning, tax planning, and long-term personal goals. Instead of treating an exit as a single event, PWOS™ frames it as a multi-year process—so business growth, risk management, and personal wealth integration stay aligned.

Many financial planners don’t discuss equity at all, assuming there is no need to get involved before the business sells. This approach leaves entrepreneurs scrambling to understand tax decisions, value drivers, and deal structure, often from disparate sources, and sometimes only after it’s too late to make changes that could have saved time and thousands or millions of dollars.

Our team is practiced in working with business owners, and are ready to talk you through common questions like:

- How long does exit planning take?

- Do I need a valuation even if I’m not planning to sell right now?

- What’s the difference between selling stock or selling assets?

- Should I be asking my CPA about Qualified Small Business Stock (QSBS)?

- Is the entity structure or Operating Agreement I set up when my business first started right for where we are today?

What to do next

If you’re a business owner and want a clearer view of how your company value may translate into personal financial security, schedule a 20-minute call to talk through your goals.

This article is intended for general informational purposes and does not constitute a recommendation of any type. Please seek advice from your tax, legal, and financial professional prior to taking action. Advisory services offered through Destiny Capital Corporation, an Investment Adviser registered with the U.S. Securities & Exchange Commission.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.