CIO Mailbag: AI’s Impact on Investment Opportunities in 2024

Given the rapid pace of AI and technological advancements, how do you see technology and innovation shaping investment opportunities in the coming years?

This is a question that is timely to ask, yet challenging to answer. Personally, my formative years did not include personal computers, and cell phones were only seen on TV shows like Lifestyles of the Rich and Famous or were used by movie characters like Gordon Gekko in Wall Street. So, from the perspective of an individual who lived in a pre-tech boom world, the pace of technological advancement over the past 10-20 years has been downright staggering. Now introduce generative AI technology, and we’re entering a brave new world for just about everyone, including investors.

Where We Are

In late 2022, the world was enthralled as ChatGPT, created by OpenAI, captured the world’s imagination. ChatGPT is an Artificial Intelligence chatbot that facilitates human-like conversations and can be used to complete various tasks. The popularity and effectiveness of ChatGPT led to investor exuberance about the potential for AI-driven tech. This exuberance helped to spur an AI boom where broad stock market returns, as measured by the S&P 500, have since been largely driven by a select few companies who are seen as potential innovators in the realm of AI.

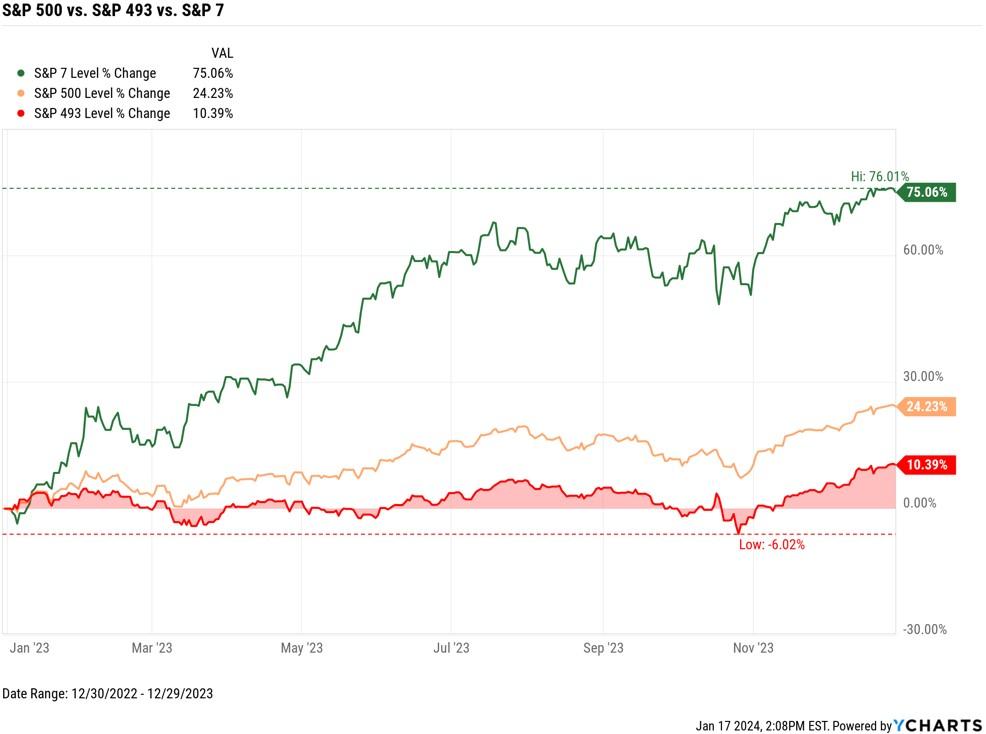

These companies include household names like Microsoft, Alphabet (Google), Meta (Facebook), Amazon, Apple, NVIDIA, and Tesla. These seven companies contributed to much of the positive performance of the S&P 500 index throughout 2023. In fact, in 2023, the combined performance of the seven largest S&P 500 companies (aka ‘The S&P 7’ – Microsoft, Alphabet, Meta, Amazon, Apple, NVIDIA and Tesla) was +75.06%. The other 493 companies in the S&P 500 (aka ‘The S&P 493’) had combined annualized returns of +10.39%, as seen in the chart below.

By far, the biggest AI winner to-date has been NVIDIA, as the chip maker’s market capitalization has soared from $360 billion in January of 2023 to a mind-bending $3 trillion in roughly eighteen months. This equated to a +802% increase in the price of NVIDIA stock between January 1, 2023 and June 15, 2024.

We are very early in the evolution of AI, but it’s been clear that, from an investment perspective, there has been a select group of mega cap companies that have benefitted from ‘the AI trade’, then there’s everyone else.

Where We May Be Headed

I tend to view the AI investing landscape through the lens of enablers vs. engagers/implementers. Right now, investors seem to be rewarding the enablers of AI technology. These are the companies who provide products and services (semiconductors, cloud computing, data centers, components, etc.) that help to facilitate the growth and development of AI. Soon, I imagine we’ll be seeing more and more investor dollars flow to engagers/implementers who utilize AI to boost profits through enhanced productivity and/or who create entirely new products and services that utilize AI tech to increase revenues.

