Markets and Economy – Venezuela, Oil, and an Unexpected Start to 2026

by Tim Doyle, Chief Investment Officer, CFP®, MBA

At the beginning of each new year, I’ve always found it fascinating to look back on impactful events from the prior year where I said to myself “boy, I didn’t see that coming”. In 2020, it was the COVID-19 pandemic and the subsequent shutdown of the global economy. In 2022, it was the Russian invasion of Ukraine along with the significant spike in inflation where the Consumer Price Index topped-out at a whopping 9%. In 2023, it was the banking crisis that resulted in the failure of several banks. In 2025, I’d wager that most investors weren’t anticipating the size and scope of the tariffs authorized by the Trump administration targeting nearly all U.S. trade partners across the globe. Well, here we are in early 2026 and my leftover champagne hadn’t even gone flat yet, and I’ve already had one of those “boy, I didn’t see that coming” moments.

On Saturday, January 3rd, as most of us slept, U.S. special forces carried out Operation Absolute Resolve that struck targets across northern Venezuela, including the capital of Caracas, and captured Venezuelan President Nicolas Maduro and his wife Cilia Flores. President Maduro and his wife were subsequently transported to the U.S. where they have been indicted in the Southern District of New York under charges of Narco-Terrorism Conspiracy, Cocaine Importation Conspiracy, Possession of Machine Guns and Destructive Devices, and Conspiracy to Possess Machine Guns and Destructive Devices against the United States.

Perhaps this is an outcome I should’ve anticipated. After all, the U.S. had been building up a significant military presence in the region as you can see in the illustration below, and we’ve seen military strikes on alleged drug boat targets in the Caribbean and seizures of tankers carrying Venezuelan oil in recent weeks.

Source: Reuters – How the US is Preparing a Military Staging Ground Near Venezuela

As you can imagine, this situation is evolving rapidly and remains incredibly fluid. There are far more questions than answers at this stage. So, rather than analyze and opine about what has already happened, we’ll focus on what might come next, and what it could mean for financial markets.

As an investor, I tend to view many key events through the lens of risk and opportunity, so I’ll approach this commentary from that perspective. Clearly, the Trump administration views Venezuela as an opportunity, and we got some unambiguous answers in this regard during the initial press conference hosted by President Trump, Secretary of State Marco Rubio, and others after the military operation.

Given that we’re in the midst of the NFL playoffs, I’ll describe this situation using a sports metaphor. As a long-time Philadelphia Eagles fan (please don’t hold it against me), I’ve seen my Birds play their rival New York Giants thirty-three times with Eli Manning as their quarterback. Never, as an opposing fan, was I concerned about the Giants with Eli at the helm. If anything, I was confident that we could likely count on Manning to throw an interception or two (he had 244 in his career) that would cost his team the game. Yet, Eli will likely be inducted into the NFL Hall of Fame in the years to come. Many of Eli’s critics have said, “if his last name was Richards and not Manning, would we be focusing on him as a Hall of Famer?” After all, Eli’s last name is akin to NFL royalty, and that is part of why he stands out from the fray.

