Five Tax-Efficient Charitable Giving Strategies

Americans gave over $499 billion to charity in 2022, and the overwhelming majority of these gifts (around 64%) came from individuals[1]. Likewise, many of our clients are passionate about supporting charities or causes that are dear to them, and we take great pleasure in partnering with clients to reach their philanthropic goals. While we firmly believe the desire to make a positive impact should be the primary driver for charitable giving, there are also potential tax benefits and strategies to consider.

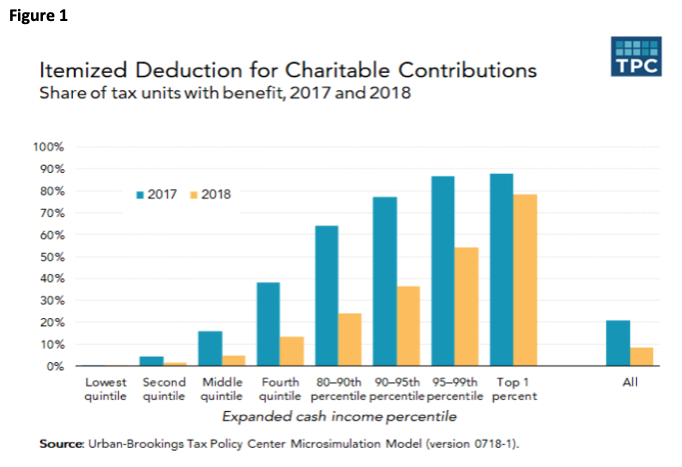

The Tax Cuts and Jobs Act (TCJA), passed in late 2017, made several changes to our tax code. In addition to reducing marginal tax rates for most taxpayers, the bill increased the standard deduction for individuals from $6,500 to $12,000 and for joint returns from $13,000 to $24,000 (and it has continued to increase ever since). This enabled many households to lower their tax bill and significantly reduced the number of taxpayers that are better off itemizing deductions. This meant that for many who previously deducted amounts donated to charity, it was no longer optimal to do so. The Tax Policy Center reported that the percentage of taxpayers who received a tax benefit from itemizing charitable deductions fell from 21% in 2017 (the year before the TCJA went into effect) to just 9% in 2018[2] (see Figure 1).

Some provisions of the TCJA are scheduled to expire at the end of 2025 and, without extending the provisions of the bill, tax rates, the standard deduction amount, and several other items are set to revert to 2017 amounts (adjusted for inflation). But regardless of those changes, there are still several tax-smart strategies to consider when giving to charity.

Completing Qualified Charitable Distributions

If you’re 70½ or older, Qualified Charitable Distributions (or QCDs) are a great way to receive a tax benefit for charitable gifts. A Qualified Charitable Distribution is a distribution made directly from an IRA, whose owner is at least 70½, to a qualified 501(c)(3) charitable organization. The primary benefit of QCDs is that they are entirely tax-free. Also, if you have reached the age where you are required to complete an annual Required Minimum Distribution from your IRA, QCDs can count toward that requirement.

In some cases, even if you can itemize your deductions, it could be optimal to give via QCD. Since they can be excluded from the taxable IRA distribution amount reported on your tax return, QCDs help to reduce your Adjusted Gross Income (AGI) and, in turn, other items that are calculated using that number. For instance, the taxability of Social Security benefits is based on AGI plus a couple of other income sources. Likewise, Medicare Part B and Part D premiums are based partially on AGI. By comparison, itemized deductions only come into play after AGI is calculated and do not actually reduce AGI.