When it comes to some specific examples of this, one sector that comes to mind is healthcare. AI could be instrumental in the development of new life-saving drugs and innovative medical devices. AI technology can also be crucial in improving outcomes by making preventative care more efficient and effective.

The Mayo Clinic provided an interesting example of how AI has impacted patient outcomes. Researchers found that the total size of the kidneys (total kidney volume) is correlated with how rapidly kidney function will decline in the future. Assessing total kidney volume, however, is onerous and requires analyzing dozens of kidney images, one after another. This process is laborious and can take about 45 minutes per patient. However, at the Mayo Clinic, researchers now utilize AI to automate this process and can generate results in a matter of seconds.

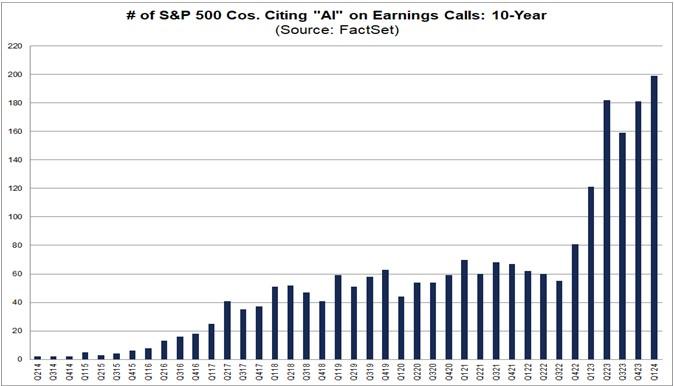

You better believe that CEOs across the globe are paying attention to examples like the one outlined above. The potential for enhanced efficiency, scalability, and productivity through AI technology must have C-Suite executives frothing at the mouth. In fact, in Q1 of 2024, we saw a record number of S&P 500 companies reference ‘AI’ on quarterly earnings calls, as seen below. It’s clearly a very hot topic.

Source: FactSet Earnings Insight

It’s also important to note that investors love disruptive technologies. Disruptive technologies can also lead to speculation. Speculation can cause stocks to become grossly overvalued, much like we saw in the great tech bubble of the late 1990’s. That was a time when any company with the word ‘internet’ in their value proposition saw their stock price soar to exorbitant levels. Those valuations were ultimately not supported by either revenues or profits (if there were any), and eventually led to a -45% decline in the S&P 500 between January 1, 2000 and October of 2002.

AI also brings quite a bit of uncertainty, and uncertainty can breed fear. This is understandable. If I recently received an undergraduate degree as a software engineer or if I just paid for a coding bootcamp, I’d be a little worried when I hear folks like OpenAI’s CEO, Sam Altman, infer that the future of coding is likely going to be handled by AI. If I were a graphic designer and saw the new image-from-text or video-from-text releases like OpenAI’s Sora or Google’s VEO, I would have a lot of questions about my role in the workforce over the next 3, 5, or 10 years.

These are a few very basic examples and tend to be existential considerations related to AI, but are worth noting. An individual’s outlook on AI may also depend on their perspective and/or role. From the seat of a CEO whose primary role is to increase shareholder value, I might be thrilled to potentially (and perhaps substantially) increase profits by employing AI instead of a small army of coders.

I also expect that regulation will be key in building and enforcing guardrails around AI. We’ve all seen movies like iRobot, The Terminator, 2001 A Space Odyssey, or even Wall-E where AI and/or super-computers assume control over humans. That type of occurrence would be less than ideal, and opinions vary about that type of eventual risk. However, there are absolutely universal concerns about the weaponization of AI should it fall in the hands of bad actors. An extreme, yet legitimate, example of this may be autonomous machines capable of making self-determined decisions about taking human life. Therefore, there will likely need to be regulatory guardrails in place.

From the perspective of an investor, I am fascinated, yet cautious when it comes to AI and other emerging technologies. I don’t think it is hyperbole to say that AI’s potential for disruption will likely be on par with the advent of the microprocessor, the personal computer and, eventually, the internet. Those innovations aided in the creation of some of the most valuable companies in the world today like Microsoft, Apple, Amazon, Alphabet, and many others.

Therefore, it’s exciting to think about the innovation and investing opportunities that may emerge in the years ahead. However, when it is this early in the evolution of an emerging technology like AI, we must remind ourselves that we are investors, not speculators. There was a time when Apple made lousy products like The Newton. Amazon was once an online bookstore. It can take time for the dust to settle and for winners (and losers) to emerge. In the meantime, we will be very busy tracking new developments in AI as we carefully consider potential investment opportunities for our investors.

Looking for more insights from our CIO? Check out our previous CIO Mailbag post: “Navigating Market Uncertainties.” In this article, Tim Doyle explores strategies for managing your investments during turbulent times. Read it here to gain valuable perspectives on market volatility and long-term investment approaches.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services provided by Destiny Capital Corporation, a registered investment adviser.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.