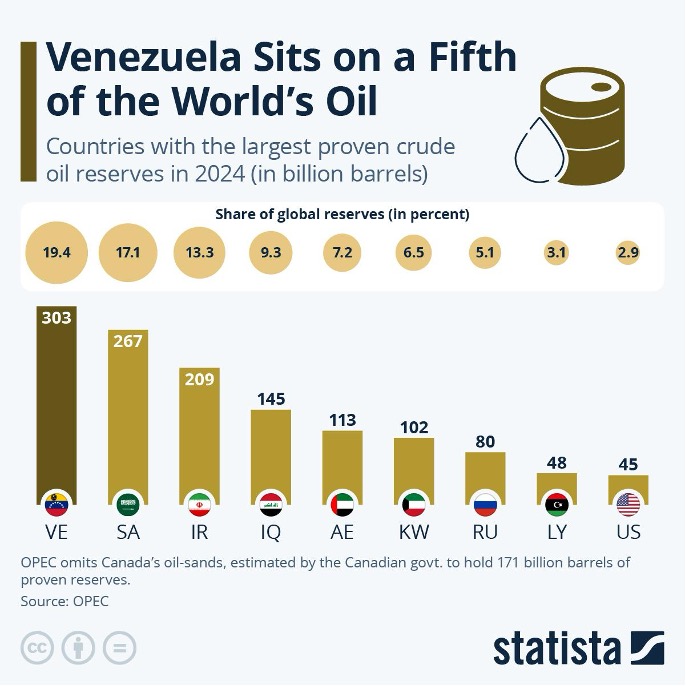

I think of Venezuela in a similar light. To be very clear, I am not comparing Eli Manning to Nicolas Maduro, regardless of my innate distaste for the New York Giants. However, like Nicolas Maduro, there are leaders entrenched in seats of power across the globe who deal heavily in weapons and drugs. So, why is the Trump Administration focused on Maduro and Venezuela? Well, unlike many other leaders around the world, Maduro is (was) the head of the country with the single largest, proven crude oil reserves in the world. In fact, as you can see in the chart below, Venezuela sits on a fifth of the world’s total proven crude oil supply.

Yes, the Trump administration declared that Operation Absolute Resolve was intended to bring Nicolas Maduro to face U.S. justice. However, within the first five minutes of his press conference, President Trump also stressed the fact that access to Venezuelan oil was also a key consideration in the decision to oust Maduro and facilitate regime change as he stated, “we’re going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country.”

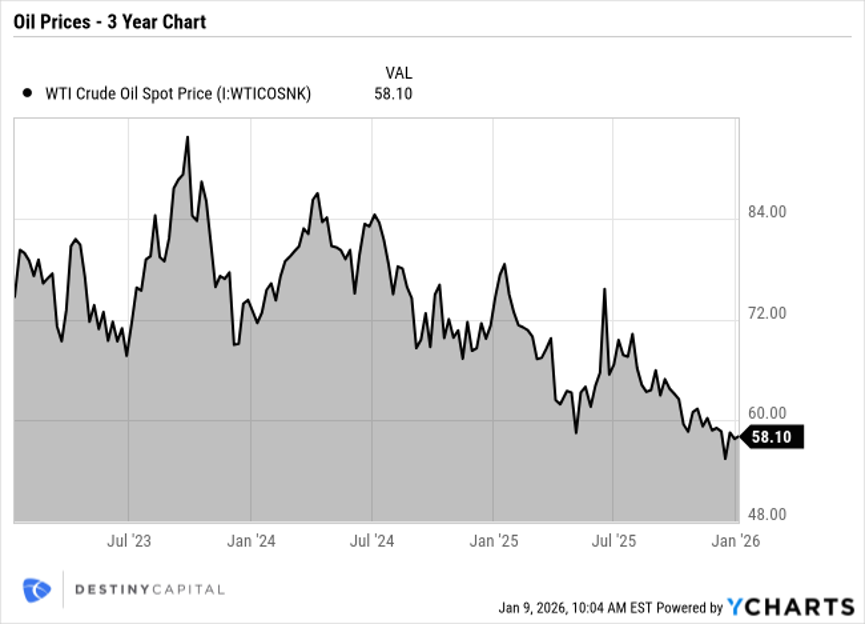

Clearly, access to Venezuela’s vast oil reserves was an opportunity identified by the Trump administration, and it will remain a key area of focus moving forward. The market’s reaction to this has been somewhat muted, and oil prices remain near 3-year lows as seen in the chart below.

