Markets and Economy – September: A Pivotal Month for the U.S. Economy

by Tim Doyle, Chief Investment Officer, CFP®, MBA

For many families like mine here on the east coast, Labor Day weekend represents the last true days of summer. This is because the public school year begins on the Tuesday after, and the long holiday weekend is our last chance for some fun and sun even as we scramble to run some last-minute back-to-school errands.

On the morning of September 2nd, my kids posed for a few ‘Back to School’ pictures in front of our home. My boys were bundles of nervous energy as we coaxed them into a few smiles, and their behavior had me reminiscing about how I felt as a kid when each new school year began. I recall having butterflies in my stomach as I approached the first day of school with both excitement and trepidation as a litany of questions would race through my mind. Will I have a nice teacher? Will my best friends be in my class? Who will I sit with at lunch, and can I even find my new classroom?

As an investor, I feel a heightened sense of anticipation and eager tension as we head deeper into the month of September. Like those first days of school as a kid, many questions are racing through my mind around the path forward for both the U.S. economy and financial markets. Will the labor market continue to show weakness? Will inflation level off or continue to surge higher? Will the Fed cut interest rates or keep them unchanged? Will the stock market move higher to close-out the year? When I think about what’s in store and what’s at stake over the month of September, the word ‘pivotal’ comes to mind. For investors, the next few weeks will likely set the tone for the remainder of the year, so we’ll delve into some of these key topics, beginning with some newly released data that shows continued weakness in the U.S. labor market.

From Hot to Not – The U.S. Labor Market

In last month’s letter, we communicated that investors were startled by revisions in the Bureau of Labor Statistics (BLS) jobs report which showed that 258,000 fewer jobs had been created in the months of May and June than initially believed. Then, on September 5th, the BLS released its latest jobs report that showed that a paltry 22,000 jobs were added in August, far below the 75,000 forecasted by economists.

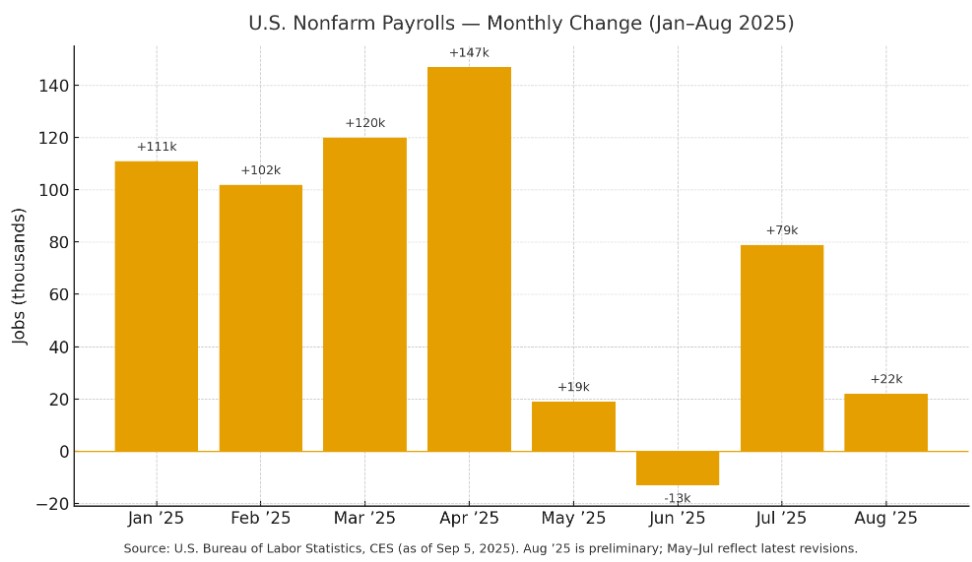

The chart below shows jobs added/lost during each month of 2025, and you can see a clear dropoff in job creation beginning in May. Latest revisions even show that 13,000 jobs were lost in the month of June.

Over the past three to four years, a strong labor market endured despite soaring inflation and monetary policy designed to restrict U.S. economic growth. So, what is finally causing the labor market to crack? Well, the reasons are many, and likely include some factors such as:

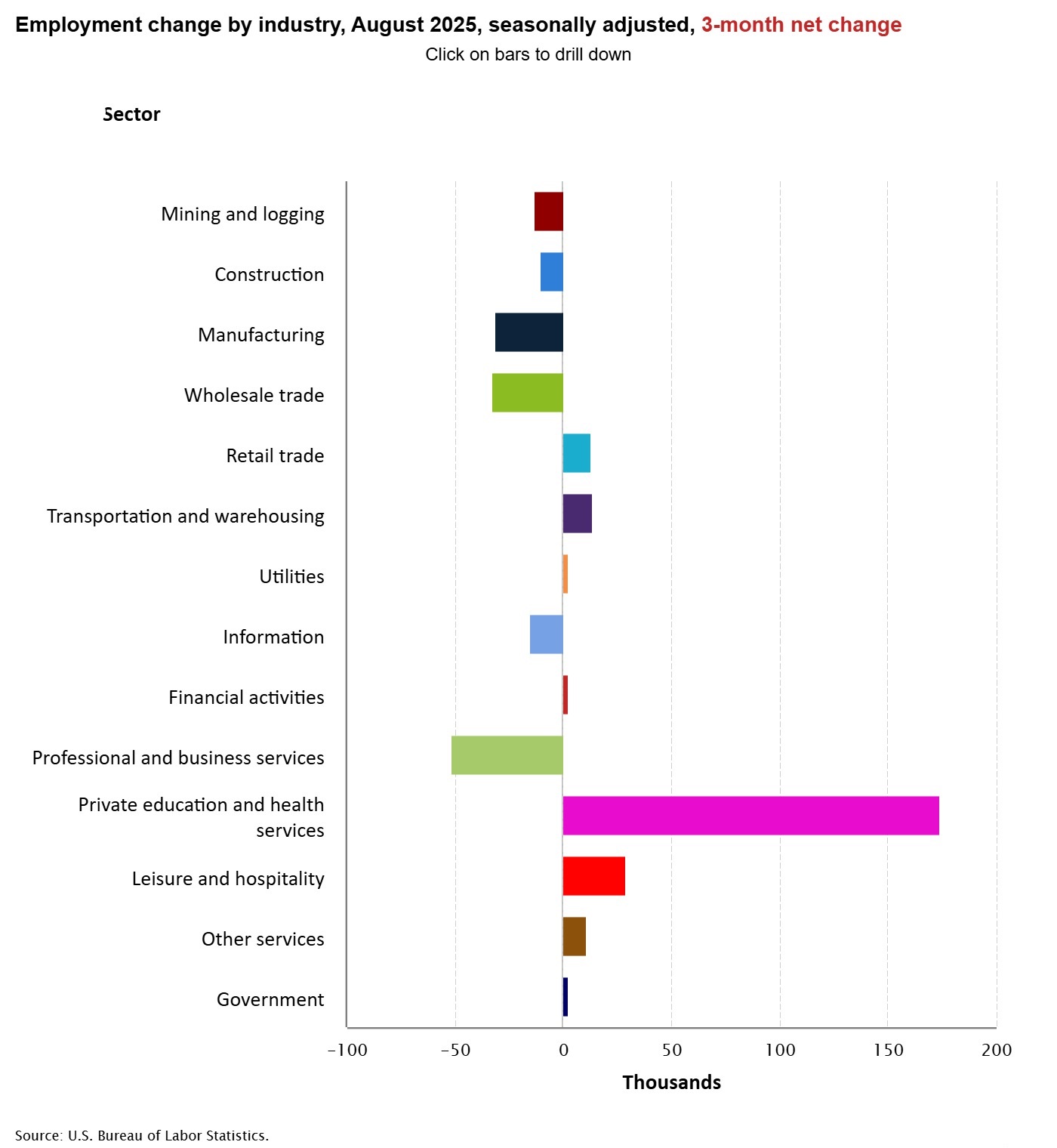

U.S. Trade Policy: in just a few short months, the United States has re-written the rules of global trade by imposing steep new tariffs across all major trade partners of the U.S. Among other things, this appears to have impacted hiring practices, especially in manufacturing and other sectors most impacted by tariffs. This can be seen in the chart below from the BLS that shows jobs gained or lost over the past 3 months, and it’s clear that certain industries like manufacturing, wholesale trade, construction and even professional and business services are seeing net job losses over the near-term.

To help solidify who and what we are referring to when referencing these sectors, below are some brief examples of major corporations classified in the manufacturing, wholesale trade, and professional & business services sectors:

Manufacturing: General Motors, Ford, Boeing, 3M, Proctor & Gamble

Wholesale Trade: Sysco (food distribution), W.W. Grainger (industrial supplies), McKession (pharmaceuticals).

Professional & Business Services: Deloitte, Accenture, Robert Half, ADP

General Economic Uncertainty: are we experiencing a ‘downshift’ in the U.S. economy where slower growth is expected in the quarters ahead? Based on tariff uncertainty and recent economic indicators, employers are asking themselves that exact same question.