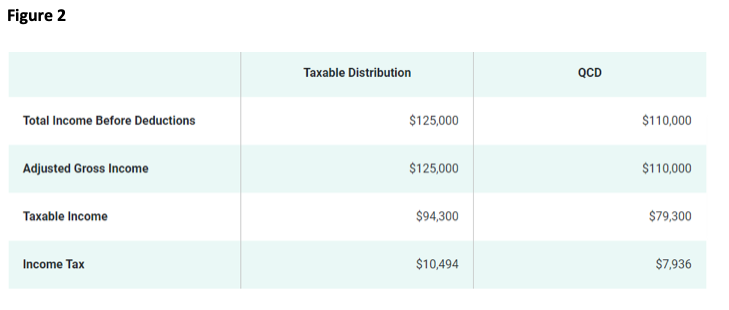

To illustrate the potential benefit of QCDs, consider the following example (see Figure 2):

A retired couple in their mid-70s has total income of $125,000 per year, which consists of required IRA distributions, pension income, and Social Security benefits. Let’s also assume that this couple gives a total of $15,000 per year to their church and a couple other charities by writing checks from their bank account. However, when added to their other itemized deductions, it is still better for them to apply the standard deduction ($30,700 for those over 65 in 2023). Therefore, they receive no tax benefit for their gifts and have a total federal income tax liability of roughly $10,500.

If they had instead given all charitable gifts directly from their IRAs via QCD, they could have reduced their taxable income by $15,000, saving over $2,500 in taxes. This represents a 24% reduction in their federal tax liability!

Although this is only an example and each household’s situation is different, we have seen similar scenarios play out with many of our clients, simply by changing the source of their gifts.

“Bunching” Your Itemized Deductions

For those under 70½ who give to charity but are just under the threshold where itemizing deductions makes sense, it could be beneficial to “bunch” deductions into alternating years. This approach involves consolidating two years’ worth of charitable donations into one year, allowing you to itemize deductions for that year, take the standard deduction the following year, and so on. By doing so, the goal is to maximize your tax savings long term.

Although Colorado is not one of them, some states (Florida, Texas, Wisconsin, and several others) even allow you to do this with property taxes. In these states, you are allowed to make at least a portion of your property tax payment in the following year, meaning you could pay property taxes for the prior year and current year and deduct them both on the same tax return. If allowed in your state, this could help supercharge itemized deductions every other year. One thing to note: Since the passage of the Tax Cuts and Jobs Act, taxpayers who itemize may only deduct up to $10,000 per year in property taxes plus state income or sales taxes. So, if your property taxes are currently near or more than $10,000 per year, it may be beneficial to simply pay them annually.

Utilizing a Donor-Advised Fund

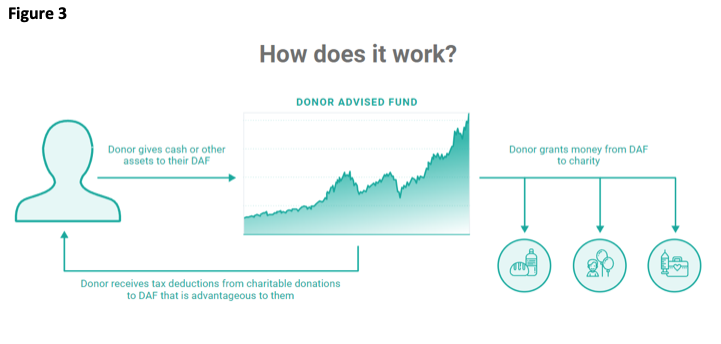

Understandably, some may not be comfortable with the idea of donating to charity every other year and would prefer to give more frequently. A great way to maintain a rhythm of regular giving while still maximizing deductions is to utilize a donor-advised fund. A donor-advised fund (DAF) is a charitable investment account dedicated solely to charitable giving. With this type of account, you receive a tax deduction for your contributions, and can then give from the account to qualified public charities of your choice at any point in the future (see Figure 3). By making a relatively large contribution to your account up front, you can receive the benefit of bunching your deductions while giving to the actual charities you care about at a pace that works for you. According to Fidelity, “Donor-advised funds are the fastest-growing charitable giving vehicle in the United States because they are one of the easiest and most tax-advantageous ways to give to charity.”[3]

But the benefits of donor-advised funds don’t stop there. In addition to cash, you can donate stocks and other securities, real estate, business interests, royalty interests, and other assets (more on this in a bit). Plus, you can invest your account so that it has the potential to grow tax-free over time. DAFs can also be used in estate planning to fulfill charitable goals after you pass away. You can even name a trusted individual to manage the account and distribute funds to your preferred charities or other qualified organizations when you are gone.