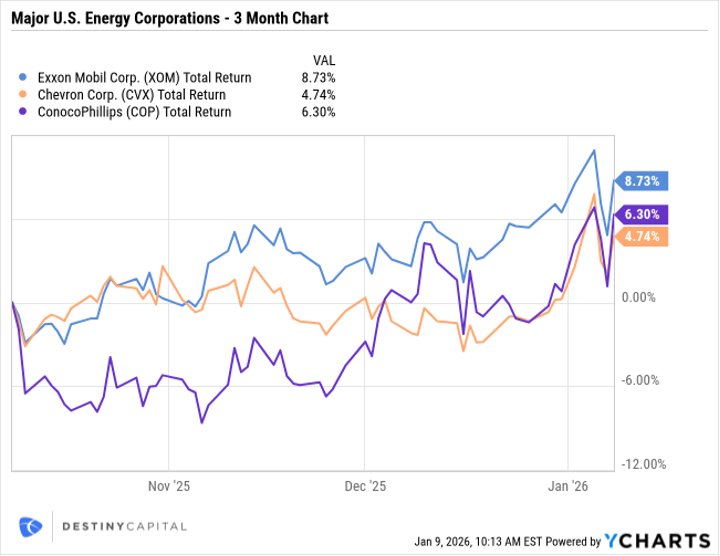

After Maduro’s capture, we also saw an immediate surge in the stock prices of the major U.S. energy companies such as Exxon Mobile, Chevron, and ConocoPhillips, as you can see in the chart below. However, these stock prices have whipsawed a bit as the realities of the situation on the ground in Venezuela have tempered any hopes of a surge in near-term profits for the major U.S. oil companies.

While these are not entirely the stated goals outlined by the Trump administration, other opportunities resulting from the ousting of Nicolas Maduro could be regional stabilization and Venezuela’s realignment with the U.S. and the west versus adversaries like Russia, China and Iran. With a new regime aligned with the U.S., we could see a reduction in the production and distribution of narcotics, and potentially a decline in forced migration as Venezuela, ideally, stabilizes. However, I would view these outcomes as optimistic given how fraught and unpredictable regime change has been from a historical context.

When it comes to risks, there are many, and my hope is that some of these risks will be addressed and/or mitigated through a better understanding of the long-term goals of the Trump administration as it relates to America’s role in Venezuela. I’ll bullet-point a few key questions and considerations below:

‘Running’ Venezuela: In his press conference, President Trump stated that the United States will ‘run’ Venezuela. His direct quote was “We’re there now, but we’re going to stay until such time as the proper transition can take place. So we’re gonna stay until such time as, we’re gonna run it, essentially, until such time as a proper transition can take place.” Investors clearly need a better understanding of what the intent is here and what commitment the U.S. is willing and able to make to overseeing and facilitating a democratic transition of power.

Accessing Oil: while Venezuela’s vast oil reserves represent a tremendous opportunity for U.S. energy companies, we are likely a long way away from seeing significant amounts of oil pumped out of the ground. As you can imagine, these U.S. energy corporations are likely very concerned about safety and security on the ground, and they may be hesitant to commit considerable resources (both human and financial) until the situation is less fraught. Most analysts estimate that it will likely be 2-3 years before meaningful amounts of oil can be extracted and exported from Venezuela, so this will likely not be an immediate gratification situation. Regardless, I expect the Trump administration to ramp-up rhetorical pressure on Exxon, Chevron, and others to commit to capitalizing on Venezuela’s vast oil reserves in the weeks ahead.

Costs and Length of the Current Military Posture: as seen in the image at the beginning of this letter, the U.S. military’s presence in the region surrounding Venezuela is considerable. Therefore, it begs the question of how long is the U.S. willing and able to maintain its current military posture? After all, prolonged military engagements can grow quite costly, and the U.S. is already scheduled to run a significant fiscal deficit in 2026 with U.S. public debt approaching $37 trillion. At Destiny Capital, the current pace of federal deficit spending and ballooning debt is a topic we’ve highlighted for years. While we aren’t anticipating another costly engagement like the Iraq war, it is likely that costs of this conflict will rise the longer the U.S. must maintain a substantial presence in the region.

Singular Focus: the conflict with Venezuela will clearly draw a lot of attention from the Trump administration. As the saying goes, this engagement could “suck up much of the oxygen in the room” and draw the federal government’s focus away from other key issues such as the 1/30/26 expiration of the continuing resolution that kept the government open last year. This could also draw focus from domestic issues around inflation and jobs, while also resulting in less acute attention to other regional conflicts such as Russia/Ukraine, China/Taiwan, the nationwide protests in Iran, and more.

