How to Open a 529 Plan: A Simple Guide for Parents

Education planning is one of the most important financial decisions a parent will make — and opening a 529 plan can be a game-changer.

A 529 account is a tax-advantaged savings plan designed to encourage savings for future education costs. Whether planning for college savings or contributing to other eligible educational expenses, opening a 529 account can help you achieve the financial goals needed to support your child’s future.

Opening a 529 Plan — Understanding the Benefits of This Type of Savings Account

A 529 plan offers numerous benefits for parents and guardians looking to save for their child’s education. Some key advantages to understand when opening a 529 plan include:

Tax Advantages

Contributions to a 529 account grow tax-free. Additionally, withdrawals for qualified education expenses are also tax-free. Many states also offer state tax deductions or credits for contributions to their 529 plans, which can further enhance your savings.

Flexibility

Funds in these accounts can be used for various educational expenses, including tuition, fees, books, and even certain room and board costs. Some plans also allow for flexibility when changing beneficiaries.

High Contribution Limits

Unlike other savings accounts, 529 plans have high contribution limits, allowing you to save more.

Control

The 529 account owner maintains control of the funds even after the beneficiary reaches adulthood.

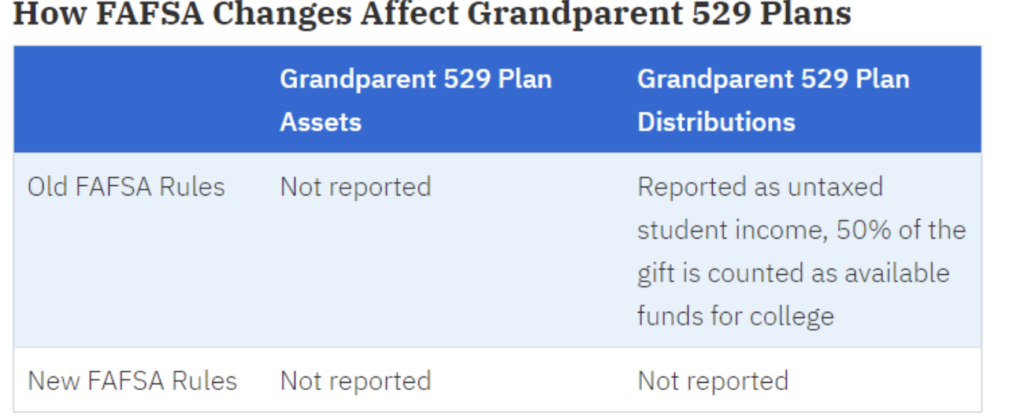

Finally, one of the lesser-known advantages of a 529 plan is its minimal impact on financial aid eligibility. When you save in a 529 plan, the account is considered a parental asset, which typically has a smaller impact on the Expected Family Contribution (EFC) than student-owned assets. This typically means that the savings in a 529 plan will not significantly reduce your child’s chances of qualifying for financial aid, allowing you to save for education while still being eligible for need-based assistance.

Be Prepared: What You Need to Know Before Opening a 529 Plan

Before diving into the process of opening a 529 plan, it’s crucial to consider a few preparatory steps, such as:

Understand Your State’s Plan

Each state offers its own 529 plan with unique benefits and tax advantages. To maximize your savings, consult a professional financial advisor, tax advisor, or research your state’s specific plan.

Determine Your Savings Goals

Estimate the future cost of education and how much you need to save. Work with your financial advisor to get specific about your goals and how you’ll work together to achieve them.

Consider Your Time Horizon

Your child’s age and the time left until they start college will influence your investment choices within the 529 plan. An experienced advisor can help you crunch the numbers to develop an appropriate savings process.

Review Plan Fees and Expenses

Different plans have varying fees and expenses. Look for a plan with low fees to ensure more of your money goes toward saving for education.

Gather Relevant Information

Before you open the account, gather the following information:

- Your Social Security number and date of birth

- Your beneficiary’s Social Security number and date of birth

- Your address and contact information

- Bank account information for funding the 529 account

529 Account Setup: A Parents’ Step-by-Step Guide

Step #1. Choose the Right 529 Plan

You’re not limited to your state’s plan, so always research and compare options. Check to determine if your state offers tax benefits for contributions to the plan. You should also compare fees, investment options, and performance across plans. Finally, always inquire about additional features some plans offer, such as matching grants or even scholarship opportunities.

Step #2. Select the Account Type

Decide between two main types of 529 plans:

- Savings Plans: Invest in mutual funds or ETFs

- Prepaid Tuition Plans: Lock in current tuition rates at specific colleges

Most families opt for savings plans due to their flexibility and broader investment options.

Step #3: Open the Account Online

Once you’ve chosen a plan:

- Visit the plan’s website and click “Open an Account” or “Enroll”

- Enter your personal information and your beneficiary’s details

- Choose your investment options

- Set up initial and recurring contributions

Step #4: Select Investment Options

Most 529 plans offer various investment portfolios, ranging from conservative to aggressive. Choose an investment strategy that aligns with your risk tolerance and time horizon.

Step #5: Fund Your Account

You can fund your 529 plan through:

- Electronic bank transfer

- Check

- Payroll deduction (if offered by your employer)

Consider setting up automatic monthly contributions to build your savings consistently.

Step #6: Monitor and Adjust

Review your 529 plan’s performance regularly with your financial advisor and make adjustments as needed. You can also consider increasing your contributions as your financial situation allows.

Education Planning: Final Tips and Suggestions

Some of the most important best practices with education planning and college savings include:

Start Early

It’s never too early to start planning for your child’s future. The earlier you start, the better equipped you’ll be to tap into the power of compound growth, which helps even small contributions grow significantly over time.

Contribute Regularly

Set up automatic monthly contributions to stay consistent. Regularly scheduled contributions can help keep you focused on your financial goals.

Review Annually

Reassess your investment choices and contribution amounts each year. Consult with a professional financial advisor to ensure your plan maximizes return on investment.

Involve Family Members

Grandparents and other relatives can contribute to your child’s 529 plan. Keep them informed and involved throughout the process so they can also contribute.

Finally, when it comes to education planning and college savings, it’s important to remember that while 529 plans offer significant benefits, they’re just one part of a comprehensive financial plan. Consulting with a financial advisor can help ensure your final strategy fits within your overall financial picture.

Start Education Planning Now: Schedule a Call with Destiny Capital

Are you ready to take the next step in helping to secure your child’s educational future? Destiny Capital can help. Our experienced financial advisors can help you navigate the process of opening a 529 plan, set realistic savings goals, and ensure your investment strategy aligns with your broader financial plans. Don’t wait — let us help you make the most of your education savings opportunities. Schedule a call today!

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.