Get Clear: Creating Your Wealth Vision and Identifying True Priorities

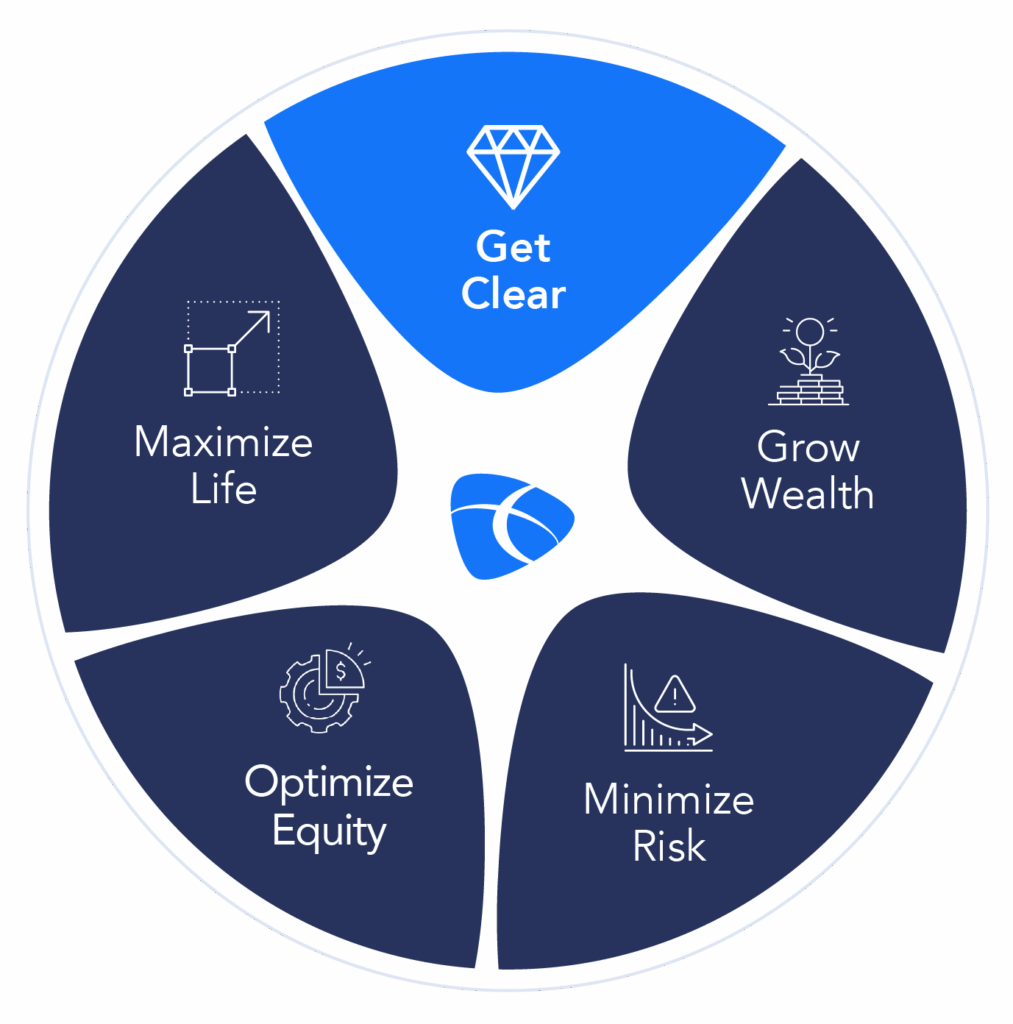

Clarity is the catalyst for every meaningful financial outcome. Without it, even smart decisions can feel scattered, and progress can stall. With it, every next step becomes purposeful. At Destiny Capital, the first pillar of the Personal Wealth Operating System™ (PWOS™) is simple and powerful: Get Clear. This is where values, goals, and family needs converge into a wealth vision that guides decisions with confidence and intention.

Ready to Get Clear on your goals? Schedule your free Personal Wealth Operating System™ Assessment today!

Why clarity comes first

Financial tools, markets, and strategies matter, but they only create real impact when aligned with what matters most. Getting clear establishes a north star for both day-to-day choices and long-term planning. For business owners and retirees alike, clarity reduces decision fatigue, increases confidence, and connects wealth to purpose in a way that is deeply motivating.

We recommend starting this process with a wealth vision. A wealth vision is a concise, living statement of the future being built. It reflects personal values, family priorities, and desired impact, whether that’s at home, in the business, or in the community. When clearly articulated, it becomes the lens for making tradeoffs, weighing risks, and sequencing goals. A strong vision answers: What does success look like in 3, 5, and 10 years? What will life feel like at each milestone?

Identify true priorities

Clarity means prioritization. Not everything can be first, and that’s a strength. Typical priority categories include:

- Lifestyle and family: education, experiences, giving, and time freedom.

- Business: reinvestment, equity value, liquidity, and succession.

- Security: reserves, insurance, and risk management.

- Legacy: estate intentions, philanthropy, and multi-generational goals.

Sorting goals into “now, next, later” helps allocate resources with intention rather than impulse. Talking through priorities with your financial advisor can help you think through the pros and cons of various strategies and what components might be more time-sensitive than others.

Translate goals into aligned, measurable targets

Goals gain power when measurable and time-bound. Replace “save more” with “build a 12-month personal reserve within the next two years,” or “diversify outside the business to 40% of net worth within 5 years.” Measurable targets enable tracking, accountability, and real momentum. They also allow for agile adjustments when life changes.

For business owners, clarity must bridge both sides of the balance sheet. Profit distributions, reinvestment, tax strategy, retirement funding, and estate design should all support the same vision. For retirees, clarity unifies income planning, tax efficiency, risk posture, and lifestyle choices into a cohesive plan. In both cases, alignment reduces conflict, simplifies choices, and de-risks the path forward.

Practical exercises to get clear

- Values discovery: choose your top five values and define how each shows up in financial decisions.

- Vision statement: write a one-paragraph picture of life 5–10 years from now.

- Priority map: list top goals and assign them to now, next, later.

- Measurement: define the metrics (cash reserves, savings rate, diversification ratio, income replacement, giving targets).

- Roadmap: translate the next 90 days into three concrete actions that move the plan forward.

Getting clear is more than a conversation – it’s a structured process that creates decisions with conviction. The Personal Wealth Operating Systemä transforms a scattered list of goals into a purposeful, measurable plan that reflects a unique life and legacy. With clarity established, every subsequent step (growth, risk, equity, retirement, and alignment0 moves faster and with greater confidence.

Begin with clarity. Request a complimentary PWOS™ Get Clear Session with Destiny Capital to define a wealth vision, identify true priorities, and turn purpose into a measurable plan. Start building the confidence and momentum that come from knowing exactly where to go next.

This article is intended for general informational purposes and does not constitute a recommendation of any type. Please seek advice from your tax, legal, and financial professional prior to taking action. Advisory services offered through Destiny Capital Corporation, an Investment Adviser registered with the U.S. Securities & Exchange Commission.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.