Markets and Economy: Harrowing Headlines – Navigating the News

by Tim Doyle, Chief Investment Officer, CFP®, MBA

Here at Destiny Capital, there are times when I need to communicate important information around key topics and/or events to our entire team. Examples of this might be an announcement related to U.S. trade policy, a change in monetary policy by the Federal Reserve, an important earnings update, a geopolitical event, and much more. If possible, I do this in-person during team meetings, but there are situations where information is timely and I need to distribute something to team members in writing. My secret to ensuring that this important content is read and digested by everyone is to create the most sensationalized subject/header possible for each communication.

For example, if the Fed raises interest rates, my subject may read, “The Fed Raises Rates 50bps – Is a Global Market Collapse Imminent?” – or – “Earnings Update – Should Investors Sell All and Put Cash Under their Mattresses? READ TO FIND OUT”. Why do I do this? Well, I do this because it works. Whenever I sensationalize a subject header, I tend to get the most immediate engagement with my content. The same goes for social media influencers and major news outlets across the globe. Chaos gets clicks. Sensationalism sells.

This has certainly been the case over the past few weeks as investors have been bombarded with alarming headlines across a variety of assets including private credit, software stocks, gold/silver, Bitcoin and more as you can see in some of the headlines I’ve sampled below.

“The Canary in the Private Credit Coal Mine Just Dropped Dead” – American Banker

“Blackstone Stock, Alternative Managers, BDCs Dive as Software Woes Infect Private Credit” – Barrons

“The meltdown in software stocks is a warning sign for the entire market.” – Business Insider

“Gold and Silver Plunge in Worst Day Since 1980” – The Wall Street Journal

“BTC falls sharply (~9%) in a single day as crypto sentiment sours” – Axios

Those five headlines alone are enough to make me want to crawl under my desk and re-emerge a month from now. With constant headlines like those above, it’s not surprising that investors have seen volatility spike in each of these assets. Is this worry and volatility warranted? Well, in this month’s letter, we’ll attempt to address that question for two important assets – private credit and software stocks.

Private Credit – Overview

I’ll start by outlining exactly what private credit is, as it may be an asset class that’s less familiar to some readers. At Destiny Capital, we classify private credit as an alternative asset class that exists outside of the realm of traditional stock and bond markets. In the wake of the 2008 financial crisis, traditional banks experienced increased regulatory scrutiny and, as a result, retreated from lending to smaller, middle market corporations as they focused their limited resources on lending to ‘bigger fish’. This left a substantial lending void that was ultimately filled by private investors as private credit funds increasingly grew in popularity.

Private credit can represent a broad universe of credit strategies with the most popular, by far, being Direct Lending. In Direct Lending, investors lend directly (hence the name) to middle market corporations, entirely bypassing traditional intermediaries like banks. These loans are typically short-term (three to five years), floating-rate, and senior secured, meaning they are backed by borrower assets and sit at the top of the capital structure in the event of a default. Ultimately, direct lending offers investors the potential for attractive income while providing meaningful portfolio diversification, as returns are driven primarily by contractual cash flows and credit performance rather than public market price movements.

Private Credit – The Canary in the Coal Mine?