Remember, roughly two-thirds of U.S. GDP growth comes from consumption. As I’ve written many times, “as goes the consumer, so goes the U.S. economy”. While consumers are a resilient bunch, we are seeing cracks in consumer confidence emerge as the labor market weakens and inflation begins to heat up. This can be seen in the chart below that shows the results of the monthly Consumer Sentiment Survey conducted by the University of Michigan. As you can see, consumer sentiment recently fell to 52 in April and May – levels not seen since inflation spiked to 9% during the summer of 2022.

Concerns about the strength of the consumer, the path of inflation, and the impact of tariffs can, at the very least, lead to greater caution around hiring until the path forward becomes a bit more clear.

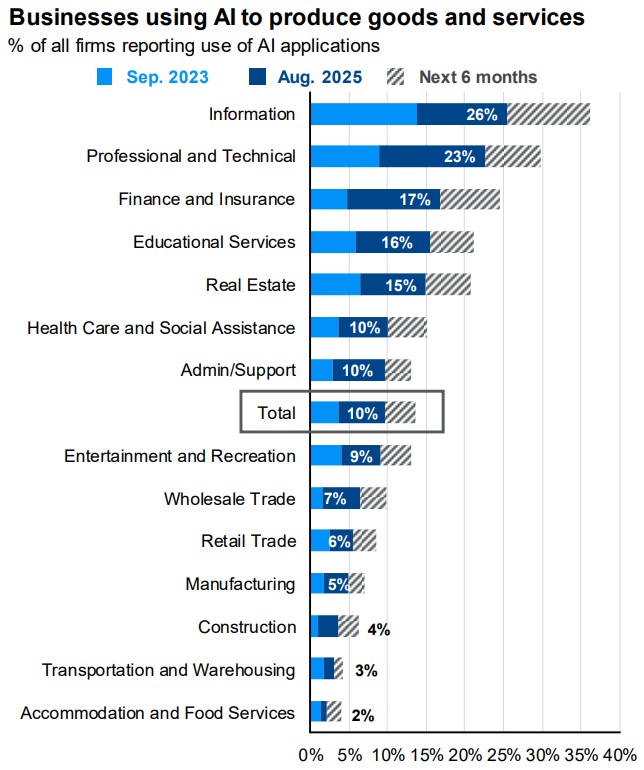

The Emergence of Artificial Intelligence (AI): while this may be a bit preemptive, AI is broadly expected to be a disruptive technology that allows corporations to become more efficient, productive and profitable. Some of that efficiency, productivity and profitability will come from AI’s ability to perform jobs/roles once suited for humans.

This technology also appears to be advancing at an incredible rate. So, if you were an employer who had a need for an entry-level hire in a call center, but thought that AI might replace that role in the next 3, 6 or 12 months, would you consider pausing that hire to potentially see if a new efficient and productive technology could fill that void in the months ahead?

After all, AI doesn’t need health insurance, a 401k match, or even a bi-weekly paycheck, so that could make that arrangement much more profitable for the company. The chart below illustrates the growth in businesses that are using AI to produce goods & services and, as you can see, adoption has been rapid and is projected to continue in the months ahead.

Source: JP Morgan Asset Management – Guide to the Markets

When writing about hiring practices in the tech sector, the Wall Street Journal recently referred to AI’s impact on new employee hiring as ‘The Great Hesitation’. I think that is an apt headline and helps to demonstrate issues being addressed in human resources departments across the country. While AI isn’t likely the primary cause of the job market’s recent woes, I do expect that it will be a factor that must be monitored closely in the quarters ahead.

September – A Pivotal Month

Early in this letter, I wrote that September is likely going to be a pivotal month for the U.S. economy. The reason is that we anticipate greater visibility into critical areas like employment, inflation, and interest rates.

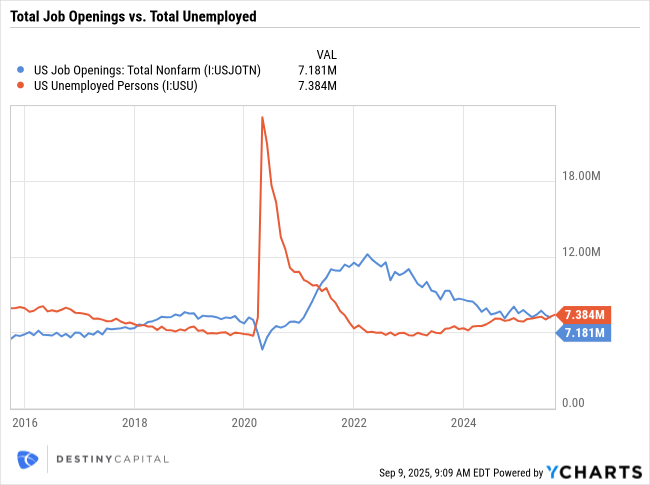

Investors already received the disappointing jobs report on September 5th that showed only 22,000 jobs added in August vs. 75,000 expected. Furthermore, for the first time since March of 2021, the number of unemployed persons exceeds total job openings in the United States, as you can see in the chart below.