Donating Appreciated Assets

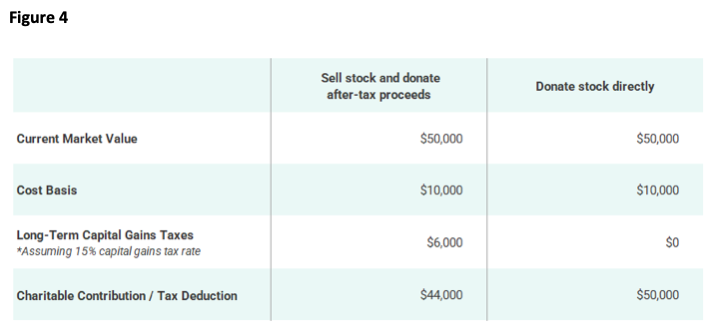

Whether you utilize a donor-advised fund or not, donating appreciated securities you’ve held more than a year to qualified charities provides multiple tax benefits. By giving stocks, real estate, business interests, or other assets to charities, you can receive an income tax deduction equal to the market value of the donated property. Additionally, you can avoid paying capital gains tax on the appreciation of such assets, which means you can effectively give more to charity (see Figure 4). And if the receiving charity is a 501(c)(3) organization, it will also not be required to pay taxes upon liquidation of the asset.

An important note: If you donate assets held less than a year, you are only allowed to deduct the cost basis rather than the full market value, so the tax benefit is significantly reduced. Similarly, it’s typically not beneficial to donate securities that have not increased in value.

Naming Charities as Beneficiaries of Your Pre-Tax Retirement Accounts

From a tax-efficiency perspective, this is one of the best ways to leave assets to charity upon death. When a person inherits money from an IRA, 401k, or other retirement account funded with pre-tax money, every dollar distributed is taxable to the beneficiary. Further, many non-spousal beneficiaries are required to distribute the entire inherited balance over ten years or less, which may significantly increase their tax burden.

However, when a qualified charity inherits from this type of account, the amount the organization receives is exempt from taxation. This means that taxes are never paid on this money, since contributions to the account were made pre-tax and organizations that qualify for 501(c)(3) status are not required to pay taxes on income. As illustrated with prior strategies, this tactic allows you to leave more to charity than if you had donated after-tax monies.

If you desire to leave money to charity but do not have specific charitable organizations in mind, you could also consider opening a donor-advised fund and naming it as beneficiary of a retirement account. Then, the individual you select can facilitate donations from the account after your death.

How Can We Help?

As you can see, tax planning related to charitable giving can be quite complex, but we are always excited to help clients find a strategy that will simultaneously reduce taxes and enable them to give in a manner that aligns with their wishes. This is just one reason we value the opportunity to review our clients’ tax returns each year. A careful review of the return allows us to identify tax-savings opportunities and proactively plan ahead. Additionally, we are also able to verify that tax strategies implemented previously actually produced the intended outcome and help make adjustments as needed.

If you are unsure which strategy is best for you, or if you are interested in discussing ways we can help optimize your charitable giving strategy, please don’t hesitate to reach out to us. We are always eager to help.

Sources:

- https://givingusa.org/giving-usa-limited-data-tableau-visualization/

- https://www.taxpolicycenter.org/briefing-book/how-did-tcja-change-standard-deduction-and-itemized-deductions

- https://www.investopedia.com/terms/q/qualified-charitable-organization.asp

- https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

- https://www.fidelitycharitable.org/guidance/philanthropy/what-is-a-donor-advised-fund.html

- Source for figures 2-4. Holistiplan

Disclaimer

Destiny Capital does not offer legal or tax advice. The information provided on this website does not, and is not intended to, constitute tax advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date tax or other information. Please consult with your attorney, accountant, and/or tax advisor for advice concerning your particular circumstances.

Share this

Stay Ahead with Smart Investments

Learn how to invest wisely and minimize risks to protect your retirement savings.

Achieve Your Retirement Goals

Get personalized advice to meet your retirement goals. Book your call with Destiny Capital now.