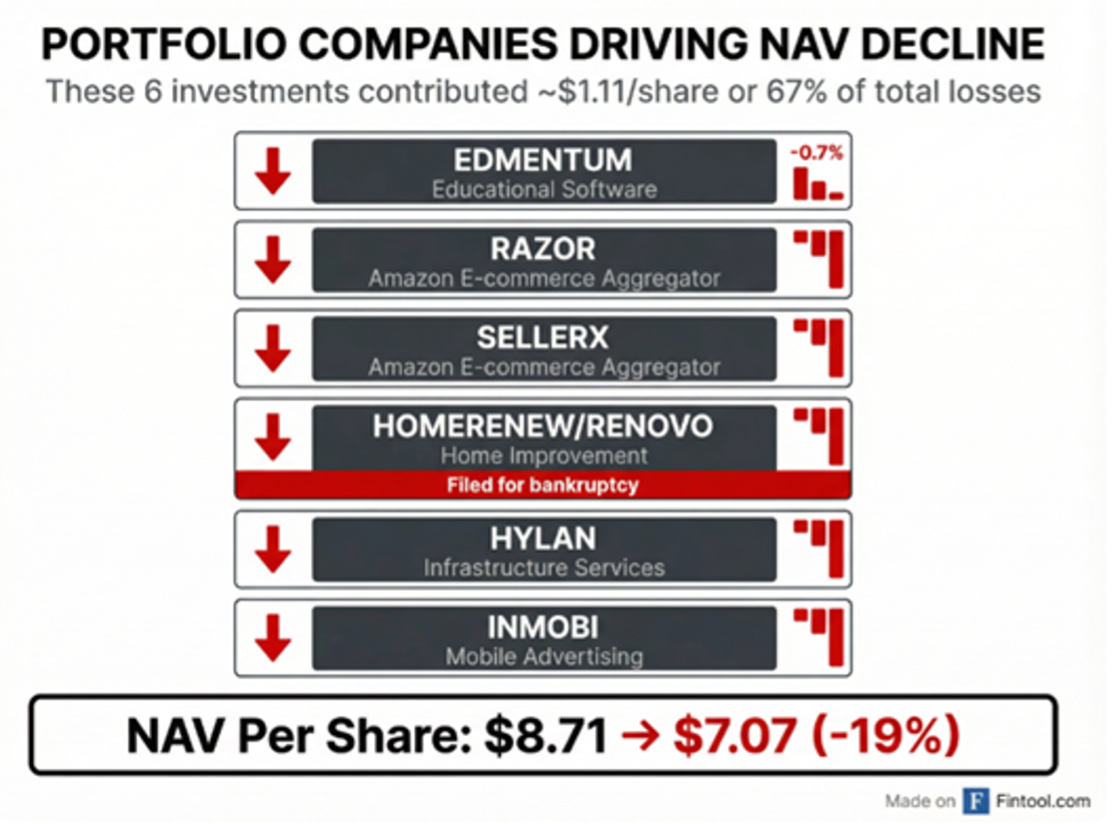

Over the past few weeks, private credit has garnered a lot of headlines due to recent struggles in a Blackrock private credit fund named TCP Capital Corp that trades on the Nasdaq exchange under the ticker TCPC. In fact, TCPC’s Net Asset Value (NAV) declined a staggering -19% largely due to non-accruals (defaults) in six of the fund’s underlying credits, as seen below.

Source: Fintool.com

This, along with broader concerns about exposure to the software sector (more on that later), led to recent volatility in parts of the $1.7 trillion private credit market. Is this fear and volatility overblown? In my opinion, the answer is yes, but it also depends on how an investor is positioned within the asset class, which we’ll get into shortly.

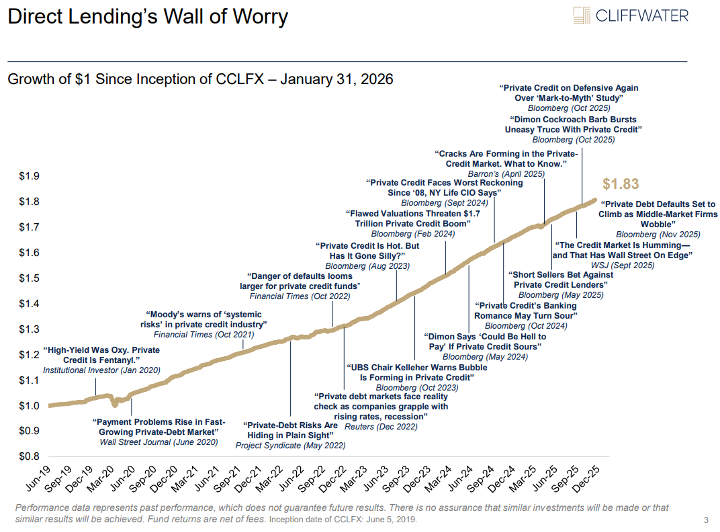

When it comes to private credit as an asset class, it has been a source of media clickbait for years due to its meteoric rise in popularity. The chart below helps to illustrate the scathing headlines that private credit has endured since 2019, with my favorite being “High Yield Was Oxy. Private Credit is Fentanyl” back in January of 2020. With a biting headline like that, I’d imagine click-through rates were quite high for that Institutional Investor article.