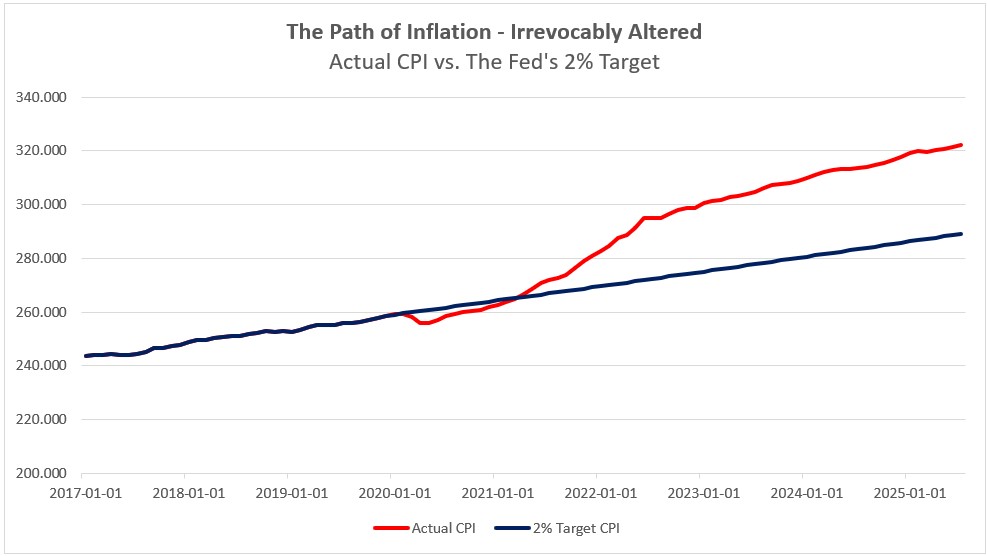

When it comes to inflation, investors will receive the next Consumer Price Index (CPI) report on September 11th which is expected to show Headline CPI at 2.9% and Core CPI at 3.1%. Keep in mind that Headline CPI in July was 2.7% so, clearly, inflation is expected to continue its move in the wrong direction.

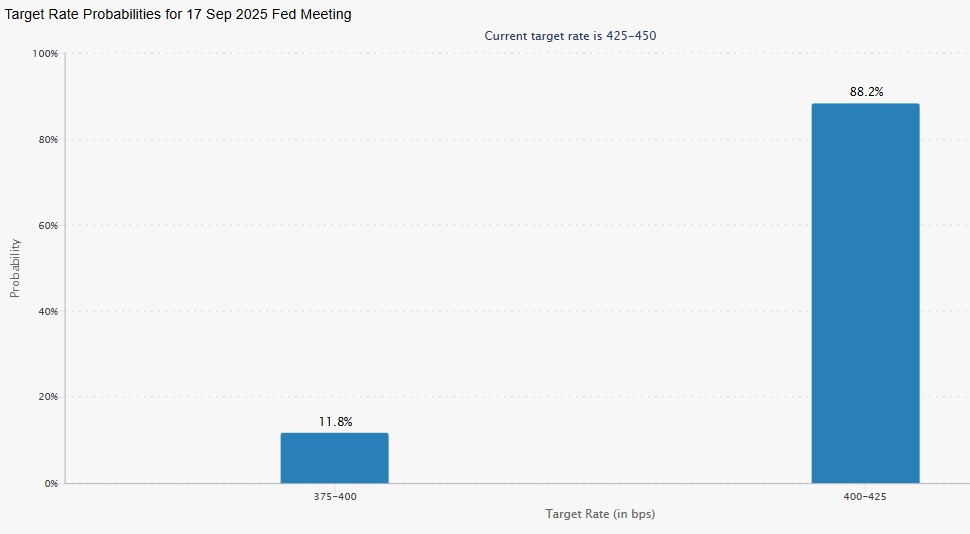

Then, all eyes will shift to the Federal Open Market Committee (FOMC) as they meet on the 16th and 17th of September. Investors believe there is an 88% probability of a single 0.25% rate cut during the Fed’s September meeting, and nearly 12% of investors believe that a 0.50% rate cut is possible, as you can see in the chart below for the CME Group’s FedWatch tool.

