Grow Wealth: Strategies for Building Wealth with Purpose

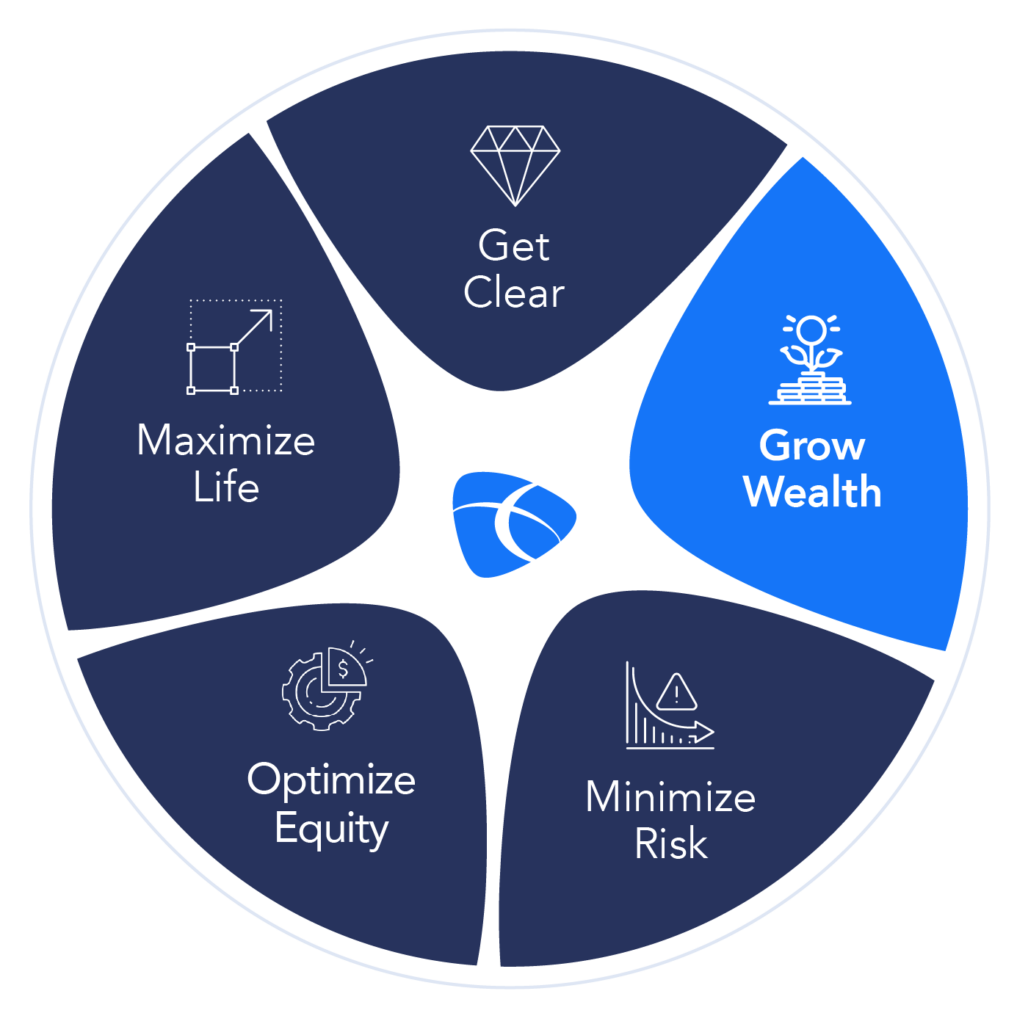

Growth without intention is activity. True wealth comes from disciplined decisions that tie your capital to what matters most. Destiny Capital’s Personal Wealth Operating System™ (PWOS™) is built to help business owners and retirees grow wealth with structure, clarity, and measurable outcomes, so progress compounds toward a meaningful vision, not just a bigger balance.

Ready to grow your wealth? Schedule your free Personal Wealth Operating System™ Assessment today!

We see it all the time – markets change. Businesses evolve. Priorities shift. Change is inevitable, but an intentional growth plan anchors strategy to clearly defined goals, risk parameters, and time horizons. This approach reduces decision fatigue, keeps emotions in check, and ensures both business and personal finances move in the same direction. The result is a coordinated plan that compounds outcomes, both financial and personal, over time.

Disciplined investing with intentionality

Disciplined investing isn’t about prediction – it’s about data and process. A thoughtful investment policy defines return targets, risk tolerance, liquidity needs, tax awareness, and rebalancing rules. At Destiny Capital, our approach is to make decisions based on objective data, removing emotion from the process, to help investors remain invested and absorb volatility over the long term. This structure aims to turn market shifts into opportunity and aligns portfolios to real-life milestones.

We use tax-smart placement to optimize returns, and consider both near-term cash needs and long-term assets. For retirees, that means building a durable income plan that blends guaranteed income, portfolio distributions, and tax-aware withdrawals. For business owners, it means investing beyond the company to reduce concentration risk and grow personal net worth deliberately.

Strategic business reinvestment

For many entrepreneurs, the greatest lever for return is inside the business. The key is to reinvest wisely – directing profits to initiatives with clear ROI, defined payback periods, and strategic alignment. This often means a focus on growth drivers – customer acquisition, pricing optimization, process automation, and talent.

Document and track your investment the way you would any other market investment. Keep clear records and track returns just as rigorously as you would in any other area. This allows you to continue to refine what works best and can create a flywheel where business growth funds personal wealth, and personal wealth reduces pressure on the business, giving you more peace of mind and more options.

Tax-aware growth

A surprise tax bill is never welcome. Coordinated tax planning across entities and accounts ensures that growth isn’t eroded unnecessarily. We help our clients do this by matching asset types to tax-advantaged accounts, while planning multi-year strategies for equity events, exits, or high-income periods. For retirees, optimizing the order of withdrawals by blending taxable, tax-deferred, and Roth, extends portfolio longevity and reduces lifetime tax burden. More often than not, planning on the front end saves headaches (and surprise bills) on the back end.

Even giving can have tax impact – many clients benefit from coordinating their charitable giving with their tax strategy through donor-advised funds or appreciated asset gifting. A proactive tax strategy can have a significant impact on the wealth you’re working hard to grow.

Diversify beyond the business

Have we mentioned diversification before? We might sound like a broken record, but we’ll say it again: concentration creates fragility. Purposeful prosperity requires diversification that reflects real-life risks and opportunities.

- Build personal wealth across liquid portfolios, real assets, and cash reserves.

- Set a target for non-business net worth and ladder progress toward it.

- Stress test: model how a downturn in business value or income affects the overall plan.

- This doesn’t dilute entrepreneurial ambition—it protects it. Diversification buys time, choices, and resilience.

Our Grow Wealth step is never taken lightly. It’s the product of a clear vision, a disciplined operating system, and a partner who keeps the plan aligned through market cycles, business transitions, and life changes. Destiny Capital’s PWOS™ brings structure to every decision, so wealth grows in service of the life being built, not the other way around.

Ready to grow wealth with intention and clarity? Schedule a complimentary PWOS™ Growth Assessment with Destiny Capital and get a tailored plan for disciplined investing, strategic reinvestment, and tax-aware compounding, all aligned to the goals that matter most. Let’s turn momentum into meaningful progress.

This article is intended for general informational purposes and does not constitute a recommendation of any type. Please seek advice from your tax, legal, and financial professional prior to taking action. Advisory services offered through Destiny Capital Corporation, an Investment Adviser registered with the U.S. Securities & Exchange Commission.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.