Source: Cliffwater

At Destiny Capital, we strongly believe that private credit and direct lending, in particular, remain very attractive investment opportunities, if done right. In fact, selling a position or exiting an asset class based on the poor performance of a fund like TCP Capital Corp would be like liquidating exposure to the S&P 500 because a single stock sold-off -40%. One rotten apple doesn’t spoil the bunch.

Situations like this are when I bang on the table and stress the old Peter Lynch adage “know what you own.” At Destiny Capital, we believe that diversification, credit quality, and discipline are crucial when investing in private credit. In the case of TCPC, the fund was lacking in each of those areas, which we’ll outline below.

Diversification: when it comes to diversification the fund had only 149 underlying credits, which means the fund was heavily concentrated. Funds like TCPC are often top-heavy, as well. This means that a large percentage of the fund’s net asset value (NAV) is devoted to the top 10 credits. Therefore, when borrowers default, the impact on the fund can be amplified which we saw with TCPC as the fund’s value declined -19% due to failures of only six companies.

Credit Quality: one of the primary objectives of private credit managers is to generate attractive income for investors. Managers pool investor capital and deploy it through directly originated loans to middle-market companies. As borrowers make interest and principal payments over time, managers distribute income back to investors. Generally speaking, we classify this income as ‘yield’ and reference it as a percentage. For some private credit managers, it can be tempting to enhance yield by taking on additional risk. To use a relatable example, an individual with an 800+ credit score may receive an auto loan at 6%, whereas an individual with a credit score of 500 may be offered a loan at a much higher interest rate. The higher the risk, the more the lender needs to be compensated through higher interest rates. In the case of TCPC, it’s apparent that fund managers took-on undue credit risk in order to enhance the fund’s yield, and this ultimately hurt them in the end as six companies defaulted.

Discipline: not only was TCPC absorbing additional credit risk, they were also utilizing leverage as evidenced by the funds 1.5x debt to equity ratio. We consider a 1.5x debt-to-equity ratio in direct lending as very aggressive (and risky). In good times, returns can be enhanced by the use of leverage. In bad times, it can result in quite the opposite. For example, in a situation like this with a 1.5x debt-to-equity ratio, a 10% decline in asset values can lead to a -25% decline in NAV.

Ultimately, that’s a long-winded way of stating that not all private credit funds are created equally. At Destiny Capital, we access the direct lending asset class through the pioneering private credit manager Cliffwater and their Cliffwater Direct Lending Fund. This fund is extremely well diversified with over 4,100 underlying credits with the fund’s top-10 holdings representing only 5.6% of the fund’s NAV. When it comes to discipline, fund managers remain incredibly conservative with a debt-to-equity ratio of .37x (vs. 1.5x for TCPC), and when considering credit quality, the fund was recently issued an ‘A’ credit rating by S&P Global – the first such rating of its kind for a private credit interval fund. The fund maintains all of these differentiating benefits while producing an annualized net return since fund inception of +9.55% with a standard deviation (volatility) of just 1.72%. Again, knowing what you own can allow an investor to benefit from unique asset classes like private credit while hopefully avoiding pitfalls along the way.

The Software Scare

During the past few years, whenever I mentioned Artificial Intelligence (AI), the word ‘disruptive’ tended to follow soon after. After all, AI has been lauded as the next great disruptive technology akin to the advent of the personal computer and the invention of the internet. However, since the launch of OpenAI’s ChatGPT tool in 2023, corporations have been in a heated race to become one of the disruptors and avoid being one of the disrupted.