Source: CME Group FedWatch Tool

Beyond September, investors are betting on an additional 0.25% to 0.50% in rate cuts between now and year end. That logic implies that the Fed will focus on boosting the labor market instead of reigning-in inflation. Is that the right call? I’m not so sure.

When economists and pundits reference inflation, they often do so in year-over-year terms, such as “headline CPI rose 2.7% in July.” However, this fails to emphasize the cumulative effect of rising prices, and doesn’t truly reflect how prices have irrevocably moved higher to a new ‘glide path’. The chart below helps to illustrate this dynamic. In early 2020, we first started seeing fluctuations in aggregate prices where inflation initially moved well-below the Fed’s 2% target during the pandemic before beginning its startling ascent in 2021. So, in the chart below, the red line represents actual inflation (CPI) while the blue line represents inflation as-if it had remained at the Fed’s 2% target from 2020 through today.

Source: The Bureau of Labor Statistics

As you can see, prices have forever shifted higher, and that has been extremely painful for many consumers. That horse, as they say, is out of the barn. My question is, can consumers absorb another surge in the inflation ‘glide-path’ if CPI starts to rise 3% or more on a year-over-year basis? All of this, and more, is being deliberated by the Federal Reserve, which makes their decisions around interest rate policy so crucial in September and beyond.

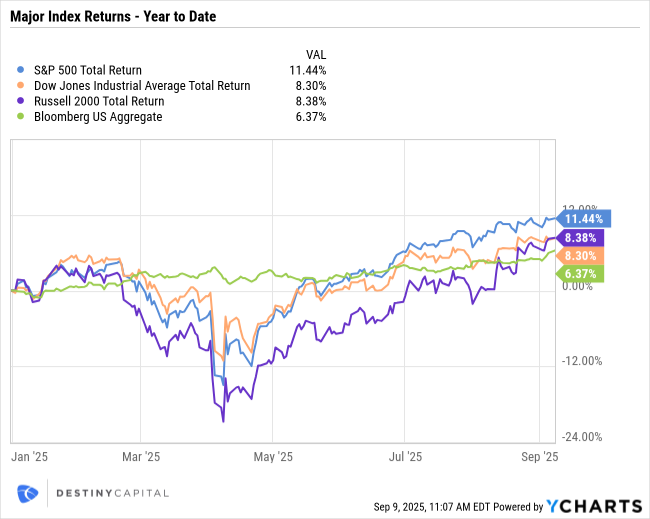

In the meantime, the stock and bond markets continue their 2025 ascent, as seen in the year-to-date return chart for four major indexes; the S&P 500, the Dow Jones Industrial Average, the Russell 2000, and the Bloomberg US Aggregate Bond index.

Driven by strong corporate earnings, the S&P 500 has risen a staggering +31% since the index’s low on April 8th. Earnings growth for the S&P 500 in Q2 was a strong +13.2%, and is expected to be +7.5% in Q3. While +7.5% earnings growth is certainly solid, I should note that earnings growth has surprised to the upside (often significantly) in recent quarters. It’s also important to mention that, if the Fed lowers interest rates, that’s generally considered stimulative to the U.S. economy and could boost the stock market. So, while I may take a bit of a pragmatic view when it comes to interest rates and inflation, the ‘investor’ in me certainly likes the short term boost that markets could see if rates move lower in September and beyond.

One thing is clear, a lot of important questions remain, and investors will start to get some answers in the days and weeks ahead. As always, we’ll keep you well-informed about any developments that may change our short and long-term investing outlook. In the meantime, if you have any questions, please don’t hesitate to reach out to our dedicated team or submit a question to my CIO Mailbag that I can either answer directly or in a future mailbag post or investor letter.

Important note and disclosure: This article is intended to be informational in nature; it should not be used as the basis for investment decisions. You should seek the advice of an investment professional who understands your particular situation before making any decisions. Investments are subject to risks, including loss of principal. Past returns are not indicative of future results. Advisory services offered through Destiny Capital Corporation, an Investment Adviser registered with the U.S. Securities & Exchange Commission.

2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts’) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated using data manually input by the creator of this report combined with data and calculations from YCharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or see, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. THE IMPORTANT DISCLOSURES FOUND AT THE END OF THIS REPORT (WHICH INCLUDE DEFINITIONS OF CERTAIN TERMS USED IN THIS REPORT) ARE AN INTEGRAL PART OF THIS REPORT AND MUST BE READ IN CONJUNCTION WITH YOUR REVIEW OF THIS REPORT. Disclosure – YCharts

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.