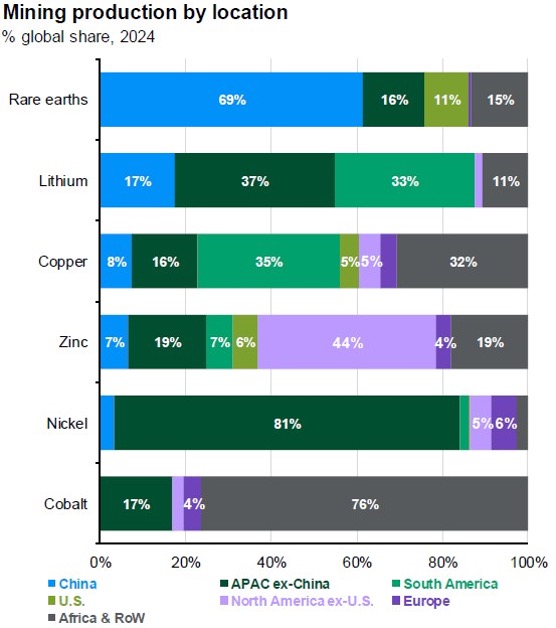

Are Other Countries Next? The Trump administration has openly floated the idea of U.S. intervention in a variety of countries across the globe, from Greenland, to Cuba, to Panama and more. When it comes to Greenland, the country is situated near key shipping routes and, perhaps more importantly, has access to rare earth minerals that are critical to enabling modern commercial and military technologies. The chart below shows mining production of key rare earths and other elements by location, with the U.S. represented by light green.

While the U.S. has vast natural resources of many kinds within its borders, this chart helps to show that we do not necessarily have resources to access these vital elements key to technological advancement. So, this helps to illustrate why Greenland has been a source of such acute interest for the Trump administration since inauguration day. The Trump administration’s language around regime change in Cuba, Panama and other countries has grown increasingly aggressive, and leaders in these countries are likely taking note. After all, as Marco Rubio stated in his press conference, “the President of the United States is not a game player. When he tells you that he’s going to do something, when he tells you he’s going to address a problem, he means it.”

Emboldened Adversaries: Finally, an outcome that could potentially impact the global economy is if key adversaries like Russia and China feel emboldened by the Trump administration’s actions to engage in regime change or other military interference in their immediate regions of influence. For Russia, that could mean looking beyond military action in just Ukraine. For China, it could mean pursuing their long sought after ‘reunification’ with Taiwan. Any of these actions could spark a broader military conflict that could potentially include the United States and other allies across the globe. Clearly, that outcome could jolt financial markets in the short-term.

While that final outcome is certainly bleak to consider, it certainly can’t be ignored as improbable or impossible. Again, as we learn much more about the Trump administration’s intentions and goals around Venezuela, many of these elements of uncertainty could be quelled in the days and weeks ahead.

In other important news for investors, the United States (and world)should also be gaining some clarity around the legality of the Trump administration’s tariff policies in the coming days. As we reviewed in late 2025, a case was brought before the Supreme Court that essentially challenged the legality of the Trump administration’s tariffs under the International Emergency Economic Powers Act (IEEPA) of 1977. This case argues that under Article I of the Constitution grants Congress the ‘power of the purse’ and the ability to tax, spend and regulate foreign commerce. It has been argued that the executive authority under the IEEPA is narrow and cannot be used for broad tariffs as announced in April of 2025 without congressional approval.

It has recently been announced that the Supreme Court is expected to issue opinions on January 14, 2026. To be clear, the Supreme Court does not specify which cases it will be ruling on when it issues opinions, but it is broadly believed that they will announce a ruling on the tariff issue sooner than later given the significant economic importance. If the Supreme Court rules against the Trump administration then, well, I’ll have an entirely new investor letter to write in short-order. This is an important ruling, and should be garnering more headlines if it were not for the recent developments in Venezuela.

It goes without saying that 2026 is off to quite a rollicking start. There will be plenty for me to report in the days and weeks ahead, and my hope is that we can soon get back to topics that should be top-of-mind for investors, including important economic indicators and boring old earnings reports. In the meantime, we will be sure to report on any key developments that might impact investors, and please don’t hesitate to reach out to your Destiny Capital team with any questions.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services offered through Destiny Capital Corporation, an Investment Adviser registered with the U.S. Securities & Exchange Commission.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.