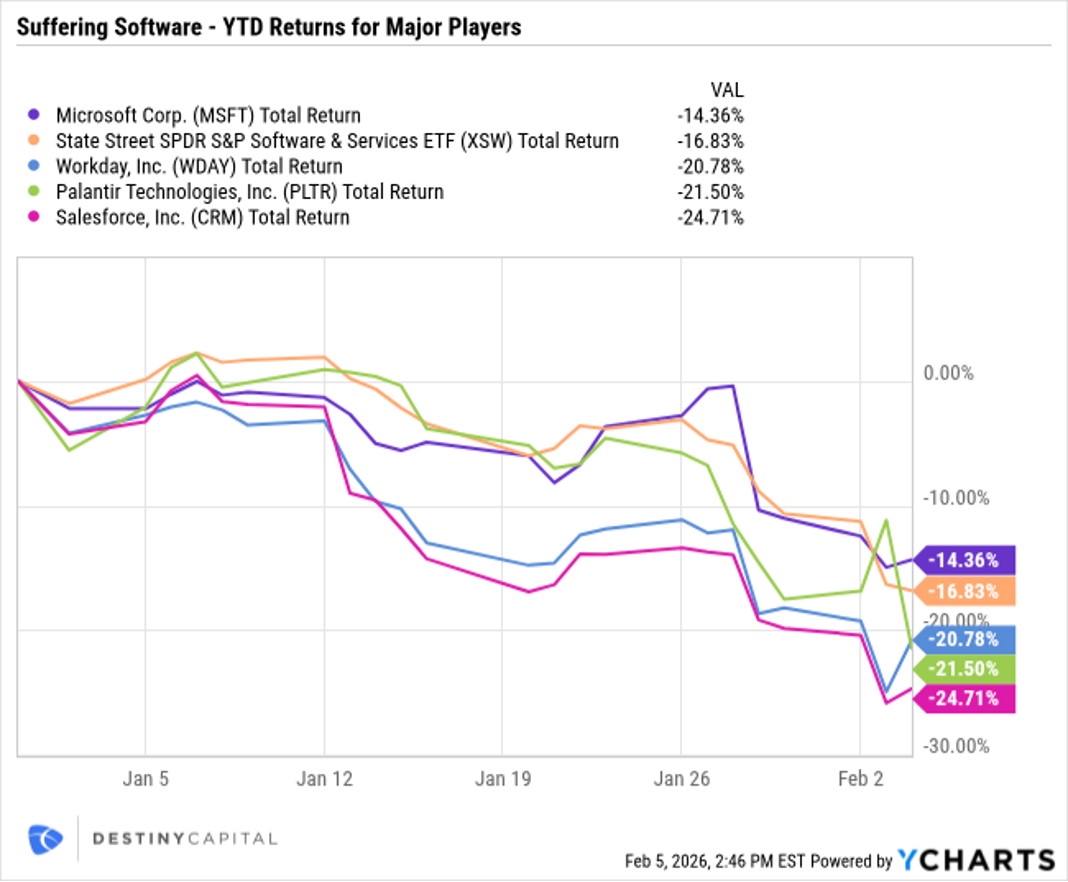

Over the past few weeks, we started to see potential disruption in action when AI company Anthropic released an advanced version of its Claude AI model (ex. Claude Opus 4.6) that possesses advanced capabilities in coding, analysis, and autonomous task execution. This model could potentially automate work that is traditionally executed by humans, facilitate legal review & document analysis, and much more. In short, investors immediately viewed this as a threat to traditional software as a service (SaaS) companies, and the route was on for software companies like Microsoft, Workday, Salesforce, Palantir, and many others as you can see in the chart below.

As markets tend to do, they immediately priced-in the worst case scenario for software before the dust even settled. After all, Claude Opus 4.6 has been in use for less than a month, so investors may be getting a little ahead of themselves. It’s important to note that many AI tools like Claude are still reliant on the current computing infrastructure and enterprise level ecosystems, and this won’t change overnight. Furthermore, many of the companies above (and more) have AI ambitions of their own.

This leads us to another key point around AI. In the company’s latest quarterly report, Microsoft announced that they spent $37.5 billion on capital expenditures last quarter, with over two-thirds of that spending going towards AI-related data center assets like GPUs, CPUs, etc. Eventually, investors are going to demand a return on investment for those expenditures, and this was a key topic we highlighted a few months ago when looking ahead at 2026.

A company like Microsoft is in a tough spot. They run the risk of being disrupted by external AI competitors, so they are investing heavily in AI build-out. Meanwhile, investors are beginning to demand results (increased revenues and/or profits) as a result of that enormous investment in AI. As the saying goes, you’re damned if you do and damned if you don’t, and there will likely be many companies facing similar challenges in quarters ahead.

Investors also need to remember that this doom and gloom sentiment tends to fade over time. Does anyone remember the release of Chinese AI model Deepseek in late January of 2025? Deepseek was lauded as a disruptor that could produce effective large language models (LLM) that rival Western counterparts only for a fraction of training and operating costs. Subsequently, NVIDIA’s stock sold-off roughly -18% in a matter of days as Deepseek became the #1 selling app in the Apple Store. Well, for many investors, Deepseek is now a distant memory, and NVIDIA’s stock has moved nearly +45% higher since that selloff.

Earnings Update

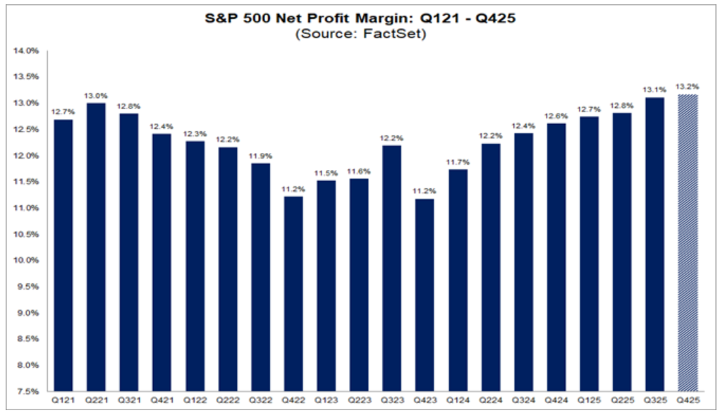

Finally, I would be remiss if I didn’t briefly mention corporate earnings before closing out this month’s letter. Roughly 59% of S&P 500 companies have reported Q4 earnings thus far, and the year-over-year earnings growth rate stands at a very strong 13%. Entering earnings season, earnings growth was projected to be somewhere in the mid-to-high single digits, so S&P 500 companies are producing the earnings growth that investors have grown accustomed to (and spoiled by). In fact, if this figure holds, this could represent the fifth consecutive quarter of double digit earnings growth for the S&P 500 index.

But wait, there’s more! At 13.2%, the S&P 500 is currently reporting the highest net profit margin in more than 15 years, and the technology sector remains a key contributor here with net profit margins of 29%.

Throughout both 2024 and 2025, stock market volatility was abnormally muted. Yes, investors experienced some bumps along the way, but markets experienced a smooth ride relative to many other periods in the market cycle. Could that change in 2026? Perhaps.

You see, in my backyard, we have a long row of hydrangea plants that flower beautifully during each summer. However, it’s imperative that we prune the plants back in the late winter/early spring to ensure that they continue to thrive each subsequent year. The stock market is similar. When I see the S&P 500 with a forward price-to-earnings ratio that grows to nearly 25x, I think to myself “now, that’s not entirely healthy.” Yes, it may look magnificent in the moment (especially when looking at account balances), but valuation levels like that are not realistically maintained. Then, investors begin to periodically trim certain positions that perhaps have grown too much, too soon, and suddenly the stock market returns to a much more sustainable path.

You didn’t realize you were going to be getting some gardening tips in this month’s letter, now did you? If, after reading this, you have any questions about anything I’ve covered in this letter, or more, please don’t hesitate to submit a question to our CIO Mailbag. This is where investors can submit questions for me to either address individually or in one of our monthly letters or webinars. As always, the Destiny Capital team and I are here to help with anything you need, whether it is market related or as investors are gearing up for tax season.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services offered through Destiny Capital Corporation, an Investment Adviser registered with the U.S. Securities & Exchange Commission.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.